SYLLABUS

SYLLABUS

SYLLABUS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

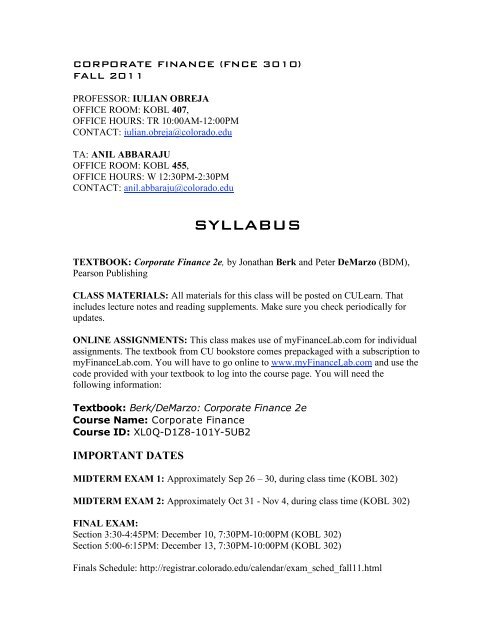

CORPORATE FINANCE (FNCE 3010)<br />

FALL 2011<br />

PROFESSOR: IULIAN OBREJA<br />

OFFICE ROOM: KOBL 407,<br />

OFFICE HOURS: TR 10:00AM-12:00PM<br />

CONTACT: iulian.obreja@colorado.edu<br />

TA: ANIL ABBARAJU<br />

OFFICE ROOM: KOBL 455,<br />

OFFICE HOURS: W 12:30PM-2:30PM<br />

CONTACT: anil.abbaraju@colorado.edu<br />

<strong>SYLLABUS</strong><br />

TEXTBOOK: Corporate Finance 2e, by Jonathan Berk and Peter DeMarzo (BDM),<br />

Pearson Publishing<br />

CLASS MATERIALS: All materials for this class will be posted on CULearn. That<br />

includes lecture notes and reading supplements. Make sure you check periodically for<br />

updates.<br />

ONLINE ASSIGNMENTS: This class makes use of myFinanceLab.com for individual<br />

assignments. The textbook from CU bookstore comes prepackaged with a subscription to<br />

myFinanceLab.com. You will have to go online to www.myFinanceLab.com and use the<br />

code provided with your textbook to log into the course page. You will need the<br />

following information:<br />

Textbook: Berk/DeMarzo: Corporate Finance 2e<br />

Course Name: Corporate Finance<br />

Course ID: XL0Q-D1Z8-101Y-5UB2<br />

IMPORTANT DATES<br />

MIDTERM EXAM 1: Approximately Sep 26 – 30, during class time (KOBL 302)<br />

MIDTERM EXAM 2: Approximately Oct 31 - Nov 4, during class time (KOBL 302)<br />

FINAL EXAM:<br />

Section 3:30-4:45PM: December 10, 7:30PM-10:00PM (KOBL 302)<br />

Section 5:00-6:15PM: December 13, 7:30PM-10:00PM (KOBL 302)<br />

Finals Schedule: http://registrar.colorado.edu/calendar/exam_sched_fall11.html

CLASS SYNOPSYS<br />

This class consists of three parts:<br />

PART 1 will cover introductory topics in corporate finance such as financial statements,<br />

the law of one price, no-arbitrage pricing, fixed income assets, stock and bond valuation,<br />

NPV investment rule, and basic elements of capital budgeting decision.<br />

The impact of uncertainty on all concepts that we will cover during this part of the class<br />

will be kept to a minimum.<br />

EXAM WEEK: week 6 of classes, approximately Sep 26-30. Prior to this week I will<br />

post a concept review and a practice midterm exam to help you prepare for the exam. The<br />

plan for this week is as follows<br />

1. Tuesday we start with a review of the concepts that will be covered in the exam<br />

and then follow with a short Q&A session (where you ask the questions). Then<br />

we spend the rest of the lecture solving the practice midterm exam.<br />

2. Thursday is exam day. The test is 1h and 15 min long and will be administered<br />

during class time.<br />

PART 2 will cover topics such as risk and return in capital markets, portfolio analysis,<br />

risk premium and the CAPM, cost of capital, capital budgeting under uncertainty,<br />

strategic investments and real options.<br />

EXAM WEEK: week 11 of classes, approximately Oct 31 - Nov 4. Prior to this week I<br />

will post a concept review and a practice midterm exam to help you prepare for the exam.<br />

