VILLAGE OF MARSHALL BOARD MEETING MINUTES APRIL 17 ...

VILLAGE OF MARSHALL BOARD MEETING MINUTES APRIL 17 ...

VILLAGE OF MARSHALL BOARD MEETING MINUTES APRIL 17 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>VILLAGE</strong> <strong>OF</strong> <strong>MARSHALL</strong><br />

<strong>BOARD</strong> <strong>MEETING</strong> <strong>MINUTES</strong><br />

<strong>APRIL</strong> <strong>17</strong>, 2012<br />

President Hensler called the Special Village Board meeting to order at 6:00 p.m. Roll Call: Arnold,<br />

Cripps, Lowrey, Raasch, Shepler and Hensler were present. Diedrick was absent. Recognize<br />

Others Present: Baker Tilly – Heather Acker, Bethany Ryers and John Andres, Tyler Lamb-Courier<br />

and Sue Peck-Clerk/Treasurer.<br />

1. The board welcomed newly elected board member Christopher Raasch. Mr. Raasch was<br />

elected to serve a 3-year term as Village Trustee. Trustee Chad Diedrick was also re-elected<br />

for 3-year term.<br />

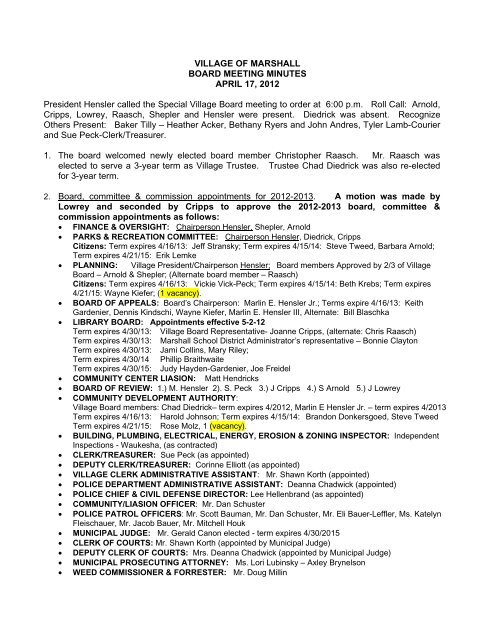

2. Board, committee & commission appointments for 2012-2013. A motion was made by<br />

Lowrey and seconded by Cripps to approve the 2012-2013 board, committee &<br />

commission appointments as follows:<br />

� FINANCE & OVERSIGHT: Chairperson Hensler, Shepler, Arnold<br />

� PARKS & RECREATION COMMITTEE: Chairperson Hensler, Diedrick, Cripps<br />

Citizens: Term expires 4/16/13: Jeff Stransky; Term expires 4/15/14: Steve Tweed, Barbara Arnold;<br />

Term expires 4/21/15: Erik Lemke<br />

� PLANNING: Village President/Chairperson Hensler; Board members Approved by 2/3 of Village<br />

Board – Arnold & Shepler; (Alternate board member – Raasch)<br />

Citizens: Term expires 4/16/13: Vickie Vick-Peck; Term expires 4/15/14: Beth Krebs; Term expires<br />

4/21/15: Wayne Kiefer; (1 vacancy).<br />

� <strong>BOARD</strong> <strong>OF</strong> APPEALS: Board’s Chairperson: Marlin E. Hensler Jr.; Terms expire 4/16/13: Keith<br />

Gardenier, Dennis Kindschi, Wayne Kiefer, Marlin E. Hensler III, Alternate: Bill Blaschka<br />

� LIBRARY <strong>BOARD</strong>: Appointments effective 5-2-12<br />

Term expires 4/30/13: Village Board Representative- Joanne Cripps, (alternate: Chris Raasch)<br />

Term expires 4/30/13: Marshall School District Administrator’s representative – Bonnie Clayton<br />

Term expires 4/30/13: Jami Collins, Mary Riley;<br />

Term expires 4/30/14 Phillip Braithwaite<br />

Term expires 4/30/15: Judy Hayden-Gardenier, Joe Freidel<br />

� COMMUNITY CENTER LIASION: Matt Hendricks<br />

� <strong>BOARD</strong> <strong>OF</strong> REVIEW: 1.) M. Hensler 2). S. Peck 3.) J Cripps 4.) S Arnold 5.) J Lowrey<br />

