African Fine Coffees Review Special Edition Oct-Dec - EAFCA

African Fine Coffees Review Special Edition Oct-Dec - EAFCA

African Fine Coffees Review Special Edition Oct-Dec - EAFCA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Sleeping Giant<br />

Awakes<br />

<strong>Oct</strong> - Nov 2012<br />

Volume 2 Issue 2<br />

1

THE<br />

BREWING POT<br />

The Coffee Corner<br />

THE BREWING POT<br />

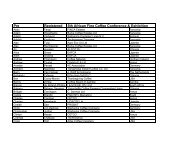

1. AFCA News – A round up of AFCA<br />

Activities in the Region<br />

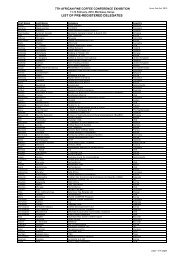

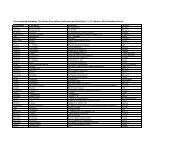

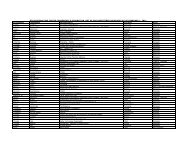

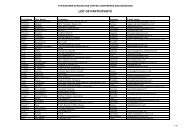

The 10th <strong>African</strong> <strong>Fine</strong> Conference and Exhibition<br />

Launched in Style<br />

AFCA Presents the <strong>African</strong> Coffee Outlook at the ICO<br />

Council Meeting<br />

JETRO and AFCA partner for 4th Coffee Trade<br />

Delegation Trip<br />

AFCA presents on Certification at ICO Seminar<br />

Coffee Breakfasts Held in Malawi and Zambia<br />

2. Coffee News – Quick round up around the<br />

Continent and World<br />

4C Association appoints new Chairman<br />

85,000 smallholder coffee farmers in Tanzania to<br />

benefit from the Bill & Melinda Gates Foundation<br />

Kenyan Coffee Producers Learn to Plan<br />

Kilimanjaro Coffee Farmers Get Health Insurance<br />

Cover<br />

Cameroon Stakeholders Crusade for Better Coffee<br />

Quality<br />

A Celebration of Coffee at the 3rd Uganda Coffee<br />

7<br />

9<br />

11<br />

12<br />

12<br />

14<br />

14<br />

14<br />

16<br />

16<br />

16<br />

17<br />

17<br />

5<br />

South Africa’s top coffee champions were<br />

crowned.<br />

VISA and Travel Information for 10th AFCC & E<br />

Delegates<br />

<strong>Special</strong> Reports<br />

Uganda Quality Coffee Traders Moves To Act.<br />

Meeting Uganda’s Three time National Champion<br />

and the 3rd <strong>African</strong> Barista Challenge Champion<br />

The Sleeping Giant Awakes<br />

A Ripple in the Ocean of Coffee Growing…<br />

Around the Region<br />

Know your Blogs<br />

Know your Uganda Coffee Map<br />

Sustainable Coffee Areas in Uganda<br />

Around the region<br />

Mitigation of Impact on Coffee Production<br />

3<br />

19<br />

20<br />

22<br />

22<br />

23<br />

26<br />

29<br />

34<br />

37<br />

38<br />

39<br />

43

4<br />

Editorial Team<br />

Editors<br />

Samuel Kamau<br />

Maraka Martin<br />

Associate Editors<br />

Filtone Sandando<br />

Wycliffe Murwayi<br />

Advisory Board<br />

Harrison Kalua<br />

Lionel H.E. de Roland Phillips<br />

Ben Sitati<br />

Contributors<br />

Robin Saunders<br />

Micheal Nuwagaba<br />

Martin Maraka<br />

Filtone Sandando<br />

Wycliffe Murwayi<br />

Publisher<br />

<strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong> Association<br />

from the<br />

www.coffeeboard.or.tz

THE<br />

COFFEE CORNER<br />

We would like to start by thanking all our members and strategic partners<br />

as we close the 2011/2012 financial year. AFCA has come a long way<br />

during this period as key regional brand and as a financially sustainable<br />

organization something we hope to continue to do over the coming years.<br />

During this period AFCA, made significantly steps in representing Africa at<br />

various international forums such as ICO and 4C, strengthened regional capacity<br />

through the CFC project, chapter networking through breakfasts and marketed<br />

<strong>African</strong> coffees at various platforms both physically and digitally through the<br />

new Taste of Harvest Portal.<br />

AFCA is now preparing to roll out several high level trainings through the AFCA<br />

Coffee Institute and strengthen its regional voice and impact. We also thank<br />

key partners in the preparation for the 10th <strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong> Conference<br />

and Exhibition in Kampala, Uganda. We welcome you all to Uganda for another<br />

memorable conference.<br />

The <strong>Oct</strong>ober – <strong>Dec</strong>ember 2012 issue will also feature as our Annual Magazine<br />

that will be released in print form at the 10th <strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong> Conference and<br />

Exhibition in Kampala Uganda.<br />

The Sleeping Giant Awakes, our feature article, seeks to explore the awakening<br />

of the Ugandan coffee industry over the last 5 to 10 years. This insightful article<br />

provides a rare insight into what led to the industry comeback.<br />

A ripple in the ocean of coffee growing provides a brief on the history of coffee<br />

in Malawi from inception to independence while our Champions of Africa<br />

blog provides an exclusive interview with Robert Mbabazi, Uganda’s three-time<br />

national barista champion and Africa’s 2012 Barista Challenge Champion<br />

Mitigation of Climate Change raises a case for climate change while Uganda<br />

Quality Coffee Processors and Traders Association move to act looks at the<br />

efforts of Ugandan traders to make significant steps to enhance quality along<br />

the value chain.<br />

Our special report from the AFCA Coffee Institute, Around the Region provides<br />

an outlook from the AFCA Coffee Institute on the <strong>African</strong> Coffee Market.<br />

Enjoy!<br />

Mr. Harrison Kalua<br />

Chairman Board of Directors, AFCA<br />

5

6<br />

Guest of Honour – Minister of Agriculture, Animal Industry and Fisheries, Hon. Tress Bucyanayandi<br />

(Centre), joins Mr Harrison Kalua (AFCA Board Chairman, left) and Mr. Hannington Karuhanga<br />

(Host Country Chair, right) to cut a Mocha Styled cake officially launching the 10th AFCC & E.

AFCA NEWS<br />

In an event that had all the hallmarks of the 2012 London<br />

Olympics Opening Ceremony, the 10th <strong>African</strong> <strong>Fine</strong><br />

Conference and Exhibition was officially launched at<br />

the Kampala Serena Hotel on the 6th September 2012. The<br />

conference and exhibition will be held from the 14th to the<br />

16th February 2013 in Kampala Uganda at the Munyonyo<br />

Commonwealth Resort under the theme, “Uganda,<br />

Discover a Diversity of <strong>Coffees</strong>, from the Pearl of Africa.”<br />

The stakeholder and media event drew over 100 guests<br />

from the Uganda’s top coffee stakeholders and leading<br />

media houses. Guests were also able to view finished<br />

coffee samples, coffee seedlings, processing and brewing<br />

equipment. Guests were further treated to a documentary<br />

on the 9th AFCC & E that was held in Addis Ababa,<br />

Ethiopia with interviews from showgoer on the benefits of<br />

the conference.<br />

The stakeholder and media event drew over 100 guests<br />

from the Uganda’s top coffee stakeholders and leading<br />

media houses. Guests were also able to view finished<br />

coffee samples, coffee seedlings, processing and brewing<br />

equipment. Guests were further treated to a documentary<br />

on the 9th AFCC & E that was held in Addis Ababa,<br />

Ethiopia with interviews from showgoers on the benefits<br />

of the conference.<br />

The 10th <strong>African</strong> <strong>Fine</strong> Conference<br />

and Exhibition Launched in Style<br />

The Guest of Honour, Minister of Agriculture,<br />

Animal Industry and Fisheries, Hon. Tress<br />

Bucyanayandi joined the Ugandan Coffee<br />

fraternity in welcoming the coffee world<br />

to Uganda. He further emphasised the<br />

government’s commitment to coffee research<br />

and production as it increasingly continues to<br />

act as the leading source of household income<br />

for families in Uganda.<br />

The AFCA Board Chair, stressed the importance<br />

of the 10th AFCC & E as a unique business<br />

opportunity for Ugandan stakeholders to sell<br />

their coffee on the spot, gathering valuable<br />

coffee information and build trade relations.<br />

The stakeholder and media event drew over<br />

100 guests offee stakeholders and leading<br />

media houses. Guests were also able to view<br />

finished coffee samples, coffee seedlings,<br />

processing and brewing equipment. Guests<br />

were further treated to a documentary<br />

on the 9th AFCC & E that was held in<br />

Addis Ababa, Ethiopia with interviews<br />

from showgoers on the benefits of the<br />

conference.<br />

7

AFCA<br />

Presents the<br />

<strong>African</strong> Coffee<br />

Outlook at the<br />

ICO Council<br />

Meeting<br />

On the 27th September 2012, the AFCA Board Chairman, Mr<br />

Harrison Kalua spoke at the 109th ICO Council on the strategy of<br />

AFCA and the coffee outlook in Africa. The speech was well received<br />

by ICO council delegates and other stakeholders in attendance.<br />

This is the first time that AFCA has presented the <strong>African</strong> Coffee Outlook<br />

the ICO.<br />

The AFCA chairman further called for engagement with <strong>African</strong><br />

