Annual Accounts 2011-2012 (pdf - 973 kB) - Royal Botanic Garden ...

Annual Accounts 2011-2012 (pdf - 973 kB) - Royal Botanic Garden ...

Annual Accounts 2011-2012 (pdf - 973 kB) - Royal Botanic Garden ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The <strong>Royal</strong> <strong>Botanic</strong> <strong>Garden</strong> Edinburgh<br />

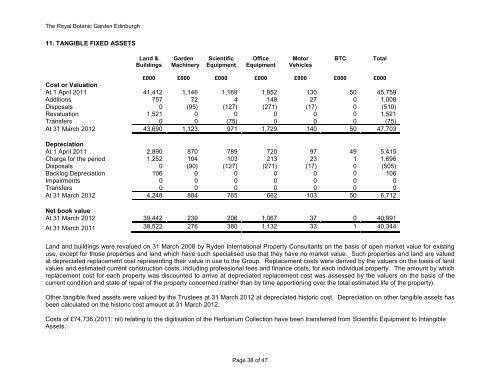

11. TANGIBLE FIXED ASSETS<br />

Land &<br />

Buildings<br />

<strong>Garden</strong><br />

Machinery<br />

Scientific<br />

Equipment<br />

Office<br />

Equipment<br />

£000 £000 £000 £000 £000 £000 £000<br />

Cost or Valuation<br />

At 1 April <strong>2011</strong> 41,412 1,146 1,169 1,852 130 50 45,759<br />

Additions 757 72 4 148 27 0 1,008<br />

Disposals 0 (95) (127) (271) (17) 0 (510)<br />

Revaluation 1,521 0 0 0 0 0 1,521<br />

Transfers 0 0 (75) 0 0 0 (75)<br />

At 31 March <strong>2012</strong> 43,690 1,123 971 1,729 140 50 47,703<br />

Land and buildings were revalued on 31 March 2008 by Ryden International Property Consultants on the basis of open market value for existing<br />

use, except for those properties and land which have such specialised use that they have no market value. Such properties and land are valued<br />

at depreciated replacement cost representing their value in use to the Group. Replacement costs were derived by the valuers on the basis of land<br />

values and estimated current construction costs, including professional fees and finance costs, for each individual property. The amount by which<br />

replacement cost for each property was discounted to arrive at depreciated replacement cost was assessed by the valuers on the basis of the<br />

current condition and state of repair of the property concerned (rather than by time apportioning over the total estimated life of the property).<br />

Other tangible fixed assets were valued by the Trustees at 31 March <strong>2012</strong> at depreciated historic cost. Depreciation on other tangible assets has<br />

been calculated on the historic cost amount at 31 March <strong>2012</strong>.<br />

Costs of £74,736 (<strong>2011</strong>: nil) relating to the digitisation of the Herbarium Collection have been transferred from Scientific Equipment to Intangible<br />

Assets.<br />

Page 38 of 47<br />

Motor<br />

Vehicles<br />

Depreciation<br />

At 1 April <strong>2011</strong> 2,890 870 789 720 97 49 5,415<br />

Charge for the period 1,252 104 103 213 23 1 1,696<br />

Disposals 0 (90) (127) (271) (17) 0 (505)<br />

Backlog Depreciation 106 0 0 0 0 0 106<br />

Impairments 0 0 0 0 0 0 0<br />

Transfers 0 0 0 0 0 0 0<br />

At 31 March <strong>2012</strong> 4,248 884 765 662 103 50 6,712<br />

Net book value<br />

At 31 March <strong>2012</strong> 39,442 239 206 1,067 37 0 40,991<br />

At 31 March <strong>2011</strong> 38,522 276 380 1,132 33 1 40,344<br />

BTC<br />

Total