� COMMUNITY DEVELOPMENT AUTHORITY:<br />

Village Board members: Chad Diedrick– term expires 4/2012, Marlin E Hensler Jr. – term expires 4/2013<br />

Term expires 4/16/13: Harold Johnson; Term expires 4/15/14: Brandon Donkersgoed, Steve Tweed<br />

Term expires 4/21/15: Rose Molz, 1 (vacancy).<br />

� BUILDING, PLUMBING, ELECTRICAL, ENERGY, EROSION & ZONING INSPECTOR: Independent<br />

Inspections - Waukesha, (as contracted)<br />

� CLERK/TREASURER: Sue Peck (as appointed)<br />

� DEPUTY CLERK/TREASURER: Corinne Elliott (as appointed)<br />

� <strong>VILLAGE</strong> CLERK ADMINISTRATIVE ASSISTANT: Mr. Shawn Korth (appointed)<br />

� POLICE DEPARTMENT ADMINISTRATIVE ASSISTANT: Deanna Chadwick (appointed)<br />

� POLICE CHIEF & CIVIL DEFENSE DIRECTOR: Lee Hellenbrand (as appointed)<br />

� COMMUNITY/LIASION <strong>OF</strong>FICER: Mr. Dan Schuster<br />

� POLICE PATROL <strong>OF</strong>FICERS: Mr. Scott Bauman, Mr. Dan Schuster, Mr. Eli Bauer-Leffler, Ms. Katelyn<br />

Fleischauer, Mr. Jacob Bauer, Mr. Mitchell Houk<br />

� MUNICIPAL JUDGE: Mr. Gerald Canon elected - term expires 4/30/2015<br />

� CLERK <strong>OF</strong> COURTS: Mr. Shawn Korth (appointed by Municipal Judge)<br />

� DEPUTY CLERK <strong>OF</strong> COURTS: Mrs. Deanna Chadwick (appointed by Municipal Judge)<br />

� MUNICIPAL PROSECUTING ATTORNEY: Ms. Lori Lubinsky – Axley Brynelson<br />

� WEED COMMISSIONER & FORRESTER: Mr. Doug Millin

Village of Marshall<br />

Board meeting minutes April <strong>17</strong>, 2012<br />

Page | 2<br />

� UTILITY SUPERINTENDENT: Dean Gerber (as appointed)<br />

� WATER - WASTEWATER OPERATORS: (appointed positions) Michael Schlimgen, Brent Mosher, Mike<br />

Scheel<br />

� STREET DEPARTMENT FOREMAN: Doug Millin (as appointed)<br />

� STREET DEPARTMENT EMPLOYEES: Fred Warren, Mike Scheel<br />

� ASSESSOR: Landretti & Company LLC (Dominic Landretti)<br />

� PARKS & RECREATION DIRECTOR & <strong>MARSHALL</strong> SENIOR REPRESENTATIVE: Matt Hendricks (as<br />

appointed)<br />

� EMS & PUBLIC SAFETY BUILDING REPRESENTATIVE: Jeff Lowrey - (alternate: Marlin E. Hensler<br />

Jr.)<br />

� <strong>MARSHALL</strong> AREA BUSINESS ASSOCIATION REPRESENTATIVE: Deanna Chadwick<br />

� LIBRARY DIRECTOR (Appointed by Library Board): Diana Skalitzky<br />

� LIBRARIAN ASSISTANTS (appointed by Library Director): Joanne Mackey, Marian Barth, Marilyn<br />

Osterlie, Laura Rose<br />

� ATTORNEY & ENGINEER REPRESENTATIVE: Village President Hensler<br />

� <strong>VILLAGE</strong> ATTORNEY: Mr. Allen Reuter - Reuter, Whitish & Evans<br />

� <strong>VILLAGE</strong> ENGINEER: Town & Country Engineering, Inc., Warren Myers<br />

