Board Of DIRECTORS - Company Announcements - Bursa Malaysia

Board Of DIRECTORS - Company Announcements - Bursa Malaysia

Board Of DIRECTORS - Company Announcements - Bursa Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

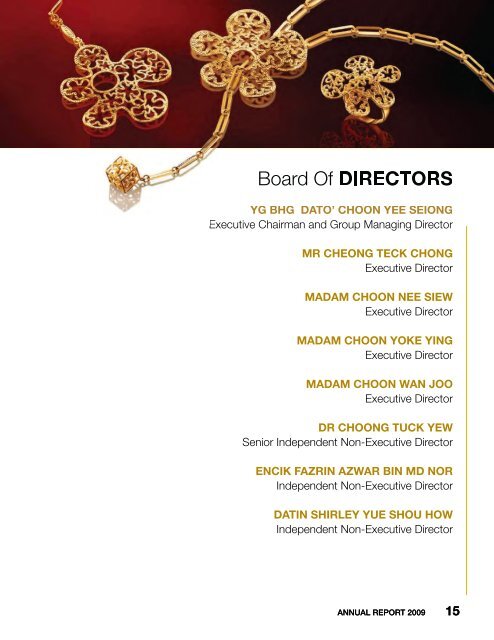

<strong>Board</strong> <strong>Of</strong><br />

<strong>DIRECTORS</strong><br />

YG BHG DATO’ CHOON YEE SEIONG<br />

Executive Chairman and Group Managing Director<br />

MR CHEONG TECK CHONG<br />

Executive Director<br />

MADAM CHOON NEE SIEW<br />

Executive Director<br />

MADAM CHOON YOKE YING<br />

Executive Director<br />

MADAM CHOON WAN JOO<br />

Executive Director<br />

DR CHOONG TUCK YEW<br />

Senior Independent Non-Executive Director<br />

ENCIK FAZRIN AZWAR BIN MD NOR<br />

Independent Non-Executive Director<br />

DATIN SHIRLEY YUE SHOU HOW<br />

Independent Non-Executive Director<br />

ANNUAL REPORT 2009 15

16 Poh Kong Holdings Berhad<br />

Profile of BOARD OF <strong>DIRECTORS</strong><br />

YG BHG DATO’ CHOON YEE SEIONG<br />

Executive Chairman and Group Managing Director<br />

Yg Bhg Dato’ Choon Yee Seiong, age 55 years, a <strong>Malaysia</strong>n, was appointed to the <strong>Board</strong><br />

of Directors of Poh Kong Holdings Berhad (PKHB) as Executive Chairman and Group<br />

Managing Director on 13 January 2004. As one of the founders of the <strong>Company</strong> in 1976,<br />

he is a visionary entrepreneur, and has helmed the Poh Kong Group since its inception as<br />

Poh Kong Jewellers (PKJ).<br />

Yg Bhg Dato’ Choon is responsible for the overall strategic and marketing directions,<br />

management policies and expansion of PKHB. Over the years, he has been instrumental<br />

in the acquisition of companies, the successful development of a portfolio of international<br />

brands and retail concept stores. He has proven that jewellery retailing is a serious<br />

business which requires resilience, mettle, a good head for numbers and, most of all,<br />

dedication and passion. Under his leadership, he has expanded PKJ retail stores to 95<br />

outlets making it the largest jewellery chain store nationwide.<br />

In 2001, under his supervision, a manufacturing facility in Shah Alam was established<br />

to create exclusive designs by a team of skilled master craftsmen. His determination to<br />

have the finest in jewellery resulted in the set up of the first ever, exclusive Schoeffel for<br />

Poh Kong flagship store at Pavilion Kuala Lumpur in 2007 and was given the exclusive<br />

distribution and marketing rights of the Schoeffel brand in <strong>Malaysia</strong> and Southeast Asia.<br />

The following year, Poh Kong and Schoeffel officially launched a range of exquisite<br />

watches called the Schoeffel Time Collection. In 2009, Yg Bhg Dato’ Choon led Poh<br />

Kong in collaborating with Luca Carati, one of Italy’s oldest and prestigious jewellers, to<br />

launch the exclusive brand in <strong>Malaysia</strong>.<br />

He has won prestigious awards, such as the “19 Years At The Top Award” given by<br />

<strong>Malaysia</strong> Tatler in 2008 and “Super Star of the Year 2008” by the <strong>Malaysia</strong>n Retailer-<br />

Chains Association (MRCA) for his leadership and business achievements.<br />

Yg Bhg Dato’ Choon was the Founder President of the MRCA, and holds numerous<br />

directorships in the companies within the Group. He is a substantial shareholder and<br />

director of Choon Yee Seiong Sdn Bhd, an investment holding company. He is also a<br />

member of the Remuneration Committee of PKHB.<br />

He is the spouse of Datin Hon Wee Fong. His sibilings Madam Choon Nee Siew, Madam<br />

Choon Yoke Ying, Encik Mohd Annuar Choon Bin Abdullah, Madam Choon Wan Joo,<br />

Mr Choon Yee Fook, Mr Choon Yee Bin, Madam Choon Ching Yih and Madam Choong<br />

Bee Chu are shareholders of the <strong>Company</strong>. His brothers-in-law Mr Siow Der Ming and Mr<br />

Chang Kwong Him are also shareholders of the <strong>Company</strong>.

MR CHEONG TECK CHONG<br />

Executive Director<br />

Mr Cheong Teck Chong, age 60 years, a <strong>Malaysia</strong>n, was appointed<br />

to the <strong>Board</strong> of Directors of PKHB as Executive Director on 13<br />

January 2004.<br />

A veteran in the jewellery industry, he was a co-founder of Poh<br />

Kong Jewellers (PKJ) in 1976. Mr Cheong began his career in the<br />

gold jewellery industry in 1967 and rose to the rank of General<br />

Manager in Lian Sin Pawnshop. He became a Partner of Lian Yik<br />

Goldsmith in 1972 until 1980. In 1982, he was appointed Managing<br />

Director of PKJ (SS2) Sdn Bhd, Petaling Jaya. Mr Cheong assists<br />

in the growth, development and expansion of the Group.<br />

He also sits as a Director of other companies within the Group and<br />

is a director and shareholder of Lian Sin Tang Sdn Bhd, Heng Seng<br />

Sdn Bhd and a director of Pajak Gadai Rakyat Sdn Bhd.<br />

Mr Cheong is the spouse of Madam Pang Cheow Moi. Mr Cheong’s<br />

sibiling Madam Cheong Siew Loi @ Chong Kim Looi is also a<br />

shareholder of the <strong>Company</strong>. His children are Ms Cheong Poh See,<br />

Mr Cheong Chee Khoon and Mr Cheong Chee Kong. Ms Cheong<br />

Poh See and Mr Cheong Chee Kong are also shareholders of the<br />

<strong>Company</strong>.<br />

Profile of BOARD OF <strong>DIRECTORS</strong><br />

MADAM CHOON NEE SIEW<br />

Executive Director<br />

Madam Choon Nee Siew, age 54 years, a <strong>Malaysia</strong>n, was appointed<br />

to the <strong>Board</strong> of Directors of PKHB as Executive Director on 13<br />

January 2004.<br />

She brings with her more than 30 years of experience in the jewellery<br />

industry having held several portfolios over the years. She started<br />

her career in 1972 as a Sales Representative in Lian Yik Jewellery.<br />

In 1980, she left the company to join Poh Kong Jewellers (PKJ)<br />

as a Sales Manager. Two years later, she was appointed Director<br />

of PKJ (SS2) Sdn Bhd and in 1991 was promoted to Managing<br />

Director of PKJ (Subang Parade) Sdn Bhd.<br />

Her main responsibilities are in overseeing the daily retail operations<br />

and development of the Group. She also holds directorships<br />

of several other companies within the Group and with her vast<br />

experience in the jewellery retail trade has contributed invaluably to<br />

the Group’s growth and development.<br />

Madam Choon Nee Siew’s sibilings Dato’ Choon Yee Seiong,<br />

Madam Choon Yoke Ying, Encik Mohd Annuar Choon Bin<br />

Abdullah, Madam Choon Wan Joo, Mr Choon Yee Fook, Mr Choon<br />

Yee Bin, Madam Choon Ching Yih and Madam Choong Bee Chu<br />

are shareholders of the <strong>Company</strong>. His brothers-in-law Mr Siow<br />

Der Ming and Mr Chang Kwong Him are also shareholders of the<br />

<strong>Company</strong>. Ms Cheong Poh See, Mr Cheong Chee Khoon and Mr<br />

Cheong Chee Kong are Madam Choon’s children. Ms Cheong Poh<br />

See and Mr Cheong Chee Kong are shareholders of the <strong>Company</strong>.<br />

ANNUAL REPORT 2009 17

MADAM CHOON YOKE YING<br />

Executive Director<br />

18 Poh Kong Holdings Berhad<br />

Profile of BOARD OF <strong>DIRECTORS</strong><br />

Madam Choon Yoke Ying, age 52 years, a <strong>Malaysia</strong>n, was<br />

appointed to the <strong>Board</strong> of Directors of PKHB as Executive Director<br />

on 22 January 2008.<br />

She is the Assistant Managing Director of Poh Kong Jewellers Sdn<br />

Bhd (PKJSB) and began her career in the gold jewellery industry<br />

in 1977 when she joined PKJ as a retail Sales Representative. In<br />

1979, she became a Partner in PKJ. In 1993, she was appointed<br />

Director of PKJSB.<br />

Her current responsibilities are marketing and merchandising<br />

for the Group. In addition, she is also in charge of research and<br />

development of the Group. She attends trade fairs regularly to<br />

constantly keep up-to-date on the latest technology, development,<br />

designs and trends in the jewellery industry. She is also a Designer<br />

for Poh Kong’s exclusive jewellery and a Director of various<br />

companies within the Group.<br />

Madam Choon Yoke Ying is the spouse of Mr Chang Kwong Him.<br />

Her siblings Dato’ Choon Yee Seiong, Madam Choon Nee Siew,<br />

Encik Mohd Annuar Choon Bin Abdullah, Madam Choon Wan Joo,<br />

Mr Choon Yee Fook, Mr Choon Yee Bin, Madam Choon Ching Yih<br />

and Madam Choong Bee Chu are shareholders of the <strong>Company</strong>.<br />

Her brother-in-law Mr Siow Der Ming is also a shareholder of the<br />

<strong>Company</strong>.<br />

MADAM CHOON WAN JOO<br />

Executive Director<br />

Madam Choon Wan Joo, age 48 years, a <strong>Malaysia</strong>n, was appointed<br />

to the <strong>Board</strong> of Directors of PKHB as Executive Director on 22<br />

January 2008.<br />

She was appointed as Managing Director of Poh Kong Jewellery<br />

Manufacturer Sdn Bhd (PKJM) since 1991. Her main responsibilities<br />

are in overseeing the daily operations and decision making policies<br />

of PKJM.<br />

Madam Choon Wan Joo’s career in the gold jewellery industry<br />

started in 1980 when she joined Precious Jewellery Sdn Bhd<br />

(Precious) as a Retail Representative. In 1981, she was promoted<br />

to Production Supervisor cum Designer at Precious and was with<br />

the company until 1990. She was responsible for the initial set-up<br />

of the manufacturing plant and has successfully steered the plant to<br />

become fully operational with a work force strength of about 160.<br />

She participates in trade exhibitions to keep abreast of the latest<br />

trends in product designs and development, and advanced<br />

manufacturing technologies. She oversees in the production,<br />

quality control, manufacturing techniques, marketing, design and<br />

administration. In addition, her responsibilities also cover human<br />

resources, accounts and finance functions of the manufacturing<br />

facility. She heads the Group’s research and development team<br />

and provides support in new products development and enhancing<br />

the manufacturing capabilities of the Group. She is also a Director<br />

of several other companies within the Group.<br />

Madam Choon Wan Joo is the spouse of Mr Siow Der Ming.<br />

Her sibilings Dato’ Choon Yee Seiong, Madam Choon Nee Siew,<br />

Madam Choon Yoke Ying, Encik Mohd Annuar Choon Bin Abdullah,<br />

Mr Choon Yee Fook, Mr Choon Yee Bin, Madam Choon Ching Yih<br />

and Madam Choong Bee Chu are shareholders of the <strong>Company</strong>.<br />

Her brother-in-law Mr Chang Kwong Him, is a shareholder of the<br />

<strong>Company</strong>.

