Forget CA revival, Prez tells parties

Forget CA revival, Prez tells parties

Forget CA revival, Prez tells parties

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE HIMALAYAN TIMES, MONDAY, OCTOBER 29, 2012 www.thehimalayantimes.com<br />

BUSINESS<br />

• BIZ BRIEFS<br />

HK’s realty plans<br />

HONG KONG: Hong Kong announced<br />

Friday it will raise real-estate<br />

purchasing and resale costs to<br />

cool its overheating property market<br />

down, in a move targeting non-local<br />

buyers and speculative activities. The<br />

prices of small and medium sized<br />

residential flats in the southern Chinese<br />

city, famous for its sky-high rent,<br />

surged 20 per cent for the first nine<br />

months of the year, prompting the<br />

government to take action. The new<br />

measures include the increase of special<br />

stamp duties for properties resold<br />

within the first three years of its<br />

purchase and imposing an extra 15<br />

per cent transaction cost on non-local<br />

buyers and local and foreign companies.<br />

The measures ‘targets speculative<br />

activities, and for most genuine<br />

homebuyers it would not affect them<br />

because they won’t be reselling in a<br />

short period of time’. —AFP<br />

Samsung profit up<br />

SEOUL: South Korean technology<br />

powerhouse Samsung Electronics Co<br />

posted a fourth straight record quarterly<br />

profit - of $7.4 billion - with<br />

strong sales of its Galaxy range of<br />

phones masking sharply lower sales<br />

of memory chips. The record run,<br />

though, is likely to end in December,<br />

with profit growth slowing even more<br />

next year as TV markets stagnate and<br />

growth in high-end smartphones<br />

eases from the recent breakneck<br />

speed. Profit is expected to grow 16<br />

per cent next year, down from a forecast<br />

73 per cent this year. Samsung<br />

said July-September operating profit<br />

almost doubled to 8.12 trillion won,<br />

in line with its earlier estimate. Net<br />

profit rose to 6.56 trillion won. —AFP<br />

Australia’s new rating<br />

SYDNEY: Australian treasurer Wayne<br />

Swan welcomed a decision by ratings<br />

agency Fitch to affirm the country’s<br />

AAA credit rating, days after his midyear<br />

economic review lowered this<br />

year’s growth forecast. The affirmation<br />

overnight of the AAA rating with<br />

a stable outlook comes after the government<br />

last week cut its growth and<br />

budget surplus forecasts as worsening<br />

global conditions hurt revenues<br />

in the mining-driven economy. “We<br />

manage our economy in the interests<br />

of working people and we’ve had a<br />

big tick from the rating agencies<br />

overnight,” said Swan. —AFP<br />

HUL beats forecasts<br />

MUMBAI: Consumer goods giant<br />

Hindustan Unilever (HUL), Indian<br />

unit of Anglo-Dutch Unilever, on Friday<br />

reported an above-expected rise<br />

in quarterly profit. HUL, which is India’s<br />

largest consumer goods maker,<br />

posted a 17 per cent rise in net profit<br />

at IRs 8.07 billion ($152 million) in the<br />

three months to September, compared<br />

to IRs 6.89 billion a year earlier.<br />

Sales rose 12 per cent to IRs 61.55 billion<br />

rupees. HUL’s earnings beat market<br />

expectations of a 7.7-billion-rupee<br />

profit. Its personal care business<br />

rose in quarter by 12 per cent yearon-year,<br />

while soaps and detergents<br />

jumped 22 per cent. Its food products<br />

segment grew 10 per cent in the quarter<br />

from a year earlier. —AFP<br />

• FOREX RATES<br />

The foreign exchange rates for October 29 as fixed by Nepal Rastra Bank are as follows:<br />

