The Lower Austrian Raiffeisen banks

The Lower Austrian Raiffeisen banks

The Lower Austrian Raiffeisen banks

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

Treasur y<br />

In the year just ended Treasury was reorganized, and its<br />

operations strategically realigned. <strong>The</strong> restructured Treasury<br />

Department comprises the Asset /Liability Management &<br />

Money Market, Foreign Exchange Trading & Sales, Securities<br />

Trading & Sales, and Treasury Support sections. At the end<br />

of 2000 the Bank established a new organizational unit<br />

called “Asset /Liability Management for <strong>Raiffeisen</strong> Banks”.<br />

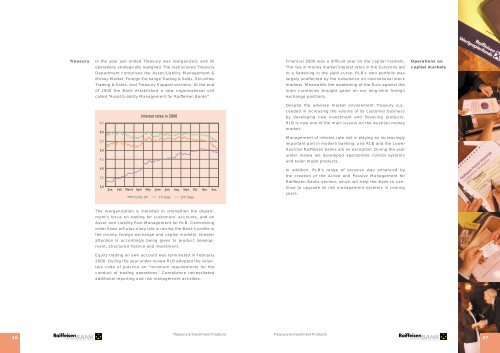

6,5<br />

6,0<br />

5,5<br />

5,0<br />

4,5<br />

4,0<br />

3,5<br />

3,0<br />

Interest rates in 2000<br />

Jan. Feb. March April May June July Aug. Sept. Oct. Nov. Dec.<br />

Euribor 3M 5Yr Swap 10Yr Swap<br />

<strong>The</strong> reorganization is intended to strengthen the department’s<br />

focus on trading for customers’ accounts, and on<br />

Asset and Liability Risk Management for RLB. Centralizing<br />

order flows will play a key role in raising the Bank’s profile in<br />

the money, foreign exchange and capital markets. Greater<br />

attention is accordingly being given to product development,<br />

structured finance and investment.<br />

Equity trading on own account was terminated in February<br />

2000. During the year under review RLB adopted the voluntary<br />

code of practice on “minimum requirements for the<br />

conduct of trading operations”. Compliance necessitated<br />

additional reporting and risk management activities.<br />

Treasury & Investment Products<br />

Financial 2000 was a difficult year on the capital markets.<br />

<strong>The</strong> rise in money market interest rates in the Eurozone led<br />

to a flattening in the yield curve. RLB’s own portfolio was<br />

largely unaffected by the turbulence on international stock<br />

markets. Meanwhile the weakening of the Euro against the<br />

main currencies brought gains on our long-term foreign<br />

exchange positions.<br />

Despite the adverse market environment Treasury succeeded<br />

in increasing the volume of its customer business<br />

by developing new investment and financing products.<br />

RLB is now one of the main issuers on the <strong>Austrian</strong> money<br />

market.<br />

Management of interest rate risk is playing an increasingly<br />

important part in modern banking, and RLB and the <strong>Lower</strong><br />

<strong>Austrian</strong> <strong>Raiffeisen</strong> <strong>banks</strong> are no exception. During the year<br />

under review we developed appropriate control systems<br />

and tailor-made products.<br />

In addition, RLB’s range of services was enhanced by<br />

the creation of the Active and Passive Management for<br />

<strong>Raiffeisen</strong> Banks section, which will help the Bank to continue<br />

to upgrade its risk management systems in coming<br />

years.<br />

Treasury & Investment Products<br />

Operations on<br />

capital markets<br />

37