Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

(c) According to the records of the Company, the dues outstanding of income-tax, sales-tax, wealth-tax, service tax, customs<br />

duty, excise duty and cess on account of any dispute, are as follows:<br />

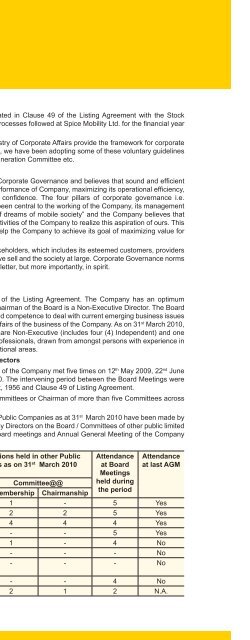

Name of the<br />

Nature of dues Amount Period to which the Forum where dispute<br />

statute<br />

(Rs ‘000) amount relates<br />

is pending<br />

Tamil Nadu Tax on transfer/ replacement of<br />

814 1993-94 & 1996-97 High Court, Chennai<br />

General Sales Tax material under Annual maintenance<br />

Act, 1959 Contract<br />

Delhi Sales Tax Demand against non submission<br />

408 2002-03 Additional Commissioner<br />

Act, 1975 of form ‘C’ and treating exempted<br />

sales as sales<br />

Appeals, Delhi<br />

Central Sales Tax Demand against non submission of 3,289 2002-03 and 2003-04 Additional Commissioner<br />

Act, 1956 read with Form ‘C’<br />

the Delhi Sales Tax<br />

Act, 1975<br />

Appeals, Delhi<br />

Central Sales Tax Demand for Sales Tax 737 2005-2006 Joint Commissioner of<br />

Act, 1956<br />

Commercial Taxes, Kolkata<br />

West Bengal Sales Demand for Sales Tax 394 2005-2006 Joint Commissioner of<br />

Tax Act, 1994<br />

Commercial Taxes, Kolkata<br />

Central Excise Act, Demand for Excise duty including 64,263 1990-91 to 1993-94 CESTAT, Delhi<br />

1944<br />

penalty<br />

(x) The Company has no accumulated losses at the end of the fi nancial year and it has not incurred cash losses in the current<br />

year and immediately preceding fi nancial period.<br />

(xi) Based on our audit procedures and as per the information and explanations given by the management, we are of the<br />

opinion that the Company has not defaulted in repayment of dues to banks. The Company did not have outstanding dues<br />

to any fi nancial institutions and did not have any outstanding debentures during the year.<br />

(xii) According to the information and explanations given to us and based on the documents and records produced to us, the<br />

Company has not granted loans and advances on the basis of security by way of pledge of shares, debentures and other<br />

securities.<br />

(xiii) In our opinion, the Company is not a chit fund or a nidhi / mutual benefi t fund / society. Therefore, the provisions of clause<br />

4(xiii) of the Companies (Auditor’s Report) Order, 2003 (as amended) are not applicable to the Company.<br />

(xiv) In our opinion, the Company is not dealing in or trading in shares, securities, debentures and other investments. Accordingly,<br />

the provisions of clause 4(xiv) of the Companies (Auditor’s Report) Order, 2003 (as amended) are not applicable to the<br />

Company.<br />

(xv) According to the information and explanations given to us, the Company has not given any guarantee for loans taken by<br />

others from banks or fi nancial institutions.<br />

(xvi) The Company did not have any term loans outstanding during the year.<br />

(xvii) According to the information and explanations given to us and on an overall examination of the balance sheet of the<br />

Company, we report that no funds raised on short-term basis have been used for long-term investment.<br />

(xviii) The Company has not made any preferential allotment of shares to parties or companies covered in the register maintained<br />

under Section 301 of the Companies Act, 1956.<br />

(xix) The Company did not have any outstanding debentures during the year.<br />

(xx) The Company has not raised money by way of public issue during the year.<br />

(xxi) Based upon the audit procedures performed for the purpose of reporting the true and fair view of the fi nancial statements<br />

and as per the information and explanations given by the management, we report that no fraud on or by the Company has<br />

been noticed or reported during the course of our audit.<br />

For S.R. BATLIBOI & CO.<br />

Firm Registration No.: 301003E<br />

Chartered Accountants<br />

per Anil Gupta<br />

Partner<br />

Membership No.: 87921<br />

Place: Gurgaon<br />

Date: 15 th May 2010<br />

25