Wealth Manag - Henley & Partners

Wealth Manag - Henley & Partners

Wealth Manag - Henley & Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

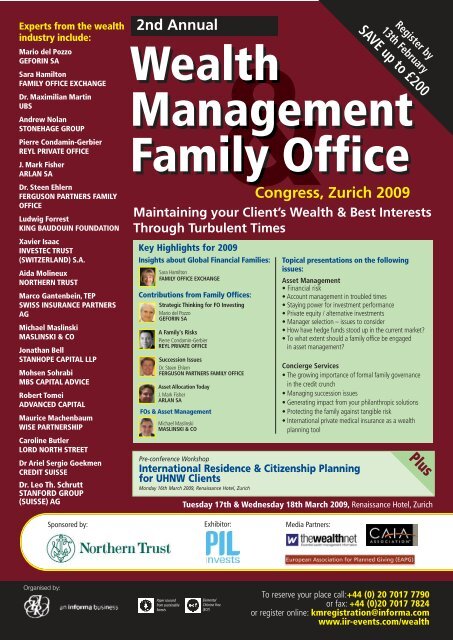

Experts from the wealth<br />

industry include:<br />

Mario del Pozzo<br />

GEFORIN SA<br />

Sara Hamilton<br />

FAMILY OFFICE EXCHANGE<br />

Dr. Maximilian Martin<br />

UBS<br />

Andrew Nolan<br />

STONEHAGE GROUP<br />

Pierre Condamin-Gerbier<br />

REYL PRIVATE OFFICE<br />

J. Mark Fisher<br />

ARLAN SA<br />

Dr. Steen Ehlern<br />

FERGUSON PARTNERS FAMILY<br />

OFFICE<br />

Ludwig Forrest<br />

KING BAUDOUIN FOUNDATION<br />

Xavier Isaac<br />

INVESTEC TRUST<br />

(SWITZERLAND) S.A.<br />

Aida Molineux<br />

NORTHERN TRUST<br />

Marco Gantenbein, TEP<br />

SWISS INSURANCE PARTNERS<br />

AG<br />

Michael Maslinski<br />

MASLINSKI & CO<br />

Jonathan Bell<br />

STANHOPE CAPITAL LLP<br />

Mohsen Sohrabi<br />

MBS CAPITAL ADVICE<br />

Robert Tomei<br />

ADVANCED CAPITAL<br />

Maurice Machenbaum<br />

WISE PARTNERSHIP<br />

Caroline Butler<br />

LORD NORTH STREET<br />

Dr Ariel Sergio Goekmen<br />

CREDIT SUISSE<br />

Dr. Leo Th. Schrutt<br />

STANFORD GROUP<br />

(SUISSE) AG<br />

Organised by:<br />

Sponsored by:<br />

2nd Annual<br />

Key Highlights for 2009<br />

Insights about Global Financial Families:<br />

Sara Hamilton<br />

FAMILY OFFICE EXCHANGE<br />

Contributions from Family Offices:<br />

Strategic Thinking for FO Investing<br />

Mario del Pozzo<br />

GEFORIN SA<br />

A Family's Risks<br />

Pierre Condamin-Gerbier<br />

REYL PRIVATE OFFICE<br />

Succession Issues<br />

Dr. Steen Ehlern<br />

FERGUSON PARTNERS FAMILY OFFICE<br />

Asset Allocation Today<br />

J. Mark Fisher<br />

ARLAN SA<br />

FOs & Asset <strong>Manag</strong>ement<br />

Michael Maslinski<br />

MASLINSKI & CO<br />

Pre-conference Workshop<br />

International Residence & Citizenship Planning<br />

for UHNW Clients<br />

Monday 16th March 2009, Renaissance Hotel, Zurich<br />

Paper sourced<br />

from sustainable<br />

forests<br />

Media <strong>Partners</strong>:<br />

Register by<br />

13th February<br />

SAVE up to £200<br />

<strong>Wealth</strong><br />

<strong>Manag</strong>ement<br />

Family Office<br />

Congress, Zurich 2009<br />

Maintaining your Client’s <strong>Wealth</strong> & Best Interests<br />

Through Turbulent Times<br />

Tuesday 17th & Wednesday 18th March 2009, Renaissance Hotel, Zurich<br />

Exhibitor:<br />

Elemental<br />

Chlorine Free<br />

(ECF)<br />

Topical presentations on the following<br />

issues:<br />

Asset <strong>Manag</strong>ement<br />

Financial risk<br />

Account management in troubled times<br />

Staying power for investment performance<br />

Private equity / alternative investments<br />

<strong>Manag</strong>er selection – issues to consider<br />

How have hedge funds stood up in the current market?<br />

To what extent should a family office be engaged<br />

in asset management?<br />

Concierge Services<br />

The growing importance of formal family governance<br />

in the credit crunch<br />

<strong>Manag</strong>ing succession issues<br />

Generating impact from your philanthropic solutions<br />

Protecting the family against tangible risk<br />

International private medical insurance as a wealth<br />

planning tool<br />

Plus<br />

To reserve your place call:+44 (0) 20 7017 7790<br />

or fax: +44 (0)20 7017 7824<br />

or register online: kmregistration@informa.com<br />

www.iir-events.com/wealth

Sign up today for email updates on our events…<br />

www.iir-conferences.com/optin<br />

email: optin@iir-conferences.com<br />

CONFERENCE DAY ONE<br />

Tuesday 17th March 2009<br />

09.00 Chairman’s Welcome & Opening Address:<br />

09.10 Insights about Global Financial Families<br />

<strong>Manag</strong>ing family risks and financial risks in uncertain times<br />

Common investment mistakes wealth owners make<br />

Characteristics of a well-structured financial enterprise<br />

<strong>Manag</strong>ing your wealth as professionally as your business<br />

Planning structures and risk assessment that lead to long-term<br />

success<br />

Examples of how families orchestrate that process<br />

Sara Hamilton<br />

Founder & CEO<br />

FAMILY OFFICE EXCHANGE<br />

