Strategic Financial Management

Strategic Financial Management

Strategic Financial Management

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

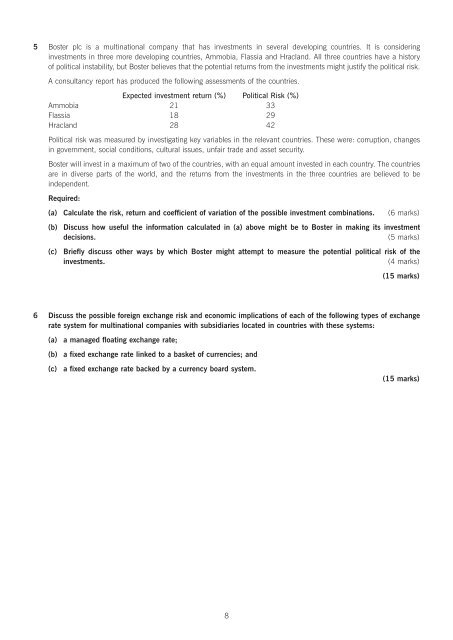

5 Boster plc is a multinational company that has investments in several developing countries. It is considering<br />

investments in three more developing countries, Ammobia, Flassia and Hracland. All three countries have a history<br />

of political instability, but Boster believes that the potential returns from the investments might justify the political risk.<br />

A consultancy report has produced the following assessments of the countries.<br />

Expected investment return (%) Political Risk (%)<br />

Ammobia 21 33<br />

Flassia 18 29<br />

Hracland 28 42<br />

Political risk was measured by investigating key variables in the relevant countries. These were: corruption, changes<br />

in government, social conditions, cultural issues, unfair trade and asset security.<br />

Boster will invest in a maximum of two of the countries, with an equal amount invested in each country. The countries<br />

are in diverse parts of the world, and the returns from the investments in the three countries are believed to be<br />

independent.<br />

Required:<br />

(a) Calculate the risk, return and coefficient of variation of the possible investment combinations. (6 marks)<br />

(b) Discuss how useful the information calculated in (a) above might be to Boster in making its investment<br />

decisions. (5 marks)<br />

(c) Briefly discuss other ways by which Boster might attempt to measure the potential political risk of the<br />

investments. (4 marks)<br />

(15 marks)<br />

6 Discuss the possible foreign exchange risk and economic implications of each of the following types of exchange<br />

rate system for multinational companies with subsidiaries located in countries with these systems:<br />

(a) a managed floating exchange rate;<br />

(b) a fixed exchange rate linked to a basket of currencies; and<br />

(c) a fixed exchange rate backed by a currency board system.<br />

8<br />

(15 marks)