Tough times - Hedge Funds Review

Tough times - Hedge Funds Review

Tough times - Hedge Funds Review

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40<br />

StatiSticS<br />

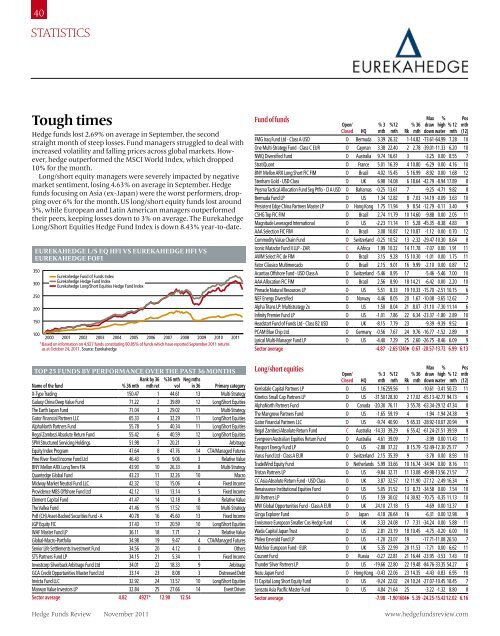

<strong>Tough</strong> <strong>times</strong><br />

<strong>Hedge</strong> funds lost 2.69% on average in September, the second<br />

straight month of steep losses. Fund managers struggled to deal with<br />

increased volatility and falling prices across global markets. However,<br />

hedge outperformed the MSCI World Index, which dropped<br />

10% for the month.<br />

Long/short equity managers were severely impacted by negative<br />

market sentiment, losing 4.63% on average in September. <strong>Hedge</strong><br />

funds focusing on Asia (ex-Japan) were the worst performers, dropping<br />

over 6% for the month. US long/short equity funds lost around<br />

5%, while European and Latin American managers outperformed<br />

their peers, keeping losses down to 3% on average. The Eurekahedge<br />

Long/Short Equities <strong>Hedge</strong> Fund Index is down 8.43% year-to-date.<br />

eurekahedge l/s eq hfI vs eurekahedge hfI vs<br />

eurekahedge fofI<br />

350<br />

300<br />

250<br />

200<br />

150<br />

Eurekahedge Fund of <strong>Funds</strong> Index<br />

Eurekahedge <strong>Hedge</strong> Fund Index<br />

Eurekahedge Long/Short Equities <strong>Hedge</strong> Fund Index<br />

100<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

*Based on information on 4,927 funds constituting 80.85% of funds which have reported September 2011 returns<br />

as at October 24, 2011. Source: Eurekahedge<br />

Top 25 funds by performance over The pasT 36 monThs<br />

Name of the fund % 36 mth<br />

Rank by 36<br />

mth ret<br />

%36 mth<br />

vol<br />

2011<br />

Neg mths<br />

in 36 Primary category<br />

X-Type Trading 150.47 1 44.61 13 Multi-Strategy<br />

Galaxy China Deep Value Fund 71.22 2 39.89 12 Long/Short Equities<br />

The Earth Japan Fund 71.04 3 29.02 11 Multi-Strategy<br />

Gator Financial Partners LLC 65.33 4 32.29 11 Long/Short Equities<br />

AlphaNorth Partners Fund 55.78 5 40.34 11 Long/Short Equities<br />

Regal Zambezi Absolute Return Fund 55.42 6 40.59 12 Long/Short Equities<br />

SPM Structured Servicing Holdings 51.98 7 20.21 3 Arbitrage<br />

Equity Index Program 47.64 8 47.76 14 CTA/Managed Futures<br />

Pine River Fixed Income Fund Ltd 46.43 9 9.06 3 Relative Value<br />

BNY Mellon ARX Long Term FIA 43.93 10 26.33 8 Multi-Strategy<br />

Quantedge Global Fund 43.23 11 32.26 10 Macro<br />

Midway Market Neutral Fund LLC 42.32 12 15.06 4 Fixed Income<br />

Providence MBS Offshore Fund Ltd 42.12 13 13.14 5 Fixed Income<br />

Element Capital Fund 41.47 14 12.18 8 Relative Value<br />

The Vallea Fund 41.46 15 17.52 10 Multi-Strategy<br />

PvB (CH) Asset-Backed Securities Fund - A 40.78 16 45.60 13 Fixed Income<br />

JGP Equity FIC 37.43 17 20.59 10 Long/Short Equities<br />

WAF Master Fund LP 36.11 18 7.71 2 Relative Value<br />

Global-Macro-Portfolio 34.98 19 9.47 4 CTA/Managed Futures<br />

Senior Life Settlements Investment Fund 34.56 20 4.12 0 Others<br />

STS Partners Fund LP 34.15 21 5.34 1 Fixed Income<br />

Investcorp Silverback Arbitrage Fund Ltd 34.01 22 18.33 9 Arbitrage<br />

GCA Credit Opportunities Master Fund Ltd 33.14 23 8.08 3 Distressed Debt<br />

Invicta Fund LLC 32.92 24 13.57 10 Long/Short Equities<br />

Marwyn Value Investors LP 32.84 25 27.66 14 Event Driven<br />

Sector average 4.82 4927* 12.90 12.54<br />

Fund of funds<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

FMG Iraq Fund Ltd - Class A USD O Bermuda 3.39 26.32 1-14.82 -73.61-64.99 7.28 10<br />

One Multi-Strategy Fund - Class C EUR O Cayman 3.38 22.40 2 2.78 -39.01-11.33 6.20 10<br />

