2011 Annual Report - Delaware State Housing Authority

2011 Annual Report - Delaware State Housing Authority

2011 Annual Report - Delaware State Housing Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DSHA<br />

DelAwAre StAte HouSing AutHority<br />

<strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Providing Affordable <strong>Housing</strong> & Supporting <strong>Delaware</strong>’s Economy

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Our Mission<br />

DSHA Staff<br />

Our Mission is to efficiently provide,<br />

and assist others to provide,<br />

quality, affordable housing opportunities and<br />

appropriate supportive services to responsible<br />

low- and moderate-income<br />

<strong>Delaware</strong>ans.

Table of Contents<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2011</strong> Agency Accomplishments ................................................................................................... 2<br />

Letter from the Governor and Lieutenant Governor ..................................................................... 3<br />

Letter from DSHA Director Anas Ben Addi .................................................................................... 4<br />

Letter from the Council on <strong>Housing</strong> ............................................................................................. 5<br />

Core Services<br />

• Homeownership .............................................................................................................. 6-7<br />

• Rental Opportunities ........................................................................................................ 8-9<br />

Letter from Auditor and Financial Highlights ....................................................................... 10-11<br />

Mortgage Lenders & Servicers ....................................................................................................12<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

1

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

<strong>2011</strong> Agency Accomplishments<br />

• over 1,500 families provided with first & second<br />

mortgage assistance to help purchase a home using safe, secure, fixed-rate<br />

affordable mortgage products<br />

• nearly 1,500 families provided with foreclosure<br />

prevention assistance through housing counseling and the <strong>Delaware</strong> Emergency<br />

Mortgage Assistance Program<br />

• Launched new <strong>State</strong>wide Rental Assistance Program — an<br />

affordable state housing voucher program collaboration with Department of Health and Social Services<br />

and Department of Services for Children, Youth and Their Families<br />

2 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

• 16th consecutive Certificate of Achievement<br />

earned for DSHA’s Comprehensive <strong>Annual</strong> Financial <strong>Report</strong><br />

• 692 units at12 sites renewed contracts to provide long-term affordability<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong><br />

FY <strong>2011</strong> Total Production:<br />

$194,294,969<br />

5882 units<br />

• NAHRO national award recognition for the<br />

New Issue Bond Program

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

A letter from the Governor & Lt. Governor<br />

Governor Jack A. Markell<br />

Lt. Governor Matt Denn<br />

Photo by: Ron MacArthur at the<br />

Cape Gazette<br />

JACK A. MARKELL<br />

GOVERNOR<br />

Dear Citizens,<br />

STATE OF DELAWARE<br />

OFFICE OF THE GOVERNOR<br />

TATNALL BUILDING, SECOND FLOOR<br />

WILLIAM PENN STREET, DOVER, DE 19901<br />

PHONE: 302-744-4101<br />

FAX: 302-739-2775<br />

Although it has been a very busy year, affordable housing has remained a top priority for this<br />

administration. FY <strong>2011</strong> saw <strong>Delaware</strong>’s economy finally looking up. We took the opportunity<br />

to infuse $10 million into the Building <strong>Delaware</strong>’s Future Now Fund, which will preserve<br />

<strong>Delaware</strong>’s aging rental housing stock for families of low- and moderate-incomes while<br />

employing hundreds of <strong>Delaware</strong>ans. This administration believes everyone should have a<br />

safe, stable place to call home. The Building <strong>Delaware</strong>’s Future Now Fund will ensure that<br />

housing remains available and affordable for our families and children.<br />

Homeownership remains strong here in the First <strong>State</strong> with a rate of 74.4%. However, we<br />

have not been immune to the effects of the economic downturn. Affordable homeownership<br />

remains a significant challenge, made more difficult in recent lean years. In FY <strong>2011</strong>, we<br />

launched several efforts to help stimulate the market, sustain and create jobs, revitalize<br />

communities and ensure families seeking to purchase their first home had the opportunity to<br />

make that dream come true.<br />

Among those initiatives were the New Issue Bond Program and a new Acquisition<br />

Rehabilitation Loan Program that offered the lowest mortgage interest rate in DSHA history –<br />