CURRENCY UNIT BUYING (in Rs.) SELLING (in Rs.)<br />

Swiss Franc 1 91.34 91.98<br />

Australian Dollar 1 88.60 89.22<br />

Canadian Dollar 1 85.60 86.20<br />

Singapore Dollar 1 69.89 70.39<br />

Saudi Arab Riyal 1 22.77 22.93<br />

Qatari Riyal 1 23.45 23.62<br />

Thai Bhat 1 2.78 2.80<br />

UAE Dihram 1 23.25 23.41<br />

Malaysian Ringit 1 28.09 28.29<br />

Swedish Krona 1 12.76<br />

Danish Krona 1 14.81<br />

Hongkong Dollar 1 11.02<br />

Note: Under the present system the open market exchange rates quoted by<br />

different /commercial banks may differ.<br />

Himalayan News Service<br />

Kathmandu, October 28<br />

In the first half of 2012, global<br />

FDI fell by eight per cent to<br />

an estimated $668 billion,<br />

down from $729 billion in<br />

first half of 2011, according<br />

to UNCTAD’s FDI Global<br />

Quarterly Index.<br />

South Asia witnessed a fall<br />

by 40 per cent in its FDI inflows<br />

as a result of declines<br />

across nearly all countries in<br />

the subcontinent. Inflows to<br />

India, which accounts for the<br />

lion’s share of inward FDI to<br />

the sub-region, fell from $18<br />

billion to $10 billion, partly<br />

as a result of shrinking market-seeking<br />

FDI to the country.<br />

Strong interest by foreign<br />

investors in manufacturing,<br />

especially in garments,<br />

helped keep FDI inflows to<br />

Bangladesh at a relatively<br />

high level — about $430 million<br />

in the first two quarters.<br />

It was due to increased uncertainty<br />

in the global economy,<br />

marked by fears of an<br />

exacerbation of the sovereign<br />

debt crisis in Europe<br />

and a slow down of growth in<br />

major emerging market<br />

economies, it said, adding<br />

that in the second quarter of<br />

2012 the value of index,<br />

which tracks FDI flows,<br />

dropped from 128 to 123.<br />

The $61 billion fall was<br />

mainly caused by a decline<br />

of $37 billion in inflows to<br />

the US and a $23 billion fall<br />

in inflows to BRIC — Brazil,<br />

Russian Federation, India<br />

and China — countries.<br />

The declines were caused<br />

by steep falls in both greenfield<br />

investment projects<br />

(down by 40 per cent) and<br />

cross-border Merger and Ac-<br />

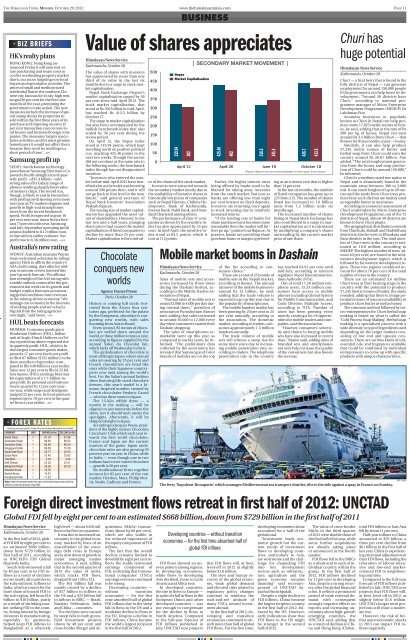

Value of shares appreciates<br />

Himalayan News Service<br />

Kathmandu, October 28<br />

The value of shares with investors<br />

has appreciated by more than one<br />

third of its value in the last six<br />

months due to a surge in stock market<br />

capitalisation.<br />

Nepal Stock Exchange (Nepse)’s<br />

market capitalisation surged by 36<br />

per cent since mid-April 2012. The<br />

stock market capitalisation, that<br />

stood at Rs 302 billion in mid-April,<br />

has reached Rs 413.5 billion by<br />

October 27.<br />

The surge in market capitalisation<br />

has also been accompanied by the<br />

bullish benchmark index that also<br />

scaled by 36 per cent during the<br />

review period.<br />

On April 12, the Nepse index<br />

stood at 319.94 points, which kept<br />

travelling north on positive political<br />

cue, reaching 425.46 points in the<br />

next two weeks. Though the ascent<br />

did not continue at the same rate in<br />

the following weeks, the benchmark<br />

index though has not disappointed<br />

investors.<br />

“Investors who entered the market<br />

before mid-April 2012 have benefited<br />

a lot as the index was hovering<br />

around 300 points then, and it will<br />

not go back to that level in the near<br />

future,” said general secretary of<br />

Nepal Stock Investors’ Association<br />

Prakash Rajaure.<br />

The waxing size of market capitalisation<br />

has upgraded the asset values<br />

of shareholders. However, in the<br />

last two and a half years, plunging<br />

share prices had caused the market<br />

capitalisation of listed companies to<br />

decline by more than 25 per cent.<br />

Market capitalisation is the total val-<br />

Chocolate<br />

conquers new<br />

worlds<br />

Agence France Presse<br />

Paris, October 28<br />

History is coming full circle: borrowed<br />

from the Aztecs four centuries<br />

ago, perfected for the palate<br />

by the Europeans, chocolate is conquering<br />

new worlds, with sales<br />

booming from Asia to Brazil.<br />

Every second, 95 tonnes of chocolate<br />

are wolfed down around the<br />

world, or three million tonnes a year,<br />

according to figures supplied by the<br />

annual Salon du Chocolat fair,<br />

which kicks off Wednesday in Paris.<br />

