Hengdeli Holdings Limited - The Standard Finance

Hengdeli Holdings Limited - The Standard Finance

Hengdeli Holdings Limited - The Standard Finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

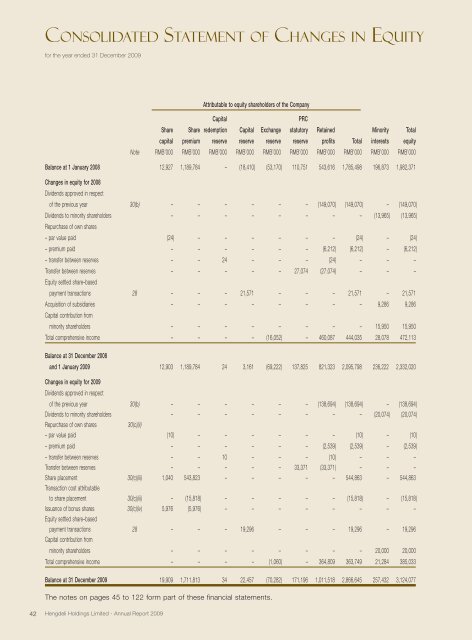

Consolidated statement of Changes in equity<br />

for the year ended 31 December 2009<br />

42 <strong>Hengdeli</strong> <strong>Holdings</strong> <strong>Limited</strong> - Annual Report 2009<br />

Attributable to equity shareholders of the Company<br />

Capital PRC<br />

Share Share redemption Capital Exchange statutory Retained Minority Total<br />

capital premium reserve reserve reserve reserve profits Total interests equity<br />

Note RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000<br />

Balance at 1 January 2008 12,927 1,189,784 – (18,410 ) (53,170 ) 110,751 543,616 1,785,498 196,873 1,982,371<br />

Changes in equity for 2008<br />

Dividends approved in respect<br />

of the previous year 30(b) – – – – – – (149,070 ) (149,070 ) – (149,070 )<br />

Dividends to minority shareholders<br />

Repurchase of own shares<br />

– – – – – – – – (13,965 ) (13,965 )<br />

– par value paid (24 ) – – – – – – (24 ) – (24 )<br />

– premium paid – – – – – – (6,212 ) (6,212 ) – (6,212 )<br />

– transfer between reserves – – 24 – – – (24 ) – – –<br />

Transfer between reserves<br />

Equity settled share–based<br />

– – – – – 27,074 (27,074 ) – – –<br />

payment transactions 28 – – – 21,571 – – – 21,571 – 21,571<br />

Acquisition of subsidiaries<br />

Capital contribution from<br />

– – – – – – – – 9,286 9,286<br />

minority shareholders – – – – – – – – 15,950 15,950<br />

Total comprehensive income – – – – (16,052 ) – 460,087 444,035 28,078 472,113<br />

Balance at 31 December 2008<br />

and 1 January 2009 12,903 1,189,784 24 3,161 (69,222 ) 137,825 821,323 2,095,798 236,222 2,332,020<br />

Changes in equity for 2009<br />

Dividends approved in respect<br />

of the previous year 30(b) – – – – – – (138,694 ) (138,694 ) – (138,694 )<br />

Dividends to minority shareholders – – – – – – – – (20,074 ) (20,074 )<br />

Repurchase of own shares 30(c)(ii)<br />

– par value paid (10 ) – – – – – – (10 ) – (10 )<br />

– premium paid – – – – – – (2,539 ) (2,539 ) – (2,539 )<br />

– transfer between reserves – – 10 – – – (10 ) – – –<br />

Transfer between reserves – – – – – 33,371 (33,371 ) – – –<br />

Share placement<br />

Transaction cost attributable<br />

30(c)(iii) 1,040 543,823 – – – – – 544,863 – 544,863<br />

to share placement 30(c)(iii) – (15,818 ) – – – – – (15,818 ) – (15,818 )<br />

Issuance of bonus shares<br />

Equity settled share–based<br />

30(c)(iv) 5,976 (5,976 ) – – – – – – – –<br />

payment transactions<br />

Capital contribution from<br />

28 – – – 19,296 – – – 19,296 – 19,296<br />

minority shareholders – – – – – – – – 20,000 20,000<br />

Total comprehensive income – – – – (1,060 ) – 364,809 363,749 21,284 385,033<br />

Balance at 31 December 2009 19,909 1,711,813 34 22,457 (70,282 ) 171,196 1,011,518 2,866,645 257,432 3,124,077<br />

<strong>The</strong> notes on pages 45 to 122 form part of these financial statements.