Governments to pay more attention to the Coffee Sector.<br />

A separate presentation on the 10th AFCC&E was made to the ICO Council<br />

by the AFCA CEO Mr Samuel Kamau. The presentation focused on inviting<br />

the ICO council members and delegates to the 10th <strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong><br />

Conference and Exhibition to be held in Kampala, Uganda from 14th to<br />

16th February, 2013.<br />

We congratulate the team on this expedition to strengthen AFCA’s position<br />

on the international front as key resource on information and policy change.<br />

9

10<br />

SCAJ Conference Delegates<br />

stream in at the AFCA -<br />

JETRO Booth to learn more<br />

about Africa’s <strong>Fine</strong>st <strong>Coffees</strong>

JETRO and AFCA partner for 4th Coffee<br />

Trade Delegation Trip<br />

The fourth mission from AFCA to SCAJ Japan<br />

was successful arranged with the sponsorship<br />

of Japan External Trade Organization<br />

(JETRO). The main objectives of the trip<br />

were to promote fine quality <strong>African</strong> coffees<br />

into Japan, find business opportunities in<br />

the Japanese market, learn ways to create<br />

additional value of <strong>African</strong> coffees and<br />

disseminate the participants’ findings through<br />

AFCA network.<br />

The AFCA Team included Mr. Bernard<br />

Sitati Kenya Chapter Chairman, Mr. John<br />

Rebero AFCA Rwanda Chapter Chairman,<br />

Mr. Abdullah Bagersh Ethiopia Chapter<br />

Chairman and Wycliffe Murwayi AFCA<br />

Coffee <strong>Special</strong>ist.<br />

During the trip AFCA was able to secure<br />

meetings with top japanese industry coffee<br />

buyers like Mitsubishi Corporation, Doutor<br />

coffee, Mi Cafeto, Ishimitsu and Co. ltd,<br />

Tulleys coffee, Key Coffee, Horiguchi Coffee<br />

and UCC among others.<br />

AFCA also held several presentations and<br />

seminars on <strong>African</strong> <strong>Coffees</strong> to Tokyo<br />

University on Certification in Africa, <strong>African</strong><br />

coffee cupping seminar – attended by selected top<br />

cuppers in Japan where they cupped certified and Taste<br />

of Harvest <strong>Coffees</strong> and Sustainable coffee showcase<br />

that allowed delegates to test their cupping skills on 24<br />

specialty coffees form AFCA.<br />

Key issues to do with challenges to <strong>African</strong> <strong>Coffees</strong><br />

were discussed with key areas for improvement raised<br />

along the lines of improved <strong>African</strong> coffee branding,<br />

Japan consumers are still in favour of quality, reduction<br />

of cost through direct relationships with producers and<br />

traceability.<br />

The mission remained very successful and created<br />

the desired impacts and needs to be enhanced. This is<br />

evidenced by the success of Malawi coffee following<br />

last year’s mission. During the tour the AFCA Team<br />

were shown a shop that sold Malawi Coffee as single<br />

origin. There was even an enquiry and request for more<br />

sample of Malawi which AFCA hopes will result into<br />

business.<br />

Key issues to do with challenges to <strong>African</strong><br />

<strong>Coffees</strong> were discussed with key areas<br />

for improvement raised along the lines<br />

of improved <strong>African</strong> coffee branding,<br />

Japan consumers are still in favour<br />

of quality, reduction of cost through<br />

direct relationships with producers and<br />

traceability.<br />

11

12<br />

AFCA presents on Certification<br />

at ICO Seminar<br />

The ICO seminar on certification was held on 25 September 2012<br />

at the ICO council chamber. The theme of the seminar was<br />

the Economic, Social and Environmental Impact of Certification<br />

on the Coffee Supply Chain. With support from the CFC/ICO/EU<br />

Project (CFC/IC/45), AFCA was invited to make a presentation on<br />

the activities of project on building capacity in coffee certification<br />

and verification in AFCA countries.<br />

The title of the presentation was Activities of the CFC/ICO Project<br />

on building capacity in coffee certification and verification for<br />

specialty coffee farmers in AFCA countries, and lessons learnt<br />

about certification and verification in Africa. The seminar was<br />

held by espousing issues in two panels. The first panels discussed<br />

the perspectives of certification bodies and the demand side of the<br />

coffee value chain. The second panel focused on the perspectives<br />

and experiences of the coffee producers. The output from the<br />

seminar discussions was that sustainability of the coffee value chain<br />

was important for both producers (supply chain) and consumers<br />

(demand side). And that, certification should be viewed as an<br />

integral part of the sustainability of the value chain. However, it<br />

was noted that there were significant challenges that required to be<br />

addressed on certification for it to be sustainable.<br />

Presentation was made by Mr Filtone C. Sandando, AFCA Project<br />

Manager for the CFC/ICO/EU Project (CFC/IC/45)<br />

Coffee Breakfasts Held in<br />

Malawi and Zambia<br />

In August 2012, the <strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong><br />

Association held coffee breakfasts in Malawi and<br />

Zambia under the theme “AFCA: Discussing<br />

Great Opportunities over a Cup of Coffee.”. Both<br />

breakfasts attracted various key stakeholders from<br />

the chapter countries.<br />

The Zambian breakfast was held at the<br />

Intercontinental Hotel in Lusaka on the 29th<br />

August 2012 while the Malawi breakfast was held<br />

at the Casa Mia Hotel in Blantyre on the 31st of<br />

August 2012.<br />

The Chapter Chairmen of Zambia and Malawi<br />

both thanked members for attending while the<br />

Chief Executive Officer, Mr Kamau Samuel shared<br />

with members the AFCA Strategy.<br />

AFCA delegation also visited the famous Munali<br />

Estates in Zambia.