The plan for this week is as follows<br />

1. Tuesday we start with a review of the concepts that will be covered in the exam<br />

and then follow with a short Q&A session (where you ask the questions). Then<br />

we spend the rest of the lecture solving the practice midterm exam.<br />

2. Thursday is exam day. The test is 1h and 15 min long and will be administered<br />

during class time.<br />

PART 3 will cover topics such as security issuance, payout and financing policies, taxes,<br />

optimal capital structure, firm valuation, WACC and APV valuation methods,<br />

acquisitions and divestitures, and corporate restructuring.<br />

FINAL EXAM covers selected topics from PART 1, 2, and 3. This exam is 2h and 30<br />

min long and will take place in your classroom.<br />

ASSIGNMENTS: There will be two types of assignments:<br />

1. Group assignments (GA). A total of 2 or 3 GAs will be distributed approximately<br />

at the end of class parts 1, 2 and (possibly) 3.<br />

2. Individual assignments (IA). A total of 11 IAs will be distributed at the end of<br />

lecture weeks.<br />

Group assignments target relatively complex problems. You will be required to write a<br />

brief and concise memo summarizing your results and to provide a technical appendix

showing your calculations. These group assignments will increase in difficulty as the<br />

class progresses. Groups of 3 or 4 students should form by the end of third week of<br />

classes. That is by September 9. The group assignment will be distributed towards the<br />

end of each of the three class parts. You will get 1 week to work on it. The group<br />

assignment is meant to be part of your preparation towards the coming midterm/final<br />

exam. Each group member is expected to contribute to the group assignments or else<br />

he/she will receive a grade of 0. Each group assignment will be graded from 1 to 10.<br />

Individual assignments will be administered through www.myFinanceLab.com, so make<br />

sure you establish an account as soon as possible during the first week of classes. Please<br />

see the top of this syllabus for more information or contact me if you need help with this.<br />

Individual assignments (IAs) will be distributed at the end of each lecture week and will<br />

consist of sets of short problems on the material covered during that lecture week. IAs<br />

will be due the first Tuesday.<br />

Important: I have zero tolerance for late assignments. Pay attention to deadlines or your<br />

work will receive no grade.<br />

GRADING<br />

Please be aware that the Leeds School of Business has recently passed a mandatory<br />

grading policy stating that the average course grade cannot exceed 3.0. The school also<br />

recommends a grade distribution with no more than 25% A- or above, no more than 75%<br />

B- or above and at least 25% C+ or below. The official grading guidelines can be found<br />

at: http://leeds.colorado.edu/asset/undergraduate/gradingpolicy.pdf.<br />

In computing your final grade I will use the following weighting scheme:<br />

1. Midterm 1: 25%<br />

2. Midterm 2: 25%<br />

3. Final Exam: 25%<br />

4. Group Assignment: 10%<br />

5. Individual Assignments: 15%<br />

Example: Suppose you scored 80% in Midterm1, 90% in Midterm 2, 85% in Final<br />

Exam, 95% in Group Assignments and 89% in Individual Assignments. Then your total<br />

(percentage) score is<br />

86.6% = 0.25 X 80% + 0.25 X 90% + 0.25 X 85% + 0.10 X 95% + 0.15 X 89%.

