the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

the tamil nadu entertainments tax act, 1939 - Tamil Nadu VAT

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

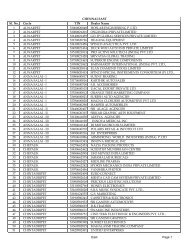

(2) Where such rectification has <strong>the</strong> effect of reducing an<br />

assessment or penalty, <strong>the</strong> authority competent to assess <strong>tax</strong><br />

under this Act shall make any refund which may be due to <strong>the</strong><br />

proprietor.<br />

(3) where any such rectification has <strong>the</strong> effect of<br />

enhancing an assessment or penalty, <strong>the</strong> authority competent to<br />

assess <strong>tax</strong> under this Act shall give <strong>the</strong> proprietor a revised<br />

notice of assessment or penalty and <strong>the</strong>re upon, <strong>the</strong> provisions<br />

of this Act and <strong>the</strong> rules made <strong>the</strong>re under shall apply as if such<br />

notice has been given in <strong>the</strong> first instance].<br />

1[15- B. prohibition of disclosure of particulars<br />

produced before <strong>the</strong> entertainment <strong>tax</strong> authorities.- (1) All<br />

particulars contained in any statement made, return finished, or<br />

accounts, registers, records or documents produced under <strong>the</strong><br />

provisions of this Act or in any evidence given or affidavit or<br />

deposition made, in <strong>the</strong> course of any proceeding under this Act<br />

or in any record of any proceeding relating to <strong>the</strong> recovery of<br />

demand, prepared for <strong>the</strong> purposes of <strong>the</strong> Act shall be treated as<br />

confidential and shall not be disclosed.<br />

1. Inserted by <strong>Tamil</strong> <strong>Nadu</strong> Act No. XXV of 1971with effect from 1 st<br />

April 1986.<br />

(2) Nothing contained in sub-section (1) shall apply to<br />

<strong>the</strong> disclosure of any such particulars-<br />

(i) for <strong>the</strong> purpose of investigation of, or<br />

prosecution for, an offence under this<br />

Act, or under <strong>the</strong> Indian Penal code<br />

(Central Act No. XLV of 1860) or under<br />

any o<strong>the</strong>r law for <strong>the</strong> time being in<br />

force; or,<br />

(ii) to any person enforcing <strong>the</strong> provisions<br />

of this Act where it is necessary to<br />

disclose <strong>the</strong> same to him for <strong>the</strong><br />

purposes of this Act; or,<br />

(iii) occasioned by <strong>the</strong> lawful employment<br />

under <strong>the</strong> Act or any process for <strong>the</strong><br />

recovery of any demand; or