ING (L) RENTA FUND - ING Investment Management, Asia Pacific

ING (L) RENTA FUND - ING Investment Management, Asia Pacific

ING (L) RENTA FUND - ING Investment Management, Asia Pacific

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Semi-annual report and unaudited financial statements<br />

(Report dedicated for the Singapore market)<br />

for the period ended September 30, 2010<br />

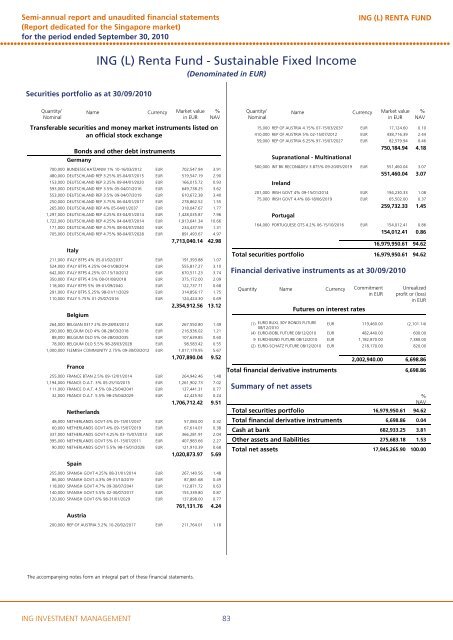

<strong>ING</strong> (L) Renta Fund - Sustainable Fixed Income<br />

(Denominated in EUR)<br />

The accompanying notes form an integral part of these financial statements.<br />

<strong>ING</strong> INVESTMENT MANAGEMENT<br />

83<br />

<strong>ING</strong> (L) <strong>RENTA</strong> <strong>FUND</strong><br />

������������������������������������������������������������������������������������������������������������������������������������<br />