Roll call votes carried 6-0, Diedrick was absent.<br />

3. Pay request #7, Miron Construction, $32,948.63 for the Well #3 project. A motion was made<br />

by Arnold and second by Lowrey to approve a pay request for Miron Construction in the<br />

amount of $32,948.63 for the Well #3 project. Roll call votes carried 6-0.<br />

4. A League of Wisconsin Municipalities workshop for new Municipal Officials will be held on May 11,<br />

2012 in Madison.<br />

5. Notice was received for the 2012 annual League of Wisconsin Municipalities Regional Dinner<br />

Meetings.<br />

6. Presentation of 2011 audit reports, Baker Tilly-Virchow Krause.<br />

Heather Acker was present to discuss the recent audit reports their firm completed. Ms. Acker<br />

audits the general funds of the Village. She noted that the Village received an unqualified financial<br />

statement at the highest rating possible. She covered new terminology that is being used in<br />

financial reporting such as non-spendable, assigned, and unassigned funds. A five year trend<br />

highlighting the Village’s financial statement was presented. Ms. Acker said the Village’s<br />

unreserved fund balances show we have a lot of stability. The Government Finance Officers<br />

Association (GFOA) recommends a two month reserve and we have a six month reserve which is<br />

very good. The Village’s debt limit is 5% of the Village’s equalized value. Our debt is at 50% of the<br />

equalized value, and that is good number with an active TIF district being included. Total debt<br />

service of principal and interest payments compared to all expenditures. Generally it is<br />

recommended around 20%. We are around 18.33% for 2011. Ms. Acker informed the board that in<br />

the internal controls document most of it is required communications.<br />

Water & Sewer Utility. John Andres and Bethany Ryers were present to discuss the water and<br />

sewer utility financial statements. Mr. Andres said the utility had a fairly stable year in 2011. The<br />

utility is in the business of selling water to customers and the collection of wastewater and treating<br />

it. He recommended a monthly comparison of gallons pumped versus billed to see if there is a<br />

problem. It was found in 2011 that two commercial properties tampered with the meters and had to<br />

be back billed.

Village of Marshall<br />

Board meeting minutes April <strong>17</strong>, 2012<br />

Page | 3<br />

The Utility has some general obligation debt but also has revenue bond debt. The revenue debt is<br />

important to know. The Water Utility Bond covenants require the earnings from the system be<br />

greater than 1.25 times the revenue bond annual debt service based on the bond year. In 2011 we<br />

were at 1.72 times, which means we are a solid investment for bond holders.<br />

The Sewer Utility is to have a 1.10 times debt coverage. The sewer utility was at 1.12 for debt<br />

coverage. The sewer rates weren’t raise in 2011. The help was a connection fee from Kwik Trip<br />

and the change in the replacement account deposit. There was a policy change that we would<br />

change to an alternative method allowable by the DNR for putting funds in the replacement<br />

account. These were onetime items. We raised rates 9% in 2012 to meet the debt coverage<br />

requirements going forward.<br />

Rate of Return is a key indicator of financial results in a regulated utility like our water utility. Any<br />

growth in plant requires that rates cover the cost of providing service or the utility will weaken<br />

financially in the long run. In 2012 a water increase was requested. The increase was needed for<br />

the costs associated with the new well #3. Those costs will be seen in 2012 and had not impacted<br />

the 2011 financials.<br />

Unrestricted funds on hand. A utility should maintain funds to cover its operations in a normal<br />

business operation cycle (ie. Quarterly, monthly) plus a contingency. In addition, utilities should<br />

have available an amount equal to one year’s capital improvements. These funding levels facilitate<br />

budgeting since there will be less concern for business cycle fluctuations. The utility has<br />

historically had ample cash reserves for operations. In addition, funds have been set aside as<br />

restricted for capital improvements. They want us to have 3 months for a quarter of a year on<br />

hand. We would need about $100,000/month and we have just about $400,000.00 in reserve. We<br />

are in a stable situation.<br />

For a utility we put a lot of money underground. How much can we borrow/debt and how much<br />

equity we should have are all considered. In the water Utility we have 90% equity. If we have<br />

more than 50% in equity and less than 50% for debt we are doing well. Sewer also doing well<br />

with a 63% equity. We have been in a stable position. The board has been good about balancing<br />

costs of what they can afford.<br />

Adjournment<br />

Having no further business a motion was made by Cripps and second by Shepler to adjourn at<br />

6:44 p.m. Motion carried unanimously.<br />

Respectfully submitted,<br />

Sue Peck<br />

Clerk/Treasurer<br />

Board approved: May 1, 2012