E-News Letter - Baroda Branch of WIRC of ICAI

E-News Letter - Baroda Branch of WIRC of ICAI

E-News Letter - Baroda Branch of WIRC of ICAI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DISCLAIMER<br />

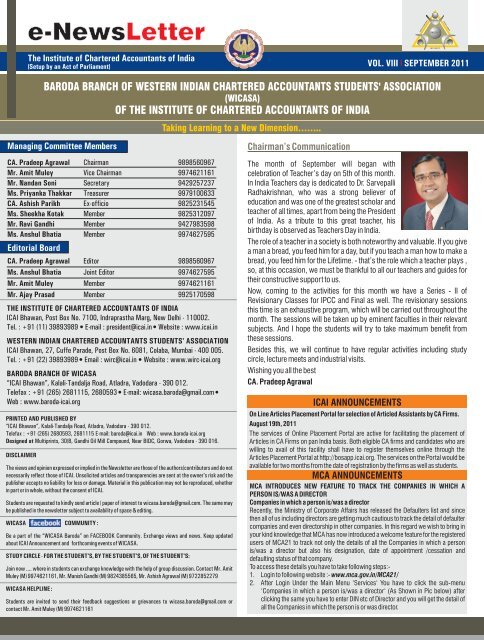

e-<strong>News</strong><strong>Letter</strong><br />

The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

(Setup by an Act <strong>of</strong> Parliament)<br />

VOL. VIII l SEPTEMBER 2011<br />

BARODA BRANCH OF WESTERN INDIAN CHARTERED ACCOUNTANTS STUDENTS' ASSOCIATION<br />

(WICASA)<br />

OF THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA<br />

Managing Committee Members<br />

CA. Pradeep Agrawal Chairman 9898560967<br />

Mr. Amit Muley Vice Chairman 9974621161<br />

Mr. Nandan Soni Secretary 9429257237<br />

Ms. Priyanka Thakkar Treasurer 9979100633<br />

CA. Ashish Parikh Ex-<strong>of</strong>ficio 9825231545<br />

Ms. Sheekha Kotak Member 9825312097<br />

Mr. Ravi Gandhi Member 9427983598<br />

Ms. Anshul Bhatia Member 9974627595<br />

Editorial Board<br />

CA. Pradeep Agrawal Editor 9898560967<br />

Ms. Anshul Bhatia Joint Editor 9974627595<br />

Mr. Amit Muley Member 9974621161<br />

Mr. Ajay Prasad Member 9925170598<br />

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA<br />

<strong>ICAI</strong> Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi - 110002.<br />

Tel. : +91 (11) 39893989 � E-mail : president@icai.in �Website<br />

: www.icai.in<br />

WESTERN INDIAN CHARTERED ACCOUNTANTS STUDENTS' ASSOCIATION<br />

<strong>ICAI</strong> Bhawan, 27, Cuffe Parade, Post Box No. 6081, Colaba, Mumbai - 400 005.<br />

Tel. : +91 (22) 39893989 �Email : wirc@icai.in �Website<br />

: www.wirc-icai.org<br />

BARODA BRANCH OF WICASA<br />

“<strong>ICAI</strong> Bhawan”, Kalali-Tandalja Road, Atladra, Vadodara - 390 012.<br />

Telefax : +91 (265) 2681115, 2680593 E-mail: wicasa.baroda@gmail.com<br />

Web : www.baroda-icai.org<br />

PRINTED AND PUBLISHED BY<br />

“<strong>ICAI</strong> Bhawan”, Kalali-Tandalja Road, Atladra, Vadodara - 390 012.<br />

Telefax : +91 (265) 2680593, 2681115 E-mail: baroda@icai.in Web : www.baroda-icai.org<br />

Designed at Multiprints, 30/B, Gandhi Oil Mill Compound, Near BIDC, Gorwa, Vadodara - 390 016.<br />

The views and opinion expressed or implied in the <strong>News</strong>letter are those <strong>of</strong> the authors/contributors and do not<br />

necessarily reflect those <strong>of</strong> <strong>ICAI</strong>. Unsolicited articles and transparencies are sent at the owner's risk and the<br />

publisher accepts no liability for loss or damage. Material in this publication may not be reproduced, whether<br />

in part or in whole, without the consent <strong>of</strong> <strong>ICAI</strong>.<br />

Students are requested to kindly send article / paper <strong>of</strong> interest to wicasa.baroda@gmail.com. The same may<br />

be published in the newsletter subject to availability <strong>of</strong> space & editing.<br />

WICASA COMMUNITY :<br />

Be a part <strong>of</strong> the “WICASA <strong>Baroda</strong>” on FACEBOOK Community. Exchange views and news. Keep updated<br />

about <strong>ICAI</strong> Announcement and forthcoming events <strong>of</strong> WICASA.<br />