NWQ Diversified Fund O Australia 9.74 16.61 3 -3.25 0.00 8.55 7<br />

StratiQuant O France 5.01 16.39 4 10.80 -6.29 0.00 4.16 10<br />

BNY Mellon ARX Long Short FIC FIM O Brazil 4.02 15.45 5 16.99 -8.92 0.00 1.68 12<br />

Stenham Gold - USD Class O UK 6.98 14.08 6 18.64 -42.79 -8.94 17.89 8<br />

Prysma Tactical Allocation Fund Seg Ptflo - Cl A USD O Bahamas -0.25 13.61 7 -9.25 -4.71 9.82 8<br />

Bermuda Fund LP O US 1.34 12.82 8 7.03 -14.19 -0.09 3.63 10<br />

Persistent Edge China Partners Master LP O Hong Kong 1.75 11.94 9 8.54 -12.79 -0.11 3.40 9<br />

CSHG Top FIC FIM O Brazil 2.74 11.79 10 14.60 -9.88 0.00 2.05 11<br />

Magnitude Leveraged International O US -2.23 11.14 11 5.28 -45.35 -8.38 4.83 9<br />

AAA Selection FIC FIM O Brazil 3.08 10.87 12 10.87 -1.12 0.00 0.70 12<br />

Commodity Value Chain Fund O Switzerland -0.25 10.52 13 -2.32 -29.47-10.30 8.64 8<br />

Iconic Matador Fund II LLP - ZAR C A Africa 1.99 10.22 14 11.78 -7.07 0.00 1.91 11<br />

AWM Select FIC de FIM O Brazil 3.15 9.28 15 10.30 -1.01 0.00 1.75 11<br />

Fator Clássico Multimercado O Brazil 2.15 9.01 16 9.99 -2.10 0.00 0.87 12<br />

Acantias Offshore Fund - USD Class A O Switzerland -5.46 8.95 17 -5.46 -5.46 7.00 10<br />

AAA Allocation FIC FIM O Brazil 2.56 8.90 18 14.21 -6.42 0.00 2.20 10<br />

Pinnacle Natural Resources LP O US 5.51 8.33 19 10.33 -15.70 -2.51 10.15 6<br />

NEF Energy Diversified O Norway 4.46 8.05 20 1.67 -10.08 -3.65 12.62 7<br />

Alpha Titans LP: Multistrategy 2x O US 1.50 8.04 21 8.07 -31.10 -7.30 11.14 6<br />

Infinity Premier Fund LP O US -1.01 7.86 22 6.34 -23.37 -1.80 2.89 10<br />

Headstart Fund of <strong>Funds</strong> Ltd - Class B2 USD O UK -8.15 7.79 23 -9.39 -9.39 9.52 8<br />

PCAM Blue Chip Ltd O Germany -0.56 7.67 24 9.76 -16.77 -1.52 2.89 9<br />

Lyrical Multi-Manager Fund LP O US -4.40 7.29 25 2.60 -26.75 -8.46 6.09 9<br />

Sector average -4.87 -2.651240♠ 0.67 -20.57-13.72 6.99 6.13<br />

Long/short equities<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

Kerrisdale Capital Partners LP O US 1.16259.56 1 -10.61 -3.41 50.73 11<br />

Kinetics Small Cap Partners LP O US -31.50128.30 2 17.02 -65.13-42.77 94.73 6<br />

AlphaNorth Partners Fund O Canada -20.30 76.11 3 55.78 -63.34-29.12 47.34 8<br />

The Mangrove Partners Fund O US -1.65 59.19 4 -1.94 -1.94 24.38 9<br />

Gator Financial Partners LLC O US -9.74 40.90 5 65.33 -28.92-10.07 20.94 9<br />

Regal Zambezi Absolute Return Fund C Australia -14.33 39.29 6 55.42 -61.24-21.51 39.59 8<br />

Evergreen Australian Equities Return Fund O Australia 4.61 39.09 7 -3.99 0.00 11.43 11<br />

Passport Energy Fund LP O US -2.88 37.22 8 15.79 -52.49-12.30 25.77 7<br />

Varus Fund Ltd - Class A EUR O Switzerland 2.15 35.39 9 -3.78 0.00 8.93 10<br />

TradeWind Equity Fund O Netherlands 5.99 33.66 10 16.74 -34.94 0.00 8.16 11<br />

Tristan Partners LP O US -9.84 32.71 11 13.08 -49.98-13.56 21.57 7<br />

CC Asia Absolute Return Fund - USD Class O UK 3.87 32.57 12 11.90 -27.12 -2.49 16.34 6<br />

Renaissance Institutional Equities Fund O US 5.05 31.52 13 8.73 -34.58 0.00 7.54 10<br />

JW Partners LP O US 1.59 30.02 14 30.92 -70.75 -0.35 11.13 10<br />

MW Global Opportunities Fund - Class A EUR O UK 24.10 27.18 15 -4.69 0.00 13.37 8<br />

Ginga Explorer Fund O Japan 4.18 26.64 16 -6.31 0.00 12.98 9<br />

Ennismore European Smaller Cos <strong>Hedge</strong> Fund C UK 3.33 24.08 17 7.31 -34.24 0.00 5.88 11<br />

Wada Capital Japan Trust O US 2.81 23.19 18 10.45 -4.75 -0.20 6.00 10<br />

Phileo Emerald Fund LP O US -1.20 23.07 19 -17.71-11.08 26.50 7<br />

Melchior European Fund - EUR O UK 5.35 22.99 20 11.53 -7.71 0.00 6.62 11<br />

Courant Fund O Russia -0.27 22.81 21 16.44 -23.95 -3.53 7.43 10<br />

Thunder Silver Partners LP O US -19.66 22.80 22 19.48 -84.76-33.35 54.27 6<br />

Nezu Japan Fund O Hong Kong -0.43 22.06 23 14.35 -4.43 -0.83 6.95 10<br />

FJ Capital Long Short Equity Fund O US -9.24 22.02 24 10.24 -27.07-10.45 18.45 7<br />