3.49%. Under the umbrella of the Single Family Mortgage Revenue Bond program, these new<br />

initiatives stimulated 912 new first-time homebuyer mortgages and 590 second mortgages for<br />

downpayment and closing costs.<br />

We are making progress, but there is still more work to be done. By working hard alongside<br />

our federal, state and local partners, we will continue to seek out innovative ways to meet<br />

<strong>Delaware</strong>’s affordable housing challenges.<br />

Sincerely,<br />

Governor Jack Markell<br />

Lieutenant Governor Matt Denn<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> | 3

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

A letter from the Director<br />

Director, Anas Ben Addi<br />

Dear Friends:<br />

4 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

The last year has been quite a whirlwind! DSHA has been very busy on several fronts, meeting the<br />

challenges of affordable housing head on. In 2010, our focus has been three-fold: affordable rental<br />

preservation; homeownership; and foreclosure prevention.<br />

The increased demand for affordable rental housing put a strain on our aging housing stock. With the<br />

support of the administration, DSHA has been able to preserve 281 units and create 83 new affordable<br />

rental units for our deserving <strong>Delaware</strong> families.<br />

Affordable homeownership also saw a boost with the implementation of the new Acquisition<br />

Rehabilitation Mortgage Program. Even with the record low interest rates and large number of<br />

affordably priced homes on the market, buyers have found it increasingly difficult to purchase homes<br />

because of the tightened credit requirements, economic uncertainty and the challenge of finding<br />

financing because of the condition of a property. This mortgage provides homebuyers the opportunity<br />

to purchase and rehab the home of their dreams, while taking advantage of the lowest interest rate in<br />

DSHA history — 3.49%.<br />

Foreclosure continues to be major issue here in <strong>Delaware</strong>. However, with the recent boost of<br />

$6 million from the Emergency Homeowners Loan Program through the U.S. Department of <strong>Housing</strong><br />

& Urban Development, more families than ever are able to save their home. This funding has been<br />

critical in helping <strong>Delaware</strong> families facing foreclosure through no fault of their own.<br />

With the wheels rolling forward on those three fronts, we wrapped up the year by unveiling the new<br />

solar panels on two of our Public <strong>Housing</strong> sites. This renewable energy project was a DSHA goal for<br />

several years, made possible through the American Recovery & Reinvestment Act. We are proud to<br />

be a part of reducing both <strong>Delaware</strong>’s energy costs and our environmental impact on the First <strong>State</strong>.<br />

As you can see, we have been very busy on many different fronts. We will continue to look forward<br />

to the future and toward winning the challenges that will be there tomorrow.<br />

Regards,<br />

Anas Ben Addi<br />

Director, <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong><br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong><br />

18 The Green<br />

Dover, <strong>Delaware</strong> 19901

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

A letter from the <strong>Delaware</strong> Council on <strong>Housing</strong><br />

Dear Neighbors,<br />

<strong>Delaware</strong> Council on<br />

<strong>Housing</strong><br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong><br />

18 The Green<br />

Dover, <strong>Delaware</strong> 19901<br />

The <strong>Delaware</strong> Council on <strong>Housing</strong> studies, researches, plans and advises the Governor, DSHA Director<br />

and General Assembly on housing matters and approves the allocation of loans and grants through the<br />

<strong>Housing</strong> Development Fund. In fiscal year <strong>2011</strong> the Council approved resolutions resulting in over<br />

$14 million in grants and loans from the <strong>Housing</strong> Development Fund resulting in the creation or<br />

preservation of 855 units of affordable housing. These funds supported work on providing homeless<br />

services, affordable rental, homeownership, foreclosure prevention, housing rehabilitation, housing<br />

counseling and nonprofit administration services. <strong>Housing</strong> initiatives launched this year have created<br />

and sustained jobs in the building industry through the creation and rehabilitation of affordable rental<br />

housing sites and through the subsidizing of mortgages for first-time homebuyers purchasing newconstruction<br />

single family homes. This work was supported by federal stimulus programs which<br />

helped DSHA to mitigate the effect of reduced private investment in housing tax credits and bonds.<br />

However, the need for affordable housing in the <strong>State</strong> of <strong>Delaware</strong> remains great and is increasing. The<br />

foreclosure crisis and the current economic downturn have imposed great stress on the housing system<br />

and on working families at the lower end of the income brackets. The Council remains dedicated to<br />

raising the priority of housing and striving to meet the need for affordable homeownership, increasing<br />

the number of affordable rental opportunities in our state and expanding our capacity to serve other<br />

populations still in need. The Council is looking forward to continuing our work toward these goals<br />

in cooperation with DHSA, elected officials and our many partners throughout <strong>Delaware</strong>.<br />