PROJECT ON BUILDING CAPACITY<br />

IN COFFEE CERTIFICATION AND<br />

VERIFICATION FOR SPECIALTY<br />

COFFEE FARMERS IN THE EASTERN<br />

AFRICA REGION<br />

Project funded by the:<br />

• EUROPEAN UNION<br />

• COMMON FUND FOR COMMODITIES<br />

• INTERNATIONAL COFFEE ORGANISATION<br />

13

14<br />

The<br />

Coffee News<br />

Mr. Robert Waggwa Nsibirwa (Pictured Right)<br />

has been appointed the first <strong>African</strong> Board<br />

Chairman of the 4C Council during the 3rd<br />

General Assembly which was held in Geneva, Switzerland<br />

on 26th – 27th September 2012 under the motto “Takeoff<br />

for Delivery”. The meeting saw 70 members meet in<br />

Geneva to set the future direction of the 4C Association<br />

and outline the plan to deliver increasing volumes of<br />

sustainably produce coffee.<br />

The 4C Association has experienced tremendous growth<br />

in membership since its last General Assembly – from<br />

fewer than 140 members three years ago to 221 members<br />

to date. Today, the majority of the coffee industry’s<br />

key players, from producers to traders, roasters and<br />

civil society actors are represented in this unique and<br />

flourishing roundtable effort.<br />

“With the new business model in place, the new governance<br />

structure and the newly-elected Council we are now in<br />

an excellent position to define a Three-year Plan that will<br />

ensure the Association is taking- off for delivery,” said<br />

Robert Waggwa Nsibirwa, the newly elected Chairman of<br />

85,000 smallholder<br />

coffee farmers<br />

in Tanzania to<br />

benefit from the<br />

Bill & Melinda Gates<br />

Foundation<br />

4C Association appoints<br />

new Chairman<br />

the 4C Council “The 3rd General Assembly was a unique<br />

event in the sense that it provided the opportunity for<br />

many members to meet other members in person for the<br />

first time, exchange ideas and make important decisions<br />

that will shape the future work of the 4C Association,” he<br />

added.<br />

Mr. Robert Nsibirwa is also currently the AFCA Chapter<br />

Chairman for Uganda and CEO of the Africa Coffee<br />

Academy. We wish him all the best.<br />

The German development finance institution DEG –<br />

Deutsche Investitions- und Entwicklungsgesellschaft mbH<br />

– has announced the launch of the Coffee Partnership<br />

for Tanzania (CPT), a partnership bringing together Tanzanian<br />

smallholder coffee farmers, DEG plus its private sector partners.<br />

The four-year project aims to increase the net income of 85,000<br />

female and male smallholder coffee farmers in Tanzania, largely<br />

by doubling their yields and by improving the quality of produced<br />

coffee, thereby providing a better livelihood for up to 510,000<br />

Tanzanian .<br />

The Bill & Melinda Gates Foundation will support the project with<br />

a grant of US$ 8 million. Alongside, three major implementing<br />

partners – the two coffee traders Armajaro Trading Ltd. and Ecom<br />

Agroindustrial Ltd. plus the private foundation Hanns R. Neumann<br />

Stiftung – will co-finance the project with large investments into<br />

the sector, increasing the significance of the overall project budget<br />

substantially. Furthermore, strategic partners such as Hivos,<br />

Solidaridad and Café Africa will support the partnership.

The Coffee Partnership for Tanzania (CPT) will substantially<br />

support 85,000 Tanzanian smallholder farmers from 2012 –<br />

2016. “The partnership’s goal is to enable female and male<br />

farmers to take full advantage of the opportunities arising<br />

from the production of coffee and additional products,<br />

helping producers to increase their incomes and improve<br />

their livelihood”, says Ian Lachmund, DEG Project Director<br />

for the partnership. Supported by the Gates Foundation’s<br />

funding, the implementing partners undertake capacitybuilding<br />

measures to promote the empowerment of<br />

smallholder coffee producers within the global coffee value<br />

chain.<br />

The project activities include promotion of the organization<br />

of well-governed farmer groups, training of farmers in<br />

basic business and agronomy skills, improvement of<br />

farmers’ access to finance, and facilitation of producers’<br />

affiliation to certification schemes – thereby increasing the<br />

overall productivity and quality of the coffee production<br />

and meanwhile improving smallholders’ access to stable<br />

export markets. Additional activities in the areas of gender,<br />

seedling multiplication and distribution, renewable energy<br />

as well as livestock and food production further promote the<br />

environmental and social sustainability of the partnership.<br />

DEG manages the overall project based on its far-reaching<br />

experience in development<br />

cooperation with private<br />

partners in the agricultural<br />

sector worldwide and in Africa<br />

in particular. The German<br />

development finance institution<br />

will also coordinate the monitoring<br />

and evaluation process with<br />

external evaluations allowing for<br />

regular feedback from supported<br />

farmers throughout the project’s<br />

tenure. This will allow constant<br />

process and implementation<br />

improvement. Furthermore, results, lessons learnt and best<br />

practices will be shared with the wider stakeholder community.<br />

The mutual long-term interest of the implementing and<br />

strategic partners as well as the lasting effect of smallholder<br />

farmers’ capacity building will ensure a sustainable impact of<br />

the project.<br />

The intended increase of the coffee farmers’ net income will<br />

contribute to poverty reduction, improving the livelihood of up<br />

to 510,000 Tanzanian in rural areas.<br />

The Coffee Partnership for Tanzania is a good example<br />

of innovative partnerships between public, private and<br />

philanthropic partners facilitating and providing investment<br />

to empower smallholder farmers in Africa and throughout the<br />

developing world to overcome poverty and hunger.<br />

“The Bill & Melinda<br />

Gates Foundation puts<br />

smallholder farmers’<br />

interests at the center of<br />

their work”, says Dana<br />

Boggess, the foundation’s<br />

Program Officer. “We<br />

are glad to continue<br />

supporting Tanzanian<br />

producers over the next<br />

years in order to help them<br />

improve their productivity<br />

and the quality of the coffee<br />

they produce. We believe the partnership will contribute to<br />

the Tanzanian coffee industry’s growth, while increasing<br />

incomes throughout the coffee value chain, especially those<br />

of smallholder farmers.”<br />

Mohamed S. Muya, Permanent Secretary at the Ministry<br />

for Agriculture, Food Security and Cooperatives, agrees:<br />

“The partnership’s goals and its planned activities fully<br />

align with the Tanzanian coffee industry’s Development<br />

Strategy that we have formulated in the sector’s Task Force<br />

Committee. The partnership provides a great opportunity<br />

for smallholder farmers and is expected to help us increase<br />

the sector’s overall production volumes over the four year<br />

tenure.”<br />

15

16<br />

Kenyan<br />

Coffee<br />

Producers<br />

Learn to Plan<br />

OVER 10,000 households engaged in coffee production in<br />

Kilimanjaro Region have benefited from health insurance<br />

facilities introduced and coordinated by the Kilimanjaro<br />

Native Cooperative Society (KNCU).<br />

“By the end of this year, the number is expected to grow to 28,000<br />

family members who will be enjoying health insurance services,”<br />

remarked Mr Godfrey Massawe, KNCU Commercial Manager in<br />

an interview held in Moshi, Kilimanjaro Region last week.<br />

He added: “Our target is to serve 375,000 family members by the<br />

end of 2014.” KNCU is a co-operative union that produces and<br />

exports mild Arabica coffee of Bourborn and Kent variety from the<br />

region. It serves small producer members in four districts, namely<br />

Rombo, Moshi Rural, Hai and Siha.<br />

Mr Massawe said the department of Health Plan was established<br />

specifically to run the KNCU Health Plan project which is an<br />

insurance scheme launched in August 2010. The department<br />

prepares implements and evaluates the provision of health<br />

insurance to its members.<br />

‘Plan or die’ was the blunt but powerful take-home-message<br />

from the coffee workshop on sustainable agriculture. Consultant Charles<br />

Kabuga used the message to explain the importance of making plans for<br />

sustainable livelihoods to the participants. He was one of the speakers at<br />

the workshop which had 24 producers drawn from Kenya, Uganda and<br />

Tanzania. Key topics of discussion centered on the internal and external<br />

threads to agricultural cooperatives, their challenges in financing and how<br />

