Prof. Dr. Jörg Prokop Publications & Presentations 1 Publications ...

Prof. Dr. Jörg Prokop Publications & Presentations 1 Publications ...

Prof. Dr. Jörg Prokop Publications & Presentations 1 Publications ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

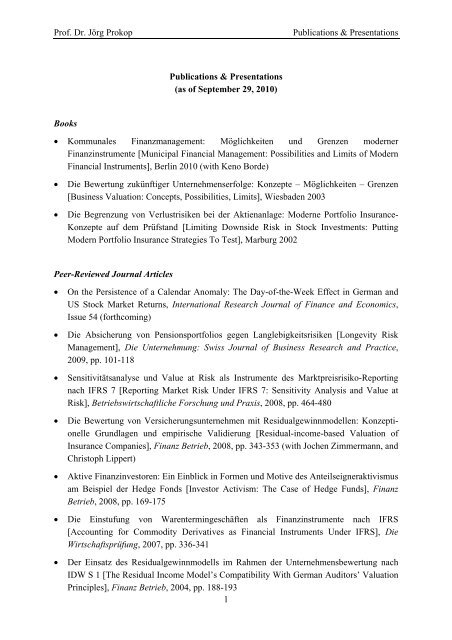

<strong>Prof</strong>. <strong>Dr</strong>. <strong>Jörg</strong> <strong>Prokop</strong> <strong>Publications</strong> & <strong>Presentations</strong><br />

Books<br />

<strong>Publications</strong> & <strong>Presentations</strong><br />

(as of September 29, 2010)<br />

• Kommunales Finanzmanagement: Möglichkeiten und Grenzen moderner<br />

Finanzinstrumente [Municipal Financial Management: Possibilities and Limits of Modern<br />

Financial Instruments], Berlin 2010 (with Keno Borde)<br />

• Die Bewertung zukünftiger Unternehmenserfolge: Konzepte – Möglichkeiten – Grenzen<br />

[Business Valuation: Concepts, Possibilities, Limits], Wiesbaden 2003<br />

• Die Begrenzung von Verlustrisiken bei der Aktienanlage: Moderne Portfolio Insurance-<br />

Konzepte auf dem Prüfstand [Limiting Downside Risk in Stock Investments: Putting<br />

Modern Portfolio Insurance Strategies To Test], Marburg 2002<br />

Peer-Reviewed Journal Articles<br />

• On the Persistence of a Calendar Anomaly: The Day-of-the-Week Effect in German and<br />

US Stock Market Returns, International Research Journal of Finance and Economics,<br />

Issue 54 (forthcoming)<br />

• Die Absicherung von Pensionsportfolios gegen Langlebigkeitsrisiken [Longevity Risk<br />

Management], Die Unternehmung: Swiss Journal of Business Research and Practice,<br />

2009, pp. 101-118<br />

• Sensitivitätsanalyse und Value at Risk als Instrumente des Marktpreisrisiko-Reporting<br />

nach IFRS 7 [Reporting Market Risk Under IFRS 7: Sensitivity Analysis and Value at<br />

Risk], Betriebswirtschaftliche Forschung und Praxis, 2008, pp. 464-480<br />

• Die Bewertung von Versicherungsunternehmen mit Residualgewinnmodellen: Konzeptionelle<br />

Grundlagen und empirische Validierung [Residual-income-based Valuation of<br />

Insurance Companies], Finanz Betrieb, 2008, pp. 343-353 (with Jochen Zimmermann, and<br />

Christoph Lippert)<br />

• Aktive Finanzinvestoren: Ein Einblick in Formen und Motive des Anteilseigneraktivismus<br />

am Beispiel der Hedge Fonds [Investor Activism: The Case of Hedge Funds], Finanz<br />

Betrieb, 2008, pp. 169-175<br />

• Die Einstufung von Warentermingeschäften als Finanzinstrumente nach IFRS<br />

[Accounting for Commodity Derivatives as Financial Instruments Under IFRS], Die<br />

Wirtschaftsprüfung, 2007, pp. 336-341<br />

• Der Einsatz des Residualgewinnmodells im Rahmen der Unternehmensbewertung nach<br />

IDW S 1 [The Residual Income Model’s Compatibility With German Auditors’ Valuation<br />

Principles], Finanz Betrieb, 2004, pp. 188-193<br />

1

<strong>Prof</strong>. <strong>Dr</strong>. <strong>Jörg</strong> <strong>Prokop</strong> <strong>Publications</strong> & <strong>Presentations</strong><br />

