thailand in global automobile networks - International Trade Centre

thailand in global automobile networks - International Trade Centre

thailand in global automobile networks - International Trade Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

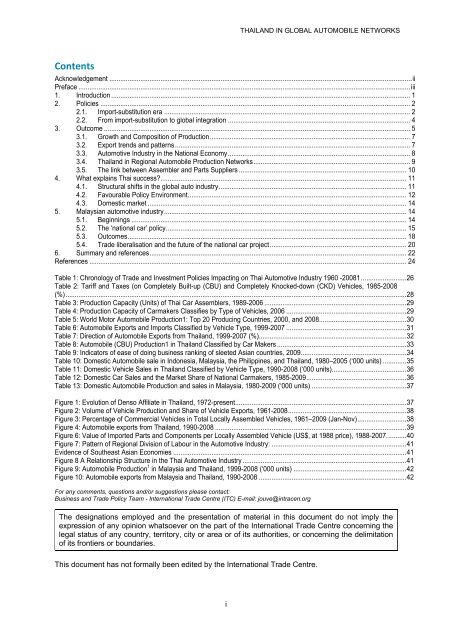

Contents<br />

i<br />

THAILAND IN GLOBAL AUTOMOBILE NETWORKS<br />

Acknowledgement ...................................................................................................................................................................... ii<br />

Preface ...................................................................................................................................................................................... iii<br />

1. Introduction .................................................................................................................................................................... 1<br />

2. Policies .......................................................................................................................................................................... 2<br />

2.1. Import-substitution era ....................................................................................................................................... 2<br />

2.2. From import-substitution to <strong>global</strong> <strong>in</strong>tegration .................................................................................................... 4<br />

3. Outcome ........................................................................................................................................................................ 5<br />

3.1. Growth and Composition of Production .............................................................................................................. 7<br />

3.2. Export trends and patterns ................................................................................................................................. 7<br />

3.3. Automotive Industry <strong>in</strong> the National Economy .................................................................................................... 8<br />

3.4. Thailand <strong>in</strong> Regional Automobile Production Networks ...................................................................................... 9<br />

3.5. The l<strong>in</strong>k between Assembler and Parts Suppliers ............................................................................................ 10<br />

4. What expla<strong>in</strong>s Thai success? ....................................................................................................................................... 11<br />

4.1. Structural shifts <strong>in</strong> the <strong>global</strong> auto <strong>in</strong>dustry ....................................................................................................... 11<br />

4.2. Favourable Policy Environment ........................................................................................................................ 12<br />

4.3. Domestic market .............................................................................................................................................. 14<br />

5. Malaysian automotive <strong>in</strong>dustry ..................................................................................................................................... 14<br />

5.1. Beg<strong>in</strong>n<strong>in</strong>gs ....................................................................................................................................................... 14<br />

5.2. The ‘national car’ policy .................................................................................................................................... 15<br />

5.3. Outcomes ......................................................................................................................................................... 18<br />

5.4. <strong>Trade</strong> liberalisation and the future of the national car project ........................................................................... 20<br />

6. Summary and references ............................................................................................................................................. 22<br />

References .............................................................................................................................................................................. 24<br />

Table 1: Chronology of <strong>Trade</strong> and Investment Policies Impact<strong>in</strong>g on Thai Automotive Industry 1960 -20081 ......................... 26<br />

Table 2: Tariff and Taxes (on Completely Built-up (CBU) and Completely Knocked-down (CKD) Vehicles, 1985-2008<br />

(%) ........................................................................................................................................................................................... 28<br />

Table 3: Production Capacity (Units) of Thai Car Assemblers, 1989-2006 .............................................................................. 29<br />

Table 4: Production Capacity of Carmakers Classifies by Type of Vehicles, 2006 .................................................................. 29<br />

Table 5: World Motor Automobile Production1: Top 20 Produc<strong>in</strong>g Countries, 2000, and 2008................................................ 30<br />

Table 6: Automobile Exports and Imports Classified by Vehicle Type, 1999-2007 .................................................................. 31<br />

Table 7: Direction of Automobile Exports from Thailand, 1999-2007 (%) ................................................................................. 32<br />

Table 8: Automobile (CBU) Production1 <strong>in</strong> Thailand Classified by Car Makers ....................................................................... 33<br />

Table 9: Indicators of ease of do<strong>in</strong>g bus<strong>in</strong>ess rank<strong>in</strong>g of sleeted Asian countries, 2009 .......................................................... 34<br />

Table 10: Domestic Automobile sale <strong>in</strong> Indonesia, Malaysia, the Philipp<strong>in</strong>es, and Thailand, 1980–2005 (‘000 units) ............. 35<br />

Table 11: Domestic Vehicle Sales <strong>in</strong> Thailand Classified by Vehicle Type, 1990-2008 (‘000 units) ......................................... 36<br />

Table 12: Domestic Car Sales and the Market Share of National Carmakers, 1985-2009 ....................................................... 36<br />

Table 13: Domestic Automobile Production and sales <strong>in</strong> Malaysia, 1980-2009 (‘000 units) .................................................... 37<br />

Figure 1: Evolution of Denso Affiliate <strong>in</strong> Thailand, 1972-present .............................................................................................. 37<br />

Figure 2: Volume of Vehicle Production and Share of Vehicle Exports, 1961-2008 ................................................................. 38<br />

Figure 3: Percentage of Commercial Vehicles <strong>in</strong> Total Locally Assembled Vehicles, 1961–2009 (Jan-Nov) ........................... 38<br />

Figure 4: Automobile exports from Thailand, 1990-2008 ......................................................................................................... 39<br />

Figure 6: Value of Imported Parts and Components per Locally Assembled Vehicle (US$, at 1988 price), 1988-2007. .......... 40<br />

Figure 7: Pattern of Regional Division of Labour <strong>in</strong> the Automotive Industry: .......................................................................... 41<br />

Evidence of Southeast Asian Economies ................................................................................................................................ 41<br />

Figure 8 A Relationship Structure <strong>in</strong> the Thai Automotive Industry .......................................................................................... 41<br />

Figure 9: Automobile Production 1 <strong>in</strong> Malaysia and Thailand, 1999-2008 (‘000 units) .............................................................. 42<br />

Figure 10: Automobile exports from Malaysia and Thailand, 1990-2008 ................................................................................. 42<br />

For any comments, questions and/or suggestions please contact:<br />

Bus<strong>in</strong>ess and <strong>Trade</strong> Policy Team - <strong>International</strong> <strong>Trade</strong> <strong>Centre</strong> (ITC) E-mail: jouve@<strong>in</strong>tracen.org<br />

The designations employed and the presentation of material <strong>in</strong> this document do not imply the<br />

expression of any op<strong>in</strong>ion whatsoever on the part of the <strong>International</strong> <strong>Trade</strong> <strong>Centre</strong> concern<strong>in</strong>g the<br />

legal status of any country, territory, city or area or of its authorities, or concern<strong>in</strong>g the delimitation<br />

of its frontiers or boundaries.<br />

This document has not formally been edited by the <strong>International</strong> <strong>Trade</strong> <strong>Centre</strong>.