TENTATIVE WEEKLY TOPIC COVERAGE<br />

Week 1 (Aug 22-26): a) Financial Statements b) Using Ratios c) Objective of the firm<br />

Chapters covered: 1, 2<br />

Individual Assignment 1<br />

Week 2 (Aug 29-Sep 2): a) Time value of money b) The NPV decision rule c) Arbitrage<br />

in capital markets and the Law of One Price d) No-arbitrage pricing e) Risky cash flows<br />

and risk premiums<br />

Chapters covered: 3, 4<br />

Individual Assignment 2<br />

Week 3 (Sep 5-9): a) Valuing fixed income assets (bonds and annuities) b) US Treasury<br />

bonds and the term structure of interest rates<br />

Chapters covered: 4, 5<br />

Individual Assignment 3<br />

Week 4 (Sep 12-16): a) NPV and other investment rules b) Choosing between projects c)<br />

Constraint resources d) Incremental earnings of a project e) Sunk costs, opportunity costs,<br />

competition, f) Working capital, g) Salvage value h) Free cash flows i) Project analysis<br />

Chapters covered: 6, 7<br />

Individual Assignment 4, Group Assignment 1<br />

Week 5 (Sep 19-23): a) Equity markets b) DCF valuation models c) Inferring the market<br />

capitalization rate for a stock d) The value of growth options<br />

Chapters covered: 9<br />

Individual Assignment 5<br />

Week 6 (Sep 26-30): EXAM WEEK - MIDTERM EXAM 1<br />

Week 7 (Oct 3-7): a) Capital markets and risk b) Forms of compensation for bearing risk<br />

(risk premiums) c) Measuring the risk of an asset d) The ex-post risk-return relationship<br />

e) Financial vs. real assets f) General principles for estimating the opportunity cost of<br />

capital g) Measuring the risk characteristics of a portfolio of assets<br />

Chapters covered: 10<br />

Individual Assignment 6<br />

Week 8 (Oct 10-14): a) Portfolio vs. Individual asset risk b) Diversification c) Normallydistributed<br />

asset returns and the mean-variance efficient frontier d) Investors’ preferences<br />

e) Optimal portfolio allocation with or without risk-free assets f) Two-fund separation<br />

Chapters covered: 11<br />

Individual Assignment 7

Week 9 (Oct 17-21): a) The Capital Asset Pricing Model (CAPM) b) Systematic vs.<br />

idiosyncratic risk c) Alternatives to CAPM<br />

Chapters covered: 11<br />

Individual Assignment 8<br />

Week 10 (Oct 24-28): a) Real assets and flexibility b) Real options: expansion,<br />

abandonment and timing options c) Real options and investment decisions<br />

Chapters covered: 22<br />

Individual Assignment 9<br />

Week 11 (Oct 31 - Nov 4): EXAM WEEK - MIDTERM EXAM 2<br />

Week 12 (Nov 7-11): a) Capital budgeting under uncertainty b) Opportunity cost of<br />

capital of a project c) Cost of equity capital d) Cost of debt capital e) Cost of capital for a<br />

firm f) Optimal capital structure and Modigliani-Miller result g) The tax benefits of<br />

corporate debt h) Impact of corporate taxes on the cost of capital (Tax-adjusted WACC)<br />

i) Personal taxes and the Miller equilibrium j) Net tax benefits: theory vs. empirical<br />

evidence, k) Theories of the optimal capital structure of a firm<br />

Chapters covered: 12, 14, 15, 16<br />

Individual Assignment 10<br />

Week 13 (Nov 14-18): a) Optimal payout policy b) Firm valuation methods, tax shields<br />

for finitely-lived projects and recapitalization c) The WACC method d) The Adjusted<br />

prevent value method (APV) e) Comparing WACC vs. APV f) WACC and APV methods<br />

in practice g) When to use WACC vs. APV methods h) Acquisitions financed with equity<br />

i) Acquisitions financed partly with debt<br />

Chapters covered: 17, 18<br />

Individual Assignment 11, Group Assignment 2<br />

Guest Lecturer (exact date/time TBA): Clinton Kent, Director of Business<br />

Development, DAE Engineering and Manufacturing, Dubai Aerospace Enterprises<br />

