Lottery Winners' Handbook - New York Lottery - New York State

Lottery Winners' Handbook - New York Lottery - New York State

Lottery Winners' Handbook - New York Lottery - New York State

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

U R L O T T E R Y PP R I Z E T A X I S S U E S S E E K I N G A D V I C E P U B B L II C I T Y F U T U R E C O N S I D E R A T I

Winners’ <strong>Handbook</strong><br />

Introduction<br />

Congratulations! You are a <strong>New</strong> <strong>York</strong> <strong>Lottery</strong> jackpot winner,<br />

a prize coveted by millions of players who share the same<br />

love for the games that you do.<br />

You now have the fi nancial capability to make diff erent choices<br />

about the direction you want your life to take. You have won the<br />

chance to translate dreams into reality in a way that may not have<br />

been possible before. You join a long line of players with the good<br />

fortune of winning a big <strong>New</strong> <strong>York</strong> <strong>Lottery</strong> jackpot prize.<br />

Winning that big jackpot brings big responsibilities for you and your family. With proper, competent and<br />

expert advice in dealing with these issues, you can open doors to so many wonderful new opportunities.<br />

This booklet focuses on some of the concerns you may have. It seeks to defi ne, in general terms, the areas<br />

where you might be best served by seeking competent and qualifi ed advice.<br />

Keep in mind professional advisors will give their opinions, but the fi nal decisions rest with you.<br />

We recommend you speak with more than one advisor before forming your judgments.<br />

1<br />

Rev 5/2010

Winners’ <strong>Handbook</strong><br />

Your <strong>Lottery</strong> Prize<br />

What exactly is my prize?<br />

If you won a Lotto, Mega Millions or Powerball jackpot, the prize you have won (or will ll share) h is a multi-million l ll<br />

dollar jackpot prize. You will be given more information when you claim your prize.<br />

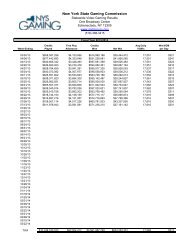

Lotto: Your Lotto jackpot prize will be paid according to the choice you made at the time you purchased your<br />

ticket. Lotto jackpot prizes will be paid in one lump sum cash payment equal to the current cash value of the<br />

advertised jackpot or in 26 annual payments over 25 years. Lotto jackpot payments are graduated payments,<br />

increasing in value each year.<br />

Mega Millions: Mega Millions will be paid according to the choice you made when purchasing your ticket and<br />

will be paid in one lump sum cash payment equal to the current cash value of the advertised jackpot or in 26<br />

annual payments over 25 years. Mega Millions jackpot payments are paid in equal payments annually.<br />

Powerball: You will have 60 days from the date you become entitled to a Powerball jackpot prize to decide if<br />

you want to receive your jackpot prize in one lump sum cash payment. Winners who choose the annual payments<br />

option in Powerball will be paid in 30 payments over 29 years. Powerball annual jackpot payments are<br />

graduated payments, increasing in value each year.<br />

Sweet Million: A Sweet Million jackpot prize of $1,000,000, will be paid in one cash payment of $1,000,000<br />

(before applicable taxes).<br />

Instant Games: The payment methods of Instant Game jackpot prizes vary greatly. Some games off er a single<br />

payment of the jackpot prize while others may be paid annually or quarterly over several years or for the life<br />

of the prize winner. For each instant game, prizes are paid in accordance with the game’s rules. Please refer to<br />

our website www.nylottery.org to see how a particular instant game jackpot prize is paid.<br />

When will I receive my prize money?<br />

If you are to receive annual payments, your annual payments will continue each year around the anniversary<br />

of your win. Quarterly payments are paid in February, May, August and November of each year. For your<br />

protection, the <strong>Lottery</strong> requires all prize payments to be electronically transferred into your account at your<br />

fi nancial institution. An “Authorization for Deposit” form will be provided to you at the time you claim your<br />

prize. Once you have completed this form and returned it to the <strong>Lottery</strong>’s Prize Payment Offi ce, your lump sum<br />

payment or initial installment payment will be transferred to your account after your media announcement.<br />

2

You will receive a Certifi cate of Term Payment<br />

which outlines your specifi c payment plan<br />

along with a payment schedule at that time.<br />

How much will my payment be?<br />

The payment will vary depending on the<br />

game. The money that will be available to you almost immediately is the amount of the initial installment<br />

payment or lump sum payment less applicable taxes.<br />

I might like to share my prize with my family or friends. Does that aff ect how I claim my prize?<br />