Sensato Asia Pacific Master Fund O US 4.84 21.64 25 -3.22 -1.32 8.80 8<br />

Sector average -7.98 -1.901604♠ 5.39 -24.25-15.4212.02 6.16<br />

<strong>Hedge</strong> <strong>Funds</strong> <strong>Review</strong> November 2011 www.hedgefundsreview.com

cTas struggle<br />

Managed futures funds lost 0.50% on average in September as<br />

trend reversals in bonds and commodities erased gains in other<br />

asset classes. Commodity trading advisers (CTAs) in North America<br />

outperformed other regional managers, posting gains of 2.27% on<br />

average for the month. The Eurekahedge CTA/Managed Futures<br />

<strong>Hedge</strong> Fund Index is down 1.77% year-to-date.<br />

Arbitrage strategies also struggled with the volatility in September.<br />

The Eurekahedge Arbitrage <strong>Hedge</strong> Fund Index fell 1.44% for the<br />

month. Latin American managers were the exception to the rule,<br />

finishing the month with a positive 0.7% return. Latin American<br />

arbitrage funds are up over 7% year-to-date.<br />

eurekahedge dIs debT vs eurekahedge cTa/managed<br />

fuTures hfI vs eurekahedge arb hfI<br />

500<br />

400<br />

300<br />

200<br />

100<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

*Based on information on 4,927 funds constituting 80.85% of funds which have reported September 2011 returns<br />

as at October 24, 2011. Source: Eurekahedge<br />

Arbitrage<br />

Eurekahedge Arbitrage <strong>Hedge</strong> Fund Index<br />

Eurekahedge CTA/Managed Futures <strong>Hedge</strong> Fund Index<br />

Eurekahedge Distressed Debt <strong>Hedge</strong> Fund Index<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

ABCA Reversion Fund O France 5.52 28.14 1 -0.87 0.00 6.20 10<br />

Rockwell Fulton Capital LP O US 3.48 27.55 2 15.54 -19.94 0.00 4.15 12<br />

SPM Structured Servicing Holdings O US 6.33 24.23 3 51.98 -30.43 0.00 7.79 10<br />

Calderon Fund PCC Ltd - CC1 Fund O Gibraltar 5.97 19.22 4 0.00 0.00 3.71 12<br />

Estee I-Alpha O India 4.06 17.95 5 0.00 0.00 2.02 12<br />

Stratus Feeder Limited - Cl B (USD Std Leverage) O France 4.94 16.72 6 11.91 -6.14 0.00 4.17 10<br />

KWK Partners LP O US 1.42 15.23 7 13.64 -0.90 0.00 1.93 12<br />

MKP Opportunity Offshore Ltd O US 10.00 13.71 8 11.00 -3.70 0.00 5.59 10<br />

III Relative Value Credit Strategies Fund Ltd O US VI -0.44 12.45 9 9.25 -31.27 -0.90 4.65 9<br />

Tang Gamma Opportunity Fund (Aggressive) LP O US 6.29 12.11 10 -9.04 -3.28 18.37 8<br />

Kevlon Fund LP O US 15.49 11.59 11 7.76 -9.69 0.00 12.76 8<br />

Pine River Convertibles Fund LP O US 3.61 11.22 12 -3.80 0.00 5.52 8<br />

Alphabet Partners LP O US -9.23 10.50 13 6.84 -21.27 -9.23 10.29 9<br />

Fator Arbitragem FIM O Brazil 2.20 9.60 14 10.49 -2.62 0.00 1.67 11<br />

Investcorp Silverback Arbitrage Fund Ltd O US -0.32 9.21 15 34.01 -25.78 -1.11 4.19 8<br />

NorCap Diversified Premium Fund LP O US -0.14 9.04 16 9.19 -9.71 -0.23 2.42 11<br />

GS Allocation Dinamico FIM O Brazil 2.33 8.79 17 9.31 0.00 0.00 0.31 12<br />

Amundi Fds Dynarb Forex Asia Pacific - Cl I USD Acc O Luxembourg 4.29 8.23 18 4.01 -2.58 -0.79 5.95 6<br />

Chicago Capital Management Ltd - Offshore Fund O US 1.04 8.22 19 -1.54 0.00 1.86 11<br />

Glazer Enhanced Fund LP O US -0.02 8.05 20 -0.22 -0.22 2.23 11<br />

Salus Alpha Commodity Arbitrage O Liecht -1.18 8.01 21 1.83 -5.24 -1.30 4.49 7<br />

R-SQUARED Fund - Class A JPY O Singapore -3.07 7.48 22 -6.90 -5.58 5.94 10<br />

Barnegat Fund Ltd O US -1.82 7.18 23 31.40 -55.86 -3.29 9.01 10<br />

5:15 Master Fund O US 2.52 6.81 24 -2.52 0.00 1.59 10<br />

Wolverine Convertible Arbitrage Fund LLC O US -2.02 6.61 25 14.37 -25.76 -2.98 4.23 9<br />

Sector average -2.28 3.15 171♠ 6.61 -13.67 -6.33 5.67 7.36<br />

2011<br />

CTA/managed futures<br />

41<br />

StatiSticS<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

TriFex Trading Fund LP O US 44.99 87.93 1 12.85 -36.49 0.00 62.50 9<br />

Equity Index Program O US 105.51 70.28 2 47.64 -35.51 0.00 69.98 7<br />

Dairy Advantage Program O US 10.20 62.31 3 32.22 -41.49-17.61 48.35 6<br />

Hamer Trading Inc - Diversified Program O US 21.99 58.96 4 25.53 -38.45 0.00 20.22 8<br />

