the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

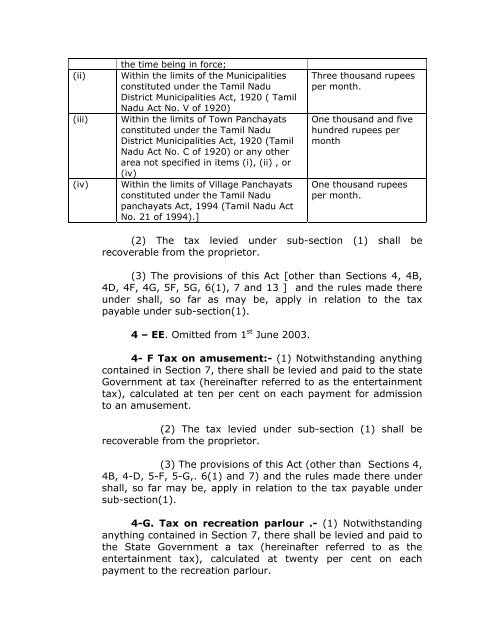

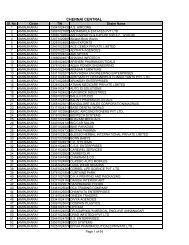

<strong>the</strong> time being in force;<br />

(ii) Within <strong>the</strong> limits of <strong>the</strong> Municipalities<br />

constituted under <strong>the</strong> <strong>Tamil</strong> <strong>Nadu</strong><br />

District Municipalities Act, 1920 ( <strong>Tamil</strong><br />

<strong>Nadu</strong> Act No. V of 1920)<br />

(iii) Within <strong>the</strong> limits of Town Panchayats<br />

constituted under <strong>the</strong> <strong>Tamil</strong> <strong>Nadu</strong><br />

District Municipalities Act, 1920 (<strong>Tamil</strong><br />

<strong>Nadu</strong> Act No. C of 1920) or any o<strong>the</strong>r<br />

area not specified in items (i), (ii) , or<br />

(iv)<br />

(iv) Within <strong>the</strong> limits of Village Panchayats<br />

constituted under <strong>the</strong> <strong>Tamil</strong> <strong>Nadu</strong><br />

panchayats Act, 1994 (<strong>Tamil</strong> <strong>Nadu</strong> Act<br />

No. 21 of 1994).]<br />

Three thousand rupees<br />

per month.<br />

One thousand and five<br />

hundred rupees per<br />

month<br />

One thousand rupees<br />

per month.<br />

(2) The <strong>tax</strong> levied under sub-section (1) shall be<br />

recoverable from <strong>the</strong> proprietor.<br />

(3) The provisions of this Act [o<strong>the</strong>r than Sections 4, 4B,<br />

4D, 4F, 4G, 5F, 5G, 6(1), 7 and 13 ] and <strong>the</strong> rules made <strong>the</strong>re<br />

under shall, so far as may be, apply in relation to <strong>the</strong> <strong>tax</strong><br />

payable under sub-section(1).<br />

4 – EE. Omitted from 1 st June 2003.<br />

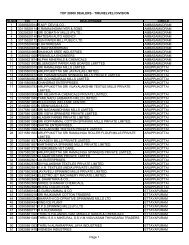

4- F Tax on amusement:- (1) Notwithstanding anything<br />

contained in Section 7, <strong>the</strong>re shall be levied and paid to <strong>the</strong> state<br />

Government at <strong>tax</strong> (hereinafter referred to as <strong>the</strong> entertainment<br />

<strong>tax</strong>), calculated at ten per cent on each payment for admission<br />

to an amusement.<br />

(2) The <strong>tax</strong> levied under sub-section (1) shall be<br />

recoverable from <strong>the</strong> proprietor.<br />

(3) The provisions of this Act (o<strong>the</strong>r than Sections 4,<br />

4B, 4-D, 5-F, 5-G,. 6(1) and 7) and <strong>the</strong> rules made <strong>the</strong>re under<br />

shall, so far may be, apply in relation to <strong>the</strong> <strong>tax</strong> payable under<br />

sub-section(1).<br />

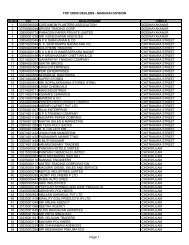

4-G. Tax on recreation parlour .- (1) Notwithstanding<br />

anything contained in Section 7, <strong>the</strong>re shall be levied and paid to<br />

<strong>the</strong> State Government a <strong>tax</strong> (hereinafter referred to as <strong>the</strong><br />

entertainment <strong>tax</strong>), calculated at twenty per cent on each<br />

payment to <strong>the</strong> recreation parlour.