Publication 1436 (Rev. 10-2012) - Internal Revenue Service

Publication 1436 (Rev. 10-2012) - Internal Revenue Service

Publication 1436 (Rev. 10-2012) - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

WHAT IS MODERNIZED e-FILE (MeF)?<br />

The Modernized e-File (MeF) system is a replacement of IRS tax return filing technology with a modernized, Internetbased<br />

electronic filing platform. MeF uses the widely accepted Extensible Markup Language (XML) format. This is<br />

an industry standard used when identifying, storing and transmitting data rather than the proprietary data transmission<br />

formats used by older e-File programs. MeF is successfully processing electronically filed tax returns for individuals,<br />

corporations, partnerships, excise tax filers, and exempt organizations.<br />

MeF will accept the current Tax Year and two prior Tax Years. In Processing Year 2013, MeF will accept Tax Year<br />

20<strong>10</strong> (prior year), Tax Year 2011 (prior year) and Tax Year <strong>2012</strong> (current year) returns for Form <strong>10</strong>40. Subsequent<br />

Tax Years added to the MeF Platform, will affect the filing of prior year returns through MeF.<br />

• DO NOT file a Form 4868 for a prior year return.<br />

• MeF will not be accepting Forms 8839 or 8854 for Tax Years 2011 and <strong>2012</strong>, in XML or PDF.<br />

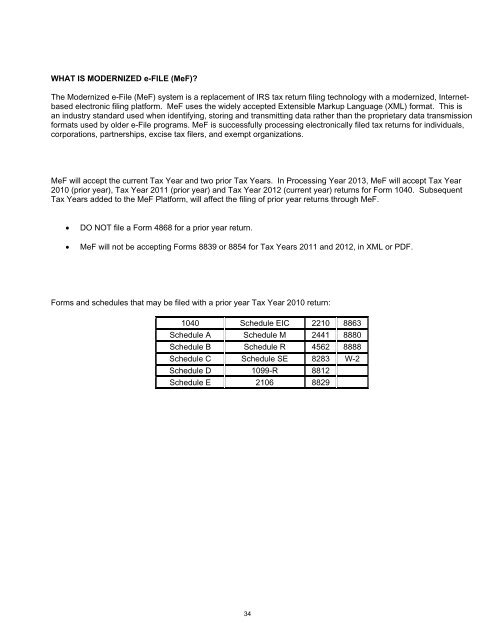

Forms and schedules that may be filed with a prior year Tax Year 20<strong>10</strong> return:<br />

<strong>10</strong>40 Schedule EIC 22<strong>10</strong> 8863<br />

Schedule A Schedule M 2441 8880<br />

Schedule B Schedule R 4562 8888<br />

Schedule C Schedule SE 8283 W-2<br />

Schedule D <strong>10</strong>99-R 8812<br />

Schedule E 2<strong>10</strong>6 8829<br />

34