Annual Financial Statements Of AUDI AG

Annual Financial Statements Of AUDI AG

Annual Financial Statements Of AUDI AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

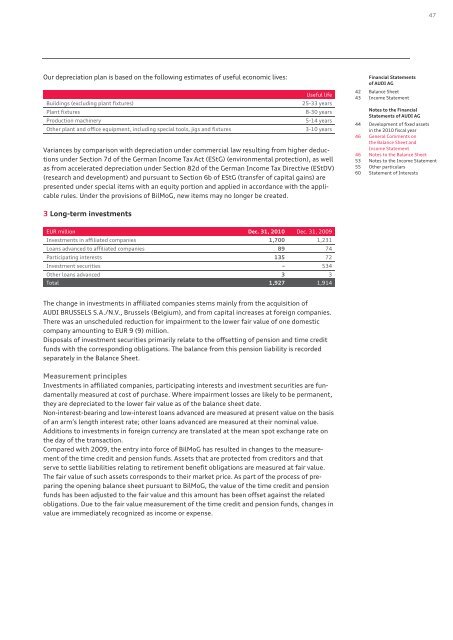

Our depreciation plan is based on the following estimates of useful economic lives:<br />

Buildings (excluding plant fixtures)<br />

Useful life<br />

25-33 years<br />

Plant fixtures 8-30 years<br />

Production machinery 5-14 years<br />

Other plant and office equipment, including special tools, jigs and fixtures 3-10 years<br />

Variances by comparison with depreciation under commercial law resulting from higher deductions<br />

under Section 7d of the German Income Tax Act (EStG) (environmental protection), as well<br />

as from accelerated depreciation under Section 82d of the German Income Tax Directive (EStDV)<br />

(research and development) and pursuant to Section 6b of EStG (transfer of capital gains) are<br />

presented under special items with an equity portion and applied in accordance with the applicable<br />

rules. Under the provisions of BilMoG, new items may no longer be created.<br />

3 Long-term investments<br />

EUR million Dec. 31, 2010 Dec. 31, 2009<br />

Investments in affiliated companies 1,700 1,231<br />

Loans advanced to affiliated companies 89 74<br />

Participating interests 135 72<br />

Investment securities – 534<br />

Other loans advanced 3 3<br />

Total 1,927 1,914<br />

The change in investments in affiliated companies stems mainly from the acquisition of<br />

<strong>AUDI</strong> BRUSSELS S.A./N.V., Brussels (Belgium), and from capital increases at foreign companies.<br />

There was an unscheduled reduction for impairment to the lower fair value of one domestic<br />

company amounting to EUR 9 (9) million.<br />

Disposals of investment securities primarily relate to the offsetting of pension and time credit<br />

funds with the corresponding obligations. The balance from this pension liability is recorded<br />

separately in the Balance Sheet.<br />

Measurement principles<br />

Investments in affiliated companies, participating interests and investment securities are fundamentally<br />

measured at cost of purchase. Where impairment losses are likely to be permanent,<br />

they are depreciated to the lower fair value as of the balance sheet date.<br />

Non-interest-bearing and low-interest loans advanced are measured at present value on the basis<br />

of an arm’s length interest rate; other loans advanced are measured at their nominal value.<br />

Additions to investments in foreign currency are translated at the mean spot exchange rate on<br />

the day of the transaction.<br />

Compared with 2009, the entry into force of BilMoG has resulted in changes to the measurement<br />

of the time credit and pension funds. Assets that are protected from creditors and that<br />

serve to settle liabilities relating to retirement benefit obligations are measured at fair value.<br />

The fair value of such assets corresponds to their market price. As part of the process of preparing<br />

the opening balance sheet pursuant to BilMoG, the value of the time credit and pension<br />

funds has been adjusted to the fair value and this amount has been offset against the related<br />

obligations. Due to the fair value measurement of the time credit and pension funds, changes in<br />

value are immediately recognized as income or expense.<br />

<strong>Financial</strong> <strong>Statements</strong><br />

of <strong>AUDI</strong> <strong>AG</strong><br />

42 Balance Sheet<br />

43 Income Statement<br />

47<br />

Notes to the <strong>Financial</strong><br />

<strong>Statements</strong> of <strong>AUDI</strong> <strong>AG</strong><br />

44 Development of fixed assets<br />

in the 2010 fiscal year<br />

46 General Comments on<br />

the Balance Sheet and<br />

Income Statement<br />

46 Notes to the Balance Sheet<br />

53 Notes to the Income Statement<br />

55 Other particulars<br />

60 Statement of Interests