strategic planning will support their risk management.<br />

In second session climate change and opportunities of the carbon market<br />

for producers were discussed. External speakers were invited to give<br />

background and technical information to producers, and share their<br />

expertise and practical experiences. A practical overview about carbon<br />

credits was presented by James Gathage from Carbon Leaf. The producers<br />

learned about the opportunity the carbon market has to offer, especially<br />

for small-scale farmers.<br />

Source – Fairtrade Africa<br />

Kilimanjaro Coffee Farmers Get<br />

Health Insurance Cover<br />

Currently, the project covers 23 primary cooperative societies with<br />

a view to serve all members of KNCU with the insurance scheme<br />

by end of next year. The project operates in partnership with the<br />

Harm Access Foundation (PharmAccess), MicroEnsure, MEMS,<br />

EnviroCare, KCMC and ACORD.<br />

In the meantime, Mr Massawe said coffee production has in recent<br />

years dropped massively due to various reasons, forcing farmers to<br />

opt for other economic activities. Some of the problems emanate<br />

from the two major factors, namely climate change effect and the<br />

move by KNCU to stop supplying agricultural inputs to its farmers.<br />

The situation has forced coffee producers to procure inputs<br />

directly from their own pockets which is largely determined by<br />

the income level. “In actual sense, coffee is only profitable to those<br />

who apply correct management in production irrespective of price<br />

fluctuation,” he said.<br />

Source - Tanzania Daily News

Cameroon Stakeholders Crusade for<br />

Better Coffee Quality<br />

Stakeholders in the coffee sub sectors have been sensitizing<br />

small and medium-size producers on the importance to<br />

consolidating the quality of the produce so that it remains<br />

competitive in the world market. The campaign that falls under<br />

the fertilizer sub sector programme is placed under the auspices of<br />

the Ministry of Agriculture and Rural Development, and is being<br />

managed under a technical supervisory scheme, “The Support<br />

Project for the use of fertilizer in the Cocoa /Coffee Subsectors”<br />

(SPUF2C).<br />

The campaign that held from the September 23 - 28 was headed<br />

by Difo Gnilachi Robert, head of mission to the West Region<br />

and the campaign took the delegation to Menoua, Upper<br />

Nkam, Bamboutos and Noun Divisions where the cocoa/coffee<br />

farmers were drilled and sensitized on the activities and project<br />

intervention for fertilizer development integrated approach. Difo<br />

Gnilachi, who was accompanied in his sensitisation campaign by<br />

the Regional Delegate of Agriculture and Rural Development for<br />

West, Tazanou Martin, had as resource persons Mpoh Eboue and<br />

Tabandjou Gaston, all Agric-Engineers, specialists in the cocoa/<br />

coffee sub sectors.<br />

Addressing the farmers at the various stops, Mr. Difo said the<br />

project specifically intends to help coffee (and cocoa) producers<br />

A Celebration<br />

of Coffee at<br />

the 3rd Uganda<br />

Coffee Day<br />

master the use of fertilizers,<br />

increase their annual yields<br />

in these crops that are<br />

considered as the main<br />

stay of our economy. He<br />

said after a careful study by<br />

government and its partners<br />

they agreed to invest in<br />

the sub sector through<br />

what he described as<br />

“Sustainable intensification<br />

of Cocoa /coffee sector” in<br />

Cameroon. He further said<br />

that the sector will support<br />

producer’s organisations of<br />

2nd and 3rd levels (Union of CIGs, federations, cooperatives and<br />

confederations) through the supply of fertilizers, adding that in<br />

the months ahead Menoua, Noun, Bamboutos and Upper Nkam<br />

Divisions where Robusta and Arabica coffee are grown, will be<br />

used as experimental and pilot fields for fertilizer. Lively debates<br />

between farmers and officials of SPUF2C ended each meeting.<br />

Source - Cameroon Tribune<br />

As Uganda prepared to celebrate 50 years of independence, the coffee fraternity<br />

came together to celebrate the 3rd Uganda Coffee Day on Thursday 4th <strong>Oct</strong>ober<br />

2012 at the Coffee Research Centre, Kituuza, Mukono District under the theme “<br />

Uganda @50 Years: Milestones of the Century and Strategies for the Future.”<br />

The event drew over 200 people from Uganda’s coffee fraternity to the famous research<br />

station. Key speeches came from the Host Dr. Emily Twinamasiko – Director General<br />

– NARO, Robert Waggwa Nsibirwa – CEO, Africa Coffee Academy, Mr. Hannington<br />

Karuhanga; Savannah Commodities - Board Member UCF and UCDA, Mr John Schulter:<br />

Café Africa and Francis Chesang, UCDA.<br />

Exhibitors from Brazafric, AFCA, UCDA, NARO and NUCAFE also came to show their<br />

support of the industry as well as conduct business.<br />

Guests were a treated to a live performance of beautiful traditional dances as a celebration<br />

of coffee and culture.<br />

The key message from all the presentations was that the importance of coffee to the<br />

economy of Uganda could not be underestimated and it’s therefore important for Uganda<br />

celebrate it with the nation.<br />

Attendees were further encouraged to attend the upcoming 10th <strong>African</strong> <strong>Fine</strong> <strong>Coffees</strong><br />

Conference and Exhibition to be held in Kampala Uganda. This conference would provide<br />

a unique platform for Uganda to showcase its brand coffee to the world.<br />

The 3rd Uganda Coffee Day is proudly sponsored by aBi Trust, USAID LEAD and<br />

Solidaridad Network with support from UCDA.<br />

17

South Africa’s top coffee champions<br />

were crowned.<br />

South Africa’s top coffee champions were crowned at the<br />

at the 2012 Good Food & Wine Show in Johannesburg.<br />

The National Barista Championship title went to<br />

Lovejoy Chirambasukwa, 31, (Western Cape) from Origin<br />

Coffee Roastery.<br />

Lovejoy, originally from Zimbabwe, moved to South Africa<br />

in 2009 and started training as a barista under trainers Jake<br />

Easton and Wayne Oberholzer.<br />

“It means four years of hard work come to fruition. I have<br />

learned a great deal since first entering this competition two<br />

years ago. My coffee career started in SA and I’m grateful<br />

for the opportunity to represent SA at the World Barista<br />

Championships in Melbourne next year.”<br />

Maxine Keet (KZN) took honours in the Cup Tasters<br />

Championship and will compete in Nice, France in the World<br />

Championships in 2013.<br />

“I feel amazing. Words can’t describe how hard my<br />

heart is pumping. Cupping is my passion. Nice here I<br />

come!”<br />

Phumlani Sibeko (Gauteng), from Stil.Coffee won the<br />

Latte Art division.<br />

“Latte art is special to me - it’s part of the presentation<br />

and gives the customer something to remember.<br />

Latte art is the start of the experience and tells you<br />

immediately about the care that’s gone into making the<br />

cup of coffee.”<br />

Two-time former SA Barista Champion, Ishan Natalie<br />

(Gauteng) from Tribeca Coffee won the Aeropress<br />

division, the newest division in the Championships.<br />

“I’m ecstatic. I really wanted this, I had a whole lot of<br />

stuff that no-one else on stage.<br />

I tried some unconventional things. I’m so happy, I<br />

really want to go to the Worlds and represent SA in this<br />

division.”<br />

19

20<br />

VISA and Travel Information for 10th<br />

AFCC & E Delegates<br />

Before you travel to Uganda, there a few aspects that you may need to<br />

know. About travel documents, accommodation, climate, transport, health<br />

and safety, all is presented below.<br />

Where is Uganda located?<br />

Uganda lies astride the Equator in Eastern Africa between longitudes 29<br />

½° East and 35° East and between latitudes 4 ½° North and ½° South,<br />

at an average altitude of 1,100 meters above sea- level. The total area is<br />

236,580sq.Km.<br />

Do I need a visa to enter into Uganda?<br />

Yes! With effect from March 1, 1999, the Government of Uganda<br />

introduced visa requirements for all visitors entering Uganda. However<br />

this is in exemption of the following countries:<br />

East <strong>African</strong> Community (EAC) Citizens Nationals of COMESA<br />

countries( Angola, Comoros, Eritrea, Kenya, Malawi, Mauritius,<br />

Madagascar, Rwanda, Seychelles, Swaziland, Tanzania, Zambia,<br />

Zimbabwe) Other countries e.g. Antigua, Bahamas, Barbados, Belize,<br />

Fiji, Gambia, Grenada, Jamaica, Lesotho, Malta, Sierra Leone, Singapore,<br />

Solomon Islands, St. Vincent & The Grenadines, Tonga, Vanuatu, Italy<br />

(Only diplomatic passports) and Cyprus.<br />

Where do I apply for a visa from?<br />

You can acquire a visa at Uganda’s High Commission or embassy in your<br />

country of residence or on arrival at Entebbe International Airport.<br />

What immunizations are required when I’m travelling to Uganda?<br />

Yellow fever vaccine is essential.<br />

Hepatitis A and B, Meningitis, Tetanus, Polio and Typhoid are also<br />

recommended.<br />

Expecting to get closer to wild animals, rabies vaccination should be<br />

prioritized.<br />

Traveling Around<br />

Travelling around Uganda has never been easier than today, flexibility<br />

exists in use of private or public transport. The improving transport<br />

network and extended communication facilities to upcountry regions is<br />

commendable.