DR CHOONG TUCK YEW<br />

Senior Independent Non-Executive Director<br />

Dr Choong Tuck Yew, age 71 years, a <strong>Malaysia</strong>n, was appointed to<br />

the <strong>Board</strong> of Directors of PKHB as an Independent Non-Executive<br />

Director on 13 January 2004. He was promoted to Senior<br />

Independent Non-Executive Director in 2005.<br />

He possesses a DComSc, a MBA and is a Member of the <strong>Malaysia</strong>n<br />

Institute of Accountants (MIA), and <strong>Malaysia</strong>n Institute of Certified<br />

Public Accountants. He is also a Fellow of the CPA Australia, a<br />

Fellow of the <strong>Malaysia</strong>n Association of the Institute of Chartered<br />

Secretaries and Administrators, a Fellow of the Chartered Taxation<br />

Institute of <strong>Malaysia</strong>, and a Chartered Fellow, as well as a Chartered<br />

Audit Committee Director of the Institute of Internal Auditors,<br />

<strong>Malaysia</strong>.<br />

In the early years of his career, Dr Choong worked as an accountant<br />

in several companies. In 1968, he joined Bank Negara <strong>Malaysia</strong><br />

(Central Bank of <strong>Malaysia</strong>) and, in 1987, he was appointed as the<br />

Chief Manager of the Central Bank of <strong>Malaysia</strong>. In 1990, he was<br />

seconded as the Managing Director of Visia Finance Berhad, a<br />

licensed finance company. Currently, Dr Choong is the Chairman<br />

of OSK Investment Bank Berhad. He is also the Deputy Chairman<br />

of C & C Investigation Services Sdn Bhd, a licensed private<br />

investigation company.<br />

His other business interests include directorships at OSK-UOB Unit<br />

Trust Management Berhad and O & G Equities Berhad.<br />

Presently, Dr Choong is the Vice President of the <strong>Malaysia</strong>n Institute<br />

of Directors and an Ambassador representing the World Association<br />

of Detectives in <strong>Malaysia</strong>. He has been a guest speaker at various<br />

conferences in <strong>Malaysia</strong> as well as abroad.<br />

Dr Choong is the Chairman of the Audit Committee and a member<br />

of the Remuneration Committee and Nomination Committee<br />

of PKHB.<br />

Profile of BOARD OF <strong>DIRECTORS</strong><br />

ENCIK FAZRIN AZWAR BIN MD NOR<br />

Independent Non-Executive Director<br />

Encik Fazrin Azwar Bin Md Nor, age 43 years, a <strong>Malaysia</strong>n, was<br />

appointed to the <strong>Board</strong> of Directors of PKHB as a Non-Independent<br />

Non-Executive Director on 13 January 2004. He became an<br />

Independent Non-Executive Director in 2005.<br />

An advocate and solicitor, Encik Fazrin was called to the <strong>Malaysia</strong>n<br />

Bar in 1991 following his graduation from the University of Malaya<br />

in 1990 with a Bachelor of Laws (LLB) Honours degree. He started<br />

his career as a legal assistant in 1991 at Messrs Adnan, Sundra &<br />

Low until 1998. In 1999 until 2004, he was the managing partner of<br />

Messrs Michael Chen, Gan, Muzafar & Azwar. In 2005, he became<br />

the managing partner of Messrs Rashidah, Muzafar & Azwar.<br />

He holds directorships in both listed and non-listed companies.<br />

In 1999, he was appointed as an Independent Non-Executive<br />

Director of Tong Herr Resources Berhad, a stainless steel fastener<br />

manufacturer. In 2000, he was appointed as the Independent Non-<br />

Executive Chairman of Mercury Industries Berhad, an industrial<br />

paint manufacturer. In 2003, he was appointed as an Independent<br />

Non-Executive Director of Ire-Tex Corporation Berhad, a packaging<br />

solutions provider. In 2004, he was appointed as an Independent<br />

Non-Executive Director of DPS Resources Berhad, a rubber<br />

wood furniture manufacturer. In 2005, he was appointed as the<br />

Independent Non-Executive Director of Daya Material Berhad,<br />

a polymer based manufacturer. He is also the Non-Independent<br />

Director of Kuchinta Holdings Sdn Bhd and its’ group of companies.<br />

In 2007, he was appointed as an Independent Director of Times<br />

<strong>Of</strong>fset (M) Sdn Bhd.<br />

Encik Fazrin is the Chairman of the Nomination Committee, a<br />

member of the Audit Committee, and Remuneration Committee<br />

of PKHB.<br />

ANNUAL REPORT 2009 19

20<br />

Profile of BOARD OF <strong>DIRECTORS</strong><br />

DATIN SHIRLEY YUE SHOU HOW<br />

Independent Non-Executive Director<br />

Datin Shirley Yue Shou How, age 60 years, a <strong>Malaysia</strong>n, was<br />

appointed to the <strong>Board</strong> of Directors of PKHB as an Independent<br />

Non-Executive Director on 23 January 2009.<br />

Datin Yue has 24 years experience in the local and foreign luxury<br />

fashion retail, business development and consulting, and investment<br />

banking industry.<br />

She was Managing Director/General Manager of Fine Lines,<br />

a company dealing with imported lady apparels and high-end<br />

bespoke orders from 1985 to 1993. Subsequently, she served as<br />

Investment Advisor of Credit Lynonnaise Securities (Asia) Ltd from<br />

1993 to 1998 and was an Investment Banker of Soloman Smith<br />

Barney, Citibank Singapore from 2000 to 2003. She has been a<br />

Director of Oilvest Engineering (M) Sdn Bhd & Elbex Holdings Sdn<br />

Bhd since 2004. She served as Boutique Manager of Chopard,<br />

Pavilion, Kuala Lumpur from 2007 to 2008.<br />

Datin Yue holds a Graduate Diploma in Business Administration<br />

(post graduate degree) from the University of Western Sydney,<br />

Australia and is a member of the <strong>Malaysia</strong>n Institute of Management.<br />

She is also the Chairperson of the Remuneration Committee, and<br />

a Member of the Nomination Committee and the Audit Committee<br />

of PKHB.<br />

Save as disclosed above, none of the Directors has:<br />

· any family relationship with any Directors and/or major<br />

shareholders of the <strong>Company</strong>.<br />

· any conflict of interest with the <strong>Company</strong>.<br />

· any conviction for offences within the past 10 years other than<br />

traffic offences, if any.<br />

Poh Kong Holdings Berhad

Value<br />

PREFERENCE · PROFIT · WORTH · RETURN-ON-INVESTMENT<br />

ANNUAL REPORT 2009 21

22 Poh Kong Holdings Berhad<br />

Chairman’s STATEMENT<br />

Dear Valued Shareholders,<br />

On behalf of the <strong>Board</strong> of Directors (“<strong>Board</strong>”)<br />

of Poh Kong Holdings Berhad (“the <strong>Company</strong>”<br />

or “PKHB”), I am pleased to present the Annual<br />

Report and Audited Financial Statements of the<br />

<strong>Company</strong> and its subsidiaries (“the Group”) for the<br />

financial year ended 31 July 2009 (“FYE 2009”).<br />

Economic and Business Overview<br />

The <strong>Malaysia</strong>’s economy registered a lower growth of 4.6% in 2008 compared to 6.3%<br />

in the previous year. GDP growth was close to negative territory in the fourth quarter of<br />

2008 at 0.1%.<br />

In 2009, the global economy was largely affected by the financial crisis and economic<br />

recession which emanated in the US and Europe on a scale that was unprecedented.<br />

As asset prices fell and global demand plunged, developing economies were impacted<br />

by the fallout.<br />

In the first quarter of 2009, the <strong>Malaysia</strong>n economy contracted by 6.2% due largely to<br />

a drop in external demand and exports as advanced countries had to contend with a<br />

deepening recession. The country’s economy contracted to a slower 3.9% in the second<br />

quarter of 2009 and in the third quarter, the economy contracted to a smaller 1.2%<br />

mainly due to a decline in the manufacturing sector but it was reported that the worst<br />

was over for the economy.*<br />

Notwitstanding the various uncertainties, the global and domestic economies are<br />

expected to register modest growth in 2010. In <strong>Malaysia</strong>, this is mainly due to the<br />

Government’s earlier stimulus spending packages totalling RM67 billion, unveiled in<br />

November 2008 (RM7 billion) and March 2009 (RM60 billion), which are having positive<br />

impact on the economy.<br />

Supported by the domestic demand, stabilization and the fiscal stimulus packages<br />

designed to lessen the impact of a global recession, the Government is confident<br />

of achieving a 5% GDP growth in 2010. In announcing this on November 18, 2009,<br />

YB Tan Sri Nor Mohamed Yakcop, Minister in the Prime Minister’s Department, said<br />

the Government had no plans to introduce additional stimulus package to boost the<br />

economy as it was in the process of formulating the 10th <strong>Malaysia</strong>n Plan and a new<br />

economic model.**<br />

According to Retail Group <strong>Malaysia</strong> (RGM) which tabulates retail data, spending in the<br />

retail industry in <strong>Malaysia</strong> was expected to grow marginally between 1% and 3% by the<br />

end of 2009 in view of the sluggish economic conditions.***

This posed challenging times for malls and retailers of luxury goods<br />

which have gone through one of the toughest ever operating<br />

environment.<br />

However, RGM is more optimistic next year and projects annual<br />

retail sales growth at about 5% in 2010.<br />

In this context, Poh Kong remains committed to the luxury retail<br />

sector and has put in more focus on promotions of its products to<br />

further enhance sales of its jewellery.<br />

Shopping malls and retailers have geared up for the <strong>Malaysia</strong> Year<br />