Iron Fortress FX Management Ltd O US 27.85 57.43 5 -8.05 0.00 17.86 10<br />

MKC Global Fund LP O US 37.77 52.67 6 -20.40 0.00 30.37 8<br />

Pardo Capital Ltd O US 21.99 49.70 7 17.21 -55.16-10.90 18.57 9<br />

Mulvaney Global Markets Fund Ltd O UK 8.17 45.18 8 27.71 -41.28-11.69 40.39 7<br />

Global-Macro-Portfolio O Germany 15.51 45.00 9 34.98 -5.98 0.00 15.20 8<br />

Eagle Global Ltd O US 16.80 41.10 10 19.01 -32.13 0.00 19.59 10<br />

Superfund Cayman C US 8.13 38.24 11 1.44 -60.95-33.14 41.68 6<br />

Duet Commodities Fund - Class A USD O UK -0.08 32.42 12 -3.76 -3.76 10.98 10<br />

Antipodean Capital Man A$ Currency Fund (3X) O Australia 36.21 32.14 13 8.42 -16.60 0.00 37.40 5<br />

Oxeye Growth Fund - USD O UK 5.86 31.80 14 5.16 -26.57 0.00 11.41 9<br />

Clarke Millennium Program O US 13.14 31.13 15 -1.18 -60.98-18.85 26.99 7<br />

FORT Global Diversified LP O US 22.66 29.89 16 27.64 -17.16 0.00 18.56 8<br />

Global Trend Following - Large Account O US 26.34 28.45 17 20.06 -24.75 0.00 30.76 7<br />

SafePort Silver Mining Fund O Liecht -4.27 28.03 18 17.85 -80.96-26.44 45.82 6<br />

Credence Oriental Trade Enterprise Ltd Partnership O China 2.76 27.39 19 31.93 -9.18 0.00 5.42 11<br />

Krom River Commodity Systematic Fund O Switzerland -0.75 26.53 20 -19.96-17.36 28.78 8<br />

Qbasis Futures Fund - Class A O Cayman 18.38 25.66 21 7.87 -35.48-18.92 33.24 6<br />

AIS Futures Fund LP (3x-6x) O US -28.05 25.50 22-10.08 -89.67-65.92 69.08 8<br />

D’Best Futures Fund LP O US 22.00 24.35 23 24.46 -52.06 0.00 28.99 7<br />

Somers Brothers Diversified Futures Program #1 O US 16.94 24.26 24 7.50 -33.56 0.00 23.84 7<br />

Tactical Institutional Commodity Program C US 5.20 23.74 25 31.99 -30.75-17.53 35.77 8<br />

Sector average 2.05 4.81 582♠ 5.12 -23.05-11.7016.68 6.40<br />

Distressed debt<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

Simplon Partners LP O US -7.97 20.58 1 7.42 -29.91 -9.72 13.48 9<br />

Simplon International Limited O US -8.05 20.22 2 7.57 -29.51 -9.99 13.57 9<br />

Hildene Opportunities Fund LP O US -9.15 19.64 3 26.91 -9.15 -9.15 13.84 9<br />

Orchard Centar O Hong Kong -0.06 19.09 4 12.92 -12.35 -2.48 7.82 9<br />

KDC Distressed & High Income Securities Fund LP O US -2.31 15.95 5 4.21 -15.92 -2.40 7.42 10<br />

Waterfall Eden Fund LP O US 0.37 15.77 6 8.32 -21.97 -1.44 4.22 9<br />

VR Global Offshore Fund Ltd C US -6.91 13.89 7 26.40 -48.38 -8.95 11.72 10<br />

Candlewood Special Situations Fund LP O US -3.58 8.91 8 10.65 -25.86 -4.06 5.68 9<br />

GCA Credit Opportunities Master Fund Ltd O US -1.05 6.56 9 33.14 -1.95 -1.95 3.19 10<br />

Armory Offshore Fund Ltd O US -25.20 4.10 10 25.94 -72.58-29.56 32.06 6<br />

Zazove High Yield Convertible Securities Fund LP O US -10.57 3.74 11 11.52 -49.89-12.75 10.89 7<br />

Third Avenue Special Situations Offshore Fund Ltd O US -7.38 3.39 12 6.41 -40.43 -7.96 6.93 8<br />

KS Capital Partners LP O US -2.00 2.47 13 7.20 -25.70 -3.01 3.69 7<br />

Restoration Offshore Fund Ltd O US -4.59 2.42 14 1.92 -7.67 -4.88 4.75 10<br />

KS International Inc O US -2.13 2.20 15 6.71 -25.82 -3.10 3.73 7<br />

Credit Renaissance Fund Ltd O US -2.92 0.58 16 2.31 -54.61-25.33 6.49 7<br />

Marathon Special Opportunity Fund O US -5.05 -0.05 17 5.74 -34.17 -7.38 6.32 7<br />

Sothic Capital European Opp Fund Ltd Cl A EUR O UK -4.09 -1.50 18 -7.33 -7.33 6.90 6<br />

Wexford Credit Opportunities Fund LP O US -6.69 -2.79 19 12.45 -12.62 -7.93 7.09 7<br />

Alcentra Global Special Situations Fund O UK -8.52 -3.33 20 18.82 -48.74 -8.58 6.11 7<br />

Argo Distressed Credit Fund O UK -4.35 -5.78 21 5.52 -8.08 -8.08 9.09 7<br />

JLP Credit Opportunity Fund LP O US -23.82 -7.83 22 28.95 -51.75-25.65 21.52 7<br />

PENN Distressed Fund LP O US -16.67 -10.42 23 16.26 -44.28-20.33 14.30 5<br />

TIG Distressed Opportunities LP/Ltd O US -11.35 -11.18 24 8.71 -17.34-17.34 9.59 4<br />