• Rechnungswesenorientierte Unternehmensbewertung und Clean Surplus Accounting:<br />

Konzeptionelle Bewertungseignung der Konzernabschlüsse deutscher<br />

Aktiengesellschaften [Accounting-based Business Valuation and Clean Surplus<br />

Accounting: Evidence From Germany], Zeitschrift für kapitalmarktorientierte<br />

Rechnungslegung, 2003, pp. 134-142 (with Jochen Zimmermann)<br />

Other Journal Articles<br />

• Probleme der Discounted Cash Flow-Bewertung: FTE-, WACC-, TCF- und APV-Ansatz<br />

im Vergleich [A Comparison of Four Discounted Cash Flow Valuation Models],<br />

Unternehmensbewertung & Management, 2003, pp. 85-92<br />

• Unternehmensbewertung aus Sicht des Rechnungswesens: Das Residual Income Model<br />

[Business Valuation From an Accounting Perspective: The Residual Income Model],<br />

Wirtschaftswissenschaftliches Studium, 2002, pp. 272-277 (with Jochen Zimmermann)<br />

Book Chapters<br />

• Ergebnis je Aktie [Earnings Per Share], in: Ballwieser et al. (Eds.): Wiley Kommentar zur<br />

internationalen Rechnungslegung nach IFRS 2006, 2 nd ed., Weinheim 2006, pp. 805-832<br />

(with Frank Beine)<br />

• Ergebnis je Aktie [Earnings Per Share], in: Ballwieser et al. (Eds.): Wiley Kommentar zur<br />

internationalen Rechnungslegung nach IAS/IFRS, Braunschweig 2004, S. 833-855 (with<br />

Frank Beine)<br />

Contributions to Edited Working Paper Volumes<br />

• Once Upon a Time: The Day-of-the-Week-Effect in German Stock Market Returns, in:<br />

Andrikopoulos (Ed.): Contemporary Issues of Economic and Financial Integration: A<br />

Collection of Empirical Work, ATINER, Athens 2009, pp. 259-278<br />

Editorships<br />

• Kai Brackschulze: Funktionen und Strategien von Hausbanken unter Basel II, Banking,<br />

Finance & Accounting Research Series, Oldenburger Verlag für Wirtschaft, Informatik<br />

und Recht, Edewecht, Volume 1 (co-edited with Stefan Müller)<br />

• Sandra Lüth: Mindestanforderungen an das Risikomanagement: Eine Herausforderung für<br />

Kreditinstitute und Bankenaufsicht, Schriften zum Risikomanagement, Oldenburger<br />

Verlag für Wirtschaft, Informatik und Recht, Edewecht, Volume 1 (co-edited with<br />

Angelika May, Dietmar Pfeifer, and Jürgen Taeger)<br />

2

<strong>Prof</strong>. <strong>Dr</strong>. <strong>Jörg</strong> <strong>Prokop</strong> <strong>Publications</strong> & <strong>Presentations</strong><br />

Conference <strong>Presentations</strong> (Peer-Reviewed)<br />

• Market Concentration and Auditor Independence: The Case of Minority Squeeze-outs,<br />

Annual Conference of the British Accounting Association, Cardiff, UK, March 30-April<br />

1, 2010<br />

• Hedge Fund Performance Evaluation – Does Ratio Choice Matter?, Annual Conference of<br />

the British Accounting Association, Cardiff, UK, March 30-April 1, 2010<br />

• Hedge Fund Performance Evaluation – Does Ratio Choice Matter?, 59 th Midwest Finance<br />

Association Annual Meeting, Las Vegas / Nevada, USA, February 24-27, 2010<br />

• Measuring Hedge Fund Performance: Evidence from Selected Hedge Fund Indices, 5 th<br />

Conference on Performance Measurement and Management Control, Nice, France,<br />

September 23-25, 2009<br />

• The Market for Squeeze-out Valuation and Auditing Services: Evidence from Germany,<br />

32 nd Annual Congress of the European Accounting Association, Tampere, Finland, May<br />

12-15, 2009<br />

• Agency Problems in Impartial Business Appraisals, 12 th Conference of the Swiss Society<br />

for Financial Market Research, Geneva, Switzerland, April 3, 2009<br />

• Once Upon a Time: The Day-of-The-Week Effect in German and US Stock Market<br />