End Sale (MYES) campaign, a much anticipated celebration of<br />

shopping, dining and entertainment from Nov 21 to Jan 3, 2010.<br />

This campaign aimed at promoting domestic and tourist shopping<br />

regionally, would benefit the Group in jewellery retail sales.<br />

Sources:<br />

* Reported in The Edge online “<strong>Malaysia</strong> Q3 GDP shrinks less than<br />

expected”, 20 Nov 2009<br />

** Reported in StarBiz, “No plan for additional stimulus package”,<br />

19 Nov 2009, Page 5<br />

*** Reported in StarBiz, “Retail industry still growing despite slowdown”<br />

19 October 2009, Page 6<br />

Review of Financial Performance<br />

The Poh Kong Group achieved an increase of 6.34% in revenue of<br />

RM541.6 million in its financial year ended 31 July 2009 (FYE2009)<br />

compared with RM509.3 million for its previous financial year<br />

(FYE2008). This is an increment of RM32.3 million in sales revenue.<br />

Chairman’s STATEMENT<br />

Poh Kong’s higher revenue was attributed to additional revenue<br />

from new stores together with like-for-like growth in existing stores,<br />

as well as higher sales of diamonds and gem-based jewellery from<br />

existing stores.<br />

The Group opened eight new outlets in various urban and suburban<br />

mega malls in FYE2009. Poh Kong’s inventory comprising<br />

of gold and gems, notwithstanding the outlets expansion, have<br />

decreased from RM391.3 million in FYE2008 to RM356.7 million in<br />

FYE2009 due to efficiencies in stock control.<br />

Profit before taxation stood at RM38.6 million for the FYE 2009 or<br />

a marginal decrease of RM1.4 million or a 3.5% decline against<br />

RM40 million for its FYE2008.<br />

The decrease in profit before tax was mainly due to thinner profit<br />

margins from having purchased gold at higher prices and increased<br />

initial operating costs associated with the opening of new outlets.<br />

Based in terms of the number of outlets, the Group is the largest<br />

jewellery retail chain store in <strong>Malaysia</strong>, and the market leader<br />

nationwide (RAM Ratings Report, November 2009).<br />

Gold jewellery remains Poh Kong’s main revenue contributor<br />

although the Group has stepped up the sales of diamonds and<br />

gems in its advertising and promotions campaigns. The branding<br />

strategy of these stores have been adopted so that the <strong>Company</strong><br />

becomes less dependant on its traditional yellow gold jewellery.<br />

As at 31 July 2009, the Group’s net assets recorded an increase<br />

of RM22.6 million at RM283.7 million over the previous year of<br />

RM261.1 million.<br />

ANNUAL REPORT 2009 23

Retailing and Marketing Support<br />

24<br />

Poh Kong Holdings Berhad<br />

Chairman’s STATEMENT<br />

Besides Poh Kong stores as the top line contributor to total sales<br />

revenue, the Group has broaden its range of non-yellow gold<br />

jewellery via alternate brands, namely Tranz and Walt Disney<br />

Collections. The <strong>Company</strong> currently operates specialty brands and<br />

retail concept stores, such as Diamond Boutique, Diamond & Gold,<br />

Jade Gallery, Poh Kong Gallery, Oro Bianco white gold jewellery,<br />

and Schoeffel boutique, as well as the Schoeffel Time Collection, a<br />

range of fine watches from Germany.<br />

At Poh Kong, we are committed to brand building and will continue<br />

to invest in branding as a long-term investment in our luxury fashion<br />

retailing business.<br />

The Group also represents exclusive designer jewellery brands from<br />

international houses, such as Alessandro Fanfani, Angel Diamonds,<br />

Lapplesite Collection, Luca Carati, Rodney Rayner, SunDay and<br />

Verdi Gioielli. These brands are mainly from European countries,<br />

such as the United Kingdom, Germany and Italy.<br />

From exquisite pieces to simple elegant designs, from irresistible<br />

collections to dazzling custom-made orders, Poh Kong has just<br />

the right jewellery for every occasion. The Group’s marketing mix<br />

continues to place strong emphasis and commitment on design,<br />

craftsmanship, reputation, premium quality and competitive pricing.<br />

For marketing support, intensified efforts in advertising, merchandising<br />

and implementing various product launches, sponsorships, road<br />

shows and promotions over the year will help to maintain the<br />

Group’s leading position.<br />

These effort included the Miss Poh Kong Glamour/ Miss Tourism<br />

International Pageant World Final 2008 beauty parade held at the<br />

Sunway Pyramid Shopping Mall in December. We plan to continue<br />

the Miss Poh Kong Glamour 2009 sponsorship in conjunction<br />

with the opening of an upcoming outlet in Malacca in December.<br />

In June, we launched one of Italy’s oldest and most prestigious<br />

jewellery brand Luca Carati and commemorated Poh Kong as<br />

the sole distributor in <strong>Malaysia</strong>. Poh Kong’s co-sponsored the<br />

Mary Search for Celebrities, a popular cable TV programme to<br />

unearth talents in <strong>Malaysia</strong> to star in the Jia Yu family entertainment<br />

channel on Astro 304 in September. Road shows for this talent<br />

search were organized during preliminary rounds in Penang, Ipoh,<br />

Klang Valley and Johore Bahru with the grand finals held in Kuala<br />

Lumpur. Several jewellery road shows were organized to coincide<br />

with the Hari Raya Puasa and UMNO General Assembly in Kuala<br />

Lumpur from August to October. In October, Poh Kong featured<br />

two of its labels, Schoeffel pearls from Germany and Luca Carati<br />

diamonds from Italy, and held a jewellery show at the “Fashion on<br />

the Turf” Ladies Day event in the Selangor Turf Club. Poh Kong and<br />

Schoeffel also presented the new line of ready-to-wear Schoeffel<br />

pieces for the Autumn-Winter Collection 2009/2010 to a group of<br />

patrons and guests at the Hilton Kuala Lumpur in November.<br />

Branding & The Customer Experience<br />

Poh Kong has been spending considerable time and capital in<br />

brand building which has paid off over the years.<br />

The Group has promoted its brands to become one of the most<br />

recognised jewellery brands nationwide. Our specialty brands and<br />

retail concept stores not only stands out distinctly for our renowned<br />

yellow gold but also for the finest quality in jewellery, be it pearls,<br />

jade, gold, diamonds or gem stones.<br />

The customer’s experience and brand’s advertising are the two<br />

most critical elements that go into the building of our successful<br />

brands. The advertising of our specialty brands and retail concept<br />

stores are often remembered, being the first point of contact with<br />

our customers, and that sets the stage for the brand’s promise. It<br />

is the customer experience that ultimately delivers the promise in<br />

our branding.<br />

Poh Kong continues to deliver the customer’s experience through<br />

our brands and products at our stores that’s high-end, accessible<br />

and affordable. At the end of the day, we believe our customers<br />

will look for chic products at the right price points and mix to<br />

complement their individual lifestyle.<br />

Corporate Social Responsibility<br />

The initiatives of Corporate Social Responsibility (CSR) have<br />

been an integral part of the Group’s social objectives. This means<br />

integrating CSR activities into our workplace, our market place, our<br />

community and our environment. The Group’s CSR activities are<br />

highlighted on a separate page in this Annual Report.<br />

Future Prospects<br />

The <strong>Board</strong> expects FYE 2010 to pose stiffer competitive challenges<br />

than before and remains cautious of the current economic<br />

conditions and weakness in consumer demand.

In response to this general trading environment, the Group has<br />

taken a more prudent approach in major capital expenditures<br />

and implemented cost control initiatives. It will continue to place<br />

emphasis on achieving higher productivity and improve operational<br />

efficiency for the Group’s divisions.<br />

Poh Kong’s management plans to continue its drive to build market<br />

share by enhancing and differentiating its product offerings to its<br />

targeted market segments. The <strong>Company</strong> is actively evaluating<br />

various initiatives and opportunities to attract new customers<br />

through the introduction of new product lines, designs and<br />

enhanced customer service.<br />

The <strong>Company</strong> has a total of 95 retail outlets nationwide and will<br />

identify strategic locations for outlets across the country which have<br />

the potential for higher revenue growth and consumer demand.<br />

Moving forward, the Group will continue to expand outlets at a<br />

more moderate pace in view of the softer economic conditions and<br />

will invest on the refurbishment of existing stores.<br />

With the current economic environment, Poh Kong does not expect<br />

to record any significant momentum in sales growth in the fourth<br />

quarter 2009 and first quarter 2010.<br />

However, the Group is optimistic on its retail sales due mainly to<br />

the festive seasons and its loyal customers who buy gold-based<br />

jewellery as a long-term investment and as an alternative to termdeposits<br />

or as a hedge against inflation.<br />

Barring unforeseen circumstances, the <strong>Board</strong> remains positive on<br />

the performance of the Group for the FYE 2010.<br />

Earnings Per Share<br />

The basic earnings per share for the financial year ended 31 July<br />

2009 stands at 6.93 sen (2008: 6.99 sen).<br />

Dividend<br />

The <strong>Board</strong> is pleased to recommend a first and final single tier tax<br />

exempt dividend of 1.40 sen per ordinary share of RM0.50 each<br />

in respect of the financial year ended 31 July 2009 (2008 : 1.40<br />

sen single tier tax exempt per ordinary share of RM0.50 each). The<br />

proposed dividend is subject to shareholders’ approval at the 7th<br />

Annual General Meeting to be held on 20 January 2010.<br />

Chairman’s STATEMENT<br />

Acknowledgements<br />

On behalf of the <strong>Board</strong> of Directors, I would like to record our<br />

appreciation to Mr Choon Yee Fook who has resigned as an<br />

Executive Director of the <strong>Board</strong> during the course of the year. We<br />

are also pleased to welcome Datin Shirley Yue Shou How as our<br />

new Independent Non-Executive Director of the <strong>Board</strong>.<br />

I would like to express my utmost and sincere appreciation to all<br />

my fellow <strong>Board</strong> Directors for their counsel and support during the<br />

course of the year. To the Management and Staff, thank you for your<br />

conscientious efforts, commitment, dedication and contributions<br />

towards the Group.<br />

We are also grateful to our shareholders for their confidence, valued<br />

customers, business partners, Government authorities, financiers<br />

and suppliers for their continued support and cooperation in the<br />

Group.<br />

DATO’ CHOON YEE SEIONG<br />

Executive Chairman & Group Managing Director<br />

16 December 2009<br />

ANNUAL REPORT 2009 25

26<br />

Poh Kong Holdings Berhad<br />

Penyata PENGERUSI<br />

Pemegang-pemegang Saham yang Dihargai,<br />

Bagi pihak Lembaga Pengarah (“Lembaga”) Poh Kong Holdings<br />

Berhad (“Syarikat” atau “PKHB”), saya dengan sukacitanya<br />

membentangkan Laporan Tahunan dan Penyata Kewangan<br />

Teraudit Syarikat dan anak-anak syarikatnya (“Kumpulan”)<br />

bagi tahun kewangan berakhir 31 Julai 2009 (“FYE 2009).<br />

Gambaran Keseluruhan Ekonomi dan Perniagaan<br />

Ekonomi <strong>Malaysia</strong> mencatat pertumbuhan lebih rendah sebanyak 4.6% pada tahun 2008<br />

berbanding 6.3% pada tahun sebelumnya. Pertumbuhan Keluaran Dalam Negara Kasar<br />

(KDNK) hampir ke paras negatif pada suku keempat 2008 sebanyak 0.1%.<br />

Pada tahun 2009, ekonomi global telah terjejas terutamanya oleh krisis kewangan dan<br />

kemelesetan ekonomi yang berpunca di US dan Eropah pada skala yang belum pernah<br />

berlaku sebelum ini. Apabila harga aset jatuh dan permintaan global jatuh menjunam,<br />

negara-negara ekonomi membangun turut terjejas akibat kejatuhan tersebut.<br />

Pada suku pertama 2009, ekonomi <strong>Malaysia</strong> menguncup sebanyak 6.2% sebahagian<br />

besarnya disebabkan oleh kejatuhan dalam permintaan dan eksport memandangkan<br />

negara-negara maju telah menghadapi kemelesetan yang semakin parah. Ekonomi<br />

negara telah menguncup pada kadar yang lebih perlahan sebanyak 3.9% pada suku<br />

kedua 2009 dan pada suku ketiga, ekonomi menguncup pada kadar yang lebih kecil<br />

sebanyak 1.2% terutamanya disebabkan kemerosotan dalam sektor perkilangan namun<br />

adalah dilaporkan bahawa kemelut ekonomi ini telah berakhir.*<br />

Tanpa mengambil kira pelbagai ketidaktentuan, ekonomi global dan ekonomi dalam negeri<br />

dijangka mencatat pertumbuhan teguh pada tahun 2010. Di <strong>Malaysia</strong>, ini terutamanya<br />

disebabkan pakej perbelanjaan rangsangan lebih awal Kerajaan berjumlah RM67 bilion,<br />

didedahkan pada November 2008 (RM7 bilion) dan Mac 2009 (RM60 bilion), yang telah<br />

memberi kesan positif ke atas ekonomi.<br />

Disokong oleh permintaan dalam negeri, penstabilan dan pakej rangsangan fiskal yang<br />

dirangka untuk mengurangkan kesan kemelesetan global, Kerajaan yakin dapat mencapai<br />

pertumbuhan KDNK sebanyak 5% pada tahun 2010. Semasa pengumumannya pada<br />

18 November 2009, YB Tan Sri Nor Mohamed Yakcop, Menteri di Jabatan Perdana<br />

Menteri, berkata Kerajaan tidak mempunyai rancangan untuk memperkenalkan pakej<br />

rangsangan tambahan bagi merangsang ekonomi memandangkan ia sedang dalam<br />

proses merumuskan Rancangan <strong>Malaysia</strong> Ke-10 dan model ekonomi baru.**<br />