The globalisation of chocolate is<br />

most striking in Japan, where annual<br />

sales are soaring by 25 per cent and<br />

French chocolatiers are feted like<br />

stars while their Japanese counterparts<br />

now rank among the world’s<br />

best. For the Salon’s annual fashion<br />

show featuring life-sized chocolate<br />

dresses, this year’s model is a kimono-inspired<br />

number created by<br />

French chocolatier Frederic Cassel<br />

— who has three stores in Japan.<br />

The 15-kilo edible dress — a<br />

month in the making — will be<br />

slipped on just moments before the<br />

show, lest it should melt under the<br />

spotlights. Afterwards, it will be<br />

shipped straight to Japan.<br />

According to Jacques Pessis, president<br />

of the highly serious Chocolate<br />

Crunchers’ Club which each year rewards<br />

the best world chocolates,<br />

France and Japan are the current<br />

masters of the game. Japan aside,<br />

chocolate sales are also growing 30<br />

percent year on year in China, while<br />

in India — even though one in two<br />

Indians have never tasted chocolate<br />

— growth is 20 per cent.<br />

Six multinational firms together<br />

account for 85 per cent of the vast<br />

market: Hershey, Mars, Philip Morris,<br />

Nestle, Cadbury and Ferrero.<br />

quisitions (M&As) transactions<br />

(down by 60 per cent),<br />

which are also visible in<br />

the reduced importance of<br />

the equity component of FDI<br />

inflows.<br />

The fact that the overall<br />

decline remains limited to<br />

downfall by eight per cent reflects<br />

the stable reinvested<br />

earnings component of<br />

FDI, indicating that transnational<br />

companies’ (TNCs)<br />

earnings overseas continued<br />

to be strong.<br />

Developing countries —<br />

without transition<br />

economies — for the first<br />

time absorbed half of global<br />

FDI inflows due to the steep<br />

fall in flows to the US and a<br />

moderate decline in flows to<br />

the EU. Despite a decline in<br />

FDI inflows, China became<br />

the world’s largest recipient<br />

in the first half of 2012.<br />

ue of the shares of the stock market.<br />

Investors were attracted towards<br />

the secondary market mostly due to<br />

the availability of lucrative shares at<br />

historically low prices of companies<br />

such as Nepal Telecom, Chilime Hydropower,<br />

Bank of Kathmandu,<br />

Everest Bank, Nabil Bank, and Standard<br />

Chartered among others.<br />

The performance of class ‘A’ companies<br />

as shown by the sensitive index<br />

has also appreciated by 33 per<br />

cent. In mid-April, the sensitive index<br />

stood at 84.5 points, which is<br />

now at 112 points.<br />

FDI flows showed an uneven<br />

pattern among regions.<br />

In developing economies,<br />

while flows to developing<br />

Asia declined, those to Latin<br />

America and Africa rose.<br />

In developed countries,<br />

the rise in flows to Europe —<br />

in spite of a fall in flows to the<br />

European Union and other<br />

developed countries — was<br />

not enough to compensate<br />

for the decline in flows to<br />

North America. Compared<br />

to the full-year forecast of<br />

FDI inflows published in<br />

July, UNCTAD now projects<br />

| SECONDARY MARKET MOVEMENT |<br />

Earlier, the higher interest rates<br />

being offered by banks used to be<br />

blamed for taking away investors<br />

from the stock market. But now as<br />

banks are offering less than eight<br />

per cent interest on fixed deposits,<br />

investors are returning once again<br />

to stock investing due to relatively<br />

increased returns.<br />

“If the lending rate of banks for<br />

share purchase loans becomes more<br />

reasonable then the market will further<br />

go up,” pointed out Rajaure. At<br />

present, banks are providing share<br />

purchase loans or margin type lend-<br />

that FDI flows will, at best,<br />

level-off in 2012 at slightly<br />

below $1.6 trillion.<br />

The slow and bumpy recovery<br />

of the global economy,<br />

weak global demand<br />

and elevated risks related to<br />

regulatory policy changes<br />

continue to reinforce the<br />

wait-and-see attitude of<br />

many TNCs toward investment<br />

abroad.<br />

In the first half of 2012, developing<br />

and transition<br />

economies continued to absorb<br />

more than half of global<br />

FDI flows. For the first time,<br />

(Figures of Nepse in points and market capitalisation in billion rupees. Source: Nepse)<br />

