Geraldton Port Authority - Parliament of Western Australia

Geraldton Port Authority - Parliament of Western Australia

Geraldton Port Authority - Parliament of Western Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

1.9 Property, plant and equipment<br />

36<br />

Notes to and forming part <strong>of</strong> the Financial<br />

Statements for the year ended 30 June 2008<br />

Property, plant and equipment purchased or constructed for port operations is recorded at the cost <strong>of</strong> acquisition less<br />

accumulated depreciation and impairment losses. This includes incidental costs directly attributable to the acquisition.<br />

Property, plant and equipment, excluding freehold land, are depreciated at rates based on the expected useful lives using the<br />

straight line method. Depreciation on assets under construction commences when the assets are ready for use. Depreciation<br />

is charged to the income statement.<br />

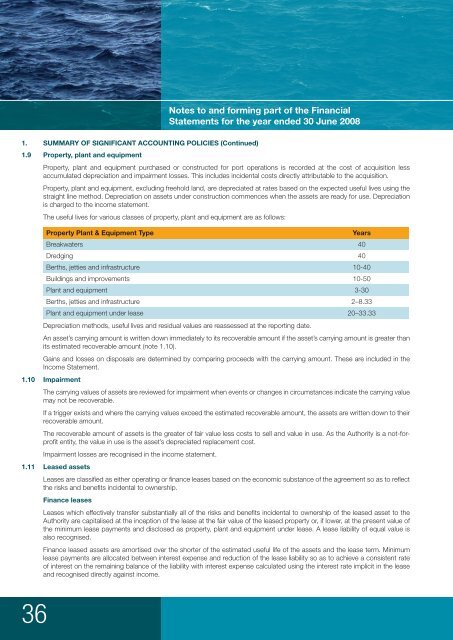

The useful lives for various classes <strong>of</strong> property, plant and equipment are as follows:<br />

Property Plant & Equipment Type Years<br />

Breakwaters 40<br />

Dredging 40<br />

Berths, jetties and infrastructure 10-40<br />

Buildings and improvements 10-50<br />

Plant and equipment 3-30<br />

Berths, jetties and infrastructure 2–8.33<br />

Plant and equipment under lease<br />

Depreciation methods, useful lives and residual values are reassessed at the reporting date.<br />

20–33.33<br />

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than<br />

its estimated recoverable amount (note 1.10).<br />

Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These are included in the<br />

Income Statement.<br />

1.10 Impairment<br />

The carrying values <strong>of</strong> assets are reviewed for impairment when events or changes in circumstances indicate the carrying value<br />

may not be recoverable.<br />

If a trigger exists and where the carrying values exceed the estimated recoverable amount, the assets are written down to their<br />

recoverable amount.<br />

The recoverable amount <strong>of</strong> assets is the greater <strong>of</strong> fair value less costs to sell and value in use. As the <strong>Authority</strong> is a not-forpr<strong>of</strong>i<br />

t entity, the value in use is the asset’s depreciated replacement cost.<br />

Impairment losses are recognised in the income statement.<br />

1.11 Leased assets<br />

Leases are classifi ed as either operating or fi nance leases based on the economic substance <strong>of</strong> the agreement so as to refl ect<br />

the risks and benefi ts incidental to ownership.<br />

Finance leases<br />

Leases which effectively transfer substantially all <strong>of</strong> the risks and benefi ts incidental to ownership <strong>of</strong> the leased asset to the<br />

<strong>Authority</strong> are capitalised at the inception <strong>of</strong> the lease at the fair value <strong>of</strong> the leased property or, if lower, at the present value <strong>of</strong><br />

the minimum lease payments and disclosed as property, plant and equipment under lease. A lease liability <strong>of</strong> equal value is<br />

also recognised.<br />

Finance leased assets are amortised over the shorter <strong>of</strong> the estimated useful life <strong>of</strong> the assets and the lease term. Minimum<br />

lease payments are allocated between interest expense and reduction <strong>of</strong> the lease liability so as to achieve a consistent rate<br />

<strong>of</strong> interest on the remaining balance <strong>of</strong> the liability with interest expense calculated using the interest rate implicit in the lease<br />

and recognised directly against income.