salli | stonehage affluent london living index - Cubitt Consulting

salli | stonehage affluent london living index - Cubitt Consulting

salli | stonehage affluent london living index - Cubitt Consulting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.2.2 NOTAbLE PRICE TRENDS<br />

Price trends vary across the different items in SALLI, for<br />

example, the price of a case of Lafite Rothschild 2000 has<br />

risen by more than a factor of three from 2002-2007, now<br />

standing at £9,250. Supply is constrained given that only an<br />

estimated 15,000-20,000 cases were produced.<br />

The main factor contributing to the remarkable increase<br />

in price has been surging demand, due to increases in<br />

wealth creation around the world. This is highlighted by the<br />

substantial increase in the number of HNW individuals rising<br />

from 7.3 million at the end of 2002 to 9.5 million by 2007 6 .<br />

Other factors might include the growth of interest in wine<br />

as an investment class. A number of indices have recently<br />

launched such as the Liv-ex <strong>index</strong> 7 , which tracks the prices<br />

of a large number of expensive wines and highlights wine<br />

as an investment opportunity as well as investment funds<br />

specialising in wine (Fine Wine Fund, Wine Investment Fund).<br />

In addition, Lafite 2000 is in limited supply.<br />

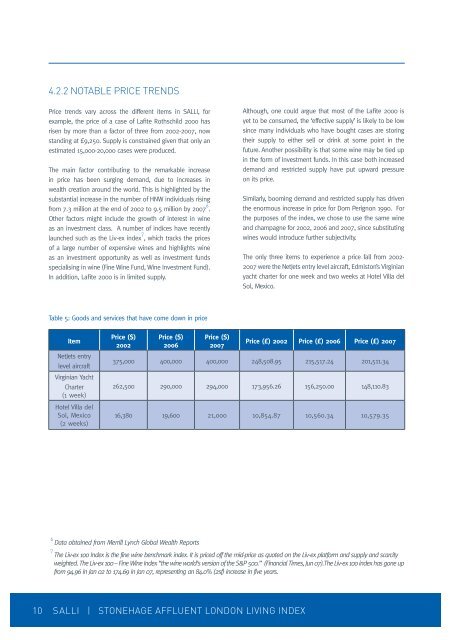

Table 5: Goods and services that have come down in price<br />

Item<br />

NetJets entry<br />

level aircraft<br />

Virginian Yacht<br />

Charter<br />

(1 week)<br />

Hotel Villa del<br />

Sol, Mexico<br />

(2 weeks)<br />

Price ($)<br />

2002<br />

Price ($)<br />

2006<br />

Price ($)<br />

2007<br />

10 SALLI | STONEHAGE AFFLUENT LONDON LIVING INDEX<br />

Although, one could argue that most of the Lafite 2000 is<br />

yet to be consumed, the ‘effective supply’ is likely to be low<br />

since many individuals who have bought cases are storing<br />

their supply to either sell or drink at some point in the<br />

future. Another possibility is that some wine may be tied up<br />

in the form of investment funds. In this case both increased<br />

demand and restricted supply have put upward pressure<br />

on its price.<br />

Similarly, booming demand and restricted supply has driven<br />

the enormous increase in price for Dom Perignon 1990. For<br />

the purposes of the <strong>index</strong>, we chose to use the same wine<br />

and champagne for 2002, 2006 and 2007, since substituting<br />

wines would introduce further subjectivity.<br />

The only three items to experience a price fall from 2002-<br />

2007 were the NetJets entry level aircraft, Edmiston’s Virginian<br />

yacht charter for one week and two weeks at Hotel Villa del<br />

Sol, Mexico.<br />

Price (£) 2002 Price (£) 2006 Price (£) 2007<br />

375,000 400,000 400,000 248,508.95 215,517.24 201,511.34<br />

262,500 290,000 294,000 173,956.26 156,250.00 148,110.83<br />

16,380 19,600 21,000 10,854.87 10,560.34 10,579.35<br />

6 Data obtained from Merrill Lynch Global Wealth Reports<br />

7 The Liv-ex 100 Index is the fine wine benchmark <strong>index</strong>. It is priced off the mid-price as quoted on the Liv-ex platform and supply and scarcity<br />

weighted. The Liv-ex 100 – Fine Wine Index “the wine world’s version of the S&P 500.” (Financial Times, Jun 07).The Liv-ex 100 <strong>index</strong> has gone up<br />

from 94.96 in Jan 02 to 174.69 in Jan 07, representing an 84.0% (2sf) increase in five years.