We recommend that you entrust your winning ticket to the <strong>Lottery</strong> immediately by submitting your prize<br />

claim in the individual or group capacity you think best fi ts your needs. Then, if you have any doubts or<br />

questions, consult your own advisors before the fi rst prize installment or lump sum payment is paid to you. If<br />

you decide that you wish to change your claim from an individual claim to a group claim, or vice-versa, we will<br />

allow you to withdraw your original claim and submit a new one – as long as you do so before the fi rst prize<br />

installment or lump sum payment has been made. After the fi rst prize installment or lump sum payment has<br />

been made, the prize is considered to have been legally awarded and the <strong>Lottery</strong> cannot change the identity<br />

of the winner without court approval. If there is no plan to share the prize, it should be claimed individually.<br />

However, some winners anticipate sharing the prize with relatives or other persons, when they have purchased<br />

the winning ticket together and agreed to share any prizes they win. In this case, it is possible for one<br />

person to claim the prize individually and then distribute shares to the other members of the group, but such<br />

an approach means that the <strong>Lottery</strong> will report the entire prize and all the withholding taxes in the name of<br />

the individual receiving the payments. That can cause problems for all concerned when annual tax returns are<br />

due because it will not be clear which members of the group are responsible for reporting taxable income and<br />

which members are entitled to credit for the withholding taxes.<br />

The <strong>Lottery</strong> can pay a group of 2 to 10 people individually and provide each person with an IRS form W-2G,<br />

<strong>State</strong>ment For Certain Gambling Winnings, for their portions of the prize.<br />

When the prize is to be shared by a group of more than 10 people, the best approach is for the group to create<br />

a formal organization such as a trust, a partnership, or a corporation. If an organization claims a prize, the<br />

group must obtain a separate taxpayer identifi cation number (called a “Federal Employer Identifi cation Number”<br />

or “FEIN”) from the Internal Revenue Service and submit that number with the prize claim so that it can<br />

be used by the <strong>Lottery</strong> to report the taxes withheld. When the organization receives the lottery prize installments,<br />

the <strong>Lottery</strong> pays the prize in the name of the trust, partnership or organization to a group representa-<br />

3

Winners’ <strong>Handbook</strong><br />

tive who in turn is responsible for paying each member of the group their portions<br />

of the prize and providing each member with a Form W-2G for tax reporting purposes. .<br />

The decision on whether to claim as an individual or as a group is important<br />

because of the income and tax accounting implications and because once a prize has been awarded the<br />

<strong>Lottery</strong> cannot change the identity of the prize winner without a court order. If there is any possibility of<br />

sharing the prize, it is recommended that you seek advice from an attorney, an accountant, or both before<br />

fi nalizing your prize claim.<br />

Any questions you or your advisors have about this issue should be directed to the <strong>Lottery</strong>’s Prize<br />

Payment Offi ce.<br />

Can a lien be fi led against my winnings?<br />

Judgment liens, tax levies or off sets may be fi led against your prize winnings by creditors or government<br />

agencies for payment of your debts. Any such off sets will be deducted from your prize payments and the<br />

remainder, if any, will be sent to you. The lien, levy or off set may continue from year to year until the debt<br />

is paid in full.<br />

Tax Issues<br />

Do I have to pay taxes on my winnings?<br />

Under Federal law, the <strong>Lottery</strong> is required to withhold federal and <strong>New</strong> <strong>York</strong> state income taxes at the applicable<br />

rates from each jackpot prize payment. In addition, the <strong>Lottery</strong> is also required to withhold <strong>New</strong> <strong>York</strong> City<br />

or City of Yonkers income taxes when applicable.<br />

You should be aware that the tax the <strong>Lottery</strong> is required to withhold may not satisfy your entire tax liability.<br />

Exactly how much your income tax will be each year depends on such factors as your family size, your fi nancial<br />

resources, and other income which determine what you as a private citizen pay in income taxes.<br />

Tax laws are extremely complicated and are continually changing. The <strong>Lottery</strong> recommends that you seek<br />

advice in this area from a professional tax accountant, attorney, or fi nancial planner. These professionals can<br />

create trusts for your assets which can provide future fi nancial independence for family members and children.<br />

You may want to consult a tax professional shortly after your media announcement to ensure you are<br />

prepared when fi ling your tax return. For further information concerning tax responsibilities see Publication<br />