Sara Hamilton is the founder and CEO of Family Office Exchange.<br />

Recognized for her expertise on sophisticated owners of wealth and<br />

their family offices, Ms. Hamilton serves as a strategic advisor to<br />

sophisticated investors with assets lasting beyond one generation. Ms.<br />

Hamilton has focused her expertise on the $50+ million market<br />

since 1986, when she joined the Personal Trust Department of Harris Bank. Her initial<br />

research identified the financial services needed by family groups with more than $1 billion<br />

in assets. This research led to her recognition of the unique needs of financial families. She<br />

subsequently spearheaded the first national conference designed to educate family<br />

principals and family office managers. Prior to joining Harris Bank, Ms. Hamilton spent<br />

eight years in marketing and client relations’ management for AT&T in Ohio and Illinois.<br />

10.00 The Growing Importance of Formal Family<br />

Governance in the Credit Crunch<br />

The need for change<br />

The approach<br />

<strong>Wealth</strong> protection<br />

Implementation<br />

Sustainability of process<br />

Andrew Nolan<br />

Executive Director and Head of Private Clients<br />

STONEHAGE GROUP<br />

Andrew is an Executive Director of the Stonehage Group. He is Head<br />

of the Private Client Division and acts as lead advisor to a number of<br />

wealthy international families. Andrew joined Stonehage in 1997 in<br />

the London office and was then transferred to head up the Neuchâtel<br />

office in 1998 and to oversee the takeover of another<br />

multi-family office. He assisted in profitably growing this office to 110 people. Andrew then<br />

moved to Zurich in 2007 in order to be based in the newly opened Stonehage Zurich office.<br />

10.40 Coffee Break<br />

11.10 <strong>Manag</strong>ing Family <strong>Wealth</strong> & Family Offices -<br />

Succession Issues<br />

How and when should the next generation be integrated in the<br />

decision making process<br />

Issues when passing on a business to the next generation<br />

Succession planning<br />

<strong>Manag</strong>ing conflicts within a family<br />

Dr Steen Ehlern<br />

<strong>Manag</strong>ing Director<br />

FERGUSON PARTNERS FAMILY OFFICE<br />

During his doctorate (magna cum laude) at the Swiss Banking<br />

Institute of the University of Zurich, Steen was employed in private<br />

banking and the trust department of a Swiss private bank, followed<br />

by positions at smaller international private banks. He gained<br />

experience as an Executive Director in international executive<br />

search and is currently working for investors in the Family Office business. He advises<br />

families, UHNWIs, family offices and specialist advisors on the set-up of family office<br />

solutions, ideas, introductions, the selection of multi-client family offices and various<br />

providers, real estate projects and investments. He covers strategic family matters as<br />

well as succession planning and mergers & acquisitions of smaller private banks and<br />

asset managers and strategic investments and de-investments.<br />

<strong>Wealth</strong> <strong>Manag</strong><br />

Maintainin<br />

12.00 Lunch<br />

13.30 Generating Impact from your Philanthropic<br />

Solutions<br />

How are today’s families involved in philanthropic activity?<br />

What motivates the philanthropist?<br />

Opportunities for the FO/wealth managers in providing<br />

philanthropic advice<br />

Dr. Maximilian Martin<br />

Global Head of Philanthropic Services<br />

UBS<br />

Maximilian Martin is Global Head of Philanthropy Services at<br />

UBS AG, a dedicated advisory unit that helps clients conceive, set<br />

up and monitor effective philanthropic vehicles. He also serves as a<br />

Visiting Professor at the University of Geneva, where he teaches<br />

philanthropy and social entrepreneurship in the MBA program, and<br />

lectures at the University of St.Gallen. Previous engagements include serving as Head<br />

of Research at the Schwab Foundation for Social Entrepreneurship, Senior Consultant<br />

with McKinsey & Company, instructor at Harvard’s Economics Department, and<br />

Fellow at the Center for Public Leadership at the John F. Kennedy School of<br />