STUDY CIRCLE - FOR THE STUDENT'S, BY THE STUDENT'S, OF THE STUDENT'S:<br />

Join now .... where in students can exchange knowledge with the help <strong>of</strong> group discussion. Contact Mr. Amit<br />

Muley (M) 9974621161, Mr. Manish Gandhi (M) 9824385565, Mr. Ashish Agrawal (M) 9722852279<br />

WICASA HELPLINE :<br />

Students are invited to send their feedback suggestions or grievances to wicasa.baroda@gmail.com or<br />

contact Mr. Amit Muley (M) 9974621161<br />

Taking Learning to a New Dimension……..<br />

� �<br />

Chairman’s Communication<br />

The month <strong>of</strong> September will began with<br />

celebration <strong>of</strong> Teacher’s day on 5th <strong>of</strong> this month.<br />

In India Teachers day is dedicated to Dr. Sarvepalli<br />

Radhakrishnan, who was a strong believer <strong>of</strong><br />

education and was one <strong>of</strong> the greatest scholar and<br />

teacher <strong>of</strong> all times, apart from being the President<br />

<strong>of</strong> India. As a tribute to this great teacher, his<br />

birthday is observed as Teachers Day in India.<br />

The role <strong>of</strong> a teacher in a society is both noteworthy and valuable. If you give<br />

a man a bread, you feed him for a day, but if you teach a man how to make a<br />

bread, you feed him for the Lifetime. - that’s the role which a teacher plays ,<br />

so, at this occasion, we must be thankful to all our teachers and guides for<br />

their constructive support to us.<br />

Now, coming to the activities for this month we have a Series - II <strong>of</strong><br />

Revisionary Classes for IPCC and Final as well. The revisionary sessions<br />

this time is an exhaustive program, which will be carried out throughout the<br />

month. The sessions will be taken up by eminent faculties in their relevant<br />

subjects. And I hope the students will try to take maximum benefit from<br />

these sessions.<br />

Besides this, we will continue to have regular activities including study<br />

circle, lecture meets and industrial visits.<br />

Wishing you all the best<br />

CA. Pradeep Agrawal<br />

<strong>ICAI</strong> ANNOUNCEMENTS<br />

On Line Articles Placement Portal for selection <strong>of</strong> Articled Assistants by CA Firms.<br />

August 19th, 2011<br />

The services <strong>of</strong> Online Placement Portal are active for facilitating the placement <strong>of</strong><br />

Articles in CA Firms on pan India basis. Both eligible CA firms and candidates who are<br />

willing to avail <strong>of</strong> this facility shall have to register themselves online through the<br />

Articles Placement Portal at http://bosapp.icai.org. The services on the Portal would be<br />

available for two months from the date <strong>of</strong> registration by the firms as well as students.<br />

MCA ANNOUNCEMENTS<br />

MCA INTRODUCES NEW FEATURE TO TRACK THE COMPANIES IN WHICH A<br />

PERSON IS/WAS A DIRECTOR<br />

Companies in which a person is/was a director<br />

Recently, the Ministry <strong>of</strong> Corporate Affairs has released the Defaulters list and since<br />

then all <strong>of</strong> us including directors are getting much cautious to track the detail <strong>of</strong> defaulter<br />

companies and even directorship in other companies. In this regard we wish to bring in<br />

your kind knowledge that MCA has now introduced a welcome feature for the registered<br />

users <strong>of</strong> MCA21 to track not only the details <strong>of</strong> all the Companies in which a person<br />

is/was a director but also his designation, date <strong>of</strong> appointment /cessation and<br />

defaulting status <strong>of</strong> that company.<br />

To access these details you have to take following steps:-<br />

1. Login to following website :- www.mca.gov.in/MCA21/<br />

2. After Login Under the Main Menu ‘Services‘ You have to click the sub-menu<br />

‘Companies in which a person is/was a director‘ (As Shown in Pic below) after<br />

clicking the same you have to enter DIN etc <strong>of</strong> Director and you will get the detail <strong>of</strong><br />