Paulson Credit Opportunites LP O US -21.94 -11.25 25 8.96 -24.07-24.07 18.84 5<br />

Sector average -9.20 4.32 41♠12.57 -29.19-11.9610.24 7.46<br />

www.hedgefundsreview.com <strong>Hedge</strong> <strong>Funds</strong> <strong>Review</strong> November 2011

42<br />

StatiSticS<br />

macro mixed<br />

Global macro funds fell 0.94% on average in September. Returns<br />

were mixed across the board. A number of well known managers,<br />

including Brevan Howard, Tudor Investment Corporation and<br />

Caxton Associates profited from bearish bets on the euro as well as<br />

commodities and equities. However, some managers were caught<br />

out by reversals in bond prices and precious metals.<br />

Relative value strategies were negatively impacted by the heightened<br />

volatility and sharp declines in equity markets. The Eurekahedge<br />

Relative Value <strong>Hedge</strong> Fund Index was down 1.87% for the<br />

month. It was also a difficult month for multi-strategy funds, which<br />

lost 1.69% in August. The Eurekahedge Multi-Strategy <strong>Hedge</strong> Fund<br />

Index is currently down 3.14% year-to-date with the losses in August<br />

and September cancelling out strong returns in earlier months.<br />

eurekahedge rel value hfI vs eurekahedge m/s hfI vs<br />

eurekahedge macro hfI<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

*Based on information on 4,927 funds constituting 80.85% of funds which have reported September 2011 returns<br />

as at October 24, 2011. Source: Eurekahedge<br />

Global macro<br />

Eurekahedge Macro <strong>Hedge</strong> Fund Index<br />

Eurekahedge Multi-Strategy <strong>Hedge</strong> Fund Index<br />

Eurekahedge Relative Value <strong>Hedge</strong> Fund Index<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

Opto Global Macro Fund O US 118.07129.39 1 -15.64 0.00 83.76 6<br />

Haidar Jupiter Fund LLC O US 19.92 43.61 2 28.38 -17.05 0.00 17.42 8<br />

HCAP Global Diversified Fund O Australia 14.23 27.52 3 -11.81 0.00 11.37 9<br />

Quantedge Global Fund O Singapore -2.93 26.61 4 43.23 -44.65-15.46 31.02 9<br />

Vicktor Opportunities Fund O Hong Kong 12.77 25.12 5 -11.38 0.00 12.46 9<br />

Polo Macro FIM O Brazil 5.43 19.00 6 -0.20 0.00 2.33 12<br />

BIA Pacific Macro Fund - US Dollar Class O Hong Kong 16.95 19.00 7 6.80 -19.66 0.00 10.65 9<br />

LGIM Global Macro Fund O UK 12.33 18.37 8 12.26 -19.71 0.00 16.71 7<br />

Paineiras <strong>Hedge</strong> FIM O Brazil 14.05 18.16 9 19.74 -14.59 0.00 10.27 10<br />

AIS Balanced Fund LP O US 1.92 18.02 10 17.34 -28.15-11.77 20.01 8<br />

Pivot Global Value Fund O Monaco 21.48 17.90 11 16.94 -5.52 0.00 16.02 8<br />

Trinity WS Global Fund O Hong Kong -6.16 15.51 12 -23.87-23.87 44.86 8<br />

Zooz Capital Partners LP O US 10.55 14.94 13 12.72 -8.46 0.00 8.13 7<br />

Sibilla Capital Ltd - Global Class O US 7.63 14.90 14 12.58 -13.11 0.00 9.63 7<br />

QFS Currency Fund LP O US -0.21 14.73 15 14.57 -18.83 -5.31 15.61 7<br />

GAP Absoluto O Brazil 3.91 14.56 16 15.43 -3.84 0.00 2.35 12<br />

The 36 South Cullinan Fund O UK 7.77 14.00 17 -14.34 -5.07 15.21 6<br />

Advis Macro FIM O Brazil 5.60 13.91 18 11.96 0.00 0.00 2.99 12<br />

Bund Macro Fund O US 5.90 12.98 19 9.07 -8.94 0.00 12.97 7<br />

Strand US Fund O Switzerland 16.18 12.68 20 13.75 -31.65 0.00 31.47 6<br />

Camelotfund Capital Guar FX Program Series 1 C Australia 1.20 12.42 21 7.16 -2.63 0.00 7.03 12<br />

Crescat Global Macro Composite O US 2.43 11.44 22 9.05 -44.11-14.79 24.35 6<br />

Bridgewater All Weather @ 12% Strategy O US 4.21 11.30 23 8.18 -32.26 -2.87 9.55 9<br />

Apeiron Global Macro Fund - Class A O Australia 5.82 11.16 24 4.46 -12.68 0.00 9.32 7<br />

Ashmore Brasil 30 O Brazil 2.03 11.11 25 12.56 -2.47 -0.05 2.55 10<br />

Sector average -0.70 0.60 275♠ 7.50 -17.05 -9.0510.54 6.16<br />

2011<br />

Multi-strategy<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

X-Type Trading O Germany 27.94122.99 1150.47 -13.58 0.00 33.10 8<br />

Infinium Global Fund O Cayman 19.16104.97 2 0.00 0.00 4.17 12<br />

The Earth Japan Fund C Japan 19.87 43.91 3 71.04 -5.05 0.00 18.33 8<br />

Bridgewater Pure Alpha 18% Volatility Strategy O US 13.91 38.19 4 28.49 -21.69 -0.31 13.84 7<br />