140-W at www.nystax.gov.<br />

4

Seeking Advice<br />

What kind of advice should I seek?<br />

You need trusted and competent advice in many areas: fi nancial planning, legal, tax, and investment to name<br />

a few. Be sure the advisor has professional expertise in the areas of service you need. Ask for references from<br />

the advisors as well as recommendations from people you know.<br />

There are many avenues of investment, and to a novice investor they can all appear confusing. A brokerage<br />

company is licensed and can provide diversifi ed investment advice on stocks, bonds, or mutual funds. Banks<br />

and brokerage houses also off er a wide range of fi nancial services, among them the establishment of trust<br />

and fi nancial accounts tailored to your specifi c needs.<br />

Financial institutions can help prepare a detailed analysis of your future goals and income requirements and<br />

assist you in developing a long-term investment plan.<br />

Be aware that you may become the target of unscrupulous people looking to exploit your good fortune.<br />

These people could be lawyers, accountants or even relatives. The best fi rst step is to talk to someone you<br />

have known for a long time, someone you trust and know, who will have your best interests in mind. It could<br />

be a trusted friend or close relative, perhaps a religious leader, or anyone who can recommend a lawyer or an<br />

accountant or an advisor who you can trust.<br />

Publicity<br />

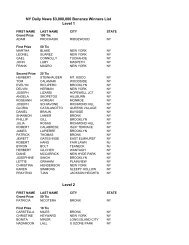

Will the fact that I’ve won be announced publicly?<br />

<strong>Lottery</strong> policy has always been to release only the name and city of residence of each winner to the news<br />

media. Since the <strong>Lottery</strong> is a government agency and <strong>Lottery</strong> prizes are public funds, it is our responsibility to<br />

inform all of our players just like you, of <strong>Lottery</strong> winners and prizes. Therefore, we must require jackpot winners<br />

to participate in a media event arranged by the <strong>Lottery</strong>. We owe it to everyone to disclose the names of<br />

all winners to protect the integrity of the <strong>Lottery</strong>.<br />

For your protection, the <strong>Lottery</strong> maintains a policy of not releasing personal information such as street addresses<br />

or phone numbers to anyone. That’s up to you. Even so, once the media fi nd out the name and city/<br />

borough of residence of a winner, they are active in seeking out the details regarding the identity of the jackpot<br />

winner. That’s because you are now a celebrity of sorts and reports of large winners are ‘newsworthy’ and<br />

5

Winners’ <strong>Handbook</strong><br />

usually good fun news stories.<br />

Viewers, listeners and readers like to learn more about you and become<br />

confi dent that they have a chance to win a prize too. A media event is<br />

advantageous to you as a winner because it allows you to answer all reporters’ questions at one time.<br />

What can I expect at a news conference/media event?<br />

There is bound to be media interest in you because you have beaten long odds to become a <strong>Lottery</strong><br />

millionaire.<br />

The questions you can expect at a news conference include: How did you choose your numbers or ticket?<br />

What do you plan to do with the money? How did you fi nd out that you were a winner? Where did you buy<br />

your ticket? What was your fi rst reaction? What is your occupation? Will you continue to work? Do you have<br />

a family?<br />

<strong>Lottery</strong> staff members always attend our news conferences and assist you in any way you would like. Our advice<br />

is to get yourself a scrapbook, a tape recorder, or a camcorder and preserve the memories of this exciting<br />

time of your life. The <strong>Lottery</strong> may be able to assist you by providing copies of newspaper, radio and television<br />

reports, so ask us for them if you wish.<br />

Future Considerations<br />

Can I assign my future payments to someone else, such as a bank or another individual?<br />

Only after receipt of an appropriate court order is the <strong>Lottery</strong> allowed to pay your payments to any<br />

other individual or entity.<br />

If I want to receive a lump sum payment instead of waiting 20 years or more for my entire<br />

prize, can I arrange for it?<br />

The <strong>Lottery</strong> may off er you the option of a lump sum payment at the time of claiming your prize. Once you<br />

have chosen to receive your prize through a lump sum payment or annually over a period of time, the <strong>Lottery</strong><br />

cannot change your selection. If you choose to receive your prize annually over a period of time, there may<br />

be some investors or companies who would be interested in arranging a transfer of your right to future prize<br />