Travelling around Uganda is truly an elegant adventure. There are several ways to get<br />

around in Uganda, and the option you choose will depend upon your time constraints<br />

and your budget. Travelling by road is the most accessible and probably the cheapest<br />

way to travel, and public transport connects all major locations, and ventures far off<br />

the beaten track.<br />

Public Transport<br />

Buses, Taxis, VIP vans and several touring trucks operated by Individual tour<br />

operators are all available for the tourists to use and reach to their destinations.<br />

Motorcycles (Boda Bodas), as they are locally known can always be used for short<br />

distances and at the minimum speed possible.<br />

Please note that there’s no guarantee of safety on using any of the above. Make sure<br />

that you find the right operator or guide to assist you in this.<br />

Costs for all these vary from time to time<br />

Driving<br />

Driving in Uganda requires a driving license, this can be obtained from face<br />

technologies, Uganda.<br />

The procedure to acquire a Ugandan Driving permit necessitates one to visit the<br />

Uganda Revenue Authority licensing office and the face Technology Center.<br />

More Information can be obtained from www.ura.go.ug<br />

Water transport<br />

There is a regular inland ferry connecting Nakiwogo in Entebbe and the Ssese<br />

islands on Lake Victoria and one between Bukakata pier near Masaka town.<br />

Information about Uganda, destinations, attractions, tourism developments, events,<br />

exhibitions, press releases and news is available for all interested parties. Tourists,<br />

visitors, travelers, investors, businessmen, planners, public and private agencies, and<br />

individuals can now find all the information here.<br />

You can contact us for any information you would wish to know using the address<br />

below.<br />

The Uganda Tourism Board<br />

42 Windsor Crescent, Kololo, Kampala<br />

P.O. Box 7211, Kampala, Uganda.<br />

Tel: +256 (414) 342 196/7<br />

Fax: +256 (414) 342 188<br />

OR by utb@tourismuganda.info<br />

21

22<br />

SPECIAL REPORTS<br />

Uganda Quality Coffee<br />

Traders Moves To Act.<br />

It is not un-common to find someone else to blame<br />

whenever a problem occurs in our lives or business. It<br />

even gets more complex if the numbers of players are<br />

in different locations and at diverse stages, making it even<br />

harder to point a finger on where the bark starts and stops.<br />

This scenario floated over the minds of most industry players<br />

about the idea of closing gaps in Uganda’s coffee quality value<br />

chain.<br />

Motivated by the desire to improve quality through sustainable<br />

and coordinated arrangement, the Uganda Quality Coffee<br />

Traders and Processors Association was born. A confluence<br />

of main traders, middlemen, farmer representatives and<br />

exporters giving a mix that is a perfect dressing for the<br />

occasion. The association seeks to supplement UCDA`s<br />

statutory mandate of ensuring total quality management of<br />

the coffee product and process throughout the supply chain.<br />

Hardly a year since its birth, the association has taken giant<br />

steps in both achievements and partnerships, boasting of<br />

over 1500 registered members and development partners.<br />

In a ground breaking countrywide tour, in partnership<br />

with UCDA, USAID-Lead project, Uganda Police, local<br />

leaders and farmers, the association generated deep sense<br />

of stakeholder responsibility towards quality and quantity<br />

improvement.<br />

The discussion centered on addressing the core issues<br />

such as coffee quality deterioration indicators, Changes in<br />

the Ugandan coffee quality trends, Methods and ways of<br />

preserving quality, Incentives of quality produced especially<br />

increased prices and value, Constitutional & regulatory<br />

framework on coffee quality control, Disadvantages of poor<br />

quality produce and also GAP (Good Agronomic Practices).<br />

During the sensitization workshop Mr. Ssekitoreko a coffee<br />

farmer in Masaka district since late 90’s, enumerated how he<br />

carefully sorts and minds his quality, but despite his individual<br />

efforts, his neighbors out of a mixture of ignorance and lack<br />

of incentive don’t pay full attention to their crop which in the<br />

end ruins Mr Ssekitoreko’s coffee, as middle men would bulk<br />

these coffees and even at times adulterate with foreign matter.<br />

Harvesting of immature, unripe cherries, poor drying<br />

methods, poor processing techniques were all key factors<br />

Scaling up quality coffee production in Uganda<br />

Beans from the Pearl<br />

affecting the<br />

quality and<br />

production of<br />

coffee at the farm level.<br />

“The story of Ssekitoreko is played out through the<br />

value chain where different players shift the blame<br />

to a third party highlighting the gravity of the<br />

quality crisis.” According to Mr. Aloysius Lubega the<br />

chairman of the association.<br />

With this association a practical conversation has<br />

been started and the industry seems to be shaking<br />

off the blame game, as each of tiers in the value is<br />

involved in action to improve Uganda’s coffee quantity<br />

and quality. To the much delight of the founders, Mr<br />

Edmund Kananura the head of quality at Uganda<br />

Coffee Development Authority has resonated well<br />

with the cause and after a few months UCDA has<br />

presided over a turn around of Drugar coffee from<br />

Kasese restoring its superb cup profile and total<br />

elimination of Robusta traces.<br />

But here is the real question: could this association<br />

present a different kind of opportunity, one that<br />

disperses power into the hands of the many rather<br />

than consolidating it in the hands of the few; one<br />

that radically expands the We, rather than Them? In<br />

short, could UQCTPA be the beginning of A People’s<br />

Quality improvement answer? Recent results are<br />

pointing to a brighter future and the industry could<br />

have woken yet another sleeping actor.<br />

By Michael Nuwagaba<br />

About Beans from the<br />

pearl<br />

In this blog, our correspondents<br />

report on the developments with<br />

Uganda, better known famously by<br />

the name given to it by Sir Winston<br />

Churchill -<br />

“The Pearl of Africa”

Meeting Uganda’s Three time<br />

National Champion and the<br />

3rd <strong>African</strong> Barista Challenge<br />

Champion<br />

Champions Of Africa<br />

In <strong>Oct</strong>ober 2012, I had interview with Robert<br />

Mbabazi at Emin Pasha Hotel in Kampala. Robert<br />

was as usual as distracted as a child in a shop full<br />

of toys. He was conducting an training for Barista’s<br />

at the hotel and with Robert, coffee comes first and<br />

passionately so.<br />

Qn. Tell us about yourself?<br />

I am a 26 year old professional Coffee Quality Controller<br />

and Barista Consultant with cross-functional expertise<br />

in business and restaurant management with over six<br />

years in the field.<br />

I have substantial work experience in all aspects of the<br />

coffee industry including green coffee bean grading,<br />

roasting, cupping, marketing, and barista skills and<br />

training. I have also received certifications in various<br />

courses including being a licensed ‘Q’ grader, a <strong>Special</strong>ty<br />

Arabica coffee grader meeting international SCAA<br />

standards.<br />

Qn. What got you into Coffee?<br />

My coffee adventure began back in 2006 when a friend<br />

invited me to go spend a few weeks at his coffee farm in<br />

Eastern Uganda.<br />

It’s here on the slopes of Mt. Elgon, with its majestic<br />

scenery; I had my first glimpse of flowering coffee trees<br />

and immediately set out to spend all my time interacting<br />

with the farming community.<br />

Their hard work and effort to grow and produce quality<br />

coffee, with very little reward, was all I needed to give<br />

me the motivation to learn all I could about coffee.<br />

Back in Kampala, I immediately signed up for the<br />

Uganda Coffee Development Authority (UCDA)<br />

training program in basic coffee quality control and<br />

barista skills, and thanks to some great professional<br />

coffee training from experts around the world, I was<br />

determined to become a professional Barista.<br />

Qn. How did it feel to be crowned the Champion of<br />

Africa?<br />

Being crowned the Africa Barista Champion was the<br />

epitome of my Barista Career, especially after winning<br />

the challenge at the source and birthplace of coffee<br />

(Ethiopia). As a coffee Barista, I could never ask for<br />

more, I wish to continue using my title to promote<br />

domestic consumption of coffee in my country and also<br />

to inspire the youth into doing something creative with<br />

their lives.<br />

23

24<br />

Robert Mbabazi,<br />

The 3rd <strong>African</strong> Barista<br />

Challenge Champion

The Epitome of his<br />

Career - Lifting the<br />

Coverted Trophy<br />

Qn. What do you think is the future of the Ugandan<br />

Coffee Industry?<br />

There has been a tremendous shift within the Uganda<br />

Coffee shop culture. A few years ago, we could only hear<br />

of two or three prominent coffee shops, Ban Café, Café<br />

Pap and 1000Cups, right now, we count over twenty and<br />

the number is rising by the day as people are shifting<br />

away from going to the bars for meet ups and breaks and<br />

now they would rather be seen in a coffee shop. With the<br />

right products to offer, soothing ambience and a good<br />

service, we are going to see more Ugandans getting a<br />

buzz from coffee.<br />

I am very convinced that with emphasis on serving<br />

high quality products and educating our customers<br />

about coffee; we will see more Ugandans and expats<br />

enjoying our coffees. Hence, the creation of more jobs<br />

for the youth out there! It is my ultimate goal to continue<br />

supporting the coffee shop culture in Uganda by sharing<br />

and training Baristas and everyone out there with all<br />

the necessary skills. The future of the Ugandan coffee<br />

industry is going to reach a point where we Ugandans<br />

regulate how much coffee is exported since we shall be<br />

drinking most of it!<br />

Qn. What advice do you have for young aspiring<br />

Baristas?<br />

A very big percentage of young people in Uganda are<br />

unemployed. The coffee sector in Uganda has the potential<br />

of cubing these numbers down. My only advice to the<br />

youth (aspiring Baristas) out there who have not yet got<br />

their dream jobs, please start thinking about the coffee<br />

and service industry. By approaching organizations like<br />

the Uganda Coffee Development Authority, <strong>African</strong> <strong>Fine</strong><br />

