to renewables than meets the eye - Channel Islands Stock Exchange

to renewables than meets the eye - Channel Islands Stock Exchange

to renewables than meets the eye - Channel Islands Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24 BULLETIN BOARD ISSUE 21 SPRING 2012<br />

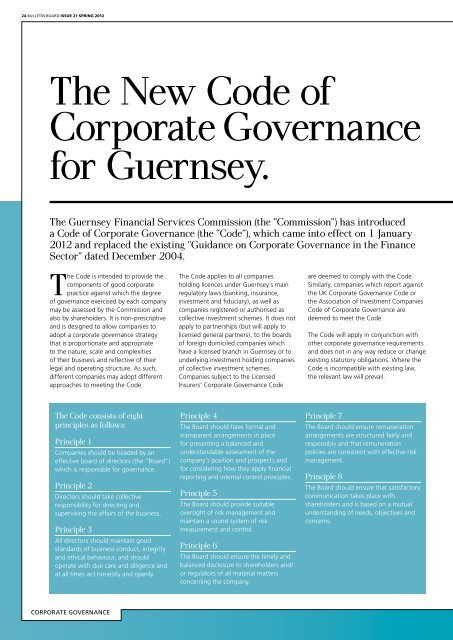

<strong>the</strong> New Code of<br />

Corporate Governance<br />

for Guernsey.<br />

<strong>the</strong> Guernsey Financial Services Commission (<strong>the</strong> “Commission”) has introduced<br />

a Code of Corporate Governance (<strong>the</strong> “Code”), which came in<strong>to</strong> effect on 1 January<br />

2012 and replaced <strong>the</strong> existing “Guidance on Corporate Governance in <strong>the</strong> Finance<br />

Sec<strong>to</strong>r” dated december 2004.<br />

<strong>the</strong> Code is intended <strong>to</strong> provide <strong>the</strong><br />

components of good corporate<br />

practice against which <strong>the</strong> degree<br />

of governance exercised by each company<br />

may be assessed by <strong>the</strong> Commission and<br />

also by shareholders. It is non-prescriptive<br />

and is designed <strong>to</strong> allow companies <strong>to</strong><br />

adopt a corporate governance strategy<br />

that is proportionate and appropriate<br />

<strong>to</strong> <strong>the</strong> nature, scale and complexities<br />

of <strong>the</strong>ir business and reflective of <strong>the</strong>ir<br />

legal and operating structure. As such,<br />

different companies may adopt different<br />

approaches <strong>to</strong> meeting <strong>the</strong> Code.<br />

<strong>the</strong> Code consists of eight<br />

principles as follows:<br />

principle 1<br />

Companies should be headed by an<br />

effective board of direc<strong>to</strong>rs (<strong>the</strong> “Board”)<br />

which is responsible for governance.<br />

principle 2<br />

Direc<strong>to</strong>rs should take collective<br />

responsibility for directing and<br />

supervising <strong>the</strong> affairs of <strong>the</strong> business.<br />

principle 3<br />

All direc<strong>to</strong>rs should maintain good<br />

standards of business conduct, integrity<br />

and ethical behaviour, and should<br />

operate with due care and diligence and<br />

at all times act honestly and openly.<br />

CORpORATE GOVERNANCE<br />

The Code applies <strong>to</strong> all companies<br />

holding licences under Guernsey’s main<br />

regula<strong>to</strong>ry laws (banking, insurance,<br />

investment and fiduciary), as well as<br />

companies registered or authorised as<br />

collective investment schemes. It does not<br />

apply <strong>to</strong> partnerships (but will apply <strong>to</strong><br />

licensed general partners), <strong>to</strong> <strong>the</strong> boards<br />

of foreign domiciled companies which<br />

have a licensed branch in Guernsey or <strong>to</strong><br />

underlying investment holding companies<br />

of collective investment schemes.<br />

Companies subject <strong>to</strong> <strong>the</strong> Licensed<br />

Insurers’ Corporate Governance Code<br />

principle 4<br />

The Board should have formal and<br />

transparent arrangements in place<br />

for presenting a balanced and<br />

understandable assessment of <strong>the</strong><br />

company’s position and prospects and<br />

for considering how <strong>the</strong>y apply financial<br />

reporting and internal control principles.<br />

principle 5<br />

The Board should provide suitable<br />

oversight of risk management and<br />

maintain a sound system of risk<br />

measurement and control.<br />

principle 6<br />

The Board should ensure <strong>the</strong> timely and<br />

balanced disclosure <strong>to</strong> shareholders and/<br />

or regula<strong>to</strong>rs of all material matters<br />

concerning <strong>the</strong> company.<br />

are deemed <strong>to</strong> comply with <strong>the</strong> Code.<br />

Similarly, companies which report against<br />

<strong>the</strong> UK Corporate Governance Code or<br />

<strong>the</strong> Association of Investment Companies<br />

Code of Corporate Governance are<br />

deemed <strong>to</strong> meet <strong>the</strong> Code.<br />

The Code will apply in conjunction with<br />

o<strong>the</strong>r corporate governance requirements<br />

and does not in any way reduce or change<br />

existing statu<strong>to</strong>ry obligations. Where <strong>the</strong><br />

Code is incompatible with existing law,<br />

<strong>the</strong> relevant law will prevail.<br />

principle 7<br />

The Board should ensure remuneration<br />

arrangements are structured fairly and<br />

responsibly and that remuneration<br />

policies are consistent with effective risk<br />

management.<br />

principle 8<br />

The Board should ensure that satisfac<strong>to</strong>ry<br />

communication takes place with<br />

shareholders and is based on a mutual<br />

understanding of needs, objectives and<br />

concerns.