Government. Dr. Martin’s research interests and publications focus on the relationship<br />

between globalization, social entrepreneurship and philanthropy, and emerging<br />

cross-sector value creation opportunities in this space that involve civil society, private<br />

individuals and business. In 2003-2004, he conceptualized and then set up the UBS<br />

Philanthropy Services model and the UBS Philanthropy Forum.<br />

14.10 Engaging in Philanthropy –<br />

What are the Options?<br />

Panellists will share insights on how best to involve clients in philanthropic<br />

activities. Each will offer a different perspective on ways of engaging, this<br />

will then be followed by a panel discussion on best practice.<br />

1 Creating your own foundation<br />

Ludwig Forrest<br />

Philanthropy Advisor<br />

KING BAUDOUIN FOUNDATION<br />

Ludwig Forrest is philanthropy advisor at the King Baudouin<br />

Foundation in Brussels, established in 1976 to improve people’s<br />

living conditions. Ludwig works at the KBF’s Centre for<br />

Philanthropy that provides information, guidance and tailor-made<br />

help on strategic philanthropy to private donors, families,<br />

businesses and professional advisers who wish to engage in public benefit initiatives.<br />

Fostering and simplifying the European cross-border giving environment with the<br />

www.givingineurope.org website and helping donors and beneficiaries to find effective<br />

solutions for philanthropic intentions are his main objectives.<br />

2 Working with advisors<br />

Perspectives from a philanthropy specialist and a trustee<br />

Maurice Machenbaum<br />

Co-founder<br />

WISE PARTNERSHIP<br />

Maurice Machenbaum is a social development and project<br />

management expert. Maurice founded and was for several years,<br />

Programme Director at Casa Alianza Nicaragua, an international<br />

NGO dedicated to the defence and rehabilitation of street children.<br />

He was subsequently in charge of research on the topic of child sol<br />

diers at the International Committee of the Red Cross, and later became Regional<br />

Director for Latin America and the Caribbean at Terre des hommes Lausanne. Maurice<br />

draws on a broad and multifaceted experience in the social development field and has<br />

visited or collaborated with over 160 projects in close to 30 countries.<br />

Xavier Isaac<br />

<strong>Manag</strong>ing Director<br />

INVESTEC TRUST (SWITZERLAND) S.A.<br />

Xavier Isaac is the <strong>Manag</strong>ing Director of Investec Trust<br />

Switzerland, a leading Swiss based trust specialist which provides<br />

bespoke family wealth structuring and administration through<br />

unique Anglo-Saxon trust expertise. Since joining Investec Trust,<br />

Xavier has been spearheading the business’ goal to become more<br />

involved with philanthropy. Prior to joining Investec Trust, Xavier was <strong>Manag</strong>ing Director<br />

of ABN AMRO Trust in Jersey. He also has over fifteen years of experience in<br />

To reserve your place call:+44 (0) 20 7017 7790 or fax: +44 (0)20 7017 7824<br />

or register online: kmregistration@informa.com www.iir-events.com/wealth<br />

Panel Discussion:

ement & Family Office Co<br />

g Your Client’s <strong>Wealth</strong> & Best Interests through Turbu<br />

17 & 18 March 2009, Renaissance Hotel, Zurich<br />

complex estate and tax planning for international families. Xavier is a full member of<br />

STEP and has been instrumental in the establishment of the Swiss Association of Trust<br />