<strong>Coffees</strong> Association, a whole new line of opportunities<br />

can be opened up. There are plenty of jobs within the<br />

coffee industry at all levels; I believe they cannot fail to<br />

get something that interests them.<br />

Conclusion<br />

During the class one of the students asked the<br />

Robert why more and more people seem to love<br />

coffee. Robert smiled and replied,<br />

“Coffee triggers memories in a way almost<br />

impossible to explain. A good coffee will trigger<br />

great memories almost as strongly as a bad<br />

coffee will trigger awful memories. It is your<br />

role as Barista to make great memories. But<br />

most importantly, a good coffee is a tribute to<br />

not art of Barista but to the farmer that waited,<br />

cared and loved the plant for four years. Respect<br />

the farmer and you will respect the coffee.”<br />

by Martin Maraka<br />

About Champions<br />

Of Africa<br />

“Champions of Africa”<br />

is a series dedicated<br />

profiling & celebrating<br />

the activities of the top<br />

baristas in the AFCA<br />

Region.<br />

25

26<br />

The Sleeping Giant<br />

Awakes<br />

As Uganda celebrated 50 years of independence, the<br />

drums of the nation beat as one while the streets<br />

and its citizens were dipped in black, yellow and red.<br />

There was a lot to be proud of. Uganda has survived a dozen<br />

or so unrests, run through 9 presidents like a wealthy female<br />

actress through shoes and remained world over an unknown<br />

country who’s most popular export still remained a dark<br />

towering Field Marshall with peculiar fondness for violence<br />

and speeches that left people in stitches.<br />

There was a lot to reflect on. Who were we in the region?<br />

What is expected of us? How can we be better? What do we<br />

do we have get us there?<br />

Tough questions but all together the right ones.<br />

Beans From the Pearl<br />

Uganda has been growing coffee since the 1920’s and coffee<br />

remains very much a part of who we are as Ugandan’s.<br />

Ingrained both economically and socially it holds a special<br />

place.<br />

In the early 1990s, exports reached their highest-ever levels<br />

of just over 4 million (60kg bags) bags (240,000 tons) during<br />

the years 1995–1997 as the consequence of a combination<br />

of higher international prices and a much greater farm gate<br />

share of export prices and these were due to two consecutive<br />

major frosts in Brazil at the end of June 1994. Since<br />

then, however, volumes have fallen; primarily because<br />

of both the occurrence of coffee wilt disease - CWD<br />

(first identified in early 1960s and recurrence in 1993).<br />

Another major factor was the 2000–2003 coffee crisis,<br />

when international coffee prices reached all-time lows.<br />

With in that period the nation had several reasons to<br />

give up. One blow was bad enough but the second was<br />

prolonged and hit the producer nation even harder.<br />

Three key events occurred during this period that<br />

altered this near industry collapse<br />

Mindset<br />

“History made when mindset changed.” Toba Beta<br />

As one of the key points of any revolutionary change,<br />

the industry sought to make huge strides to change<br />

the mindset both of the industry and among actors<br />

themselves. A spirit of togetherness was fostered and<br />

“we are all in this together” was developed.<br />

Events such as the stakeholder meetings and local<br />

breakfasts allowed participants to put aside differences<br />

to save a crop that had given them so much and with<br />

better planning would offer much more.

Efforts by the Uganda Coffee Development Authority and stakeholders<br />

to train and strengthen quality practices throughout the value chain<br />

were also imperative in shifting the mindset.<br />

Now in Uganda once a year, a day is dedicated to the crop where all<br />

stakeholders gather to reflect on the coffee year, discuss strategies on<br />

the future and celebrate the life of a crop vital to the survival of so<br />

many.<br />

Coffee is back into public foray and scarcely does a week go by without<br />

mention of the industry in the press and media. The crop is clearly<br />

back onto the national agenda.<br />

Research<br />

“All I am armed with is research” – Mike Wallace<br />

By 2009, the Uganda Coffee Development Authority (UCDA) reported<br />

that the disease had reduced the countries Robusta Coffee Plantations<br />

by 50% or 150 million trees, which has cost Uganda, an estimated $500<br />

million over the past decade.<br />

The disease, is caused by a fungus, Fusarium xylariodes, and is a major<br />

problem for coffee farmers in Uganda, Tanzania, Ethiopia and the<br />

Democratic Republic of Congo<br />

Heavy investments were poured into research and development of the<br />

several CWD resistant lines over the decade. This investment paid off<br />

with Coffee Research Centre (COREC) succeeding in carrying out<br />

research on the CWD and holding the disease at bay.<br />

Currently Uganda’s farmers demand 200 million plantlets to boost<br />

coffee output in the next 5 or so years. Should this request be met,<br />

output could reach 4 million bags by 2015.<br />

Unfortunately while COREC has the capacity to raise enough coffee<br />

wilt resistant plantlets but is operating at just 10% due to financial<br />

constraints.<br />

Farmers clearly needed to be supported with improved disease varieties<br />

and also equipped with modern farming techniques to enable them to<br />

produce improved yields.<br />

The new varieties needed to be multiplied faster. Currently the average<br />

Ugandan farmer produces 600kg per hectare, an output way below the<br />

Vietnam 2000 kg per hectare. This has inclined farmers to divert their<br />

attention to more profitable crops increasing shoving coffee to the side.<br />

Fortunately the call for increased concerted efforts to boost support for<br />

the coffee research in the country both by the direct stakeholders and<br />

in the media had been heard. UCDA, COREC and the various other<br />

stakeholders have moved greatly multiply the crop both significantly<br />

through tissue culture.<br />

This renewed interest in research played and still continues to play a<br />

definitive role in the revival of this industry.<br />

The Rise of “the” Institutions.<br />

“Cometh the hour, cometh the man” - An<br />

English Proverb<br />

As the decade rolled over, Uganda saw a rise<br />

in institutions desperately ready to solve the<br />

various problems. Café Africa, Good <strong>African</strong><br />

Coffee, NUCAFE, Uganda Coffee Farmers<br />

Alliance, Uganda Quality Coffee Traders &<br />

Processors Association and even <strong>African</strong> <strong>Fine</strong><br />