all the Companies in which the person is or was director.<br />

SUCCESS

e-<strong>News</strong><strong>Letter</strong><br />

FORTHCOMING EVENTS<br />

Revisionery Series- II for IPCC/PCE- Nov-11 Exam<br />

Date & Day : Sept. 2011<br />

Venue : <strong>ICAI</strong> Bhawan<br />

Revisionery Series - II for CA Final- Nov-11 Exam<br />

Date & Day : Sept. 2011<br />

Venue : <strong>ICAI</strong> Bhawan<br />

Teacher's Day Celebration<br />

Date & Day : 05.09.2011, Monday<br />

Time : 09.00 to 09.30 hrs<br />

Venue : <strong>ICAI</strong> Bhawan<br />

Industrial Visit<br />

Date & Day : 06.09.2011, Tuesday<br />

Time : 10.30 to 12.30 hrs<br />

Venue : <strong>Baroda</strong> Dairy, Makarpura, <strong>Baroda</strong><br />

Industrial Visit<br />

Date & Day : 09.09.2011, Friday<br />

Time : 14:00 to 16:00 hrs<br />

Venue : Oriental Insurance Co Ltd- Corporate<br />

Business Unit, Kalaghoda, <strong>Baroda</strong><br />

Study Circle Meeting<br />

Date & Day : 12.09.2011, Monday<br />

Time : 18.30 to 20.30 hrs<br />

Subject : Overview <strong>of</strong> XBRL<br />

Speaker : Mr. Prateek Patel, IPCC Student<br />

Venue : <strong>ICAI</strong> Bhawan<br />

How to track your Income tax Refund online<br />

Contributed By: Mr. Ankit Daluka (CA Final Student)<br />

The Income Tax Department entertains queries for all assessees<br />

regarding the refunding <strong>of</strong> income tax through the Tax Information<br />

Network (TIN). The SBI has been appointed as the refund banker,<br />

which processes refunds and routes them to the assessees’ bank<br />

accounts. If the assessee does not choose direct credit, a cheque is<br />

sent. This facility also helps track the status <strong>of</strong> the parcel that has been<br />

despatched by speed post. All refunds are handled by the Central<br />

Processing Centre (CPC) at Bangalore.<br />

Processing<br />

If the processing <strong>of</strong> the refund has not been completed by your<br />

assessing <strong>of</strong>ficer, or if there is no refund payable to you for that year,<br />

you will get a message saying so.<br />

Refund details<br />

If there is a refund, you will get details showing your refund reference<br />

number, the date <strong>of</strong> credit to your bank account or the date <strong>of</strong><br />

despatch <strong>of</strong> the cheque by speed post, and the speed post reference<br />

number, if applicable<br />

E-mail<br />

You can submit your reference number and e-mail ID on the speed<br />

post tracker screen. You will receive an e-mail when your parcel has<br />

been received.<br />

VOL. VIII l SEPTEMBER 2011<br />

<strong>Baroda</strong> <strong>Branch</strong> <strong>of</strong> WICASA <strong>of</strong> The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

Points to note<br />

Status check: You can check if your refund has been sent to the SBI,<br />

the refund banker, by logging into your e-filing account.<br />

Payment mode: Refunds are being sent in following two modes:<br />

RTGS / NECS: To enable credit <strong>of</strong> refund directly to the bank account,<br />

Taxpayer’s Bank A/c (at least 10 digits), MICR code <strong>of</strong> bank branch<br />

and correct communication address is mandatory.<br />

Paper Cheque: Bank Account No, Correct address is mandatory.<br />

Error notification: If there is an error in the refund or in case <strong>of</strong> any<br />

other query, the assessee can write to CPC Bangalore, quoting the<br />

refund reference number.<br />

Only e-payments by Public Sector Banks<br />

Contributed By: Ms. Pooja Agrawal (CA Final Student)<br />

Move aimed at speeding up process, checking corruption in funds’<br />

transfer.<br />

The Union finance ministry has told all state-owned banks and<br />

financial institutions to make payments only electronically from next<br />

month.<br />

The move is aimed at checking corruption in transfer <strong>of</strong> funds through<br />

cheques and making the entire process transparent and faster. In a<br />

circular to all 35 state-run banks and financial institutions, the<br />

ministry said they must not make any payment through cheques from<br />

September 1.<br />

The ministry is in touch with insurance companies as well, to extend<br />

the scope <strong>of</strong> e-payment to all their payees.<br />

As part <strong>of</strong> its e-governance initiative, the ministry says it has asked<br />

these bodies to go for paperless fund transfer so that irregularities in<br />

payments through cheques to various parties, such as employees,<br />

vendors, customers and social sector schemes can be checked.<br />

“Disbursal <strong>of</strong> funds through cheques <strong>of</strong>ten gives rise to corruption<br />

and the payment to the beneficiary is delayed. There have been<br />

instances where a cheque is not issued on time or the payment has<br />

not reached the beneficiary. E-payment will address all those issues,”<br />

said a ministry <strong>of</strong>ficial.<br />

However, for people who do not have a bank account, banks will still<br />

be required to make payments through modes other than electronic.<br />

Some bank executives expressed apprehension. They said most<br />

banks were already using e-payment wherever possible, but in a few<br />

cases it was not possible to do so.<br />

Both ministry <strong>of</strong>ficials and bank executives agreed mandatory<br />

electronic transfers would minimise corrupt practices, as money<br />

would be passed without any human intervention. There will be no<br />

middlemen and no pilferage in the process <strong>of</strong> sending the money to<br />

the actual beneficiary. Discontinuation <strong>of</strong> the use <strong>of</strong> cheques would be<br />

economical as well for banks, since it would reduce paper cost.<br />

“E-payment will be good for both the beneficiary and the remitter. It<br />

will ensure smooth and speedier flow <strong>of</strong> money. At Punjab National<br />