Menurut “Retail Group <strong>Malaysia</strong>“ (RGM) yang mengumpulkan data runcit, perbelanjaan<br />

dalam industri perdagangan runcit di <strong>Malaysia</strong> dijangka akan meningkat sedikit antara<br />

1% dan 3% menjelang akhir tahun 2009 berdasarkan keadaan ekonomi yang lembap.***

Ini menimbulkan masa yang mencabar<br />

bagi tempat membeli belah dan<br />

peruncit barangan mewah yang telah<br />

melalui salah satu daripada persekitaran<br />

operasi yang paling sukar pernah dihadapi.<br />

Walau bagaimanapun, RGM lebih<br />

optimis pada tahun hadapan dan<br />

mengunjurkan pertumbuhan jualan<br />

runcit tahunan sebanyak lebih<br />

kurang 5% pada tahun 2010.<br />

Dalam konteks ini, Poh Kong kekal<br />

komited kepada sektor runcit mewah<br />

dan telah meletakkan lebih banyak<br />

tumpuan pada promosi produknya untuk<br />

mempertingkatkan lagi jualan barang<br />

kemasnya.<br />

Kawasan membeli-belah dan peruncit telah memperhebatkan<br />

kempen Jualan Akhir Tahun <strong>Malaysia</strong> (MYES), iaitu sambutan<br />

membeli-belah, makanan dan hiburan yang sangat ditunggutunggu<br />

bermula dari 21 Nov hingga 3 Jan 2010. Kempen ini<br />

bertujuan untuk menggalakkan kegiatan membeli-belah dalam<br />

negeri dan pelancongan di peringkat serantau, yang memanfaatkan<br />

Kumpulan dalam jualan runcit barang kemas.<br />

Sumber:<br />

* Dilaporkan dalam The Edge dalam talian “Penguncupan KDNK Suku<br />

Ketiga <strong>Malaysia</strong> kurang daripada yang dijangkakan”, 20 Nov 2009<br />

** Dilaporkan dalam StarBiz, “Tiada rancangan bagi pakej rangsangan<br />

tambahan”,19 Nov 2009, Muka Surat 5<br />

*** Dilaporkan dalam StarBiz, “Industri runcit masih berkembang di sebalik<br />

kelembapan”,19 Oktober 2009, Muka Surat 6<br />

Kajian Prestasi Kewangan<br />

Kumpulan telah mencapai peningkatan sebanyak 6.34% dalam<br />

hasil sebanyak RM541.6 juta pada tahun kewangannya berakhir<br />

31 Julai 2009 (FYE2009) berbanding dengan RM509.3 juta bagi<br />

tahun kewangan sebelumnya (FYE2008). Ini adalah peningkatan<br />

sebanyak RM32.3 juta dalam hasil jualan.<br />

Hasil Poh Kong yang lebih tinggi adalah berpunca daripada<br />

hasil tambahan daripada kedai-kedai baru berserta dengan<br />

pertumbuhan sepadan kedai-kedai sedia ada, serta jualan berlian<br />

Penyata PENGERUSI<br />

dan barang kemas berasaskan batu permata daripada kedai-kedai<br />

sedia ada.<br />

Kumpulan telah membuka lapan saluran keluar baru di beberapa<br />

bandar kawasan membeli-belah bandar dan subbandar pada<br />

FYE2009. Inventori Poh Kong terdiri daripada emas dan permata,<br />

meskipun mengambil kira pengembangan saluran keluar, telah<br />

berkurangan daripada RM391.3 juta pada FYE2008 kepada<br />

RM356.7 juta pada FYE2009 disebabkan keberkesanan dalam<br />

kawalan stok.<br />

Keuntungan sebelum cukai adalah sebanyak RM38.6 juta bagi<br />

FYE 2009 atau pengurangan kecil sebanyak RM1.4 juta atau<br />

pengurangan 3.5% berbanding RM40 juta bagi FYE2008.<br />

Penurunan dalam keuntungan sebelum cukai terutamanya<br />

disebabkan oleh margin keuntungan yang lebih kecil akibat<br />

pembelian emas pada harga yang lebih tinggi dan peningkatan kos<br />

awal operasi berkaitan dengan pembukaan saluran keluar baru.<br />

Berdasarkan dari segi bilangan saluran keluar, Kumpulan adalah<br />

kedai rantaian runcit barang kemas terbesar di <strong>Malaysia</strong>, dan<br />

peneraju pasaran seluruh negara (Laporan Penarafan RAM,<br />

November 2009).<br />

Barang kemas emas kekal sebagai penyumbang hasil utama Poh<br />

Kong walaupun Kumpulan telah meningkatkan jualan berlian dan<br />

permata dalam kempen pengiklanan dan promosinya. Strategi<br />

penjenamaan kedai-kedai ini telah diterima pakai agar Syarikat<br />

kurang bergantung pada barang kemas emas kuning tradisinya.<br />

Pada 31 Julai 2009, aset bersih Kumpulan mencatat peningkatan<br />

sebanyak RM22.6 juta kepada RM283.7 juta berbanding tahun<br />

sebelumnya sebanyak RM261.1 juta.<br />

Sokongan Peruncitan dan Pemasaran<br />

Selain kedai-kedai Poh Kong sebagai barisan penyumbang utama<br />

kepada jumlah hasil jualan, Kumpulan telah memperluaskan<br />

rangkaian barang kemas emas bukan kuningnya melalui jenama<br />

pengganti, iaitu Tranz dan Koleksi Walt Disney. Syarikat pada masa<br />

ini mengendalikan jenama khusus dan kedai-kedai konsep runcit,<br />

seperti Diamond Boutique, Diamond & Gold, Jade Gallery, Poh<br />

Kong Gallery, barang kemas emas putih Oro Bianco, dan Schoeffel<br />

boutique, serta Koleksi Schoeffel Time, satu rangkaian jam tangan<br />

mewah wanita dari Jerman.<br />

ANNUAL REPORT 2009<br />

27

28<br />

Poh Kong Holdings Berhad<br />

Penyata PENGERUSI<br />

Di Poh Kong, kami komited kepada pembangunan jenama dan<br />

akan terus melabur dalam penjenamaan sebagai pelaburan jangka<br />

panjang dalam perniagaan peruncitan fesyen mewah kami.<br />

Kumpulan juga mewakili jenama barang kemas pereka eksklusif<br />

daripada syarikat-syarikat antarabangsa, seperti Alessandro<br />

Fanfani, Angel Diamonds, Lapplesite Collection, Luca Carati,<br />

Rodney Rayner, SunDay dan Verdi Gioielli. Jenama-jenama ini<br />

terutamanya datang dari negara-negara Eropah, seperti United<br />

Kingdom, Jerman dan Itali.<br />

Daripada barang kemas yang sangat indah hinggalah kepada<br />

reka bentuk anggun yang ringkas, daripada koleksi yang sangat<br />

menawan hinggalah kepada tempahan buatan khas yang berkilaukilauan,<br />

Poh Kong sememangnya mempunyai barang kemas yang<br />

hebat bagi setiap majlis. Campuran pemasaran Kumpulan sentiasa<br />

memberikan penekanan dan komitmen utama pada reka bentuk,<br />

mutu ketukangan, reputasi, kualiti premium dan peletakan harga<br />

yang berdaya saing.<br />

Bagi sokongan pemasaran, usaha-usaha yang diperhebatkan<br />

dalam pengiklanan, barangan dagangan dan pelaksanaan beberapa<br />

pelancaran produk, penajaan, persembahan kunjungan dan<br />

promosi sepanjang tahun akan sentiasa membantu mengekalkan<br />

kedudukan terunggul Kumpulan.<br />

Usaha ini termasuk peragaan ratu cantik Miss Poh Kong Glamour/<br />

Miss Tourism International Pageant World Final 2008 yang<br />

diadakan di Kawasan Membeli-belah Sunway Pyramid pada bulan<br />

Disember. Kami merancang untuk meneruskan penajaan Miss Poh<br />

Kong Glamour 2009 selaras dengan pembukaan saluran keluar<br />

akan datang di Melaka pada Disember. Pada bulan Jun, kami telah<br />

melancarkan salah satu daripada jenama barang kemas Itali tertua<br />

dan paling berprestij Luca Carati dan untuk memperingati Poh<br />

Kong sebagai pengedar tunggal di <strong>Malaysia</strong>. Penajaan bersama<br />

Poh Kong dalam acara “Mary Search for Celebrities”, sebuah<br />

program TV kabel popular untuk mencungkil bakat-bakat baru di<br />

<strong>Malaysia</strong> bagi membintangi program hiburan keluarga “Jia Yu” di<br />

saluran Astro 304 pada bulan September. Persembahan kunjungan<br />

bagi mencari bakat-bakat ini telah dianjurkan pada pusingan awal<br />

di Pulau Pinang, Ipoh, Lembah Klang dan Johor Bahru dengan<br />

kemuncak gilang-gemilang diadakan di Kuala Lumpur. Beberapa<br />

persembahan kunjungan barang kemas yang telah dianjurkan<br />

secara kebetulan bersamaan dengan Hari Raya Puasa dan<br />

Perhimpunan Agung UMNO di Kuala Lumpur dari bulan Ogos<br />

hingga Oktober. Pada bulan Oktober, Poh Kong menampilkan dua<br />

labelnya, mutiara Schoeffel dari Jerman dan berlian Luca Carati<br />

dari Itali, dan telah mengadakan pertunjukan barang kemas pada<br />

acara Hari Wanita “Fesyen Dalam Perlumbaan Kuda” (Fashion on<br />

the Turf) di Kelab Lumba Kuda Selangor. Poh Kong dan Schoeffel<br />

juga telah memperkenalkan barisan unit Schoeffel baru sedia untuk<br />

dipakai bagi Koleksi Musim Sejuk 2009/2010 kepada sekumpulan<br />

pelanggan dan tetamu di Hilton Kuala Lumpur pada November.<br />

Penjenamaan & Pengalaman Pelanggan<br />

Poh Kong telah menghabiskan masa dan modal yang besar dalam<br />

pembinaan jenama yang mendatangkan keuntungan selama ini.<br />

Kumpulan telah mempromosi jenamanya untuk menjadi salah satu<br />

daripada jenama barang kemas paling terkenal di seluruh negara.<br />

Jenama khusus dan kedai konsep runcit kami bukan sahaja sangat<br />

unik bagi emas kuning termasyhur kami tetapi juga bagi kualiti<br />

paling halus dalam barang kemas, sama ada ianya mutiara, batu<br />

jed, emas, berlian mahupun batu permata.<br />

Pengalaman pelanggan dan pengiklanan jenama adalah dua<br />

elemen paling penting yang menyumbang ke arah kejayaan<br />

pembinaan jenama kami. Pengiklanan jenama khusus dan kedai<br />

konsep runcit kami sering diingati, merupakan pusat perhubungan<br />

pertama dengan pelanggan kami, dan menetapkan peringkat bagi<br />

harapan jenama. Ia adalah pengalaman pelanggan yang akhirnya<br />

menunaikan harapan dalam penjenamaan kami.<br />

Poh Kong terus menghasilkan pengalaman pelanggan melalui<br />

jenama dan produk kami di kedai kami yang berkualiti tinggi, mudah<br />

diakses dan mampu dibeli. Pada suatu hari nanti, kami percaya<br />

pelanggan kami akan mencari produk bergaya pada jumlah harga<br />

dan campuran yang betul untuk melengkapi gaya hidup individu<br />

mereka.<br />

Tanggungjawab Sosial Korporat<br />

Inisiatif Tanggungjawab Sosial Korporat (CSR) telah menjadi<br />

bahagian penting dalam objektif sosial Kumpulan. Ini bermakna<br />

menyepadukan kegiatan CSR ke dalam tempat kerja, tempat<br />

pasaran, masyarakat dan persekitaran kami. Kegiatan CSR<br />

Kumpulan dijelaskan pada muka surat berasingan dalam Laporan<br />

Tahunan ini.