Pivotal Investments Ltd O Hong Kong 25.01 35.29 5 -3.45 -1.71 22.93 8<br />

Segantii Asia-Pacific Equity Multi-Strategy Fund O Hong Kong 15.38 33.45 6 19.64 -5.20 0.00 9.55 9<br />

InnoFusion Asia Multi-Strategy Fund O Hong Kong 16.83 31.80 7 14.24 -22.18 0.00 22.33 8<br />

SW8 Strategy Fund LP - Class B O Canada 0.24 27.16 8 -1.89 0.00 10.79 8<br />

DUNNs Insurance Fund LLC O US 19.07 23.52 9 19.40 -37.69 0.00 29.31 7<br />

Sigma Asia Equity VA Fund O Hong Kong 24.53 20.88 10 6.21 -14.75 0.00 17.85 6<br />

Fairtree Wild Fig Institutional Fund O S Africa 4.88 19.61 11 -4.75 -3.25 11.71 8<br />

FrontFour Capital Partners LP O US -8.85 18.00 12 11.67 -43.31 -9.87 12.57 8<br />

KIS Global Multi-Strategy Fund O Australia 7.77 17.91 13 -2.69 0.00 7.18 10<br />

Heartstrings Fund - Class A USD O Cayman -4.64 17.39 14 -47.76 -7.15 99.38 6<br />

Velocity American Energy Master I LP O US 6.33 16.89 15 15.66 -6.18 0.00 8.52 9<br />

HedgEnergy Partners LP O US -5.93 16.84 16 1.51 -52.43-12.71 15.88 8<br />

CSHG Verde FIC de FIM C Brazil 2.47 16.11 17 20.82 -20.56 0.00 4.79 10<br />

BNY Mellon ARX Extra FIM C Brazil 4.50 15.91 18 16.08 -14.41 0.00 1.88 12<br />

Bresser <strong>Hedge</strong> Plus FI Multimercado O Brazil 3.84 14.66 19 15.82 -4.35 0.00 4.92 9<br />

Chinook Fund LLC O US 5.15 14.55 20 20.16 -23.96-11.05 27.01 6<br />

The Kawa Fund Limited O US -0.05 13.75 21 21.93 -2.20 -0.25 2.92 11<br />

Theoria Multi-Strategy Fund - JPY C Singapore -1.26 13.40 22 -3.83 -2.02 7.93 9<br />

Fator <strong>Hedge</strong> Absoluto FIM O Brazil 6.34 13.08 23 12.15 -2.96 0.00 3.30 11<br />

Brait Multi Strategy Fund O S Africa 5.17 13.05 24 21.60 -11.92 -2.18 8.87 8<br />

JGP Max FIM O Brazil 3.67 12.89 25 14.05 -1.61 0.00 0.97 12<br />

Sector average -3.47 1.52 335♠ 9.17 -19.20-10.1710.37 6.79<br />

Relative value<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

SPM Core C US 2.90 27.36 1 -0.71 -0.45 6.51 10<br />

WAF Master Fund LP O US 0.47 25.92 2 36.11 -4.79 -1.50 5.04 11<br />

Cassiopeia Fund - Class A CHF O Switzerland 1.47 24.62 3 12.50 -14.50 0.00 10.42 9<br />

Regal Amazon Market Neutral Fund O Australia 0.93 20.17 4 21.85 -20.21 -3.32 8.27 10<br />

Catalysis Partners LLC O US -10.61 19.46 5 19.07 -23.20-10.61 18.28 7<br />

Pine River Fixed Income Fund Ltd O US -0.06 17.32 6 46.43 -1.97 -1.97 5.96 9<br />

Gamma Traders - I LLC O US -8.12 10.90 7 25.07 -28.65 -8.12 45.64 6<br />

Raven Rock Master Fund - Cayman LP O US -3.45 10.83 8 -4.39 -4.39 6.08 9<br />

Element Capital Fund O US -0.19 10.39 9 41.47 -7.83 -0.19 8.62 7<br />

The Somers Real Estate Opportunity Fund Ltd O Bermuda 2.24 9.41 10 11.38 0.00 0.00 0.12 12<br />

Parallax Fund LP O US 2.93 7.91 11 8.84 -11.85 0.00 8.07 8<br />

Empiric Market Neutral Fund LP O US -7.09 7.74 12 20.92 -9.58 -9.58 9.12 8<br />

Trafalgar Recovery Fund - EUR O UK -2.00 6.90 13 12.05 -31.37 -2.95 4.14 9<br />

Alpha Strategies Fund - Class A O Switzerland 1.66 6.64 14 2.53 -9.13 0.00 3.43 9<br />

Sanctum Fixed Income Fund - USD O UK 2.49 6.63 15 9.02 -23.62 0.00 2.20 9<br />

Richland Asia Absolute Return Fund O Hong Kong 1.24 6.51 16 9.02 -2.78 0.00 2.70 9<br />

Leviticus Partners LP O US -16.85 6.42 17 19.29 -56.02-16.85 16.99 8<br />

PIMCO Global Credit Opportunity Fund O US 0.33 6.40 18 8.92 -12.84 0.00 3.85 9<br />

Capula Global Rel Value Fund Share Cl A - USD C UK 3.45 6.01 19 10.07 -7.41 0.00 2.26 10<br />

Brummer & Partners Nektar <strong>Hedge</strong> Fund O Sweden 1.11 5.95 20 17.20 -12.96 -0.13 3.45 7<br />

Rhapsody Fund LP O US -0.35 5.89 21 18.73 -20.19 -0.88 2.77 9<br />

BlueCrest Capital International Fund O UK 1.51 5.67 22 19.39 -4.83 0.00 2.47 8<br />

Arpeggio Fund O US -0.43 5.64 23 12.50 -36.78 -0.95 2.79 9<br />

CCA Mortgage/Credit Opportunity Fund O US -14.13 5.15 24 16.68 -16.84-16.84 15.71 7<br />