6

installments in exchange for paying you a lump sum.<br />

Be aware that companies may contact you off ering<br />

to purchase some or all of your installment payments<br />

for a fee. Please know that the <strong>New</strong> <strong>York</strong> <strong>Lottery</strong> does not endorse any of<br />

these “buy out” companies or disclose personal information about prize winners. <strong>New</strong> <strong>York</strong> <strong>State</strong><br />

Law requires that you seek independent fi nancial and legal advice before making any payment<br />

assignment decision.<br />

Since the <strong>Lottery</strong> can pay the future installments to a person or entity other than you only when authorized<br />

by a court, the amount of any lump sum you receive may be reduced by the cost of obtaining the court order.<br />

You should also be aware that receiving a lump sum payment may have adverse legal and tax consequences.<br />

What should I do if there are any changes to my address, etc?<br />

You should always keep the <strong>Lottery</strong> informed of your current address. With your fi rst payment, you will receive<br />

a form known as a “Change of Winner Status” Form. During the course of your prize payment of annual or<br />

quarterly installments, if your address, name or U.S. residency status should change, please notify the <strong>Lottery</strong><br />

Prize Payment Offi ce immediately, using the “Change of Winner Status Form” provided by the <strong>Lottery</strong>. For your<br />

convenience, we will automatically send a copy of this form to you at the time of each payment.<br />

If you have any questions regarding your prize payment installments, please feel free to contact the <strong>Lottery</strong><br />

Prize Payment Offi ce at prizepayments@lottery.state.ny.us or the phone number listed on the next page of this<br />

manual.<br />

What happens if I die within the prize payment period?<br />

In the event of your death, any remaining payments will be paid to your estate. Since the remaining installments<br />

due on your prize will be paid to your estate, the estate representative should provide written notifi cation<br />

to the <strong>Lottery</strong> in the event of your death. A certifi ed copy of your Death Certifi cate and a certifi ed copy of<br />

a Certifi cate of Letters Testamentary or a Certifi cate of Letters of Administration must be submitted along with<br />

the notifi cation of your death.<br />

You are urged to execute a Will and to name an estate representative. You now have an important new asset<br />

– your <strong>Lottery</strong> prize. Your estate now includes the unpaid portion of your prize in addition to all your other<br />

assets. That means that it is important for you to have a Will. If you do have one, you should review it to make<br />

sure that it expresses how you want the remainder of your payments to be distributed after your death.<br />

7

Winners’ <strong>Handbook</strong><br />

If you die without a Will, the distribution of your assets will be made according to law, and it is possible that<br />

the distribution might not be in accord with your actual wishes. You are urged, therefore, to execute a Will<br />

refl ecting your wishes as to how you want your estate distributed.<br />

Can my estate receive all the remaining prize payments at once?<br />

Under <strong>Lottery</strong> regulations, prize payments are not accelerated upon the winner’s death. Payments will continue<br />

to be made to your estate until the total amount of the prize is paid unless a court having jurisdiction over<br />

your estate orders the <strong>Lottery</strong> to do otherwise, such as making payments directly to the estate’s benefi ciaries.<br />

What about taxes after I die?<br />

It is important to consult with an attorney about the implications your <strong>Lottery</strong> prize will have on estate and inheritance<br />

taxes in the event of death. It is a complex situation, and how you can handle it will depend a great<br />

deal on your personal circumstances. Federal and <strong>State</strong> estate and inheritance tax laws diff er in some important<br />

respects. However, in one way they are the same: Upon death, all assets are valued at their present value<br />

at the time of death and applicable taxes may be assessed on them.<br />

A lottery prize is an asset. Even though the income from the lottery prize may not be received all at once, the<br />

prize has a present value. Along with all other assets, the present value of the lottery prize is determined by<br />

considering the total amount of the prize which has not yet been received and the interest rates currently<br />

prevailing in the marketplace. This information can be provided to your attorney or estate representative by<br />

contacting the <strong>Lottery</strong>’s Prize Payment Offi ce.<br />

To avoid any tax problems, it is best to plan ahead for the estate taxes that may be due on your prize.<br />

Who do I call if I have any questions?<br />

The <strong>Lottery</strong> does not off er fi nancial or legal advice, but will be happy to provide you with any information<br />

we can.<br />

Prize Payment Offi ce: (518) 388-3370 prizepayments@lottery.state.ny.us<br />

General Counsel’s Offi ce: (518) 388-3408<br />

Press and Community Relations Offi ce: (518) 388-3415<br />

NYS <strong>State</strong> Department of Taxation & Finance: www.nystax.gov<br />

Internal Revenue Service: www.irs.gov<br />

8