Securities portfolio as at 30/09/2010<br />

Quantity/<br />

Nominal<br />

Transferable securities and money market instruments listed on<br />

an official stock exchange<br />

Bonds and other debt instruments<br />

Germany<br />

700,000 BUNDESSCHATZANW 1% 10-16/03/2012 EUR 702,547.94 3.91<br />

480,000 DEUTSCHLAND REP 3.25% 05-04/07/2015 EUR 519,547.19 2.90<br />

153,000 DEUTSCHLAND REP 3.25% 09-04/01/2020 EUR 166,015.72 0.93<br />

593,000 DEUTSCHLAND REP 3.5% 05-04/01/2016 EUR 649,738.25 3.62<br />

553,000 DEUTSCHLAND REP 3.5% 09-04/07/2019 EUR 610,672.38 3.40<br />

250,000 DEUTSCHLAND REP 3.75% 06-04/01/2017 EUR 278,862.52 1.55<br />

265,000 DEUTSCHLAND REP 4% 05-04/01/2037 EUR 318,047.67 1.77<br />

1,297,000 DEUTSCHLAND REP 4.25% 03-04/01/2014 EUR 1,428,035.87 7.96<br />

1,722,000 DEUTSCHLAND REP 4.25% 04-04/07/2014 EUR 1,913,641.34 10.66<br />

171,000 DEUTSCHLAND REP 4.75% 08-04/07/2040 EUR 234,437.59 1.31<br />

705,000 DEUTSCHLAND REP 4.75% 98-04/07/2028 EUR 891,493.67 4.97<br />

7,713,040.14 42.98<br />

Italy<br />

211,000 ITALY BTPS 4% 05-01/02/2037 EUR 191,393.88 1.07<br />

524,000 ITALY BTPS 4.25% 04-01/08/2014 EUR 555,817.27 3.10<br />

642,000 ITALY BTPS 4.25% 07-15/10/2012 EUR 670,511.23 3.74<br />

350,000 ITALY BTPS 4.5% 08-01/08/2018 EUR 375,172.00 2.09<br />

118,000 ITALY BTPS 5% 09-01/09/2040 EUR 122,737.71 0.68<br />

291,000 ITALY BTPS 5.25% 98-01/11/2029 EUR 314,856.17 1.75<br />

110,000 ITALY 5.75% 01-25/07/2016 EUR 124,424.30 0.69<br />

2,354,912.56 13.12<br />

Belgium<br />

264,000 BELGIAN 0317 2% 09-28/03/2012 EUR 267,550.80 1.49<br />

200,000 BELGIUM OLO 4% 08-28/03/2018 EUR 216,936.02 1.21<br />

88,000 BELGIUM OLO 5% 04-28/03/2035 EUR 107,639.85 0.60<br />

78,000 BELGIUM OLO 5.5% 98-28/03/2028 EUR 98,583.42 0.55<br />

1,000,000 FLEMISH COMMUNITY 2.75% 09-30/03/2012 EUR 1,017,179.95 5.67<br />

1,707,890.04 9.52<br />

France<br />

255,000 FRANCE BTAN 2.5% 09-12/01/2014 EUR 264,942.46 1.48<br />

1,194,000 FRANCE O.A.T. 3% 05-25/10/2015 EUR 1,261,902.73 7.02<br />

111,000 FRANCE O.A.T. 4.5% 09-25/04/2041 EUR 137,441.31 0.77<br />

32,000 FRANCE O.A.T. 5.5% 98-25/04/2029 EUR 42,425.92 0.24<br />

1,706,712.42 9.51<br />

Netherlands<br />

48,000 NETHERLANDS GOVT 4% 05-15/01/2037 EUR 57,084.00 0.32<br />

60,000 NETHERLANDS GOVT 4% 09-15/07/2019 EUR 67,614.01 0.38<br />

337,000 NETHERLANDS GOVT 4.25% 03-15/07/2013 EUR 366,281.91 2.04<br />

395,000 NETHERLANDS GOVT 5% 01-15/07/2011 EUR 407,983.66 2.27<br />

90,000 NETHERLANDS GOVT 5.5% 98-15/01/2028 EUR 121,910.39 0.68<br />

1,020,873.97 5.69<br />

Spain<br />

255,000 SPANISH GOVT 4.25% 08-31/01/2014 EUR 267,140.56 1.48<br />

86,000 SPANISH GOVT 4.3% 09-31/10/2019 EUR 87,881.68 0.49<br />

118,000 SPANISH GOVT 4.7% 09-30/07/2041 EUR 112,871.72 0.63<br />

140,000 SPANISH GOVT 5.5% 02-30/07/2017 EUR 155,339.80 0.87<br />

120,000 SPANISH GOVT 6% 98-31/01/2029 EUR 137,898.00 0.77<br />

761,131.76 4.24<br />

Austria<br />

Name<br />

Currency<br />

Market value<br />

in EUR<br />

%<br />

NAV<br />

200,000 REP OF AUSTRIA 3.2% 10-20/02/2017 EUR 211,764.01 1.18<br />

Quantity/<br />

Nominal<br />

15,000 REP OF AUSTRIA 4.15% 07-15/03/2037 EUR 17,124.60 0.10<br />

410,000 REP OF AUSTRIA 5% 02-15/07/2012 EUR 438,716.39 2.44<br />

59,000 REP OF AUSTRIA 6.25% 97-15/07/2027 EUR 82,579.94 0.46<br />

750,184.94 4.18<br />

Supranational - Multinational<br />

500,000 INT BK RECON&DEV 3.875% 09-20/05/2019 EUR 551,460.04 3.07<br />

551,460.04 3.07<br />

Ireland<br />

201,000 IRISH GOVT 4% 09-15/01/2014 EUR 194,230.33 1.08<br />

75,000 IRISH GOVT 4.4% 08-18/06/2019 EUR 65,502.00 0.37<br />

259,732.33 1.45<br />

Portugal<br />

Name<br />

Currency<br />

Market value<br />

in EUR<br />

%<br />

NAV<br />

164,000 PORTUGUESE OTS 4.2% 06-15/10/2016 EUR 154,012.41 0.86<br />

154,012.41 0.86<br />

16,979,950.61 94.62<br />

Total securities portfolio 16,979,950.61 94.62<br />

Financial derivative instruments as at 30/09/2010<br />

Quantity<br />

Name<br />

Currency<br />

Futures on interest rates<br />

Commitment<br />

in EUR<br />

(1) EURO BUXL 30Y BONDS FUTURE<br />

08/12/2010<br />

EUR 119,460.00<br />

(2,101.14)<br />

(4) EURO-BOBL FUTURE 08/12/2010 EUR 482,440.00<br />

600.00<br />

9 EURO-BUND FUTURE 08/12/2010 EUR 1,182,870.00<br />

7,380.00<br />

(2) EURO-SCHATZ FUTURE 08/12/2010 EUR 218,170.00<br />

820.00<br />

2,002,940.00<br />

Unrealized<br />

profit or (loss)<br />

in EUR<br />

6,698.86<br />

Total financial derivative instruments 6,698.86<br />

Summary of net assets<br />

%<br />

NAV<br />

Total securities portfolio 16,979,950.61 94.62<br />

Total financial derivative instruments 6,698.86 0.04<br />

Cash at bank 682,933.25 3.81<br />

Other assets and liabilities 275,683.18 1.53<br />

Total net assets 17,945,265.90 100.00