You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

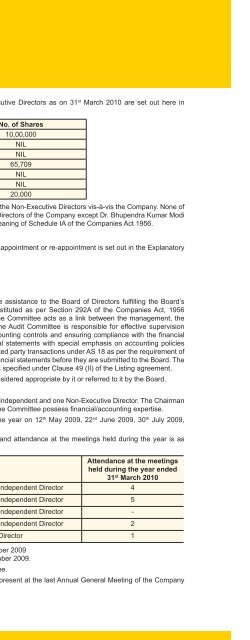

<strong>Spice</strong> <strong>Mobility</strong> Limited (formerly <strong>Spice</strong> Mobiles Limited)<br />

Schedules to the Balance Sheet<br />

Particulars<br />

As at<br />

Mar 31, 2010<br />

As at<br />

Mar 31, 2009<br />

Rs. '000 Rs. '000 Rs. '000 Rs. '000<br />

Schedule 1: Share capital<br />

Authorised<br />

170,000,000 equity shares of Rs.3 each (Previous period<br />

170,000,000 equity shares of Rs.3 each)<br />

Issued, subscribed and paid up<br />

74,638,000 (Previous period 74,638,000) equity shares of Rs. 3/–<br />

510,000 510,000<br />

each fully paid–up.<br />

Note: Out of the above, 47,205,529 (Previous period 32,133,964)<br />

shares are held by <strong>Spice</strong> Televentures Private Limited, the holding<br />

company. As at previous period end, <strong>Spice</strong> Enfotainment Limited<br />

was the holding company, holding 29,060,270 shares.<br />

223,914 223,914<br />

Schedule 2: Reserves and surplus<br />

Securities Premium Account<br />

Balance as per last account 288,070 288,070<br />

General Reserve<br />

Balance as per last account 84,966 84,966<br />

Add : Transferred from Profi t and Loss Account 70,508 155,474<br />

Profi t and Loss Account 673,612 170,022<br />

1,117,156 543,058<br />

Schedule 3: Secured loans<br />

Loans and advances from banks<br />

– Cash credit facilities – 17,200<br />

– 17,200<br />

Note: Cash credit facilities were taken from consortium of banks<br />

led by State Bank of India and were secured by hypothecation of<br />

inventories, book debts and other movable assets, both present<br />

and future. The facilities were further secured by charge by way of<br />

deposit of the title deeds of the Company's immovable property at<br />

Baddi, Himachal Pradesh.<br />

Schedule 4: Unsecured loans<br />

Short term loans and advances<br />

– From Banks – 12<br />

– 12<br />

Schedule 5: Deferred Tax Assets (net)<br />

Deferred Tax Liabilities<br />

– Differences in depreciation / amortisation and other differences<br />

in block of fi xed assets as per tax books and fi nancial books<br />

5,726 3,143<br />

Gross Deferred Tax Liabilities<br />

Deferred Tax Assets<br />

5,726 3,143<br />

– Provision for doubtful debts and advances 1,843 5,338<br />

– Effect of expenditure debited to Profi t and Loss Account in<br />

the current / earlier periods but allowable for tax purposes in<br />

following periods<br />

3,298 3,532<br />

Gross Deferred Tax Assets 5,141 8,870<br />

Deferred Tax Liabilities / Assets (net) 585 (5,727)<br />

29