Bank, we are already using this for all kinds <strong>of</strong> payments,” said the<br />

bank’s chairman and managing director, K R Kamath.<br />

Punjab & Sind Bank executive director P K Anand said the use <strong>of</strong><br />

technology in disbursal <strong>of</strong> payments would bring better transparency<br />

and efficiency into the system.<br />

Taking Learning to a New Dimension……..<br />

02<br />

SUCCESS

e-<strong>News</strong><strong>Letter</strong><br />

ROC – Name Availability Guidelines, 2011<br />

Contributed By: Mr. Kunal Ahuja, (CA Final Student)<br />

General Circular No. : 45/2011<br />

In supercession <strong>of</strong> all the previous circulars and instructions issued<br />

by Ministry <strong>of</strong> Corporate Affairs from time to time regarding name<br />

availability, the applicants andRegistrar <strong>of</strong> Companies are advised to<br />

adhere following guidelines while applying or approving a name:<br />

1. As per provisions contained in Section 20 <strong>of</strong> the Companies<br />

Act, 1956, no company is to be registered with undesirable<br />

name. A proposed name is considered to be undesirable if it<br />

is identical with or too nearly resembling with:<br />

(i) Name <strong>of</strong> a company in existence and names already approved<br />

by the Registrar <strong>of</strong> Companies;<br />

(ii) Name <strong>of</strong> a LLP in existence or names already approved by<br />

Registrar <strong>of</strong> LLP; or<br />

(iii) A registered trade-mark or a trade mark which is subject <strong>of</strong> an<br />

application for registration, <strong>of</strong> any other person under the Trade<br />

Marks Act, 1999.<br />

2. While applying for a name in the prescribed e-form-1A, using<br />

Digital Signature Certificate (DSC), the applicant shall be<br />

required to furnish a declaration to the effect that:<br />

(i) he has used the search facilities available on the portal <strong>of</strong> the<br />

M i n i s t r y o f C o r p o r a t e A f f a i r s ( M C A ) i . e . ,<br />

www.mca.gov.in/MCA21 for checking the resemblance <strong>of</strong> the<br />

proposed name(s) with the companies and Limited Liability<br />

Partnerships (LLPs) respectively already registered or the<br />

names already approved.<br />

(ii) the proposed name(s) is/are not infringing the registered<br />

trademarks or a trademark which is subject <strong>of</strong> an application for<br />

registration, <strong>of</strong> any other person under the Trade Marks Act,<br />

1999;<br />

(iii) the proposed name(s) is/are not in violation <strong>of</strong> the provisions <strong>of</strong><br />

Emblems and Names (Prevention <strong>of</strong> Improper Use) Act, 1950<br />

as amended from time to time;<br />

(iv) the proposed name(s) is not such that its use by the company<br />

will constitute an <strong>of</strong>fence under any law for the time being in<br />

force.<br />

(v) the proposed name is not <strong>of</strong>fensive to any section <strong>of</strong> people,<br />

e.g., proposed name does not contain pr<strong>of</strong>anity or words or<br />

phrases that are generally considered a slur against an ethnic<br />

group, religion, gender or heredity;<br />

(vi) he has gone through all the prescribed guidelines, understood<br />

the meaning there<strong>of</strong> and the proposed name(s) is/are in<br />

conformity there<strong>of</strong>;<br />

(vii) he undertakes to be fully responsible for the consequences, in<br />

case the name is subsequently found to be in contravention <strong>of</strong><br />

the prescribed guidelines.<br />

3. There is an option in the e-form 1A for certification by the<br />

practicing Chartered Accountants, Company Secretaries and<br />

Cost Accountants, who will certify that he has used the search<br />

facilities available on the portal <strong>of</strong> the Ministry <strong>of</strong> Corporate<br />

VOL. VIII l SEPTEMBER 2011<br />

<strong>Baroda</strong> <strong>Branch</strong> <strong>of</strong> WICASA <strong>of</strong> The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

Affairs (MCA) i.e., www.mca.gov.in/MCA21 for checking the<br />

resemblance <strong>of</strong> the proposed name(s) with the companies and<br />