Returns, 21 st Annual Australasian Finance and Banking Conference, Sydney, Australia,<br />

December 16-18 2008<br />

• Once Upon a Time: The Day-of-the-Week Effect in German Stock Market Returns, 6 th<br />

International Conference on Finance, Athens Institute for Education and Research,<br />

Athens, Greece, July 7-10, 2008<br />

• A Conceptual Framework for Assessing Agency Problems in Impartial Business Appraisals,<br />

31 st Annual Congress of the European Accounting Association, Rotterdam, The<br />

Netherlands, April 23-25, 2008<br />

• Impartial Business Valuation and Opportunistic Behaviour: Some Conceptual Thoughts,<br />

29 th McMaster World Congress / 2 nd World Congress on Strategic Business Valuation,<br />

Hamilton, Canada, January 16-18, 2008<br />

• Impartial Business Valuation and Opportunistic Behaviour: Some Conceptual Thoughts,<br />

4 th Workshop on Corporate Governance, Brussels, Belgium, November 15-16, 2007<br />

Invited <strong>Presentations</strong><br />

• “Risk Management and Behavioral Finance” (in German), Steria Mummert ISS, Lübeck,<br />

Germany, September 28, 2010<br />

• “Teaching and Conducting Research in Finance in Times of Global Competition and<br />

Financial Crisis” (in German), keynote speech at a reception of the Oldenburg University<br />

3

<strong>Prof</strong>. <strong>Dr</strong>. <strong>Jörg</strong> <strong>Prokop</strong> <strong>Publications</strong> & <strong>Presentations</strong><br />

Society’s ambassador, Oldenburg, May 6, 2010<br />

• “What Do Banks Do?” (in German), KinderUni Oldenburg [Children’s University],<br />

March 3, 2010<br />

• “Risk Management in Banks After Basel II – Implications for Insurance Companies?” (in<br />

German), 3 rd Insurance Sector Day, Oldenburg, Germany, August 25, 2009<br />

• Panel discussion “Global Economic Crisis – How Long Will It Last?” (in German),<br />

business forum gedankenPlatz e.V., Oldenburg, Germany, March 24, 2009<br />

• Panel discussion “Lessons Learnt from the Financial Crisis” (in German), 2 nd Economic<br />

Education Day, Oldenburg, Germany, March 20, 2009<br />

• Panel discussion “From Financial Crisis to Economic Crisis?” (in German), University of<br />

Oldenburg, Germany, November 19, 2008<br />

• “Effects of the German Corporate Tax Reform 2008 on Business Valuation” (in German),<br />

ad rem Investmentday 2008, Oldenburg, Germany, April 21, 2008<br />

• “Hedge Funds: Blessing or Curse? - Lessons Learnt from the CeWe Color Case” (in<br />

German), 1 st Economic Education Day, Oldenburg, Germany, April 4, 2008<br />

• Panel discussion “Effects of the US Financial Crisis on Northwestern Germany” (in<br />

German), business forum gedankenPlatz e.V., Bremen, Germany, February 21, 2008<br />

• “IFRS 7 – Risk Management and Basel II” (in German), Deloitte, Hanover, Germany,<br />

September 19, 2007<br />

• “Active Investors – The Case of CeWe Color” (in German), Förderverein Wirtschafts-<br />

und Rechtswissenschaften e.V., Oldenburg, Germany, July 10, 2007<br />

Discussions<br />

• Discussion of Shi/Wang: Don’t Confuse Brains with a Bull Market: Market Condition,<br />

Overconfidence, and Trading Behavior of Individual Investors, 59 th Midwest Finance<br />

Association Annual Meeting, Las Vegas / Nevada, USA, February 24-27, 2010<br />

• Discussion of Holzschneider: “Herding” in IPO Valuation – Evidence from Germany in<br />

“Hot” and “Cold” Markets, 12 th Conference of the Swiss Society for Financial Market<br />

Research, Geneva, Switzerland, April 3, 2009<br />

• Discussion of Podolski-Boczar/Kalev/Duong: Deafened by Noise: Do Noise Traders<br />

Affect Volatility and Returns?, 21 st Annual Australasian Finance and Banking<br />

Conference, Sydney, Australia, December 16-18, 2008<br />

• Discussion of Lobe/Schenk: Fairness Opinions and Capital Markets: Evidence from<br />

Germany, Switzerland and Austria, 15 th Annual Meeting of the German Finance<br />

Association, Münster, Germany, October 10-11, 2008<br />

4