Ruth Sokolowski,<br />

Council Vice Chair<br />

Norma Zumsteg<br />

Chair, <strong>Delaware</strong> Council on <strong>Housing</strong><br />

Connie Louder,<br />

Council Member<br />

Anita Auten,<br />

Council Member<br />

Donna Mitchell,<br />

Council Member<br />

Patricia Batchelor,<br />

Council Member<br />

Ralp Peters,<br />

Council Member<br />

Chair, Norma Zumsteg<br />

Russell Huxtable,<br />

Council Member<br />

Vincent M. White,<br />

Council Member<br />

Hugh Leahy,<br />

Council Member<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> | 5

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Homeownership<br />

Erik & Corina<br />

Wilmington, DE<br />

Looking to save money so they could purchase their frst<br />

home, Erik and Corina Steeley moved in with friends.<br />

Together for more than a decade, the Steeleys had been<br />

renting for years and were looking to the future to raise a family in a home<br />

of their own. They began looking around, but continually found that the homes<br />

that ft their needs were priced out of their reach. They were becoming frustrated<br />

and discouraged until their lender, Mark Randolph of Fairway Mortgage,<br />

suggested they consider DSHA’s 203K Acquisition /Rehabilitation Program.<br />

Highlights<br />

• Nearly $160 Million Allocated to Assist 1,500 Families with First & Second Mortgages<br />

• Offered Lowest Rate in DSHA History — 3.49%<br />

• Worked to help Save 1,500 Homes From Foreclosure Through <strong>Delaware</strong> Emergency<br />

Mortgage Assistance Program & <strong>Housing</strong> Counseling<br />

• Launched New Acquisition Rehabilitation Loan Program<br />

• Hosted DSHA’s First Homebuyer Fair<br />

6 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

The 203K program would allow them to widen their<br />

search to include homes that were more affordably<br />

priced but needed some repairs. Quickly, the Steeleys<br />

were able to fnd a home they loved and was within<br />

their budget. Using the 203K program, they were also<br />

able to roll the funding for the mortgage and the<br />

repairs into one easy payment. With the repair work<br />

nearing completion, the Steeleys have a home for their<br />

new baby that costs them less per month than they<br />

paid in rent.

Shenequa Hayes wanted so much to become a<br />

homeowner and make an investment in her future.<br />

Thanks to the partnership between DSHA<br />

and Self-Help <strong>Housing</strong> Program, when<br />

Shenequa moves in this September she will<br />

not only celebrate reaching a goal she has<br />

labored hard to achieve, she will pay nearly<br />

$300 less each month on her mortgage<br />

than she was paying in rent.<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Homeownership<br />

Shenequa<br />

Camden, DE<br />

Shenequa Hayes wanted so much to become a<br />

homeowner and make an investment in her future.<br />

Although she works full-time at Dentsply Caulk<br />

in Milford, that aspiration remained out of her reach. Not one to<br />

give up, Shenequa applied to the Milford <strong>Housing</strong> Development<br />

Corporation/USDA Rural Development Mutual Self-Help <strong>Housing</strong><br />

Program. She dedicates 30 hours each week to building her home in<br />

Harmony Hills, as well as the homes of other program participants in<br />

the neighborhood — all the homes will be complete before any of<br />

the families move in.<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> | 7

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Rental Opportunities<br />

The Joanems<br />

Magnolia, DE<br />

The dream of owning a home, especially in our current<br />

economic times, is often a difficult accomplishment.<br />

When your journey brings you from Haiti to this country,<br />

along with your seven children, that goal may have seemed a bit out of<br />

reach. However, Wilner and Hersillia Joanem and their children — Johnny,<br />

Wende, Ernis, Stephanie, Alicia, Wilterson, and Kinberlly — felt up to the<br />

challenge and committed themselves as a family to obtaining exactly that<br />

dream. The Joanem family began their journey by participating in the DSHA<br />

Moving to Work Program and took up residence<br />

in Camden at the Mifflin Meadows rental<br />

housing site in April 2005. Not only were<br />

they provided with safe affordable<br />

housing, but the children also took<br />

part in neighborhood activities, including the 4-H Afterschool Program there. Thriving as a<br />

family and working hard, both Mr. and Mrs. Joanem are employed with Harrington<br />