Prospek Masa Hadapan<br />

Lembaga menjangkakan FYE 2010 akan menimbulkan cabaran<br />

persaingan yang lebih sengit berbanding sebelumnya dan masih<br />

berwaspada terhadap keadaan ekonomi semasa dan kelemahan<br />

dalam permintaan pengguna.<br />

Sebagai respons kepada persekitaran perdagangan ini, Kumpulan<br />

telah mengambil pendekatan lebih berhati-hati dalam perbelanjaan<br />

modal utama dan melaksanakan inisiatif kawalan kos. Ia akan terus<br />

memberikan penekanan ke atas pencapaian produktiviti yang<br />

lebih tinggi dan meningkatkan kecekapan operasi bagi bahagianbahagian<br />

Kumpulan.<br />

Pengurusan Poh Kong merancang untuk meneruskan pacuannya<br />

dalam membina bahagian pasaran dengan mempertingkatkan<br />

dan membezakan penawaran produknya kepada segmen<br />

pasaran sasarannya. Syarikat secara aktif menilai pelbagai<br />

inisiatif dan peluang untuk menarik pelanggan-pelanggan baru<br />

melalui pengenalan barisan produk baru, reka bentuk dan<br />

mempertingkatkan perkhidmatan pelanggan.<br />

Syarikat mempunyai sejumlah 95 saluran keluar runcit di seluruh<br />

negara dan akan mengenal pasti lokasi-lokasi strategik bagi<br />

saluran keluar di seluruh negara yang mempunyai potensi bagi<br />

pertumbuhan hasil dan permintaan pelanggan yang lebih tinggi.<br />

Maju ke hadapan, Kumpulan akan terus mengembangkan saluran<br />

keluar pada kadar yang lebih sederhana berikutan keadaan ekonomi<br />

yang agak lemah dan akan melabur ke atas memperbaharui hiasan<br />

kedai-kedai sedia ada.<br />

Dengan persekitaran ekonomi semasa, Poh Kong dijangka tidak<br />

akan mencatat sebarang momentum ketara dalam pertumbuhan<br />

jualan pada suku keempat 2009 dan suku pertama 2010.<br />

Walau bagaimanapun, Kumpulan optimis mengenai jualan runcitnya<br />

terutamanya disebabkan oleh musim perayaan dan pelanggan<br />

setianya yang membeli barang kemas berasaskan emas sebagai<br />

pelaburan jangka panjang dan sebagai alternatif kepada deposit<br />

bertempoh atau sebagai pelindung nilai terhadap inflasi.<br />

Dalam ketiadaan keadaan di luar jangkaan, Lembaga kekal positif<br />

ke atas prestasi Kumpulan bagi FYE2010.<br />

Penyata PENGERUSI<br />

Perolehan Setiap Saham<br />

Perolehan asas setiap saham bagi tahun kewangan berakhir 31<br />

Julai 2009 adalah sebanyak 6.93 sen (2008: 6.99 sen).<br />

Dividen<br />

Lembaga dengan suka citanya mencadangkan dividen<br />

pengecualian cukai satu tier pertama dan akhir sebanyak 1.40<br />

sen setiap saham biasa bernilai RM0.50 sesaham berhubung<br />

dengan tahun kewangan berakhir 31 Julai 2009 (2008 : 1.40 sen<br />

pengecualian cukai satu tier setiap saham biasa sebanyak RM0.50<br />

sesaham). Cadangan dividen adalah tertakluk kepada kelulusan<br />

pemegang saham pada Mesyuarat Agung Tahunan Ke-7 yang<br />

akan diadakan pada 20 Januari 2010.<br />

Pengiktirafan<br />

Bagi pihak Lembaga Pengarah, saya ingin merakamkan<br />

penghargaan kami kepada Encik Choon Yee Fook yang telah<br />

meletak jawatan sebagai Pengarah Eksekutif Lembaga Pengarah<br />

sepanjang tahun ini. Kami juga dengan suka citanya mengalualukan<br />

kedatangan Datin Shirley Yue Shou How sebagai Pengarah<br />

Bebas Bukan Eksekutif Lembaga baru kami.<br />

Saya ingin menyampaikan penghargaan ikhlas dan tidak berbelah<br />

bahagi saya kepada semua rakan Lembaga Pengarah saya atas<br />

bimbingan dan sokongan mereka sepanjang tahun ini. Kepada<br />

Pengurusan dan Kakitangan, terima kasih atas usaha, komitmen,<br />

dedikasi dan sumbangan ikhlas anda kepada Kumpulan.<br />

Kami juga sangat berterima kasih kepada pemegang-pemegang<br />

saham kami atas keyakinan mereka, pelanggan yang dihargai, rakan<br />

niaga, pihak berkuasa Kerajaan, ahli kewangan dan pembekal atas<br />

sokongan dan kerjasama berterusan mereka dalam Kumpulan.<br />

DATO’ CHOON YEE SEIONG<br />

Pengerusi Eksekutif & Pengarah Urusan Kumpulan<br />

16 Disember 2009<br />

ANNUAL REPORT 2009<br />

29

எனது அன்புக்குரிய பங்குதாரர்களே,<br />

போ கொங் ஹோல்டிங்ஸ் பெர்ஹாட்<br />

நிறுவனத்திற்கான (“நிறுவனம்”) (“நிறுவனம்”) மற்றும் அதன் கிளை<br />

நிறுவனங்களுக்கான (“குழுமம்”) (“குழுமம்”) 31 ஜூலை 2009-<br />

ல் முடிவுறும் ஆண்டுக்கான ஆண்டுக்கான ஆண்டறிக்கையையும்<br />

ஆண்டறிக்கையையும்<br />

கணக்காய்வு செய்யப்பட்ட கணக்கறிக்கைகளையும்<br />

வாரிய உறுப்பினர்கள் (“வாரியம்”) சார்பாக உங்கள் முன்<br />

சமர்ப்பிப்பதில் பெருமகிழ்வு அடைகிறேன்.<br />

பொருளாதார மற்றும் வர்த்தகக் கண்ணோட்டம்<br />

தலைவர் உரை<br />

2008-ல் மலேசியப் பொருளாதாரம் சற்று மந்தமடைந்து 4.6% வளர்ச்சியே கண்டது.<br />

ஆனால் அதற்கு முந்திய ஆண்டில் அதன் வளர்ச்சி 6.3%-ஆக இருந்தது. 2008-ன்<br />

நான்காம் காலாண்டில் காலாண்டில் அதன் வளர்ச்சி வெகுவாகக் வெகுவாகக் குறைந்து 0.1% நிலையில் தேங்கி<br />

இருந்தது. இருந்தது.<br />

2009-ல் ஐக்கிய அமெரிக்காவிலும் ஐரோப்பாவிலும் ஏற்பட்ட மோசமான மோசமான நிதி நிதி நெருக்கடிகள்<br />

மற்றும் பொருளாதாரப் பின்னடைவு பின்னடைவு காரணமாக உலகளாவிய உலகளாவிய நிலையில் நிலையில் யாருமே<br />

எதிர்ப்பார்த்திராத அளவுக்கு அளவுக்கு நிதிப் பாதிப்புகள் ஏற்பட்டன. ஏற்பட்டன. சொத்து விலைகள் கிடுகிடுவென<br />

இறங்க ஆரம்பித்தன. ஆரம்பித்தன. உலகளாவிய நிலையில் பொருட்களுக்கான கிராக்கியும் படுமோசமாகச்<br />

சரிந்தது. இந்த வீழ்ச்சியின் விளைவாக வளர்ச்சியடையும் நாடுகள் பெரும் பாதிப்புகளுக்கு<br />

உள்ளாயின.<br />

வளர்ச்சி அடைந்த நாடுகள் எதிர்நோக்கிய பொருளாதாரப் பின்னடைவின் எதிரொலியாகவும்<br />

ஏற்றுமதி மற்றும் வெளிநாட்டு வணிகத்தில் ஏற்பட்ட குறைச்சல் காரணமாகவும் 2009-ன் முதல்<br />

காலாண்டில் மலேசியப் பொருளாதாரம் 6.2% சுருங்கியது. 2009-ன் இரண்டாம் காலாண்டில்<br />

இந்நிலை இன்னும் மோசமடைந்து 3.9%-ஆகவும், மூன்றாம் காலாண்டில் இது 1.2%-ஆகவும்<br />

குறைந்துகொண்டே வந்தது. பொருள் உற்பத்தித் துறையில் ஏற்பட்ட சரிவே இதற்குக்<br />

காரணமாகக் கூறப்பட்டது. எனினும் இதுவரையிலான பொருளாதார வீழ்ச்சி இனியும்<br />

தொடராது என்று ஆரூடம் கூறப்பட்டது.*<br />

பொருளாதார நிலையில் இந்த அளவுக்கு உயர்வு தாழ்வுகள் ஏற்பட்டுள்ளபோதிலும்,<br />

உலகளாவிய மற்றும் உள்நாட்டுப் பொருளாதாரத்தில் வரும் 2010-ல் கணிசமான முன்னேற்றம்<br />

ஏற்படும் என எதிர்ப்பார்க்கப்படுகிறது. மலேசியாவைப் பொறுத்தவரை அரசாங்கத்தால்<br />

ஏற்கெனவே உள்ளிடப்பட்ட பணப்புழக்க ஊக்குவிப்புத் திட்டங்கள் (stimulus spending packages)<br />

நல்ல பலன் தர ஆரம்பித்துள்ளன. இதுவரையில் மொத்தம் RM67 பில்லியன் (நவம்பர் 2008-ல் RM7<br />

பில்லியனும் மார்ச் 2009-ல் RM60 பில்லியனும்) அரசாங்கத்தால் உள்ளீடு செய்யப்பட்டுள்ளது.<br />

உள்நாட்டில் ஏற்படக்கூடிய கிராக்கி, நிலைத்தன்மையை ஏற்படுத்துவதற்கான வியூகங்கள்<br />

மற்றும் உலகளாவிய பொருளாதாரப் பின்னடைவின் தாக்கத்தை மட்டுப்படுத்தும் நோக்கில்<br />

உள்ளிடப்பட்ட பணப்புழக்க ஊக்குவிப்புகளின் பயனாக 2010-ல் மொத்த உள்நாட்டு உற்பத்தி<br />

(ஜி.டி.பி.) 5% வளர்ச்சி பெறும் என அரசாங்கம் எதிர்ப்பார்க்கிறது. 18 நவம்பர் 2009-ல் இதைப்<br />

பற்றிய அறிவிப்பை பிரதம மந்திரித் துறையைச் சார்ந்த மாண்புமிகு தாண் ஸ்ரீ நோர் மொகமட்<br />

யாக்கோப் செய்தபோது பொருதார வளர்ச்சிக்காக இனிமேல் புதிதாகப் பணப்புழக்க ஊக்கவிப்பு<br />

எதையும் உள்ளீடு செய்யும் நோக்கம் அரசாங்கத்துக்கு இல்லை என்றார். இதற்கான காரணம்<br />

பத்தாவது மலேசியத் திட்டத்தையும் புதிய பொருளாதாரக் கட்டமைப்பையும் வடிவமைப்பதில்<br />