Companies (SATC) in July 2007 of which he is Vice President.<br />

Followed by Q&A with panellists & audience<br />

15.10 Coffee break<br />

15.30 Putting the Family Office in the Driving<br />

Seat: <strong>Manag</strong>ing Risk & Performance<br />

Getting good data to support your decision-making -<br />

how do you achieve this<br />

Achieving meaningful performance measurement<br />

- what to watch out for<br />

Putting the pieces of the jigsaw together - information delivery<br />

Aïda Molineux<br />

Head of <strong>Wealth</strong> <strong>Manag</strong>ement, EMEA<br />

NORTHERN TRUST<br />

Aïda manages the business at Northern Trust’s which works with<br />

families and their advisors based in Europe and the Middle East.<br />

Her team delivers onshore and offshore trust and asset<br />

administration services, (global custody, performance measurement<br />

and banking) and asset management. Aïda has over 20 years<br />

financial services experience and joined Northern Trust in 2000.<br />

16.10 A Family's Risks:<br />

It's Not Where you Think it is<br />

Tangible assets vs. financial assets<br />

Conflicts of interest<br />

Third party due diligence<br />

Family governance<br />

Risk management and assessment<br />

Pierre Condamin-Gerbier<br />

<strong>Manag</strong>ing Partner<br />

REYL PRIVATE OFFICE<br />

Pierre Condamin-Gerbier graduated from the Institut National des<br />

Télécommunications (INT Business School '93) and the Ecole des<br />

Hautes Etudes Commerciales (HEC Paris - Master in International<br />

Finance '94). In 1994, he joined in London and Guernsey the private<br />

office formed by two Franco-Swiss families who were the original<br />

shareholders of one of the world’s leading commodity trading groups, to act as personal<br />

assistant to some of the family members. He then went on to work for a major Greek<br />

ship-owning family within its London-based private office and private bank before cofounding<br />

Credit Suisse Family Office in London and Zurich as <strong>Manag</strong>ing Director. He then<br />

created Mandarin Fortune Plc. in London, a multi-client private office whose activity was<br />

then absorbed within Banque Bonhôte and the UBS Group in Switzerland where he<br />

relocated in 2004. He joined REYL & CIE and REYL Private Office in 2006.<br />

16.50 International Private Medical Insurance<br />

as a <strong>Wealth</strong> Planning Tool<br />

Worldwide coverage<br />

Free choice of doctors/hospitals<br />

Independent of residence<br />

Advice on choice of clinics<br />

Marco Gantenbein, TEP<br />

<strong>Manag</strong>ing Partner<br />

SWISS INSURANCE PARTNERS AG<br />

Marco Gantenbein is an insurance specialist with extensive knowledge<br />

and experience of international health insurance solutions. He is the<br />

author of many articles on international health insurance which have<br />

been published in the Swiss and international media. He is also a<br />

member of the Society of Trust and Estate Practitioners (STEP).<br />

17.30 Close of Day One Followed by Drinks Reception<br />

CONFERENCE DAY TWO<br />

Wednesday 18th March 2009<br />

09.00 Chairman’s Welcome & Opening Address:<br />

To What Extent Should a Family Office be<br />

Engaged in Asset <strong>Manag</strong>ement?<br />

Ultimately the capital of a family is its key commodity – where<br />

does the buck stop with outsourcing asset management (AM)<br />

services?<br />

If outsourced, how does the FO retain influence over how assets<br />

are managed?<br />

Does performance investment management fall into the remit of<br />

the FO?<br />

What is the difference between purchasing AM services and<br />

selling AM services?<br />

Michael Maslinski<br />

Director<br />

MASLINSKI & CO<br />

Michael is a director of Maslinski & Co Ltd, London based<br />

strategy and marketing consultants specialising in the Private<br />

Banking and <strong>Wealth</strong> <strong>Manag</strong>ement sector. Maslinski & Co has been<br />

recognised as the consultancy firm with the best understanding of<br />

the wealth management sector, in a survey of 40 European<br />

financial institutions, covering 11 different countries. Michael has advised a wide<br />

variety of institutions on the development of their services for private clients, ranging<br />

from major retail and investment banks to wealth management boutiques and family<br />

offices. He is author of numerous articles on the wealth management industry and<br />

is frequently quoted in the financial press as a leading authority on the sector. Prior<br />

to establishing his own consulting firm in 1995, he was Head of Marketing and<br />

Business Development at Coutts, where he had over 20 years practical experience of<br />

private banking.<br />

09.40 Account <strong>Manag</strong>ement in Troubled Times<br />

How to reduce the chances of losing a client during difficult<br />

times<br />

A client’s 5 stage wealth management process<br />

Jonathan Bell<br />

Chief Investment Officer<br />

STANHOPE CAPITAL LLP<br />

Jonathan is Chief Investment Officer of Stanhope Capital, one of<br />

Europe’s leading Multi-Family Offices based in London and<br />

Geneva. He has 20 years experience in investment management<br />

and was formerly Chief Investment Officer of Newton Private Investment<br />

<strong>Manag</strong>ement.<br />

10.20 Ways for the <strong>Wealth</strong>y Family to Plan for the<br />

Unthinkable in Unstable Times<br />

Succession planning issues in volatile times<br />

Tax optimised structures including insurance wrappers<br />

Private label funds for succession management and entrepreneurs<br />

Dr. Ariel Sergio Goekmen<br />

<strong>Manag</strong>ing Director, Private Banking Division<br />

CREDIT SUISSE<br />

Ariel Goekmen is a Director of Credit Suisse in the Private<br />

Banking division, based in Zurich. He is in charge of the '<strong>Wealth</strong>y<br />