San Diego Foreclosure Fund LLC O US 0.10 4.38 25 -0.58 -0.01 3.29 7<br />

Sector average -3.16 4.07 111♠ 9.79 -17.01 -6.46 7.78 7.41<br />

<strong>Hedge</strong> <strong>Funds</strong> <strong>Review</strong> November 2011 www.hedgefundsreview.com

event driven slide<br />

The Eurekahedge Event Driven <strong>Hedge</strong> Fund Index registered<br />

losses for the fifth month in succession, dropping almost 3% in<br />

August. Merger funds struggled as deal volume continued to fall,<br />

especially in Europe. The Eurekahedge Event Driven <strong>Hedge</strong> Fund<br />

Index is down 6.76% year to date.<br />

Fixed income hedge funds recorded average losses of 1.86%<br />

on average in September. US focused fixed income strategies<br />

benefited from a rally in Treasuries as yield continued to fall,<br />

losing less than 1% for the month. Asian and Latin American fixed<br />

income managers found the environment tougher, losing 4% and<br />

5.5% respectively.<br />

eurekahedge fIxed Income hfI vs eurekahedge evenT<br />

drIven hfI vs eurekahedge em hfI<br />

600<br />

500<br />

400<br />

300<br />

200<br />

Eurekahedge Emerging Markets <strong>Hedge</strong> Fund Index<br />

Eurekahedge Event Driven <strong>Hedge</strong> Fund Index<br />

Eurekahedge Fixed Income <strong>Hedge</strong> Fund Index<br />

100<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

*Based on information on 4,927 funds constituting 80.85% of funds which have reported September 2011 returns<br />

as at October 24, 2011. Source: Eurekahedge<br />

dIsclaImer<br />

Intellectual property and copyrights in the data provided, in whole or in part, shall be<br />

held either by Eurekahedge or be subject to Eurekahedge’s control or delegated authority<br />

to administer and provide. Any data forming part of the contents here may not be<br />

disseminated, recompiled, resold, copied or otherwise stored in any electronic system,<br />

fax, photocopy, server, hard-disk, hard-copy paper format or website without receiving<br />

the express written approval of Eurekahedge. Extracts may be made for the purposes of<br />

research or comment, or form part of an article so long as the source is acknowledged.<br />

Investment in the funds may be subject to marketing and investment regulations relating<br />

to qualified and/or accredited investors. Users should be aware of the restrictions relating<br />

to dissemination of data in whole or as part of other marketing activities within your<br />

jurisdiction and comply with applicable law.Your permitted use of the data shall be on the<br />

basis that you shall not look to Eurekahedge for loss or liability relating to your use of the<br />

data whether with reference to intellectual property, accuracy or any reason whatsoever.<br />

The data is provided on the basis of a matter of record only and are provided for information<br />

purposes only. The data does not, and should not be construed to, constitute an offer to sell<br />

or a solicitation of an offer to buy any of the shares, or other interest, in any fund or form<br />

the basis of any contract or commitment whatsoever, nor should it be treated as financial,<br />

professional or expert advice. Past performance is not indicative of future performance. The<br />

data is based on information and data received from the subjects of each and from other<br />

third-party sources and no guarantee of completeness or accuracy can be made, nor is any<br />

representation or warranty made in this regard. Eurekahedge will not be responsible for any<br />

liability resulting from loss pertaining to the use of the data.<br />

All tables’ hedge fund performance statistics are for period ending September 30, 2011 (data<br />

reported to October 24, 2011). All statistics at a glance are for period ending September 30,<br />

2011(data reported to October 24, 2011). All 36-month performance is annualised.* Please note<br />

the data in the Eurekahedge graphs and for the tables thereafter are based on 80.85% of the<br />

NAV returns for September 2011, as at October 24, 2011. The positive- and negative-months<br />

columns show the number of gaining and losing months in the previous 12. Some fund names<br />

have been abbreviated for reasons of space, for example ‘Ltd’ or ‘LLP’ being removed from end<br />

of a fund’s name. Similarly Dighton World Wide Fund (in CTA strategy) has 2X and 2X leveraged<br />

programs – please check with manager for full name/details of fund. The symbol ♠ represents<br />

the total number of funds (in each strategy) that report their performance data to Eurekahedge.<br />

To submit your fund’s or funds’ data, contact Arlyn Soriano at arlyn@eurekahedge.com<br />

2011<br />

Event driven<br />

Fixed income<br />

43<br />

StatiSticS<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

Marwyn Value Investors LP O UK 9.14 68.45 1 32.84 -48.48 0.00 27.79 8<br />

Hinde Gold Fund Class USD B Lead (Income) O UK 8.15 41.18 2 30.32 -41.66 -9.32 22.79 9<br />

Sinfonietta O Singapore 17.72 31.76 3 16.55 -13.64 0.00 17.48 8<br />

The SFP Value Realization Fund Ltd USD O Singapore -3.03 27.47 4 -6.21 -55.46-39.24 27.72 6<br />

Passport Special Opportunities Fund LP O US -16.44 26.44 5 17.35 -43.24-21.14 29.34 8<br />

RenFin Fund C UK 10.97 25.46 6 -4.40 -40.68-21.98 17.02 5<br />

Instinct Japan Opportunity Fund O Australia 3.24 18.34 7 -2.13 0.00 4.09 11<br />

Azzy Fund C Singapore 0.36 13.26 8 -1.89 -0.14 4.99 10<br />

Simplex Value Up Trust - USD Unhedged O Japan 0.48 12.35 9 13.89 -19.14 -2.40 10.90 5<br />