ing at an interest rate that is higher<br />

than 14 per cent.<br />

In the last six months, the number<br />

of listed companies has gone up to<br />

225 from 215. The number of shares<br />

listed has increased to 1.6 billion<br />

units from 1.2 billion units six<br />

months ago.<br />

The increased number of shares<br />

listing at Nepal Stock Exchange has<br />

also contributed in a surge in market<br />

capitalisation as it is calculated<br />

by multiplying a company’s shares<br />

outstanding by the current market<br />

price of one share.<br />

Mobile market booms in Dashain<br />

Himalayan News Service<br />

Kathmandu, October 28<br />

Sales of mobile sets and accessories<br />

increased by three times<br />

during the Dashain festival, according<br />

to the Mobile Traders Association<br />

of Nepal.<br />

“Normal sales of mobile sets is<br />

around 3,000 to 4,000 per day during<br />

normal times,” president of<br />

association Purushottam Basnet<br />

said, adding that sales increased<br />

to around 10,000 to 12,000 every<br />

day when consumers started their<br />

Dashain shopping.<br />

The sales of smartphones remarkably<br />

went up this year, as<br />

compared to earlier years, he informed.<br />

“The preliminary data<br />

collected by the association has<br />

revealed that Samsung and Color<br />

brands of mobiles are on the top<br />

of the list according to consumers’<br />

choice.”<br />

There are a total of 25 brands of<br />

mobile sets in the Nepali market,<br />

according to Basnet. The annual<br />

turnover of the mobile business is<br />

around Rs 13 billion, he said,<br />

adding that the trade volume is<br />

expected to go up this year due to<br />

the popularity of smartphones.<br />

The mobile handset market has<br />

been growing by 20 per cent to 25<br />

per cent annually, according to<br />

the association. The domestic<br />

market, according to traders, consumes<br />

approximately 1.5 million<br />

handsets annually.<br />

The trade volume of mobile<br />

sets will witness a steep rise for<br />

some more years due to increasing<br />

mobile penetration rate, according<br />

to traders. The telephone<br />

penetration rate in the country<br />

has reached 64.91 per cent until<br />

mid-July, according to telecom<br />

regulator Nepal Telecommunications<br />

Authority (NTA).<br />

Out of total 17.28 million telephone<br />

users, 15.33 million consumers<br />

have access to mobile<br />

phones including Global System<br />

for Mobile Communication, and<br />

Code Division Multiple Access,<br />

according to NTA. Number of<br />

users has been growing every<br />

month, creating a lot of opportunities<br />

for mobile traders and companies,<br />

said the association.<br />

“However, consumers’ selectivity<br />

and choice in buying mobile<br />

sets have also increased in recent<br />

days,” Basnet said, adding sales of<br />

branded sets and smartphones<br />

not only help increase the quality<br />

of the consumers but also boosts<br />

the revenue.<br />

Foreign direct investment flows retreat in first half of 2012: UNCTAD<br />

Global FDI fell by eight per cent to an estimated $668 billion,down from $729 billion in the first half of 2011<br />