<strong>Coffees</strong> Association, this magazine’s publisher,<br />

were born of the fire to mention but a few.<br />

Each of these organizations provided practical<br />

and different solution to challenges facing the<br />

industry.<br />

The institutions further provided the perfect<br />

incubation ground that favored the rise of<br />

individuals and icons who soon be appointed<br />

Ugandan coffee ambassadors around the world<br />

in various capacities. This key positioning<br />

further strengthened a renewed interest in the<br />

industry.<br />

However what remained key about the<br />

institutions was their inability to remain<br />

stagnant. Their constant need to innovate and<br />

find practical solutions to the various challenges<br />

affecting the industry.<br />

Conclusion<br />

“Gakyali Mabaga” – A Luganda Proverb<br />

This is only the beginning and a fine one it has<br />

been to watch.<br />

In the 2011 – 2012 season alone three events<br />

show evidence of this.<br />

1. The La farge group operating in Uganda<br />

under the brand name Hima Cement initiated a<br />

3 year comprehensive concept to boost coffee<br />

production in Kasese and Kamwenge districts;<br />

while establishing an alternative energy source<br />

for the plant in Kasese.<br />

Started in late Sept 2011, the program worth<br />

1.53 Billion Ugandan Shillings (UGX) is meant<br />

to boost coffee production which in turn<br />

increases the quantity of coffee husks used as<br />

an alternative fuel for burning clinker at the<br />

new line and to improve the livelihoods of<br />

households through increased incomes.<br />

27

28<br />

Hima will provide 42,000 farmers with around 14.2 million<br />

seedlings in three phases. The first phase already started in<br />

September- <strong>Dec</strong>ember 2011; the 2nd phase started in March<br />

2012, and finally the third phase in September 2012.<br />

This unusual interest shown the cement group in planting<br />

efforts might by a sign of more non-coffee sector participation<br />

in the industry<br />

2. Middle men and traders in Uganda, had for a long<br />

time been treated as outsiders who brought only problems to<br />

the trade. following continued deterioration of coffee quality<br />

with glaring examples of mal-practices exhibited through<br />

poor handling at farm level and outright adulteration along<br />

the way to the exporter, alarm bells were sounded but<br />

everyone thought it wasn`t their duty but solely for UCDA.<br />

Farmers pointed to middlemen, middle men pointed to<br />

primary processors, exporters couldn’t find who to blame<br />

and the chain of blame game was overwhelming. Faced with<br />

this scenario, an association was born with roots in each of<br />

the coffee players to own the reverse of the trend.<br />

The Uganda Quality Coffee Processors and Traders<br />

Association (UQCTPA) as highlighted earlier in this<br />

magazine came together to be the change. Already registering<br />

success through strong partnerships with Uganda Police,<br />

UCDA, USAid and several other bodies, the once “bad boys”<br />

of coffee may prove to be the real tipping point in improving<br />

the coffee quality.<br />

3. The 2011/2012 coffee year saw Uganda take to seats<br />

of significant seats in the world. The International Coffee<br />

Organisation and 4 Cs Association have their chairmanship<br />

held by Uganda. The coffee grapevine further suggests a<br />

West <strong>African</strong> role may also fall to Uganda. This recognition<br />

could mean one of two things; either Uganda earned these<br />

positions because Africa’s growing appeal as key investment<br />

destination or because Uganda truly earned it as result of<br />

huge strides.<br />

I choose to believe the latter.<br />

Huge potential lies in the growing fine Robusta<br />

Market, domestic coffee consumption, sustainability<br />

initiatives through increased production, market<br />

branding, access to finance and infrastructural<br />

developments.<br />

Now like a volcano dormant for thousands of years,<br />

if the forecasts are anything to go by, we are definitely<br />

in for an industry eruption like never before.<br />

Written by Martin Maraka<br />

About Beans<br />

from the Pearl<br />

In this blog, our<br />

correspondents report on the<br />

developments with Uganda,<br />

better known famously by<br />

the name given to it by Sir<br />

Winston Churchill - “The Pearl<br />

of Africa”