அரசாங்கம் தீவிர கவனம் செலுத்தி வருகிறது என்று அவர் கூறினார்.**<br />

ANNUAL REPORT 2009<br />

33

34 Poh Kong Holdings Berhad<br />

தலைவர் உரை<br />

மலேசிய சில்லறைக் குழுமத்தின் (Retail Group of <strong>Malaysia</strong>)<br />

கணிப்புப்படி, பொருதார மந்த நிலையின் அடிப்படையில்,<br />

2009-ன் இறுதிக்குள் சில்லறைத் துறை பணச்செலவழிப்பு<br />

(retail industry spending ) 1%-லிருந்து 3% வரை வளர்ச்சி<br />

காணும் என எதிர்ப்பார்க்கப்படுகிறது. ***<br />

இதனால் பேரங்காடிகளும் (malls) சொகுசு பொருள்<br />

விற்பனையாளர்களும் இதுவரை காணாத அளவுக்குப் பெரும்<br />

நிதி நெருக்கடிகளுக்கு ஆளாகியிருக்கின்றனர்.<br />

இருப்பினும் வரும் ஆண்டில் சில்லறை வணிகம் நல்ல மேம்பாடு<br />

காணும் என்னும் நம்பிக்கையின் அடிப்படையில் 2010-ல் 5%<br />

வளர்ச்சி இருக்கும் என மலேசிய சில்லறைக் குழுமம் ஆரூடம்<br />

கூறியுள்ளது.<br />

இவ்வாறான பின்னணியில் போ கொங் நிறுவனமானது<br />

தொடர்ந்து சொகுசுவகை பொருள் விற்பனையில்<br />

மும்முரமாக ஈடுபட்டு வருகிறது. தனது<br />

நகையாபரணங்களின் விற்பனையை அதிகரிக்கும் நோக்கில்<br />

வாடிக்கையாளர்களுக்குப் பல்வேறு ஊக்குவிப்புகளை<br />

அளிப்பதில் அது அதிக நாட்டம் செலுத்தி வருகிறது.<br />

நவம்பர் 21 முதல் 3 ஜனவரி 2010 வரை நீடிக்கும்<br />

(பொருள் கொள்முதல், கடையில் உணவுண்ணல்,<br />

கேளிக்கை போன்றவற்றை மையமாகக் கொண்ட) மலேசிய<br />

இறுதியாண்டு விற்பனை (MYES) பிரச்சாரத்தில் தீவிரமாகப்<br />

பங்கேற்க பேராங்காடிகளும் சில்லறை விற்பனையாளர்களும்<br />

தயார் நிலையில் உள்ளனர். உள்நாட்டினர் மற்றும் சுற்றுலாப்<br />

பயணிகள் பொருள் வாங்குவதை ஊக்குவிப்பதற்கான<br />

இந்த ஏற்பாடு போ கொங் குழுமத்தின் நகை சில்லறை<br />

விற்பனைக்கு நன்மை பயக்கும் வகையில் அமைந்திருக்கும்.<br />

மூலம்:<br />

* தி எட்ஜ் (The Edge) இணையப் பதிப்பு: ‘மலேசியாவின் 3-ம்<br />

காலாயண்டு ஜ.டி.பி.-யில் எதிர்ப்பார்த்த வளர்ச்சி இல்லை’-20<br />

நவம்பர் 2009<br />

** ஸ்டார்பிஸ் (StarBiz) செய்தி: ஊக்குவிப்புத் திட்டம்<br />

கொண்டுவரும் எண்ணம் இல்லை – 19 நவம்பர் 2009 – பக்கம் 5<br />

*** ஸ்டார்பிஸ் (StarBiz) செய்தி: மந்த நிலையிலும் சில்லறை விற்பனை<br />

அதிகரிப்பு – 19 அக்டோபர் 2009, பக்கம் 6<br />

நிதிசார் சாதனை – ஒரு மீள்பார்வை<br />

31 ஜூலை 2009 (FYE2009) முடிய பொருள் விற்பனையிலிருந்து<br />

போ கொங் குழுமம் ஈட்டிய மொத்த வரவு RM541.6<br />

மில்லியனாக இருந்தது. கடந்த ஆண்டுக்கான வரவாகிய<br />

RM509.3 மில்லியனோடு ஒப்பிடும்போது இவ்வாண்டில்<br />

மட்டும் வரவில் 6.34% அல்லது RM32.3 மில்லியன் அதிகரிப்பு<br />

காணப்படுகிறது.<br />

போ கொங் நிறுவனத்தின் இந்த கூடுதல் வரவு புதிதாகத்<br />

திறக்கப்பட்ட கடைகளிலிருந்தும் ஏற்கெனவே உள்ள<br />

கடைகளிலிருந்தும் கிடைக்கப்பெற்றது. ஏற்கெனவே உள்ள<br />

கடைகளில் நடைபெற்ற வைரக்கல் மற்றும் ஏனைய மணிக்கல்<br />

பொருத்திய நகை விற்பனையும் இந்த அதிகரிப்புக்குக்<br />

காரணமாக இருந்தது.<br />

இக்குழுமம் 2009-ன் நிதியாண்டில் நகர்ப்புற மற்றும்<br />

புறநகர்ப்புறப் பேரங்காடிகளில் எட்டு புதிய கடைகளைத்<br />

திறந்தது. போ கொங் நிறுவனத்தின் தங்க மற்றும் மணிக்கல்<br />

சரக்குகளின் மதிப்பு நிதியாண்டு 2008-ல் RM391.3<br />

ஆகவும், நிதியாண்டு 2009-ல் RM356.7 மில்லியனாகவும்<br />

இருந்தது. சரக்குக் கட்டுப்பாட்டில் கடைப்பிடிக்கப்பட்ட<br />

ஒழுங்குமுறையே இதற்குக் காரணம்.<br />

நிதியாண்டு 2008-ல் RM40 மில்லியனாக இருந்த வரிக்கு<br />

முந்தின இலாபம் நிதியாண்டு 2009-ல் RM38.6 மில்லியனாகக்<br />

குறைந்தது. அதாவது RM1.4 மில்லியன் அல்லது 3.5%<br />

குறைச்சல். இது சொற்பமான குறைச்சலே.<br />

வரிக்கு முந்தின இலாபத்தில் ஏற்பட்ட குறைச்சலுக்கான<br />

காரணம்: முன்பு தங்கம் கூடுதல் விலையில் வாங்கப்பட்டதால்<br />

இலாபத்தில் குறைச்சல் ஏற்பட்டது. அத்துடன் புதிய கடைகள்<br />

திறப்பு தொடர்பாக ஆரம்பகாலச் செலவினங்கள் ஏற்பட்டன.<br />

கடைகளின் எண்ணிக்கையை வைத்துப் பார்த்தால்,<br />

மலேசியாவிலேயே மிக அதிக எண்ணிக்கையிலான தங்கநகைக்<br />

கடைகளைக் கொண்ட வணிக அமைப்பு போ கொங்<br />

ஒன்றுதான். நாடளாவிய நிலையில் இன்று இத்துறையில் இது<br />

முதன்மை வகிக்கிறது (RAM Ratings Report, November 2009).<br />

போ கொங் நிறுவனம் சமீப காலமாக விளம்பரங்கள் மற்றும்<br />

வாடிக்கையாளர் ஊக்குவிப்புத் திட்டங்களின் வழியாக வைரம்<br />

மற்றும் மணிக்கல் விற்பனையிலும் கூடுதல் மும்முரம் காட்டி<br />

வந்தாலும், அதன் வருமானம் பெரும்பாலும் மஞ்சள் நிறத்<br />

தங்கநகை விற்பனையிலிருந்தே கிடைக்கிறது. கடைகளில்<br />

விற்பனையாகும் பொருட்களுக்கான வணிகச் சின்னங்களைப்<br />

பிரபலப்படுத்துவதன்வழி மஞ்சள் நிறத் தங்கநகை விற்பனையை<br />

அதிகம் நம்பாதிருக்கும் நிலைக்கு நிறுவனம் தன்னை இட்டுச்<br />

சென்றுகொண்டிருக்கிறது.<br />

31 ஜூலை 2009 குழுமத்தின் நிகர சொத்து மதிப்பு<br />

RM283.7 மில்லியனாக இருந்தது. கடந்த ஆண்டினல் RM261.1<br />

மில்லியனாக இருந்த இதில் இவ்வாண்டு RM22.6 மில்லியன்<br />

கூடுதல் ஏற்பட்டுள்ளது.<br />

சில்லறை விற்பனைக்கும் சந்தைப்படுத்துதலுக்கும் ஆதரவு<br />

விற்பனை வரவின் பெரும் பகுதி மஞ்சள் நிற தங்க நகை<br />

விற்பனையிலிருந்து வருவது உண்மை என்றாலும்,<br />

இந்நிறுவனம் வேறு வகை ஆபரணங்களிலும் கவனம் செலுத்தத்<br />

தொடங்கியுள்ளது. இந்த வகையில் ‘ட்ரான்ஸ்’ மற்றும் ‘வால்ட்<br />

டிஸ்னி கொலெக்ஷன்ஸ்’ போன்றவற்றின் விற்பனையில்<br />

இது களம் இறங்கியுள்ளது. அத்துடன் ‘டயமன்ட் பூட்டிக்,<br />

டயமன்ட் அன்ட் கோல்ட், ஜெட் கேலரி, போ கொங் கேலரி,<br />

ஓரொ பினய்கோ வைட் கோல்ட் ஜூவல்ரி, ஷூஃபல் பூட்டிக்<br />

‘ பெயர்கொண்ட ஆபரணக் கடைகளையும் இது தற்போது<br />

நடத்திவருகிறது. மேலும் ஜெர்மனியில் உற்பத்தியாகும்<br />

‘ஷூஃபல் டைம் கொலக்ஷன்’ என்னும் உயர்தரக் கைக்கடிகார<br />

விற்பனையிலும் இது களமிறங்கியுள்ளது.