Credit Renaissance Structured Products Fund O US -4.59 10.59 10 8.96 -17.49 -4.64 6.37 8<br />

LIM Asia Special Situations Fund - Class A O Hong Kong -2.80 9.79 11 7.53 -11.90 -3.73 6.03 8<br />

Marathon EM Opportunity Fund O US -0.10 9.43 12 -1.51 -1.51 2.85 10<br />

Twin Securities LP O US 2.00 7.18 13 9.48 -36.71 0.00 6.31 8<br />

Pengana Asia Special Events (Offshore) Fund - AUD O Singapore 0.02 6.98 14 13.55 -2.39 -1.60 2.80 9<br />

Rosseau LP O Canada -10.34 6.52 15 20.18 -49.80-17.37 23.71 6<br />

Kayne Anderson MLP Fund LP O US -5.95 6.03 16 16.58 -52.94 -7.49 8.75 7<br />

Overhill Liquid Arbitrage Fund LP O US -0.05 6.00 17 -1.71 -1.23 2.75 9<br />

Forum Absolute Return Fund Ltd O US 1.69 5.73 18 13.12 -13.38 -0.49 4.22 6<br />

Cedarview Opportunities I LP O US -4.61 5.64 19 12.25 -58.51 -4.61 5.24 9<br />

Galbraith Global Strategies Fund LP O US 1.89 5.12 20 3.14 -6.13 -3.22 8.36 7<br />

Litespeed Partners LP - Series A O US -9.21 4.89 21 9.88 -28.83-11.82 10.53 8<br />

Coriolis CaTpricorn Fund O UK 1.42 3.95 22 5.15 -6.26 0.00 2.99 9<br />

Laffitte Risk Arbitrage UCITS Fund O France 1.54 3.82 23 4.63 -2.29 0.00 1.58 8<br />

Helium Special Situations Fund - GBP O Switzerland -8.29 3.03 24 29.17 -58.87 -8.29 9.43 7<br />

The Lion Fund Ltd - USD O Bahamas -0.41 2.74 25 4.34 -34.09 -8.91 2.35 6<br />

Sector average -7.12 -0.70 167♠ 7.49 -23.82-12.6810.33 6.22<br />

Max % Pos<br />

Open/<br />

% 3 %12 % 36 draw high % 12 mth<br />

Closed HQ mth mth Rk mth down water mth (12)<br />

PvB (CH) Asset-Backed Securities Fund - A O Switzerland-14.73 53.97 1 40.78 -81.01-17.22 26.52 9<br />

Toro Capital I A - EUR C UK -2.71 40.09 2 -3.80 -3.68 10.59 11<br />

Midway Market Neutral Fund LLC O US -2.77 36.95 3 42.32 -24.94 -4.69 9.71 10<br />

Global Credit Opportunities Strategy O US 1.84 35.92 4 -0.38 -0.38 9.96 10<br />

STS Partners Fund LP O US 5.03 29.44 5 34.15 -1.50 0.00 2.56 12<br />

Capital Four Credit Opportunities Fund - Class A O Denmark -3.32 26.67 6 -4.69 -4.69 9.71 9<br />

Providence MBS Offshore Fund Ltd O US 0.19 22.63 7 42.12 -9.19 0.00 9.92 11<br />

Cranwood Fixed Income Arbitrage Fund LP O US 6.26 20.86 8 7.85 -9.63 0.00 7.17 10<br />

BlackHawk Credit Fund LP O US 25.43 17.06 9 -17.78 0.00 20.35 7<br />

Luxembourg Life Fund O Luxembourg 5.01 17.06 10 -0.47 0.00 4.28 11<br />

Beachwood Total Return Fund O US -3.98 16.39 11 -5.15 -5.15 7.04 10<br />

Oracle Invest Fd SPC - Oracle Struc Cr Seg Prtflio 1 C Hong Kong -0.67 16.19 12 -4.01 -4.01 7.42 9<br />

Definitive Guardian Partners LP O US 1.08 13.89 13 -2.31 0.00 6.72 9<br />

DKAM Capital Ideas Fund LP O Canada -8.95 13.79 14 28.87 -11.98-11.98 13.85 9<br />

Rosemawr Municipal Partners Fund LP O US 2.02 12.84 15 -0.62 0.00 3.37 11<br />

Concise Capital Offshore Fund SPC O US -3.15 12.28 16 -4.29 -4.29 6.33 10<br />

Maxima Plus O Brazil 3.20 12.06 17 10.82 0.00 0.00 0.34 12<br />

Lynx Fund I (Master Fund) Ltd O US -2.13 12.01 18 17.51 -3.05 -2.76 4.43 10<br />

CSHG DI Private O Brazil 2.93 11.13 19 10.31 0.00 0.00 0.28 12<br />

BNY Mellon ARX Referenciado DI LP O Brazil 2.89 10.96 20 10.12 0.00 0.00 0.27 12<br />

FH Emerging Markets Debt Fund O US 1.24 10.93 21 -9.38 -52.59-37.88 4.96 9<br />

Fairtree Fixed Income Fund O S Africa 4.48 10.59 22 0.00 0.00 2.30 12<br />

Goldstein Capital Managed Bond Portfolio LP O US 1.56 9.58 23 17.53 -22.24 0.00 1.14 12<br />

AlphaBridge Fixed Income Fund Ltd O US 0.15 9.55 24 9.68 -0.83 0.00 2.13 11<br />

Traded Policies Fund - USD Institutional O UK 2.12 9.51 25 9.36 -1.59 0.00 0.12 12<br />

Sector average -2.15 1.58 318♠ 6.91 -11.85 -6.09 5.81 6.54<br />

www.hedgefundsreview.com <strong>Hedge</strong> <strong>Funds</strong> <strong>Review</strong> November 2011