Families' sector, advising wealthy families on international asset<br />

management, risk mitigation and strategic issues. At the same time<br />

he is responsible for the “UK resident non-domiciled" centre of<br />

competence. His responsibilities include assisting in the implementation of appropriate<br />

holding structures for tax optimisation and succession planning, in cooperation with a<br />

network of in-house and external experts. Ariel is a member of the Society of Trust and<br />

Estate Practitioners (STEP), International Fiscal Association (IFA), L'Association de<br />

l'Arbitrage (ASA) and the International Tax Planning Association (ITPA).<br />

11.00 Coffee Break<br />

To reserve your place call:+44 (0) 20 7017 7790 or fax: +44 (0)20 7017 7824<br />

or register online: kmregistration@informa.com www.iir-events.com/wealth

ngress Zurich 2009<br />

lent Times<br />

11.20 Investment Performance:<br />

The Merits of Staying Power<br />

Mohsen Sohrabi<br />

Founder<br />

MBS CAPITAL ADVICE<br />

Mohsen founded MBS Capital Advice, an investment adviser and<br />

consultant based in Geneva in 1990. MBS currently advises or<br />

manages in excess of CHF 10 billion invested in all asset classes.<br />

Its clients are institutions, endowments and private individuals with<br />

very substantial wealth. Before founding MBS Capital Advice,<br />

Mohsen was with Banque Paribas in Switzerland. He studied in Geneva and has a<br />

Masters in Economics from Geneva University.<br />

12.00 Asset Allocation Today –<br />

Where Should we be Investing?<br />

Tactical allocation in today’s market<br />

Portfolio diversification<br />

<strong>Manag</strong>ing risk in multi asset class portfolios<br />

Risk control and exposure management<br />

Panel Discussion:<br />

Risk vs. reward – getting the right balance in your portfolio<br />

Moderator:<br />

Jonathan Bell<br />

Chief Investment Officer<br />

STANHOPE CAPITAL LLP<br />

12.45 Lunch<br />

Panellists include:<br />

Mario del Pozzo<br />

Co-Founder and <strong>Manag</strong>ing Partner<br />

GEFORIN SA<br />

Mario del Pozzo is the founder and managing partner of Geforin<br />

SA, a private portfolio management company established in 1982.<br />

The company has evolved, in its 27 years, from pure portfolio man<br />

agement to advisory and Multi family office services. Mario del Pozzo started his<br />

career with Merrill Lynch in Philadelphia, then New York and Rome; he moved to<br />

Geneva to be responsible of Italian activities for H.H. Karim Aga Khan. He was, from<br />

1988 to 1996, the international strategist for the EPTA fund group in Milan.<br />

J. Mark Fisher<br />

Finance <strong>Manag</strong>er<br />

ARLAN SA<br />

J. Mark Fisher is Finance <strong>Manag</strong>er with Arlan SA responsible for a<br />

Multi-Family Office managing the <strong>Wealth</strong> <strong>Manag</strong>ement & Portfolio<br />

Investments groups. Mr Fisher has worked in Private Banking,<br />

beginning with Robeco Bank Switzerland and then Vice-President<br />

& Head of Personal Banking at Rabo-Robeco Bank now Sarasin<br />

Bank. Mark is now the Chief Investment Officer for several families, trusts and<br />

foundations. Mr. Fisher is also the Fund Advisor for the Custodia Fund's group<br />

based in Gibraltar with Credit Suisse.<br />

13.45 <strong>Manag</strong>er Selection – Issues to Consider<br />

Performance<br />

Levels of engagement<br />

Diversity<br />

Due diligence in evaluating managers and strategies<br />

Caroline Butler<br />

Director<br />

LORD NORTH STREET<br />

Caroline joined Lord North Street in 2004. Formerly <strong>Manag</strong>ing<br />

Director and Head of UK Private <strong>Wealth</strong> <strong>Manag</strong>ement at Deutsche<br />

Bank AG. London, she was in charge of UK onshore and offshore<br />

clients and client acquisition strategy. She put in place the quantitative<br />

asset allocation model used in London. Prior to joining Deutsche<br />

Bank in 2001, Caroline was a Partner in a fund of hedge funds within Park Place Capital.<br />

An Economist by training, she worked from 1977 in London at NM Rothschild and Sons and<br />

at S.G. Warburg & Co and from 1987 in New York at Goldman Sachs and Louis Dreyfus<br />