Limited Liability Partnerships (LLPs) respectively already<br />

registered or the names already approved and the search report<br />

is attached with theapplication form. The pr<strong>of</strong>essional will also<br />

certify that the proposed name is not an undesirable name<br />

under the provisions <strong>of</strong> section 20 <strong>of</strong> the Companies Act, 1956<br />

and also is in conformity with Name Availability Guidelines,<br />

2011.<br />

4(i) Where e-form 1A has been certified by the pr<strong>of</strong>essional in the<br />

manner stated at ‘3’ above, the name will be made available by<br />

the system online to the applicant without backend processing<br />

by the Registrar<strong>of</strong> Companies (ROC). This facility is not<br />

available for applications for change <strong>of</strong> name <strong>of</strong> existing<br />

companies.<br />

(ii) Where a name has been made available online on the basis <strong>of</strong><br />

certification <strong>of</strong> practicing pr<strong>of</strong>essional in the manner stated<br />

above, if it is found later on that the name ought not to have been<br />

allowed under provisions <strong>of</strong> section 20 <strong>of</strong> the Companies Act<br />

read with these Guidelines, the pr<strong>of</strong>essional shall also be liable<br />

for penal action under provisions <strong>of</strong> the Companies Act, 1956 in<br />

addition to the penal action under Regulations <strong>of</strong> respective<br />

pr<strong>of</strong>essional Institutes.<br />

(iii) Where e-form 1A has not been certified by the pr<strong>of</strong>essional, the<br />

proposed name will be processed at the back end <strong>of</strong>fice <strong>of</strong> ROC<br />

and availability or non availability <strong>of</strong> name will be communicated<br />

to the applicant.<br />

5. The name, if made available, is liable to be withdrawn anytime<br />

before registration <strong>of</strong> the company, if it is found later on that the<br />

name ought not to have been allowed. However, ROC will pass a<br />

specific order giving reasons for withdrawal <strong>of</strong> name, with an<br />

opportunity to the applicant <strong>of</strong> being heard, before withdrawal <strong>of</strong><br />

such name.<br />

6. The name, if made available to the applicant, shall be reserved<br />

for sixty days from the date <strong>of</strong> approval. If, the proposed<br />

company has not been incorporated within such period, the<br />

name shall be lapsed and will be available for other applicants.<br />

7. Even after incorporation <strong>of</strong> the company, the Central<br />

Government has the power to direct the company to change the<br />

name under section 22 <strong>of</strong> the Companies Act, 1956, if it comes<br />

to his notice or is brought to his notice through an application<br />

that the name too nearly resembles that <strong>of</strong> another existing<br />

company or a registered trademark.<br />

8. In determining whether a proposed name is identical with<br />

another, the following shall be disregarded:<br />

(i) The words Private, Pvt, Pvt., (P), Limited, Ltd, Ltd., LLP, Limited<br />

Liability Partnership;<br />

(ii) The words appearing at the end <strong>of</strong> the names – company, and<br />

company, co., co, corporation, corp, corpn, corp.;<br />

(iii) The plural version <strong>of</strong> any <strong>of</strong> the words appearing in the name;<br />

(iv) The type and case <strong>of</strong> letters, spacing between letters and<br />

punctuation marks;<br />

(v) Joining words together or separating the words, as this does not<br />

make a name distinguishable from a name that uses the similar,<br />

Taking Learning to a New Dimension……..<br />

03<br />

SUCCESS

e-<strong>News</strong><strong>Letter</strong><br />

<strong>Baroda</strong> <strong>Branch</strong> <strong>of</strong> WICASA <strong>of</strong> The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

separated or joined words. Such as Ram Nath Enterprises Pvt.<br />

Ltd. will be considered as similar to Ramnath Enterprises Pvt.<br />

Ltd.;<br />

(vi) The use <strong>of</strong> a different tense or number <strong>of</strong> the same word, as this<br />

does not distinguish one name from another. Such as, Excellent<br />

Industries will be similar to Excellence Industries and similarly<br />

Teen Murti Exports Pvt. Ltd. will be to Three Murti Exports Pvt.<br />

Ltd.;<br />

(vii) Using different phonetic spellings or spelling variations, as this<br />

does not distinguish one name from another. For example, J.K.<br />

Industries limited is existing then J and K Industries or Jay Kay<br />

Industries or J n K Industries or J & K Industries will not be<br />

allowed. Similarly if a name contains numeric character like 3,<br />

resemblance shall be checked with ‘Three’ also;<br />

(viii) The addition <strong>of</strong> an internet related designation, such as .COM,<br />

.NET, .EDU, .GOV, .ORG, .IN, as this does not make a name<br />

distinguishable from another, even where (.) is written as ‘dot’;<br />

(ix) The addition <strong>of</strong> words like New, Modern, Nav, Shri, Sri, Shree,<br />

