2009 Reference document - Solvay

2009 Reference document - Solvay

2009 Reference document - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6 Financial<br />

158<br />

Financial and Accounting Information<br />

Statements<br />

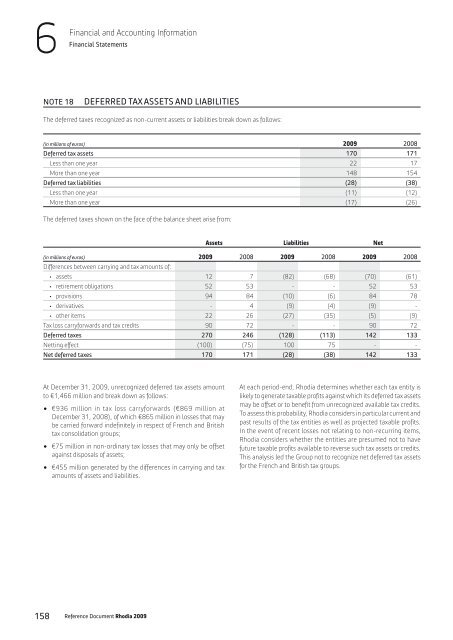

NOTE 18 DEFERRED TAX ASSETS AND LIABILITIES<br />

The deferred taxes recognized as non-current assets or liabilities break down as follows:<br />

(in millions of euros) <strong>2009</strong> 2008<br />

Deferred tax assets 170 171<br />

Less than one year 22 17<br />

More than one year 148 154<br />

Deferred tax liabilities (28) (38)<br />

Less than one year (11) (12)<br />

More than one year (17) (26)<br />

The deferred taxes shown on the face of the balance sheet arise from:<br />

<strong>Reference</strong> Document Rhodia <strong>2009</strong><br />

Assets Liabilities Net<br />

(in millions of euros)<br />

Differences between carrying and tax amounts of:<br />

<strong>2009</strong> 2008 <strong>2009</strong> 2008 <strong>2009</strong> 2008<br />

• assets 12 7 (82) (68) (70) (61)<br />

• retirement obligations 52 53 - - 52 53<br />

• provisions 94 84 (10) (6) 84 78<br />

• derivatives - 4 (9) (4) (9) -<br />

• other items 22 26 (27) (35) (5) (9)<br />

Tax loss carryforwards and tax credits 90 72 - - 90 72<br />

Deferred taxes 270 246 (128) (113) 142 133<br />

Netting effect (100) (75) 100 75 - -<br />

Net deferred taxes 170 171 (28) (38) 142 133<br />

At December 31, <strong>2009</strong>, unrecognized deferred tax assets amount<br />

to €1,466 million and break down as follows:<br />

1 €936 million in tax loss carryforwards (€869 million at<br />

December 31, 2008), of which €865 million in losses that may<br />

be carried forward indefinitely in respect of French and British<br />

tax consolidation groups;<br />

1 €75 million in non-ordinary tax losses that may only be offset<br />

against disposals of assets;<br />

1 €455 million generated by the differences in carrying and tax<br />

amounts of assets and liabilities.<br />

At each period-end, Rhodia determines whether each tax entity is<br />

likely to generate taxable profits against which its deferred tax assets<br />

may be offset or to benefit from unrecognized available tax credits.<br />

To assess this probability, Rhodia considers in particular current and<br />

past results of the tax entities as well as projected taxable profits.<br />

In the event of recent losses not relating to non-recurring items,<br />

Rhodia considers whether the entities are presumed not to have<br />

future taxable profits available to reverse such tax assets or credits.<br />

This analysis led the Group not to recognize net deferred tax assets<br />

for the French and British tax groups.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)