Corporation. The first woman elected to the Board of S.G. Warburg in 1984, her<br />

experience includes foreign exchange and debt management, corporate advisory and<br />

asset management.<br />

14.25 Private Equity:<br />

Opportunities in the Tsunami<br />

Investing in Private Equity today: the right alternative<br />

Creating diversification and long-term capital appreciation for<br />

families<br />

Portfolio active management: short term tactics vs. long-term<br />

strategy<br />

Robert J. Tomei<br />

Chairman and CEO<br />

ADVANCED CAPITAL<br />

Robert J. Tomei, Chairman and CEO of Advanced Capital, Private<br />

Equity Fund of Funds group founded in Switzerland in 2000. For<br />

years Mr. Tomei was an advisor on alternative investments and<br />

private placements Merrill Lynch International. Before joining<br />

Merrill, Mr. Tomei worked with Kidder Peabody in New York and<br />

London. Mr. Tomei is a longtime collector of contemporary art and is a Board<br />

member of several major museums.<br />

15.05 Coffee Break<br />

15.30 How Have Hedge Funds Stood Up in the<br />

Current Market?<br />

Are hedge funds & funds of funds waning in popularity?<br />

What benefits do they offer and why is this changing?<br />

Identifying alpha through other avenues<br />

Dr. Leo Th. Schrutt<br />

Senior <strong>Manag</strong>ing Director<br />

STANFORD GROUP (SUISSE) AG<br />

Dr. Leo Thomas Schrutt joined Stanford Group (Suisse) AG in<br />

September 2007 bringing 20 years of asset management- and<br />

investment research experience into the team. Prior to Stanford, Dr.<br />

Schrutt held several positions at the Julius Baer Group between<br />

1998 and 2007. He was a Member of the Group Executive Board<br />

and Chairman of the Board of Directors of Julius Baer Asset <strong>Manag</strong>ement in Zürich,<br />

Frankfurt, London and New York. His responsibilities were Asset <strong>Manag</strong>ement and<br />

Research. He did oversee CHF 23 bn AuM and was leading a team of 120 employees.<br />

Dr. Schrutt holds several positions on various boards and is an advisor to several<br />

international institutions.<br />

16.10 Strategic Thinking for Family Office<br />

Investing & T.A.A.’s Contribution<br />

16.30 Close of Conference<br />

Mario del Pozzo<br />

Co-Founder and <strong>Manag</strong>ing Partner<br />

GEFORIN SA<br />

Sponsorship Opportunities!<br />

Do you provide a service or sell a product to the <strong>Wealth</strong> <strong>Manag</strong>ement<br />

industry?<br />

If you want direct access to senior level decision makers, ensure you are at<br />

this expert industry forum.<br />

IIR will work with you to facilitate creative solutions that showcase your<br />

organisation's expertise:<br />

� Presentation opportunities<br />

� Networking reception or Luncheon<br />

� Exhibition space<br />

� Advertising in the delegate documentation pack<br />

Please call Aida Mezit on<br />

+44 (0)20 3377 3278<br />

or email aida.mezit@informa.com to find out more!<br />

To reserve your place call:+44 (0) 20 7017 7790 or fax: +44 (0)20 7017 7824<br />

or register online: kmregistration@informa.com www.iir-events.com/wealth

This workshop will offer advice and best practice for private<br />

clients looking to relocate for either business or personal<br />

reasons. Expert speakers will provide guidance on residence<br />

and citizenship planning for the global citizen who may be<br />

taking their assets and activities worldwide.<br />

Key points to consider in international private client<br />

relocation<br />

Why pre-immigration tax planning is important<br />

<strong>Wealth</strong> planning for the global citizen<br />

Citizenship-by-investment<br />

- What is available today and how to use this tool in private<br />

client planning<br />

Residence and citizenship-by-investment in Austria<br />

Residence and citizenship in Belgium<br />

International health insurance for UHNW clients<br />

- A key element in international residence planning<br />

Registration at 13.30<br />

Workshop commences at 14.00<br />

Workshop ends at 17.00<br />

Sponsored by:<br />

Pre-conference Workshop<br />

16th March 2009, Renaissance Hotel, Zurich<br />

International Residence<br />

& Citizenship Planning<br />

for UHNW Clients<br />

Northern Trust is a leading financial institution<br />

– in the world’s top 10 for<br />

asset administration and asset management.<br />

We provide asset servicing, asset<br />

management, banking and fiduciary solutions,<br />

for families of significant wealth and institutions worldwide through multiple<br />

locations.<br />

Founded in 1889, our history is financial strength and stability, business focus and a<br />

deep understanding of family needs and client confidentiality. Combining high-touch<br />

client service and expertise with solutions orientated, innovative products and information<br />

delivery, Northern Trust has looked after the financial needs of affluent individuals<br />

and families for 120 years. Our dedicated team services over 410 families, in 15 countries,<br />

investing in 90 markets across all asset classes. We work with the family and all<br />