Sree, Om, Jai, Sai, The, etc., as this does not make a name<br />

distinguishable from an existing name such as New Bata Shoe<br />

Company, Nav Bharat Electronic etc. Similarly, if it is different<br />

from the name <strong>of</strong> the existing company only to the extent <strong>of</strong><br />

adding the name <strong>of</strong> the place, the same shall not be allowed. For<br />

example, ‘Unique Marbles Delhi Limited’ can not be allowed if<br />

‘Unique Marbles Limited’ is already existing; Such names may<br />

be allowed only if no objection from the existing company by<br />

way <strong>of</strong> Board resolution is produced/ submitted;<br />

(x) Different combination <strong>of</strong> the same words, as this does not make<br />

a name distinguishable from an existing name, e.g., if there is a<br />

company in existence by the name <strong>of</strong> “Builders and Contractors<br />

Limited”, the name “Contractors and Builders Limited” should<br />

not be allowed;<br />

(xi) Exact Hindi translation <strong>of</strong> the name <strong>of</strong> an existing company in<br />

English especially an existing company with a reputation. For<br />

example, Hindustan Steel Industries Ltd. will not be allowed if<br />

there exists a company with name ‘Hindustan Ispat Udyog<br />

Limited’;<br />

9. In addition to above, the user shall also adhere to following<br />

guidelines:<br />

(i) It is not necessary that the proposed name should be indicative<br />

<strong>of</strong> the main object.;<br />

(ii) If the Company’s main business is finance, housing finance,<br />

chit fund, leasing, investments, securities or combination<br />

there<strong>of</strong>, such name shall not be allowed unless the name is<br />

indicative <strong>of</strong> such related financial activities, viz., Chit Fund/<br />

Investment/ Loan, etc.;<br />

(iii) If it includes the words indicative <strong>of</strong> a separate type <strong>of</strong> business<br />

constitution or legal person or any connotation there<strong>of</strong>, the<br />

same shall not be allowed. For eg: co¬operative, sehkari, trust,<br />

LLP, partnership, society, proprietor, HUF, firm, Inc., PLC,<br />

GmbH, SA, PTE, Sdn, AG etc.;<br />

(iv) Abbreviated name such as ‘BERD limited’ or ‘23K limited’<br />

VOL. VIII l SEPTEMBER 2011<br />

cannot be given to a new company. However the companies<br />

well known in their respective field by abbreviated names are<br />

allowed to change their names to abbreviation <strong>of</strong> their existing<br />

name (for Delhi Cloth Mills limited to DCM Limited, Hindustan<br />

Machine Tools limited to HMT limited) after following the<br />

requirement <strong>of</strong> Section 21 <strong>of</strong> the Companies Act, 1956. Further,<br />

if the name is only a general one like Cotton Textile Mills Ltd., or<br />

Silk Manufacturing Ltd., and not specific like Calcutta Cotton<br />

Textiles Mills Limited or Lakshmi Silk Manufacturing Company<br />

Limited, the same shall not be allowed;<br />

(v) If the proposed name is identical to the name <strong>of</strong> a company<br />

dissolved as a result <strong>of</strong> liquidation proceeding should not be<br />

allowed for a period <strong>of</strong> 2 years from the date <strong>of</strong> such dissolution<br />

since the dissolution <strong>of</strong> the company could be declared void<br />

within the period aforesaid by an order <strong>of</strong> the Court under<br />

section 559 <strong>of</strong> the Act. Moreover, if the proposed name is<br />

identical with the name <strong>of</strong> a company which is struck <strong>of</strong>f in<br />

pursuance <strong>of</strong> action under section 560 <strong>of</strong> the Act, then the same<br />

shall not be allowed before the expiry <strong>of</strong> 20 years from the<br />

publication in the Official Gazette being so struck <strong>of</strong>f since the<br />

company can be restored anytime within such period by the<br />

competent authority;<br />

(vi) If the proposed names include words such as ‘Insurance’,<br />

‘Bank’, ‘Stock Exchange’, ‘Venture Capital’, ‘Asset<br />

Management’, ‘Nidhi’, ‘Mutual fund’ etc., the name may be<br />

allowed with a declaration by the applicant that the requirements<br />

mandated by the respective Act/ regulator, such as IRDA, RBI,<br />

SEBI, MCA etc. have been complied with by the applicant;<br />

(vii) If the proposed name includes the word “State”, the same shall<br />

be allowed only in case the company is a government company.<br />

Also, if the proposed name is containing only the name <strong>of</strong> a<br />

continent, country, state, city such as Asia limited, Germany<br />

Limited, Haryana Limited, Mysore Limited, the same shall not<br />

be allowed;<br />

(viii) If the proposed name contains any word or expression which is<br />

likely to give the impression that the company is in any way<br />

connected with, or having the patronage <strong>of</strong>, the Central<br />

Government, any State Government, or any local authority,<br />

corporation or body constituted by the Central or any State<br />

Government under any law for the time in force, unless the<br />

previous approval <strong>of</strong> Central Government has been obtained for<br />