வருங்காலத்தில் போ கொங் நிறுவனப் பொருட்களுக்கு<br />

வணிக உலகில் ஒரு தனி அடையாளத்தை ஏற்படுத்துவதில்<br />

நாங்கள் கவனம் செலுத்தி வருகிறோம். ஆகவே எங்களால்<br />

தயாரிக்கப்படும் உயர்தர சொகுசு பொருட்கள் நிறுவனத்தின்<br />

தனிப்பட்ட அடையாளச் சின்னத்தைக் கொண்டிருக்குமாறு<br />

வடிவமைக்கப்படும். இது நிறுவனத்தின் எதிர்கால வணிக<br />

மேம்பாட்டுக்கு அடிகோலுவதாக அமையும்.<br />

அத்துடன் நில்லாது, அலெசான்ட்ரோ ͋பன்͋பனி, ஏஞ்ஜல்<br />

டயமன்டஸ், லேப்பல்சைட் கொலெக்ஷன், லூக்கா கராட்டி,<br />

ரொட்னி ரேனர் சன்டே, வெர்டி ஜியோவெல்லி போன்ற<br />

அனைத்துலகப் புகழ்வாய்ந்த உயர்தர ஆபரண விற்பனையிலும்<br />

நாங்கள் ஈடுபட்டுள்ளோம். இப்பொருட்கள் பெரும்பாலும்<br />

ஐரோப்பிய நாடுகளான ஐக்கியக் குடியரசு, ஜெர்மனி மற்றும்<br />

இத்தாலி ஆகியவற்றிலிருந்து வருபவை.<br />

நகை, ஆபரணங்களின் வடிவமைப்பைப் பொறுத்தவரை, அது<br />

எவ்வளவு எளிமையானதாக இருந்தாலும் சரி, நேர்த்தியான<br />

வேலைப்பாடுகளுடன் கூடியதாக இருந்தாலும் சரி,<br />

வாடிக்கையாளரின் தனிப்பட்ட விருப்பு வெறுப்புகளுக்கு<br />

ஏற்றபடி செய்து தருவதில் நாங்கள் கவனம் செலுத்தி<br />

வருகிறோம். பலவித நகை ஆபரண விற்பனையில் கூடுதல்<br />

ஈடுபாட்டி காட்டிவரும் நிறுவனக் குழுமம், பொருட்களின்<br />

வடிவமைப்பு, வேலைப்பாடு, பிரபல்யம், தராதரம், விலை<br />

போன்றவற்றின் அடிப்படையில் அதன் பொருட்கள்<br />

போட்டியாளர்களின் பொருட்களுக்கு இணையாக<br />

இருக்கவேண்டும் என்பதில் அதிக சிரத்தை கொண்டுள்ளது.<br />

சந்தைப்படுத்தும் துறையைப் பொறுத்தமட்டில்,<br />

நடப்பாண்டில் விளம்பரம், வணிக ரீதியான பிரச்சாரம்,<br />

நிகழ்வுகளுக்கு நிதியாதரவு, மேடை விளம்பர நிகழ்ச்சிகள்,<br />

விற்பனை ஊக்குவிப்புகள் போன்றவை இத்துறையில்<br />

நிறுவனக் குழுமம் முன்னணி வகிப்பதை உறுதி செய்வதாக<br />

அமைந்திருக்கும்.<br />

இதன் தொடர்பில் ‘மிஸ் போ கொங் க்லேமர் / மிஸ் டூரிசம்<br />

இன்டர்நேஷனல் பேஜன்ட் வோர்ல்ட் ͋பைனல் 2008’<br />

என்னும் அழகுராணிப் போட்டியை டிசம்பர் மாதத்தில்<br />

சன்வே பிரமிட் பேரங்காடி வளாகத்தில் வெற்றிகரமாக<br />

நடத்தினோம். வரும் டிசம்பர் மாதத்தில் மலாக்காவில்<br />

எங்களால் புதிதாகத் திறக்கப்படவிருக்கும் நகைக்கடையின்<br />

திறப்புவிழாவின்போது இந்த ‘மிஸ் போ கொங் க்லேமர்’<br />

நிகழ்வை மீண்டும் நடத்தத் திட்டமிட்டுள்ளோம். ஜூன்<br />

மாதத்தில் இத்தாலி நாட்டில் உற்பத்தியாகும் ’லூக்கா கராட்டி’<br />

என்னும் வணிகப் பெயர் கொண்ட நகையாபரணங்களை<br />

மலேசியாவின் மொத்த விநியோகஸ்தர் என்ற வகையில்<br />

பிரபலப்படுத்தினோம். அத்துடன், கேபல் தொலைக்காட்சியில்<br />

ஒளிபரப்பான ‘மேரி சேர்ச் ͋போர் செலிப்ரிட்டீஸ்’ (Mary Search<br />

for Celebrities) என்னும் நிகழ்ச்சிக்கு இணை நிதியாதரவாளராக<br />

நாங்கள் செயல்பட்டோம். செப்டம்பர் மாதத்தில் ஆஸ்ட்ரோ<br />

304 ஒளியலை வழியாக ஒளிபரப்பான ‘ஜியா யூ’ என்னும்<br />

குடும்ப உல்லாச நாடகத்தில் பங்கேற்க மலேசிய நாட்டில்<br />

திறமை வாய்ந்த கலைஞர்களைப் பொறுக்கி எடுக்கும்<br />

நோக்கில் இந்நிகழ்ச்சி ஒளிபரப்பானது. பினாங்கு, ஈப்போ,<br />

கிள்ளான் பள்ளத்தாக்கு, ஜோகூர்பாரு போன்ற இடங்களில்<br />

தகுதி பெற்ற கலைஞர்களைத் தேர்வு செய்யும் முயற்சிகள்<br />

மேடை போட்டி நிகழ்ச்சிகளின் வழியாக எடுக்கப்பட்டன.<br />

தலைவர் உரை<br />

இறுதிப் போட்டி அங்கம் கோலாலம்பூரில் நடைபெறும்.<br />

ஆகஸ்டு மாதத்திலிருந்து அக்டோபர் மாதம் வரையில்<br />

ஹரி ராயா பெருநாள் மற்றும் அம்னோ பொதுப்பேரவை<br />

நிகழ்வுகளை ஒட்டி ஆபரண விற்பனையை ஊக்குவிக்கும்<br />

வகையில் ஆங்காங்கே மேடை நிகழ்ச்சிகள் நடத்தப்பட்டன.<br />

அத்துடன் செலாங்கூர் குதிரைப் பந்தய கிளப்-இல் நடைபெற்ற<br />

‘͋பேஷன் ஒன் தெ டெர்͋ப்’ (Fashion on the Turf) என்னும்<br />

நிகழ்வில் ஜெர்மனியைச் சார்ந்த ஸ்கோஃபல் (schoeffel)<br />

முத்துகளும் இத்தாலியைச் சார்ந்த லூக்கா கராட்டி (Luca<br />

Carati) வைரங்களும் உத்தேச வாடிக்கையாளர்களுக்கு<br />

அறிமுகப்படுத்தப்பட்டன. நவம்பரில் கோலாலம்பூர்<br />

ஹில்ட்டன் விடுதியில் நடைபெற்ற விற்பனை நோக்கம்<br />

கொண்ட சிறப்பு உபசரிப்பு நிகழ்வில் (2009-2010-க்கான<br />

இலையுதிர்-பனிக்காலத்துக்கான) ‘ஸ்கோஃபல்’ மற்றும்<br />

போ கொங் விற்பனை பொருட்கள் எங்கள் அழைப்பின்<br />

பேரில் வந்திருந்த உத்தேச வாடிக்கையாளர்களின் பார்வைக்கு<br />

வைக்கப்பட்டன.<br />

வணிகச் சின்னமும் வாடிக்கையாளர் ஆதரவும்<br />

தனக்கென ஒரு வணிகச் சின்னத்தைத் தோற்றுவிப்பதில் போ<br />

கொங் நேரத்தையும் பணத்தையும் செலவழித்துள்ளது. இதன்<br />

பயனாக கடந்த ஆண்டுகளில் நல்ல பலன் கிடைத்துள்ளது.<br />

இன்று போ கொங் வணிகச் சின்னம் தாங்கிய நகைகளுக்கு<br />

நாடளாவிய நிலையில் நல்ல கிராக்கி ஏற்பட்டுள்ளது.<br />

விற்பனைப் பொருள் மஞ்சள் நிறத் தங்கமாக இருந்தாலும்<br />

சரி அல்லது முத்து, பச்சை மாணிக்கம், வைரம், மணிக்கல்<br />

போன்றவையாக இருந்தாலும் சரி, எங்கள் பொருட்களுக்கு<br />

நல்ல பெயரும் புகழும் கிடைத்து வருகிறது.<br />

எங்களது வணிகச் சின்னம் எங்களை வெற்றிப் பாதையில்<br />

நடத்திச் செல்லும் வகையில் இருக்கும் பொருட்டு நாங்கள்<br />

வாடிக்கையாளரின் விருப்பு வெறுப்புகளையும் எங்களது<br />

விளம்பர யுத்திகளையும் பெரிதாக நம்புகிறோம். எங்கள்<br />

விளம்பரங்களால் கவரப்பட்டு வாடிக்கையாளர் எங்கள்<br />

பொருட்களை வாங்குவதற்குக் கடைகளுக்கு வந்து,<br />

விளம்பரத்தில் கூறியவாறே பொருட்கள் தரமானவையாக<br />

இருப்பதைக் காண்கிறார்கள். இதிலிருந்து எங்கள் வணிகச்<br />

சின்னம் தந்திருக்கும் வெற்றியை எங்களால் உறுதிப்படுத்த<br />

முடிகிறது.<br />

வாடிக்கையாளர் தேவைகளுக்கு ஏற்ற தராதரம் குறையாத,<br />

கணிசமான விலை கொண்ட பொருட்களை போ கொங்<br />

நிறுவனம் தொடர்ந்து அளித்துவரும். வாடிக்கையாளர்களைப்<br />

பொறுத்தவரை தங்கள் மனதுக்குப் பிடித்தமான<br />

வடிவமைப்பிலான, தரமான பொருட்களை நியாயமான<br />

விலையில் வாங்க முடிந்தால், அதுவே அவர்களுக்கு பெரும்<br />

மனமகிழ்வையும் மனத் திருப்தியையும் அளிக்கும்.<br />

ANNUAL REPORT 2009 35<br />

35

சமுதாயத்தின்பால் உள்ள கடப்பாடு<br />

சமுதாயத்துக்கு நன்மை செய்யவேண்டும் என்பது போ<br />

கொங் நிறுவனத்தின் முக்கிய குறிக்கோள்களில் ஒன்றாகும்.<br />

அதற்கு ஏற்ப எங்கள் நிறுவனத்தின் பணியிடங்களிலும்,<br />

விற்பனை முகப்புகளிலும், பொது மக்கள் மத்தியிலும் எங்கள்<br />

சமுதாயச் சேவை காணப்படவேண்டும். இதன் தொடர்பில்<br />

நிறுவனத்தின் நடவடிக்கைகள் பற்றிய விவரங்கள் வருடாந்திர<br />

அறிக்கையில் இடம் பெற்றுள்ளன.<br />

எதிர்கால வளர்ச்சி<br />

தற்போதைய பொருளாதார சூழ்நிலையையும் பொருள்<br />

விற்பனையில் நிலவும் மந்த நிலையையும் எடுத்துக்<br />

கொண்டால், வரும் நிதியாண்டு 2010-ல் இன்னும் கடுமையான<br />

போட்டாபோட்டியை எதிர்நோக்க வேண்டிவரும் என்பது<br />

வாரிய உறுப்பினர்களின் கணிப்பு.<br />

இதைக் கருத்தில் கொண்டுள்ள போ கொங் குழுமம்<br />

பெரிய அளவிலான செலவினங்களை மேற்கொள்வதிலும்,<br />

செலவினங்களைக் குறைக்கும் வழிமுறைகளை ஆராய்வதிலும்<br />

சிறப்பு கவனம் செலுத்திவருகிறது. உற்பத்தியைப் பெருக்கும்<br />

அதே நேரத்தில் இயக்கச் செலவினங்களைக் குறைப்பதில்<br />

கவனம் செலுத்தப்படும்.<br />

போ கொங் மேலாண்மைக் குழு, வாடிக்கையாளர்களிடையே<br />

தன் பெயரை நிலைநாட்டும் நோக்கில் அடையாளம்<br />

காணப்பட்ட வாடிக்கையாளர்களுக்கு ஏற்ற<br />

பொருட்களைத் தயாரித்தளிப்பதில் அதிக கவனம்<br />

செலுத்தும். புதிய வாடிக்கையாளர்களைக் கவர, புதிய<br />

விற்பனைப் பொருட்களையும், அவற்றுக்கான புதிய<br />

வடிவமைப்புகளையும் அறிமுகப்படுத்தி தரமான<br />

வாடிக்கையாளர் சேவைதனையும் வழங்க பல வியூகங்களை<br />

வகுத்தவண்ணம் இருக்கும்.<br />

நிறுவனத்துக்குச் சொந்தமாக 95 சில்லறை விற்பனைக்<br />

கடைகள் நாடளாவிய நிலையில் இருந்தாலும், வரவை<br />

அதிகரிக்கவும் மேலும் அதிகமான வாடிக்கையாளர்களைக்<br />

கவரவும், உசிதமான இடங்களில் புதிய கடைகளைத் திறக்க<br />

ஆவன செய்யப்படும்.<br />

எனினும் பொருளாதார மந்த நிலையை அனுசரித்து,<br />

திறக்கப்படும் புதிய கடைகளின் எண்ணிக்கை<br />

சுமாரானதாகவே இருக்கும். இதற்கு மாற்றாக ஏற்கெனவே<br />

இயக்கத்தில் உள்ள கடைகளை புனர்நிர்மாணம் செய்வதிலும்<br />

அழகுபடுத்துவதிலும் பணம் செலவு செய்யப்படும்.<br />

இப்போதைய பொருளாதார சூழ்நிலையை வைத்துப்<br />

பார்த்தால், 2009-ன் நான்காம் காலாண்டிலும் 2010-ன் முதல்<br />

காலாண்டிலும் விற்பனையில் அதிக வளர்ச்சியை எதிர்ப்பார்க்க<br />

முடியாது.<br />

இருப்பினும் பண்டிகை காலத்தை முன்னிட்டு<br />

நிறுவனத்தின் கடைகளில் விற்பனை நன்றாக நடக்கும்<br />

என்ற நன்னம்பிக்கையைக் குழுமம் கொண்டுள்ளது. அது<br />

மட்டுமின்றி, முதலீட்டுக்காகவும், வங்கியில் வைப்புத்<br />

தொகையாக பணத்தைப் போடுவதற்கு மாற்றாகவும்,<br />

36 Poh Kong Holdings Berhad<br />

தலைவர் உரை<br />

பணவீக்கத்தைச் சமாளிப்பதற்காகவும் நிறுவனத்தின் விசுவாச<br />

வாடிக்கையாளர்கள் தங்க நகைகளை வாங்கவே செய்வர் என்ற<br />

நம்பிக்கை குழுமத்துக்கு உண்டு.<br />

பாதகமான சூழ்நிலைகள் தோன்றினால் ஒழிய, நிதியாண்டு<br />

2010-ல் குழுமத்தின் வணிக வெற்றி திருப்தியளிக்கும் வகையில்<br />

அமைந்திருக்கும் என வாரியம் நம்புகிறது.<br />

பிரதி பங்கின் சம்பாத்தியம்<br />

31 ஜூலை 2009-ல் முடிவுறும் நிதியாண்டுக்கான பிரதி<br />

பங்கின் சம்பாத்தியம் 6.93 காசாக இருக்கும் (2008-ல் இது 6.99<br />

காசாக இருந்தது).<br />

டிவிடென்ட்<br />

31 ஜூலை 2009-ல் முடிவுறும் நிதியாண்டுக்கு RM0.50<br />

மதிப்புள்ள ஒவ்வொரு பங்குக்கும் 1.40 சென் (வரி விலக்குடன்)<br />