A Ripple in the Ocean<br />

of Coffee Growing… A brief on the history of coffee in Malawi: from<br />

inception to independence. (Part 1)<br />

The Heart Warming Cup from the Warm Heart of Africa<br />

There are conflicting reports about when coffee<br />

was first introduced into Malawi, and dates vary<br />

between 1876 and 1879, but according to a CABI<br />

Report titled: “COFFEE PESTS, DISEASES AND THEIR<br />

MANAGEMENT” “a single tree of var. typica” “was taken<br />

from Edinburgh Botanic Gardens (UK) to Malawi (then<br />

Nyasaland) in 1878.” There is general consensus that it<br />

was introduced by Scottish Presbyterian missionaries<br />

during this period into the Southern Region, specifically<br />

around Zomba and Blantyre. The main objective of these<br />

missionaries was to eradicate the slave trade prevalent<br />

in the area at the time and that had been un-covered<br />

by an earlier expedition by the famous explorer David<br />

Livingstone in 1859.<br />

In response to the influx of these missionaries into the<br />

region, and a subsequent need to provide them services,<br />

the <strong>African</strong> Lakes Company was formed in 1878, by a<br />

group of traders who predominantly hailed from Glasgow.<br />

At the time Malawi was as yet un-named, and after “a<br />

consul of the British Government was accredited to the<br />

‘Kings and Chiefs of Central Africa’ in 1883”, Malawi<br />

was then established as the ‘British Central <strong>African</strong><br />

Protectorate’ in 1891 (en.wikipedia.org/wiki/History of<br />

Malawi/3.6&4). During this time, coffee production was<br />

taken up and grown by the first European planters in<br />

and around Mlanje (now Mulanje), Cholo (now Thyolo)<br />

and Zomba, and soon became established as the primary<br />

export crop.<br />

Coffee exports from the late 1890s to the early 1900s<br />

were said to range from “300,000 to more than 2,000,000<br />

pounds”, just over 907 thousand kilograms, and by 1900<br />

the country was recorded as having 16,917 acres of<br />

producing coffee (Chisolm, Hugh ed. 1911).<br />

Interestingly, this is also the year that Nyasaland,<br />

introduced coffee to Uganda, through the export of ‘Nyasa’<br />

seed.<br />

The country, which changed in name in 1907 to<br />

‘Nyasaland’ or the ‘Nyasaland Protectorate’, continued<br />

to produce coffee predominantly by planters in the<br />

south of the country (en.wikipedia.org/wiki/History<br />

of Malawi/5). But even at this early stage there was an<br />

evident reduction in the cultivated area of coffee, which<br />

had declined to 6134 acres in the same year. This decrease<br />

was confirmed in the “Annual Report for Nyasaland 1908-<br />

1909”, which stated that coffee “now occupies the second<br />

place in point of acreage and value of export; before the<br />

introduction of cotton it was the principal crop<br />

of the Protectorate”. The report went on to<br />

make particular mention of the difficulties with<br />

un-predictable rainfall and the resultant erratic<br />

outcome of the crop, in terms of yield (Annual<br />

No. 619, 1909).<br />

By 1910 coffee was seen as “a very speculative<br />

crop” by the administration (Annual No. 655,<br />

1910) and the view at the time was such that<br />

coffee was to be slowly replaced by cotton<br />

and tobacco. To illustrate the decline, figures<br />

for 1909-1910 indicate that only 3,957 acres<br />

of land remained with productive coffee, and<br />

export figures for 1910 were down 187,000lbs to<br />

748,410lbs. (Annual No.655, 1910).<br />

To corroborate this, in 1911 it was reported that<br />

“Africa, the origin of coffee, did not make any<br />

significant contribution to world production.”<br />

(WH Ukers, 1922). The report went onto state<br />

that this was mainly as a result of low prices<br />

offered for the produce on the world markets<br />

and better remuneration on other locally grown<br />

crops, such as cotton tobacco and tea.<br />

With a shift in focus to cotton production<br />

throughout the country, especially from 1916 to<br />

1918 where “Nyasaland” exported up to as much<br />

as 3.4 million pounds of cotton, emphasis on<br />

coffee growing was declining. In fact by 1917 the<br />

cultivated area of coffee had reduced drastically<br />

to 1,300 hectares with the resultant export<br />

production having fallen to 122,796lbs (Annual<br />

No.955, 1917).<br />

The cotton run was not to last long, and with a<br />

number of mitigating factors, the main crop in<br />

Nyasaland shifted towards what is in modern<br />

days seen as its’ “green gold”; tobacco. There<br />

were several reasons for this major shift,<br />

amongst others, a) during export of the 1917-<br />

1918 crop the exports were heavily limited due<br />

to shipping restrictions; b) growers at the time<br />

refused to invest in new more effective seed; c)<br />

in 1917 changes were made to fumigate tobacco<br />

prior to shipment – which enabled tobacco<br />

to fetch higher prices from buyers and finally<br />

d) tobacco as a crop was more profitable than<br />

cotton (Annual No. 996, 1919).<br />

29

In addition to the above, after 1920 the country was shifting to<br />

more emphasis on tea on the plantations that previously grew<br />

coffee, and as a result it was beginning to be overlooked as a<br />

major contributing crop and by 1928 was largely discarded.<br />

Nonetheless, it was still being grown, albeit to a lesser degree,<br />

by European planters and for the first time it is documented<br />

that smallholders were also growing the crop in the north of<br />

the country (Annual No. 1445, 1929).<br />

In the meantime, tobacco continued to dominate agricultural<br />

exports in Nyasaland, apart from the great collapse in 1928,<br />

but by the early 1930s’ it had re-established itself as the<br />

primary export crop, where it would remain until 1955 when<br />

it was overtaken by tea.<br />

It is thereafter that tea production came into its own,<br />

especially in the 1930s after the introduction of the<br />

International Tea Regulation Scheme of 1933 which restricted<br />

exports from leading tea producers and offered protection<br />

in pricing. From 1925 to 1938 it is clear to see the effect of<br />

prices on the London Auctions for both coffee and tea, and<br />

the subsequent prevalence of tea as a main export. In 1925-<br />

39 the price index for both coffee and tea was 100, but by<br />

1938 the price index for tea was 81 and for coffee was 35. It<br />

must be noted that the grave economic hardships as a result<br />

of depression did nothing to help matters during this time,<br />

from a coffee pricing point-of-view. This is substantiated by<br />

export figures for coffee that were garnered from 1931 to 1933<br />

which were as follows: in 1931 93,424lbs were exported for<br />

GBP 1989.00; in 1932 exports had reduced to 88,354lbs for<br />

GBP1840.00 and by 1933 exports had dropped to 39,993lbs<br />

for a paltry GBP833.00.<br />

As mentioned prior, as early as the 1920s, the expansion of<br />

coffee is documented to have been extended to smallholder<br />

farmers in the north of the country. This is supported by<br />

the “Nyasaland Annual Report 1933” that mentions while<br />

“coffee is a small industry…efforts are being made to increase<br />

it, particularly through…encouraging local, smallholder…<br />

growing.” The report goes on to mention the need for shade<br />

coffee to counter the effects of drought and also highlights the<br />

White Stem Borer as a serious pest (Annual No.1776, 1933).<br />

By 1935 the Nyasaland administration distributed coffee<br />

seedlings for planting in the ‘Henga Valley’ and in the ‘Misuku<br />

Hills’. This was in an effort to promote the smallholder<br />

growth of coffee. At the same time they reported the<br />

success of the demonstration plots at ‘Nchena-chena’. The<br />

administration was pleased with the growth in this new<br />

sector, but still held reservations over the “suitability of<br />

Nyasaland for coffee growing”. This reserved opinion was<br />

heavily influenced by the poor market prices being offered for<br />

coffee at the time, but also taking into account the extended<br />

dry season that Nyasaland experienced annually. This long<br />

dry season was not conducive to coffee growing. In light of<br />

this the administration was of the view that “rapid expansion<br />

of the industry was not recommended” (Annual No.1776,<br />

1935).<br />

On the outbreak of World War 2 in September 1939 – the<br />

London Auctions closed down and were replaced by the<br />

British Ministry of Food.<br />

By this time coffee production had been ravaged by<br />

disease and pests and was all but abandoned.<br />

During the war period from September 1939 up<br />

until January 1945 – there is very little literature<br />

in terms of the production of coffee in Nyasaland,<br />

and it is assumed that, considering that Nyasaland<br />

was a British Protectorate at the time, most of the<br />

human resources of the time were directed towards<br />

the war effort – and very little attention was given<br />

to trying to resuscitate a dying industry. What is<br />

known during this period is that global supply of<br />

coffee continued to increase whilst demand was<br />

diminishing and as a result world coffee prices were<br />

abjectly dismal (www.ico.org/history.asp).<br />

It is documented that by 1945 the coffee growing<br />

industry had reached a low point and production<br />

was down to “almost nothing”, but a resolute<br />

attempt at reviving the industry was undertaken to<br />

promote the crop again, specifically as a substitute<br />

for tung as a crop due to a major slump in tung<br />

oil prices in the post-war period. This drive to<br />

revive the industry was two-pronged, one was to<br />

re-establish the crop in certain southern plantations<br />

and the second was to promote it as smallholder<br />

crop in the more amenable and “moister remote<br />

hills of the north” (Kettlewell, R.W., 1965).<br />

This resurgence was assisted by increasing world<br />

coffee prices which experienced a boom from the<br />

late 1940s up until 1953. Unfortunately the next<br />

ten years would experience a huge plummeting of<br />

prices, which would lead to a world coffee crisis and<br />

the establishment of the first International Coffee<br />

Agreement in 1963 (www.ico.org/history.asp).<br />

This inopportunely would coincide with an<br />

outbreak of an epidemic of Fusarium Bark Disease<br />

(FBD), which had a considerable impact on the<br />

production of coffee in Nyasaland, and gripped the<br />

estate sector in 1950. This had such a debilitating<br />

effect on the crop, that together with later outbreaks<br />

of White Stem Borer almost killed the industry<br />

altogether (Kettlewell, R.W., 1965).<br />

Interestingly the varieties being grown in the<br />

northern highlands did not succumb to the<br />

Fusarium Bark Disease, and this became hugely<br />

valuable for the future of Nyasaland coffee.<br />

Coffee exports from the late 1890s<br />

to the early 1900s were said to range<br />

from “300,000 to more than 2,000,000<br />

pounds”, just over 907 thousand<br />

kilograms, and by 1900 the country<br />

was recorded as having 16,917 acres of<br />

producing coffee (Chisolm, Hugh ed.<br />

1911).<br />

31

32<br />

It was therefore no surprise that the smallholder schemes in the<br />

north were expanded upon in the 1950s by the government of<br />

the time, with specific emphasis on support to the smallholders.<br />

This led to an encouraging interest in the crop by these<br />

smallholders and inevitably led to the formation of several<br />

coffee co-operatives, the first such co-operative being named the<br />

‘Ntchenachena Coffee Growers Co-operative Society’ based in<br />

Rhumpi in 1950, followed by the ‘Misuku Coffee Growers Cooperative<br />

Society’ in Chitipa later in 1957 (Chirwa et al, 2007).<br />

In the interim, Nyasaland was to undergo further political<br />

transformation and the ‘Federation of Rhodesia & Nyasaland’<br />

(also called ‘Central <strong>African</strong> Federation’) was created in 1953<br />

and included the joining of Northern Rhodesia (Zambia),<br />

Southern Rhodesia (Zimbabwe) and Nyasaland (Malawi) into<br />

one federal realm under the British Crown (en.wikipedia.org/<br />

wiki/HistoryofMalawi/7).<br />

By 1960 production had increased to “200 tons of parchment<br />

coffee” of which around 65% was grown by smallholders. Whilst<br />

these figures are a drop in comparison to prior historical figures<br />

it was a vast improvement of the level experienced up until 1945.<br />

During 1960 it is recorded that 2,840 smallholder growers were<br />

farming over 1,130 acres of coffee.<br />

The prevailing government of the time raised further seedlings<br />

to produce a further 250 acres of smallholder grown coffee,<br />

whilst the southern plantations were recorded to have grown<br />

nearly 1,000 acres of coffee. During 1960 most of the coffee<br />

was young and as yet not bearing (Kettlewell, R.W., 1965).<br />

Regrettably world coffee prices (as mentioned above) plummeted<br />

to unprecedented levels and by 1960 were on average fetching<br />

just above 32 USC per lb.<br />

The world coffee prices would have a major impact on<br />

the future production of coffee in the country and as one<br />

commentator, R.W. Kettlewell, reporting on coffee at the time<br />

put it: “despite the importance of new varieties, considerable<br />

investigational work, and much encouragement, the future (of<br />

coffee production) seemed still to hang in the balance in 1960”<br />

(Kettlewell, R.W., 1965).<br />

All along reservations had been held by the government over the<br />

suitability of coffee as a crop for the country and it was still felt<br />

that the climate was unsuitable or “at best climatic conditions<br />

were marginal for coffee” with the long dry season between<br />

annual rains. Nonetheless efforts continued despite these<br />

drawbacks and the outbreak of the fungal disease, Fusarium<br />

Bark Disease also known as Fusarium lateritum (Kettlewell,<br />

R.W., 1965).<br />

In the meantime, the political landscape of this small landlocked<br />

country was about to change again, as the complicated<br />

federation struggled to co-exist. It is said that the federation was<br />

beleaguered from the start and ultimately political differences<br />

led to its’ demise and subsequent disbandment in 1963, when<br />

Nyasaland and Northern Rhodesia became independent of<br />

British rule (flagspot.net/flags/frn.html).<br />

This overlapped with the bottoming out of world coffee prices,<br />

and the resultant establishment of the first International Coffee<br />

Agreement in 1962, which would bring about welcome stability<br />

in world coffee prices after the volatile and variable post war<br />

period (www.ico.org/history.asp) . With the country<br />

gaining independence in 1964 and becoming ‘Malawi’,<br />

coffee was to remain on the map as it were and still does<br />

to this day! However, the next stage of evolution in<br />

coffee production from Independence to present day –<br />

will be the subject of our next installation aptly named<br />

“Its’ all in the genes.”<br />