the use <strong>of</strong> any such word or expression;<br />

(ix) If a foreign company is incorporating its subsidiary company,<br />

then the original name <strong>of</strong> the holding company as it is may be<br />

allowed with the addition <strong>of</strong> word India or name <strong>of</strong> any Indian<br />

state or city, if otherwise available;<br />

(x) Change <strong>of</strong> name shall not be allowed to a company which is<br />

defaulting in filing its due Annual Returns or Balance Sheets or<br />

which has defaulted in repayment <strong>of</strong> matured deposits and<br />

debentures and/or interest thereon;<br />

10. These guidelines and revised e-form 1A are likely to be<br />

implemented with effect from 24th July, 2011.<br />

11. This issues with the approval <strong>of</strong> competent authority.<br />

Taking Learning to a New Dimension……..<br />

04<br />

SUCCESS

e-<strong>News</strong><strong>Letter</strong><br />

IMPORTANT JUDGEMENTS IN DIRECT TAXES<br />

Contributed by : Mr. Akash Yadav (CA Final Student)<br />

a) Despite bar in Proviso to s. 14A, s. 147 reopening for earlier years valid<br />

For AY 2000-01, the assessee filed a return on 30.11.2000. As s. 14A was<br />

inserted subsequently by FA 2001 (w.r.e.f 1.4.62) and was tabled in<br />

Parliament on 28.2.2001, the assessee did not make any disallowance u/s<br />

14A. The AO also did not make a disallowance in the s. 143 (3) order passed<br />

on 7.3.2003. After the expiry <strong>of</strong> 4 years, the AO sought to reopen the<br />

assessment to make a disallowance u/s 14A. The assessee challenged the<br />

reopening on the ground that (i) under the Proviso to s. 14A, a reopening u/s<br />

147 for AY 2001-02 & earlier years was not permissible, (ii) as s. 14A was<br />

not on the statute when the ROI was filed, there was no failure to disclose &<br />

(iii) as the AO had also sought to rectify u/s 154, he could not reopen u/s 147.<br />

The High Court dismissed the Writ Petition inter alia on the ground that “the<br />

Proviso to s. 14A bars reassessment but not original assessment on the<br />

basis <strong>of</strong> the retrospective amendment. Though the ROI was filed before s.<br />

14A was enacted, the assessment order was passed subsequently. The AO<br />

ought to have applied s. 14A and his failure has resulted in escapement <strong>of</strong><br />

income. The object and purpose <strong>of</strong> the Proviso is to ensure that the<br />

retrospective amendment is not made as a tool to reopen past cases which<br />

have attained finality“. On appeal by the assessee to the Supreme Court,<br />

HELD dismissing the SLP:<br />

Statutory Dates August 2011 Events<br />

VOL. VIII l SEPTEMBER 2011<br />

SEPT. 2011<br />

<strong>Baroda</strong> <strong>Branch</strong> <strong>of</strong> WICASA <strong>of</strong> The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

Date Day Events Venue Atten.<br />

02.08.2011 Tuesday Fun with BIG FM RJ - Tejal Jani <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 60<br />

02.08.2011 Tuesday <strong>Branch</strong> Level Elocution Competition - 2011 <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 15<br />

03.08.2011 Wednesday Career Counseling Program <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 300+<br />

04.08.2011 Thursday Career Counseling Program Godhra 150+<br />

04.08.2011 Thursday Career Counseling Program P K High School, Kalol 150+<br />

04.08.2011 Thursday Study Circle Meeting <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 15<br />

05.08.2011 Friday Educational Tour Sardar Sarovar Dam,Kevadia 63<br />

06.08.2011 Saturday Industrial Visit Shr<strong>of</strong>f Engineering Ltd 25<br />

07.08.2011 Sunday Friendships Day celebration with BIG FM RJ Hiren <strong>ICAI</strong> Bhawan,<strong>Baroda</strong> 75+<br />

07.08.2011 Sunday Career Counseling Program Kadva Patidar Samaj Wadi, Sama, <strong>Baroda</strong> 1000+<br />

08.08.2011 Monday Press Conference for IPCC Results <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 75+<br />

15.08.2011 Monday 64th Independence Day Celebration <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 50+<br />

17.08.2011 Wednesday Industrial Visit ABB India Ltd 23<br />

18.08.2011 Thursday Study Circle Meeting <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 10<br />

25.08.2011 Wednesday Pop the Question - Current Affairs 3rd Round <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 5<br />