Raceway and Casino. The Moving to Work Program gave the Joanem’s the opportunity<br />

to incrementally achieve self-sufficiency and save up the funds to no longer need<br />

assistance and purchase a home. Now the<br />

family is enjoying their lovely new home<br />

in Magnolia.<br />

Highlights<br />

• Provided Homes and Emergency Shelter for Over 14,000 <strong>Delaware</strong>ans and Their Families<br />

• Allocated Over $24.5 Million in Funding for Rental Development & Preservation Creating<br />

420 New Affordable Rental Units<br />

• Leveraged $50 Million with a $12 Million in <strong>State</strong> Investment to Support Affordable Rental<br />

Development & Preservation<br />

• Maintained 99% <strong>Housing</strong> Choice Voucher Utilization Rate and 97% Public <strong>Housing</strong> Occupancy Rate<br />

8 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>

Rental Opportunities<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Nicole<br />

Newark, DE<br />

Nicole Byers moved into her apartment in<br />

July, 2010 through the Step-Up Program.<br />

Step-Up is a state-wide rental assistance voucher<br />

program funded through the <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong><br />

<strong>Authority</strong> – and the frst of its kind in <strong>Delaware</strong>.<br />

Nicole was working in a restaurant, but wanted more in life. She eventually left the restaurant and took a part-time position with the Center<br />

for Justice, which along with the Step-Up program, allowed her to concentrate on fnishing her degree at the University of <strong>Delaware</strong>. Ms. Byers<br />

is currently a junior and will graduate in May, 2012.<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> | 9

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Auditor’s <strong>Report</strong><br />

10 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>

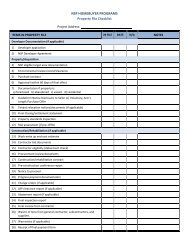

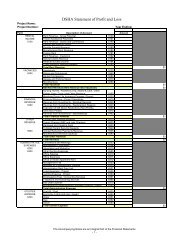

Financial <strong>Report</strong><br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

June 30, <strong>2011</strong> June 30, 2010<br />

Assets<br />

Current assets<br />

Cash and investments $212,017,057 $198,650,973<br />

Mortgages receivable $14,412,902 $15,857,001<br />

Other current assets 2 $40,350,806 $36,639,296<br />

Total current assets $266,780,765 $251,147,270<br />

Non-current assets<br />

Investments $81,558,761 $106,930,286<br />

Mortgages receivable, net $891,285,160 $931,040,373<br />

Capital assets, net of accumulated depreciation $19,578,402 $20,205,959<br />

Other non-current assets 3 $15,565,047 $16,022,630<br />

Total non-current assets $1,007,987,370 $1,074,199,248<br />

Total Assets $1,274,768,135 $1,325,346,518<br />

Liabilities and Net Assets<br />

Liabilities<br />

Current Liabilities<br />

Accounts payable and other current liabilities 4 $71,599,981 $ 2,444,315<br />

Revenue bonds payable $117,449,336 $168,456,733<br />

Total current liabilities $189,049,317 $170,901,048<br />

Non-current liabilities<br />

Escrow deposits $31,749,098 $29,322,921<br />

Revenue bonds payable $712,643,452 $795,813,822<br />

Other non-current liabilities 5 $1,669,936 $2,031,791<br />

Total non-current liabilities $746,062,486 $ 827,168,534<br />

Total Liabilities $935,111,803 $998,069,582<br />

Net Assets<br />

Invested in capital assets $19,578,402 $20,205,959<br />

Restricted 6 $290,715,395 $279,032,906<br />

Unrestricted, for <strong>Authority</strong>’s purposes $29,362,535 $28,038,071<br />

Total net assets $339,656,332 $327,276,936<br />

Total Liabilities and Net Assets $1,274,768,135 $1,325,346,518<br />

NOTES:<br />

1 For more detailed information and disclosure the Basic Financial <strong>State</strong>ments and Supplemental Information for the Year Ended June 30, <strong>2011</strong>, Including Requirements of the Single Audit Act, and<br />