டிவிடென்ட் அளிக்கும்படி வாரியம் பரிந்துரைக்கிறது. (2008-<br />

ல் RM0.50 மதிப்புள்ள பிரதி பங்குக்கும் வரிவிலக்குடன்<br />

கூடிய 1.40 சென் டிவிடென்ட் தரப்பட்டது). வரும் 20 ஜனவரி<br />

2010-ல் நடைபெறவிருக்கும் ஆண்டுப் பொதுக் கூட்டத்தில்<br />

பங்குதாரர்கள் இதை ஏற்று அங்கீகரித்தால்தான் டிவிடென்ட<br />

தரப்படும்).<br />

டிவிடென்ட்<br />

இவ்வாண்டில் வாரியத்தின் பணிசார் இயக்குனர் பதவியைத்<br />

துறந்த திரு.ச்சூன் யீ ͋புக் அவர்களுக்கு வாரிய<br />

உறுப்பினர்களின் சார்பாக நன்றி தெரிவித்துக்கொள்கிறேன்.<br />

அதைத் தொடர்ந்து வாரியத்தின் நடுநிலை பணிசார்பற்ற<br />

இயக்குனராகப் பதவி ஏற்கவிருக்கும் டத்தின் ஷெர்லி யுவே<br />

ஷாவ் ஹாவ் அவர்களை நாங்கள் இனிதே வரவேற்கிறோம்.<br />

இவ்வாண்டில் நல்ல ஆலோசனைகளையும் ஆதரவையும்<br />

வழங்கிய எனது சக இயக்குனர்களுக்கும் இவ்வேளையில்<br />

எனது மனமுவந்த நன்றியைத் தெரிவித்துக்கொள்கிறேன்.<br />

மற்றும் குழுமத்துக்காக உளப்பூர்வமான முறையில்<br />

மேற்கொண்ட முயற்சிகளுக்காகவும், ஈடுபாட்டுக்காகவும்,<br />

ஆதரவுக்காகவும் அனைத்து மேலாண்மை அதிகாரிகளுக்கும்,<br />

பணியாளர்களுக்கும் எனது நன்றி உரித்தாகுக.<br />

இறுதியாக எங்கள் மீது பெருநம்பிக்கை வைத்துள்ள எங்கள்<br />

பங்குதாரர்களுக்கும், தொடர்ந்து தங்கள் நல்லாதரவையும்<br />

ஒத்துழைப்பையும் நல்கிவரும் வாடிக்கையாளர்களுக்கும்,<br />

வணிகப் பங்காளிகளுக்கும், அரசாங்க அதிகாரிகளுக்கும்,<br />

நிதி ஈந்தவர்களுக்கும், பொருட்கள் அனுப்புபவர்களுக்கும்<br />

நாங்கள் நன்றிக்கடன் பட்டவர்களாய் இருக்கிறோம்.<br />

இப்படிக்கு<br />

டத்தோ ச்சூன் யீ சியோங்<br />

பணிசார் தலைவர் & குழும மேலாண்மை இயக்குனர்<br />

16 டிசம்பர் 2009

INTRODUCTION<br />

The <strong>Board</strong> of Poh Kong Holdings Berhad (“the <strong>Company</strong>”) is<br />

committed to instill a corporate culture that emphasises good<br />

corporate governance and is to be practised throughout the<br />

<strong>Company</strong> and its subsidiary companies (“the Group”). The<br />

Group acknowledges the importance of corporate governance<br />

in enhancing its business prosperity and corporate accountability<br />

with the absolute objective of realising long-term shareholders’ and<br />

stakeholders’ value.<br />

The Group will continue to endeavor to comply with all the key<br />

principles of the <strong>Malaysia</strong>n Code of Corporate Governance (“the<br />

Code”) in an effort to observe high standards of transparency,<br />

accountability and integrity. This is to sustain optimal governance<br />

with conscientious accountability for continuous effectiveness,<br />

efficiency and competitiveness of the Group.<br />

Set out below are descriptions of how the Group applied the<br />

Principles of the Code and how the <strong>Board</strong> has complied with the<br />

Best Practices set out in the Code.<br />

1. <strong>DIRECTORS</strong><br />

1.1 The <strong>Board</strong> Balance<br />

The control environment set the tone for the Group and<br />

is driven by an effective <strong>Board</strong> (“the <strong>Board</strong>”) consisting<br />

of competent individuals with appropriate specialised<br />

skills and knowledge to ensure capable management of<br />

the Group. The <strong>Board</strong> is responsible for overseeing the<br />

conduct and performance of the Group’s businesses and<br />

oversees the Group’s internal controls. The composition<br />

of independent and non-independent directors is carefully<br />

considered to ensure that the <strong>Board</strong> is well balanced.<br />

Statement on<br />

CORPORATE GOVERNANCE<br />

The <strong>Board</strong> comprises eight (8) members, of whom five<br />

(5) are Executive Directors and three (3) are Independent<br />

Non-Executive Directors. It is a balanced <strong>Board</strong> and<br />

comprises professionals from various backgrounds and<br />

with the relevant experience and expertise that would add<br />

value to the Group. The mix of experience is vital for the<br />

strategic success of the Group.<br />

The presence of Independent Non-Executive Directors<br />

fulfills a pivotal role in corporate accountability. The role<br />

of the Independent Non-Executive Directors is particularly<br />

important as they provide unbiased and independent<br />

views, advice and judgement.<br />

The Executive Chairman and Group Managing Director<br />

is Dato’ Choon Yee Seiong. There is a division of<br />

responsibilities. As the Chairman, he is responsible for the<br />

orderly conduct and performance of the <strong>Board</strong>. As the<br />

Group Managing Director, he is responsible for ensuring<br />

the <strong>Board</strong>’s decisions are implemented, and that the dayto-day<br />

running of the business is in tandem with the goals<br />

and policies sanctioned by the <strong>Board</strong>. The Managing<br />

Director is subject to the control of the <strong>Board</strong> of Directors.<br />

In furtherance of this, Dr Choong Tuck Yew as the Senior<br />

Independent Non-Executive Director assists with concerns<br />

regarding the <strong>Company</strong> where it could be inappropriate for<br />

those to be dealt with by the Executive Directors.<br />

In discharging its fiduciary duties, the <strong>Board</strong> is assisted<br />

by the following three (3) <strong>Board</strong> Committees each<br />

entrusted with specific tasks. All the three (3) Committees<br />

do not have executive powers but report to the <strong>Board</strong><br />

on all matters considered and their recommendations<br />

thereon. The Terms of Reference of each committee<br />

have been approved by the <strong>Board</strong> in compliance with the<br />

recommendation of the Code:<br />

a) Nomination Committee;<br />

b) Remuneration Committee; and<br />

c) Audit Committee<br />

ANNUAL REPORT 2009 37

38<br />

1.2 <strong>Board</strong> Meeting<br />

Statement on<br />

CORPORATE GOVERNANCE<br />

The <strong>Board</strong> of Directors of the <strong>Company</strong> subscribes to<br />

the Code. The <strong>Board</strong> has the overall responsibility for<br />

Corporate Governance, strategic direction, formulation of<br />

policies and overseeing the investment and performance<br />

of the <strong>Company</strong>. The <strong>Board</strong> met six (6) times during the<br />

financial year ended 31 July 2009 and details of attendance<br />

are as below:<br />

Executive Directors<br />

Dato’ Choon Yee Seiong<br />

(Executive Chairman and<br />

Group Managing Director)<br />

Mr Cheong Teck Chong<br />

Madam Choon Nee Siew<br />

Mr Choon Yee Fook<br />

(resigned w.e.f. 10 July 2009)<br />

Madam Choon Yoke Ying<br />

Madam Choon Wan Joo<br />

Independent Non-<br />

Executive Directors<br />

Dr Choong Tuck Yew<br />

Encik Fazrin Azwar<br />

Bin Md Nor<br />

Datin Shirley Yue Shou How<br />

(appointed w.e.f.<br />

23 January 2009)<br />

1.3 Supply of Information<br />

All Directors are provided with an agenda and <strong>Board</strong><br />

papers containing information relevant to the business<br />

of the <strong>Board</strong> Meetings. This is issued in sufficient time to<br />

enable the Directors to obtain further explanation where<br />

necessary, in order to be properly briefed before the<br />

meeting. Minutes of the <strong>Board</strong> Committees are also tabled<br />

at the <strong>Board</strong> Meetings for information and deliberation.<br />

Poh Kong Holdings Berhad<br />

Total<br />

number of<br />

Meetings<br />

held<br />

6<br />

6<br />

6<br />

5<br />

6<br />

6<br />

6<br />

6<br />

3<br />

Meetings<br />

attended<br />

by<br />

Director<br />

6<br />

6<br />

6<br />

2<br />

6<br />

6<br />

6<br />

5<br />

3<br />

The Audit Committee of the <strong>Board</strong> ensures compliance<br />

with disclosure requirements and accounting and audit<br />

policies overseeing all issues pertaining to financial and<br />

operational risks.<br />

All the Directors have direct access to the advice and<br />

services of Senior Management and the <strong>Company</strong><br />

Secretary in carrying out their duties. The Directors may<br />

obtain independent professional advice in furtherance of<br />

their duties, with the consent of the <strong>Board</strong>.<br />

1.4 Directors’ Training<br />

Directors are encouraged to attend continuous education<br />

programmes and seminars to keep abreast of relevant<br />