Developing countries — without transition<br />

economies — for the first time absorbed half of<br />

global FDI inflows<br />

developing economies alone<br />

accounted for a half of the<br />

global total.<br />

“Investment leads economic<br />

growth but the current<br />

trends of investment<br />

flows to developing countries,<br />

particularly to Asia,<br />

are worrisome and the challenge<br />

for channeling FDI<br />

into key development<br />

sectors such as infrastructure,<br />

agriculture and the<br />

green economy remains<br />

daunting” said secretarygeneral<br />

of UNCTAD Supachai<br />

Panitchpakdi.<br />

Despite a slight decline in<br />

FDI inflows, China became<br />

the largest recipient country<br />

in the first half of 2012, followed<br />

by the US. However,<br />

early indications show that<br />

FDI flows to the US might<br />

be stronger in the second<br />

half of 2012.<br />

The value of cross-border<br />

M&As in the third quarter<br />

of 2012 were double those of<br />

the first half of the year, while<br />

some further acquisitions<br />

are already taking place<br />

or announced in the fourth<br />

quarter.<br />

FDI flows fell to the BRICs<br />

as a whole and to each of individual<br />

country within the<br />

group. In the first half of<br />

2012, FDI inflows declined<br />

by 11 per cent in developing<br />

Asia, despite a strong recovery<br />

after the global financial<br />

crisis. It reflects a protracted<br />

period of weak external demand<br />

with consequent<br />

strongly negative effects on<br />

exports and increasing uncertainty<br />

about high-growth<br />

emerging countries, the<br />

UNCTAD said, adding that<br />

as a result of declines in China<br />

and Hong Kong (China),<br />

PAGE 11<br />

Churi has<br />

huge potential<br />

Himalayan News Service<br />

Kathmandu, October 28<br />

Churi — a fruit berry that is found in the<br />

hilly districts of Nepal — can generate<br />

employment for around 150,000 people<br />

if the government can help boost its development.<br />

“Around 50 districts have<br />

Churi,” according to national programme<br />

manager of Micro Enterprise<br />

Development Programme (MEDEP) Dr<br />

Lakshman Pun.<br />

Aesandra butyracea or popularly<br />

known as Churi in Nepal can help produce<br />

some 17,825 metric tonnes of honey,<br />

he said, adding that at the rate of Rs<br />

200 per kg of honey, Nepal can earn<br />

around Rs 3.5 billion from Churi — that<br />

flowers for three months a year — honey.<br />

Similarly, it can also help produce<br />

37,245 metric tonnes of butter and<br />

herbal soap from Churi could earn the<br />

country around Rs 26.81 billion, Pun<br />

added. “The total employment generation<br />

from the honey and soap production<br />

of Churi could be around 150,000,”<br />

he informed.<br />

Churi is a medium sized tree native to<br />

Nepal and is abundantly found in the<br />

mountain areas between 300 to 2,000<br />

msl. It can reach heights of up to 20 metres<br />

and the seeds from Churi trees produce<br />

fatty acid oils that are mainly used<br />

as vegetable butter in rural areas.<br />

According to a resource assessment of<br />

Churi undertaken by Micro Enterprise<br />

Development Programme, out of the 75<br />

districts of Nepal, almost 50 districts are<br />

known to have Churi plants.<br />

The geographical distribution extends<br />

from Darchula, Baitadi and Dadeldhura<br />

districts in the far-west to Dhankuta and<br />

Ilam districts in the east. The total number<br />

of Churi trees in the country is estimated<br />

at 10.8 million, according to<br />

MEDEP. The highest number of trees (almost<br />

40 per cent) are found in the midwestern<br />

development region, which is<br />

followed by far western development region.<br />

These two regions combined account<br />

for about 70 per cent of the total<br />

number of trees in the country.<br />

There are an estimated 5.6 million<br />

Churi trees at fruit bearing stage in the<br />

country with the potential to produce<br />

37,245 metric tonnes of butter, the study<br />

revealed, adding that there is a huge potential<br />

in terms of resource availability to<br />

produce Churi butter as well as honey.<br />

The common method followed by micro-entrepreneurs<br />

for Churi herbal soap<br />

making is based on what is called the<br />

‘Cold Process Soap Making’. Herbal soap<br />

making is a specialised process with a<br />

wide diversity in type of ingredients used<br />

depending on the target markets consisting<br />

of low end and upscale consumers.<br />

There are various kinds of oils,<br />

essential oils, and fragrances available<br />

that could be combined by individual<br />

entrepreneurs to come up with specific<br />

products with unique characteristics.<br />

The ferry ‘Napoleon-Bonaparte’, which manages Mediterranean sea transport shuttles, tilts to the side against a quay in France, on Sunday.<br />

AFP / RSS<br />

total FDI inflows to East Asia<br />

fell by about 11 per cent.<br />

Half-year inflows to China<br />

amounted to $59 billion, a<br />

three per cent decline from<br />

$61 billion in the first half of<br />

last year. China is experiencing<br />

structural adjustments in<br />

their FDI flows, including the<br />

relocation of labour-intensive<br />

and low-end marketoriented<br />

FDI to neighbouring<br />

countries.<br />

Compared to the full-year<br />

forecast of FDI inflows published<br />

in July, UNCTAD now<br />

projects that FDI flows will,<br />

at best, level-off in 2012, at<br />

slightly below $1.6 trillion.<br />

UNCTAD’s longer term projections<br />

still show a moderate<br />

rise.<br />

However, the risk of further<br />

macroeconomic shocks<br />

in 2013 can impact FDI inflows<br />

negatively.