Independent Auditor's <strong>Report</strong>s are available at: http://www.destatehousing.com/information/fnancial.shtml.<br />

2 Other current assets include the current portion of accrued interest , other receivables, prepaid expenses, and deferred bond issuance costs.<br />

3 Other non-current assets include the non-current portion of accrued interest, other receivables, and deferred bond issuance costs.<br />

4 Accounts payable and other current liabilities include current portion of accrued arbitrage payable, compensated absences payable, nonrefundable deferred commitment fees, and notes payable.<br />

5 Other non-current liabilities include the non-current portion of accrued arbitrage payable, compensated absences payable, nonrefundable deferred commitment fees, and notes payable.<br />

6 Restricted net assets include amounts restricted by federal and state program requirements, and bond covenants.<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong> | 11

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Mortgage Lenders & Servicers<br />

MORTGAGE LENDERS AND SERVICERS<br />

IN DSHA’S FISCAL <strong>2011</strong><br />

SINGLE FAMILY MORTGAGE REVENUE BOND PROGRAM<br />

Allied Mortgage Group, Inc.<br />

American Home Bank, N.A.<br />

Artisans’ Bank<br />

Atlantic Home Loans<br />

Aurora Loan Services<br />

Bank of America, N.A.<br />

Cenlar Federal Savings Bank<br />

Chase Home Finance<br />

Citi Mortgage, Inc.<br />

Citizens Mortgage<br />

<strong>Delaware</strong> National Bank<br />

Dovenmuehle Mortgage, Inc.<br />

Embrace Home Loans<br />

EverHome Mortgage, a Division of EverBank<br />

Fairway Independent Mortgage Corporation<br />

Gilpin Financial Services<br />

GMAC Mortgage Corporation<br />

Huntington Mortgage Company<br />

Lincoln Mortgage<br />

Mason Dixon Funding, Inc.<br />

MetLife Home Loans<br />

Mortgage America<br />

Mortgage Network, Inc.<br />

National City Mortgage Corporation<br />

NVR Mortgage Finance, Inc.<br />

PNC Bank National Association<br />

Prosperity Mortgage<br />

Sovereign Bank<br />

Sun Trust Mortgage, Inc.<br />

Superior Home Mortgage Corporation<br />

Trident Mortgage Company<br />

U.S. Bank Home Mortgage<br />

Wachovia Mortgage<br />

Weichert Financial Services<br />

Wells Fargo Home Mortgage, Inc.<br />

West Star Mortgage, Inc.<br />

Wilmington Mortgage Services<br />

Wilmington Savings Fund Society, FSB<br />

Wilmington Trust Company<br />

12 | <strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

DELAWARE STATE HOUSING AUTHORITY<br />

LEGAL AND FINANCIAL PARTICIPATION<br />

AS OF JUNE 30, <strong>2011</strong><br />

GENERAL COUNSEL<br />

Drinker, Biddle & Reath<br />

Wilmington, <strong>Delaware</strong><br />

BOND COUNSEL<br />

Greenberg Traurig<br />

Wilmington, <strong>Delaware</strong><br />

PAYING AGENTS<br />

Wilmington Trust Company<br />

Wilmington, <strong>Delaware</strong><br />

MORTGAGE POOL UNDERWRITERS<br />

Radian Guaranty, Inc.<br />

Philadelphia, Pennsylvania<br />

United Guaranty, Inc.<br />

Greensboro, North Carolina<br />

MANAGING UNDERWRITERS<br />

George K. Baum & Company<br />

Denver, Colorado<br />

CO-MANAGING UNDERWRITERS<br />

Bank of America Merrill Lynch<br />

New York, New York<br />

J.P. Morgan Securities<br />

New York, New York<br />

Barclays Capital<br />

New York, New York<br />

FINANCIAL ADVISOR<br />

CSG Advisors, Inc.<br />

Alpharetta, Georgia

DSHA Team Members<br />

Carl Anderson<br />

Denise Arnott<br />

Ernest Baynum<br />