Week 14 (Nov 28 – Dec 2): a) Valuing Ideko Corporation (Case Study) b) Motives for<br />

mergers, estimating synergies, and tax issues<br />

Chapters covered: 19, 28<br />

Group Assignment 3<br />

Week 15 (Dec 5 - 9): EXAM WEEK - FINAL EXAM<br />

FINAL EXAM SCHEDULE:<br />

Section 3:30-4:45PM: December 10, 7:30PM-10:00PM (KOBL 302)<br />

Section 5:00-6:15PM: December 13, 7:30PM-10:00PM (KOBL 302)

IMPORTANT DISCLAIMERS<br />

Special Accommodations for Students with Disabilities or Medical Conditions<br />

If you qualify for accommodations because of a disability, please submit to me a letter<br />

from Disability Services in a timely manner so that your needs can be addressed.<br />

Disability Services determines accommodations based on documented disabilities.<br />

Contact: 303-492-8671, Center for Community N200, and<br />

http://www.colorado.edu/disabilityservices.<br />

If you have a temporary medical condition or injury, see guidelines at<br />

http://www.colorado.edu/disabilityservices/go.cgi?select=temporary.html<br />

Disability Services' letters for students with disabilities indicate legally mandated<br />

reasonable accommodations. The syllabus statements and answers to Frequently Asked<br />

Questions can be found at http://www.colorado.edu/disabilityservices<br />

Responsible Behavior<br />

Students and faculty each have responsibility for maintaining an appropriate learning<br />

environment. Those who fail to adhere to such behavioral standards may be subject to<br />

discipline. Professional courtesy and sensitivity are especially important with respect to<br />

individuals and topics dealing with differences of race, color, culture, religion, creed,<br />

politics, veteran's status, sexual orientation, gender, gender identity and gender<br />

expression, age, disability, and nationalities. Class rosters are provided to the instructor<br />

with the student's legal name. I will gladly honor your request to address you by an<br />

alternate name or gender pronoun. Please advise me of this preference early in the<br />

semester so that I may make appropriate changes to my records. See policies at<br />

http://www.colorado.edu/policies/classbehavior.html, and at<br />

http://www.colorado.edu/studentaffairs/judicialaffairs/code.html#student_code

Discrimination and Sexual Harassment<br />

The University of Colorado at Boulder Discrimination and Harassment Policy and<br />

Procedures, the University of Colorado Sexual Harassment Policy and Procedures, and<br />

the University of Colorado Conflict of Interest in Cases of Amorous Relationships policy<br />

apply to all students, staff, and faculty. Any student, staff, or faculty member who<br />

believes s/he has been the subject of sexual harassment or discrimination or harassment<br />

based upon race, color, national origin, sex, age, disability, creed, religion, sexual<br />

orientation, or veteran status should contact the Office of Discrimination and Harassment<br />

(ODH) at 303-492-2127 or the Office of Student Conduct (OSC) at 303-492-5550.<br />

Information about the ODH, the above referenced policies, and the campus resources<br />

available to assist individuals regarding discrimination or harassment can be obtained at<br />

http://www.colorado.edu/odh<br />

Academic Honesty<br />

All students of the University of Colorado at Boulder are responsible for knowing and<br />

adhering to the academic integrity policy of this institution. Violations of this policy may<br />

include: cheating, plagiarism, aid of academic dishonesty, fabrication, lying, bribery, and<br />

threatening behavior. All incidents of academic misconduct shall be reported to the<br />

Honor Code Council (honor@colorado.edu; 303-735-2273). Students who are found to<br />

be in violation of the academic integrity policy will be subject to both academic sanctions<br />

from the faculty member and non-academic sanctions (including but not limited to<br />

university probation, suspension, or expulsion). Other information on the Honor Code<br />

can be found at http://www.colorado.edu/policies/honor.html, and at<br />

http://www.colorado.edu/academics/honorcode/<br />

Religious Holidays<br />

Campus policy regarding religious observances requires that faculty make every effort to<br />

deal reasonably and fairly with all students who, because of religious obligations, have<br />

conflicts with scheduled exams, assignments or required attendance.<br />

See full details at http://www.colorado.edu/policies/fac_relig.html