25.08.2011 Wednesday Study Circle Meeting <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 10<br />

27.08.2011 Saturday Felicitation <strong>of</strong> the All India rankers and the newly <strong>ICAI</strong> Bhawan, <strong>Baroda</strong> 75+<br />

qualified chartered accountants<br />

Contributed by :<br />

Mr. Ajay Prasad (CA Final Student)<br />

sun mon tue wed thu fri sat<br />

1 2 3<br />

4 5 6 7 8 9 10<br />

11 12 13 14 15 16 17<br />

18 19 20 21 22 23 24<br />

25 26 27 28 29 30<br />

In our view, the re-opening <strong>of</strong> assessment is fully justified on the facts and<br />

circumstances <strong>of</strong> the case.<br />

Honda Siel Power Products Ltd vs. DCIT (Supreme Court)<br />

b) If AO has allowed s. 10A deduction, DRP cannot withdraw it<br />

The assessee claimed deduction <strong>of</strong> Rs. 32.18 crores u/s 10A. The AO<br />

passed a draft assessment order u/s 144C in which he allowed s. 10A<br />

deduction though he reduced the quantum by Rs. 44.49 lakhs. When the<br />

assessee filed objections before the Dispute Resolution Panel (“DRP”), it<br />

took the view that the assessee was not at all entitled to s. 10A deduction as it<br />

was engaged in “research & development”. On the alternative plea that the<br />

assessee was engaged in providing “engineering design services”, the DRP<br />

directed the AO to examine the claim on merits. The assessee filed a Writ<br />

Petition claiming that the directions given by the DRP was beyond<br />

jurisdiction. This was dismissed by the single judge. On appeal by the<br />

assessee, HELD allowing the appeal:<br />

(i) As the AO had accepted that the assessee was eligible for s. 10A<br />

deduction and had only proposed a variation on the quantum, the DRP<br />

had no jurisdiction to hold that the assessee was not at all eligible for s.<br />

10A deduction;<br />

(ii) The DRP’s direction that the AO should decide the alternate claim <strong>of</strong> the<br />

assessee having regard to the material is also without jurisdiction. If<br />

such orders and directions are permitted to be allowed, it would defeat<br />

the object <strong>of</strong> the alternate dispute resolution.<br />

GE India Technology Centre Pvt Ltd vs. DRP (Karnataka High Court)<br />

Service Tax Payment in Form GIR7 & Excise Duty Payment for the<br />

month <strong>of</strong> August (6th in case <strong>of</strong> electronic payment, otherwise<br />

due date in 5th)<br />

TDS (Form 280/281)/TCS payment for the month <strong>of</strong> August.<br />

Excise return (ER 1) for the month <strong>of</strong> August 2011, ER-6 Monthly<br />

Return U/R9A(3) <strong>of</strong> CCR, 2004<br />

PF payment for the month <strong>of</strong> August.<br />

VAT & CST monthly payment & filing <strong>of</strong> VAT & CST returns for<br />

the month <strong>of</strong> August.<br />

ESI remittance for the month <strong>of</strong> August.<br />

PF monthly return for the month <strong>of</strong> August.<br />

Taking Learning to a New Dimension……..<br />

05<br />

SUCCESS<br />

Pr<strong>of</strong>essional Tax payment for the month <strong>of</strong> August.

e-<strong>News</strong><strong>Letter</strong><br />

VOL. VIII l SEPTEMBER 2011<br />

<strong>Baroda</strong> <strong>Branch</strong> <strong>of</strong> WICASA <strong>of</strong> The Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India<br />

Aashka Bhatt<br />

1st Runner up<br />

(Elocution)<br />

PAPER PRESENTERS IN NATIONAL STUDENTS CONFERENCES<br />

Tanmay Buch<br />

Indore<br />

Pankaj Agrawal<br />

Kolkatta<br />

Milind Joshi<br />

Ludhiana<br />

PHOTO FLASH<br />

REGIONAL LEVEL ELOCUTION & QUIZ COMPETITIONS - 2011 AT MUMBAI<br />

Anagha Dandekar<br />

2nd Runner up<br />

(Elocution)<br />

Kunal Saraiya<br />

CA Final (50th Rank)<br />

Niyati Badani<br />

(Elocution)<br />

Krupali Upadhyay<br />

IPCC (25th Rank)<br />

Taking Learning to a New Dimension……..<br />

06<br />

SUCCESS<br />

Fayazan Dabhoiwala<br />

1st Runner up<br />

(Quiz)<br />

ALL INDIA RANKER'S IN MAY-11 FROM BARODA CENTER<br />

Ukti Shah<br />

PCC (41st Rank)<br />

Vinay Uppin<br />

1st Runner up<br />

(Quiz)<br />

Krati Sankhlecha<br />

CPT (10th Rank)<br />

Congratulations