Enid Beltran<br />

Anas Ben Addi<br />

Pebbles Blanchard<br />

Lynda Blythe<br />

Calvin Bonniwell<br />

Daniel Brennan<br />

Kimberly Brockenbrough<br />

Julie Brown<br />

Kathleen Brown<br />

Gail Brown<br />

Michelle Burgess<br />

Jackie Burton<br />

Willia Carey<br />

Cassandra Claiborne<br />

Richard Clegg<br />

John Conley<br />

Patricia Conley<br />

Amber Cooper<br />

Douglas Croft<br />

Sharon Currey<br />

Carey Daniels<br />

Alice Davis<br />

Cynthia Deakyne<br />

Devon Degyansky<br />

Christina Dirksen<br />

Debra Doughty<br />

Kimberly Edwards<br />

Susan Eliason<br />

Keanna Faison<br />

Donnie Fannin<br />

Lonnie Field<br />

Cynthia Fletcher<br />

Karen Flowers<br />

Corinda Floyd<br />

Walter Floyd<br />

Arlene Fordham<br />

Elton Frazier<br />

Kevin Freese<br />

Lori Fretz<br />

Corinna Fritsch<br />

Steven Gherke<br />

Marlena Gibson<br />

Shannon Griffith<br />

Doris Hall<br />

Joseph Haney<br />

Eric Hart<br />

Mabel Hayes<br />

Gary Hecker<br />

Matthew Heckles<br />

Nancy Hopkins<br />

Karen Horton<br />

Maritza Irizarry<br />

Everett Jennings<br />

Jerry Jones<br />

Kyle Jones-Bey<br />

Cynthia Karnai-Crossan<br />

Rebecca Kauffman<br />

Shannon Keenan<br />

Stephanie Killen<br />

Christine Kinnikin<br />

Gary Kinnikin<br />

Susan Knight<br />

Raymond Kress<br />

Emily Lanter<br />

Michele Leech<br />

Cheryl Lehman<br />

Lee Ann Lepore<br />

Melinda Lewis<br />

Olga Lezcano<br />

James Loescher<br />

Andrew Lorenz<br />

Stacey Lurry<br />

Elizabeth McCloskey<br />

Katherine McCoy<br />

Jacquelin McIntyre<br />

Timothy McLaughlin<br />

Angel Mercado<br />

Michael Miles<br />

Mary Miles<br />

Annette Miller<br />

Valerie Miller<br />

Darlene Milligan-Ramsey<br />

Renee Mills<br />

Audrey Mills<br />

Donna Mitchell<br />

Kathy Morris<br />

Demarsh Murchison<br />

Nancy Nicholas<br />

Vantrina Nock<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

Katrice Obidike<br />

Carol Orzechowski<br />

Robbie Pace<br />

Rita Paige<br />

Loretta Parkhill<br />

Walter Passwaters, II<br />

Mary Louise Paul<br />

Penny Pierson<br />

LaTanya Pratt<br />

Javier Ramirez<br />

Regina Reid<br />

Karen Ressel<br />

Jennifer Rineer<br />

Theodore Robbins<br />

Arlene Robertson<br />

Tara Rogers<br />

Brian Rossello<br />

John Roth<br />

William Salamone<br />

Maynard Scott<br />

Lisa Semans<br />

Matthew Shaw<br />

Virginia Sheridan<br />

Lee Sheridan<br />

Joan Smith<br />

Pamela Spencer<br />

Wanda Spiering<br />

Jody Starke<br />

Roxann Stayton<br />

Frederick Strauss<br />

John Tilghman<br />

Corinne Todd-Grieve<br />

Sharon Truitt<br />

Jeree Turlington<br />

Paula Voshell<br />

Vanessa Walker<br />

Deborah Walker<br />

Richard Waters<br />

Evelyn Welsh<br />

Christopher Whaley<br />

Deborah Whidden<br />

Deane Willey<br />

Tabu Wilson<br />

Beverly Young<br />

Charles Young<br />

<strong>Delaware</strong> <strong>State</strong> <strong>Housing</strong> <strong>Authority</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

13

DELAWARE STATE HOUSING AUTHORITY<br />

18 THE GREEN • DOVER, DE 19901<br />

1-888-363-8808<br />

WWW.DESTATEHOUSING.COM<br />

DOC:#10-08-01-11-10-01<br />

Persons with impairments that prevent reading this document may receive appropriate assistance by contacting<br />

DSHA at (302) 739-4263 or 888-363-8808 or TDD (302) 739-7428 or by directing a letter to the attention of Community Relations, 18 The Green, Dover, <strong>Delaware</strong> 19901.