their advisers to develop a service that resolves their particular issues.<br />

The trust and confidence our clients place in us result from our founding principles: integrity,<br />

professional expertise, creative solutions and a dedication to quality.<br />

For further information please contact:<br />

Aïda Molineux +44 (20) 7982 2623 or Clare Flanagan +44 (20) 7982 1955<br />

Workshop led by <strong>Henley</strong> & <strong>Partners</strong>:<br />

Christian H. Kälin, a Partner at the firm in Zurich, Switzerland, is an international<br />

tax planning, residence and citizenship specialist. He is a frequent<br />

writer and speaker on these issues and is regularly quoted in the international<br />

media. He is the editor and one of the co-authors of the Switzerland<br />

Business & Investment Handbook and the International Real Estate Handbook<br />

as well as one of the co-editors of Anti-Money-Laundering: International<br />

Law and Practice.<br />

Jonathan K. Chalmers is an Associate with <strong>Henley</strong> & <strong>Partners</strong> based in the<br />

UK. After graduating from the University of Liverpool he joined the UK<br />

Immigration and Nationality Directorate where he was responsible for immigration<br />

policy on work permits and business investors. He then worked<br />

with several well-known private client firms, where he gained experience in<br />

immigration law and residence planning, and also citizenship issues. He has<br />

authored many articles on citizenship-by-investment and is active in both<br />

private client and government consulting work in that area.<br />

Leon van der Heiden, a Partner and Head of the firm’s Belgian office in<br />

Antwerp, has wide-ranging experience in corporate and financial affairs and<br />

in particular real estate. As a member of the firm’s Residence and Citizenship<br />

Practice Group he advises on relocation to and residence in Belgium<br />

for Non-EU nationals and handles all aspects of clients interested in moving<br />

to Belgium.<br />

About your Conference Sponsors<br />

Exhibitor:<br />

PILinvests is the trading name of <strong>Partners</strong>hip Incorporations Limited,<br />

which is authorised and regulated by the Financial Services Authority.<br />

It is the UK’s leading provider of unregulated collective investment<br />

schemes. Since 1996 PILinvests has launched over 100 funds.<br />

PILinvests is launching a new Fund of Funds aimed at private investors<br />

that will invest in Valad Property Group’s European industrial funds, in France,<br />

Germany and the Nordic regions. Each of the underlying funds have already launched,<br />

a fund size in excess of €250m and been subject to a vigorous due diligence process<br />

with each of its intuitional investors.<br />

To reserve your place call:+44 (0) 20 7017 7790 or fax: +44 (0)20 7017 7824<br />

or register online: kmregistration@informa.com www.iir-conferences.com/wealth

<strong>Wealth</strong> <strong>Manag</strong>ement & Family Office KM2170<br />

17 & 18 March 2009, Renaissance Hotel, Zurich<br />

International Residence & Citizenship Planning Workshop KM2170W<br />

16th March 2009, Renaissance Hotel, Zurich<br />

Please quote the below VIP code when registering<br />

FIVE EASY WAYS TO REGISTER<br />

Telephone:<br />

+44 (0) 20 7017 7790<br />

Please remember to quote<br />

KM2170<br />

Fax:<br />

Complete and send this<br />

registration form to:<br />

+44 (0)20 7017 7824<br />

Email:<br />

kmregistration@informa.com<br />

Payment must be made within 14 days of registration. All registrations must be paid<br />

in advance of the event. Your VIP number is on the address label. If there is no VIP<br />

label please quote KM2170<br />

HOW MUCH?<br />

❑<br />

❑<br />

Savings include Multiple Booking & Early Booking Discounts. All discounts can only be applied at the time of registration<br />

and discounts cannot be combined. All discounts are subject to approval. Please note the conference fee<br />

does not include travel or hotel accommodation costs. £200 discount for 3rd and subsequent delegates.<br />

THREE EASY WAYS TO PAY<br />

Mail:<br />

this completed form<br />

together with payment to:<br />

Richard Morgan<br />

Informa customer services<br />

PO Box 406<br />

West Byfleet<br />

Surrey, KT14 6WL<br />

Web: www.iir-events.com/wealth<br />

Register by 13th February 2009 Register after 13th February 2009<br />

❑<br />

Conference Only<br />

(KM2170C) £1399<br />

Conference + Workshop<br />

(KM2170CW) £1898<br />

(SAVE £200)<br />

Workshop Only<br />

(KM2170W) £599<br />

� Cheque. Enclosed is our cheque for £ ................ in favour of IIR Ltd<br />

Please ensure that the Reference Code KM2170 is written on the back of the cheque<br />

� Credit Card. Please debit my: � VISA � AMEX � MASTERCARD � DINERS<br />

Card No: CVV No:<br />

Expiry Date: Signature:<br />

please note that credit cards will be debited within 7 days of your registration on to the conference<br />

� Bank Transfer<br />

Full details of bank transfer options will be given with your invoice on registration<br />

Incorrect Mailing<br />

If you are receiving multiple mailings or you would like us to change any details or remove your name from<br />

our database, please contact our Database Department on +44 (0) 20 7017 7077 quoting the reference number<br />

printed on your mailing label. Alternatively, fax this brochure to the mailing department on +44 (0) 20 7017<br />

7828 or e-mail us on integrity@iirltd.co.uk. Amendments can take up to 6 weeks so please accept our apologies<br />

for any inconvenience caused in the meantime.<br />

Additional Requirements<br />

Please notify IIR at least one month before the conference date if you have any additional requirements e.g.<br />

wheelchair access, large print etc.<br />

What Happens If I Have to Cancel?<br />

What happens if you have to cancel? Confirm your CANCELLATION in writing (letter or fax) two weeks or<br />

more before the event and receive a refund (if applicable) less a 10% + VAT service charge. Should you cancel<br />

between two weeks and one week before the event then you will receive a refund (if applicable) less a<br />

50% +VAT service charge. Regrettably, no refunds can be made for cancellations received less than one<br />

week prior to the course. A substitute delegate is welcome at no extra charge<br />

❑<br />

❑<br />

❑<br />

Conference Only<br />

(KM2170C)£1499<br />

Conference + Workshop<br />

(KM2170CW) £1998<br />

(SAVE £100)<br />

Workshop Only<br />

(KM2170W) £599<br />

WHEN AND WHERE<br />

KM2170<br />

17 & 18 March 2009<br />

KM2170W<br />

16th March 2009<br />

Delegates are responsible for the arrangement and payment of their own travel and accommodation.<br />

IIR has arranged a special room rate at a number of hotels. If you wish to book a room, please call<br />

Venue Search on +44 (0)20 8546 6166 stating that you are an IIR delegate.<br />

PERSONAL DETAILS<br />

COMPANY DETAILS FOR INVOICING PURPOSES<br />

Company Name<br />

Postal Address<br />

Telephone Fax<br />

Nature of Business<br />

Billing Address (if different from above address)<br />

Email Billing Address<br />

Venue: Renaissance Hotel, Zurich<br />

Talackerstrasse 1<br />

Zurich - Glattbrugg 8152<br />

Switzerland<br />

T: 00 41 4487 45000<br />

F: 00 41 4487 45003<br />

1st Delegate Mr/Mrs/Ms<br />

Job title Department<br />

Telephone Fax<br />

Email<br />

Yes! I would like to receive information about upcoming events by email. By giving you my<br />

email address I am giving ONLY IIR companies the permission to contact me by email<br />

� Yes! I would like to receive information about future events and services via fax<br />

Signature:<br />

2nd Delegate Mr/Mrs/Ms<br />

Job title Department<br />

Telephone Fax<br />

Email<br />

Yes! I would like to receive information about upcoming events by email. By giving you my<br />

email address I am giving ONLY IIR companies the permission to contact me by email<br />

3rd Delegate Mr/Mrs/Ms<br />

Job title Department<br />

Telephone £200 Faxdiscount<br />

Email<br />

Yes! I would like to receive information about upcoming events by email. By giving you my<br />

email address I am giving ONLY IIR companies the permission to contact me by email<br />

Name of Line <strong>Manag</strong>er Mr/Mrs/Ms<br />

Job title Department<br />

Telephone Fax<br />

Email<br />

Booking Contact Mr/Mrs/Ms<br />

Job title Department<br />

Telephone Fax<br />

Email<br />

Our statement of integrity can be found on our website at www.iir-events.com/IIR-Conf/PrivacyPolicy.aspx<br />

Unable to Attend Event Documentation<br />

Nothing compares to being there – but you need not miss out!<br />

Don’t delay and order your documentation today.<br />

Simply tick the box, complete your details above and send the form along with payment.<br />

� <strong>Wealth</strong> <strong>Manag</strong>ement & Family Office, Zurich @£299 (no VAT)<br />

We regret documentation orders can only be processed on receipt of credit card details<br />

Data Protection<br />

The personal information shown on this form, and/or provided by you, will be held on a database and may be<br />

shared with other companies in the Informa Group in the UK and internationally. If you do not wish your details<br />

to be available to other companies in the Informa Group please contact the Database <strong>Manag</strong>er at the above address,<br />

Tel +44 (0)20 7017 7077, Fax +44 (0)20 7017 7828 or email: integrity@iirltd.co.uk. Occasionally your details<br />

may be obtained from, or made available to, external companies who wish to communicate with you offers<br />

related to your business activities. If you do not wish to receive these offers, please tick the box �