BIOTECHNOLOGY BB Biotech4)

BIOTECHNOLOGY BB Biotech4)

BIOTECHNOLOGY BB Biotech4)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>BIOTECHNOLOGY</strong><br />

A RESEARCH PUBLICATION BY DZ BANK AG<br />

<strong>BB</strong> Biotech 4)<br />

Year *) Security portfolio Net asset value Dividend<br />

per share<br />

CHF m CHF m EUR<br />

2003 1982.7 74.66 – 2.50<br />

2004e 2180 84.82 – 2.50<br />

2005e 2400 93.38 – –<br />

2006e 2720 105.84 – –<br />

*) Fiscal year end December<br />

Lacklustre Q3 results – but so far stock has still outperformed in 2004<br />

– Q3 2004: net loss of CHF 104.2m (Q3 2003: CHF +10m).<br />

– Net loss mainly caused by share-price losses affecting portfolio companies.<br />

– Marked outperformance against the benchmark – the BTK index - so far in 2004.<br />

– High spread to net asset value of over 15%, almost unchanged in over 12 months.<br />

– Dividend payment of around CHF 2.50/share therefore likely.<br />

– Still a high dependency on USD/CHF exchange rate.<br />

– Core holdings currently overvalued by around 10%.<br />

The stock is currently undervalued by around 17% in relation to its NAV (EUR 52.30). By<br />

contrast, however, <strong>BB</strong> Biotech’s core holdings are overvalued by around 10% on the basis of a<br />

peer-group comparison. Overall, therefore, we only anticipate upside potential of around 7%<br />

for the stock and are therefore leaving our recommendation unchanged at a weak “buy“. For<br />

investors with an investment horizon of six months, a dividend yield of around 3% may be a<br />

further argument in favour of buying the stock. We see the stock’s fair value at EUR 47.60.<br />

1)-7) Important: Please read the references to possible conflicts of interest<br />

and disclaimers/disclosures at the end of this report.<br />

Equities<br />

Flash<br />

2 Nov 2004<br />

Buy<br />

Price on 01 Nov 2004<br />

(in EUR): 44.49<br />

Risk classification: 4<br />

Financial ratios 2003e:<br />

Book value per share (in EUR): -<br />

Equity ratio (in %): -<br />

EBITDA margin (in %): -<br />

Net margin (in %): -<br />

ROE (in %): -<br />

Dividend yield (in %): -<br />

Free cash flow (EUR m): -<br />

Number of shares<br />

(million units): 25.7<br />

Market cap<br />

(in EUR m): 1143.39<br />

Free float (in %): 100.00<br />

SIN: 888509<br />

ISIN: CH0001441580<br />

Reuters: BIOZ.DE<br />

Bloomberg: <strong>BB</strong>Z GY<br />

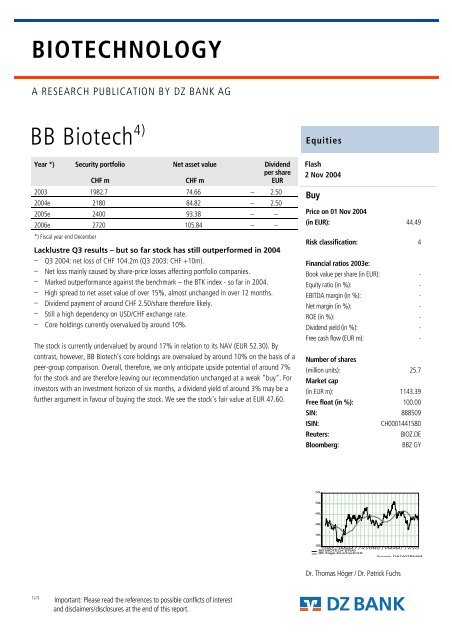

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

OND J FMAMJ J A S OND J FMAMJ J A S O<br />

<strong>BB</strong> BIOTECH (FRA)<br />

90-Tage-Durchschnitt<br />

Source: DATASTREAM<br />

Dr. Thomas Höger / Dr. Patrick Fuchs

Biotechnology – <strong>BB</strong> Biotech<br />

Average results in Q3 2004<br />

<strong>BB</strong> Biotech generated a net loss of CHF 104.2m in Q3 2004; in the same previous-year<br />

period, the company still generated a profit of CHF 10m. The loss mainly stems from a net<br />

loss of CHF 102m incurred by the securities. Over nine months, the profit amounts to CHF<br />

228.7m (EPS: CHF 8.96) against CHF 291.9m (EPS: CHF 11.24) in the previous-year period.<br />

Good price performance so far in 2004<br />

Even though <strong>BB</strong> Biotech shares have underperformed their benchmark, the BTK index, in<br />

the last three months, the overall performance over a 12-month period looks better: so far<br />

this year, <strong>BB</strong> Biotech shares have significantly outperformed their benchmark, thereby<br />

ending their negative run in the period 2000-2003, as shown in the following table. In our<br />

view, the investment focus on smaller, strong-growth companies is paying off, as the BTK<br />

index mainly consists of more mature biotechnology companies.<br />

Performance of <strong>BB</strong> Biotech share against the BTK index<br />

Period <strong>BB</strong> Biotech return BTK Index Return Difference<br />

1 month 1.48% -2.93% 4.41%<br />

3 months 4.64% 6.82% -2.18%<br />

Year-to-date 14.30% 5.12% 9.17%<br />

1 year 10.52% 10.33% 0.19%<br />

3 years -13.12% -2.58% -10.54%<br />

2003 4.29% 44.91% -40.62%<br />

2002 -53.78% -41.74% -12.04%<br />

2001 -25.63% -8.47% -17.15%<br />

2000 61.15% 62.05% -0.90%<br />

Source: Bloomberg; position at: 1.11.2004<br />

The main reason for a slightly weaker performance than the benchmark in the last three<br />

months is a disappointing price performance by Ligand Pharmaceuticals, which lost around<br />

70% of its value during the period from 30.6.2004 to 30.09.2004. Admittedly, Ligand<br />

Pharmaceuticals’s auditors, Deloitte&Touche, have resigned, sparking off rumours of<br />

financial irregularities. As a result, a number of Ligand shareholders are taking a class<br />

action against Ligand. In our view, the investment in Eye Tech-Pharmaceuticals, for<br />

example, has done very well. <strong>BB</strong> Biotech was already invested in the company before it<br />

went public. In the meantime, the entry price of USD 7.05 has increased more than fivefold.<br />

Two other pre-IPO investments of <strong>BB</strong> Biotech (Auxilium and Theravance) have also<br />

successfully completed their flotation in Q3, with share prices well in excess of the entry<br />

price of USD 1.50 and USD 7 respectively paid by <strong>BB</strong> Biotech. Auxilium and Theravance are<br />

currently trading at USD 7.85 and USD 16.55 respectively.<br />

In Q3, <strong>BB</strong> Biotech reduced its stake in Celgene, Cell Therapeutics and Durect, and raised its<br />

position in Actelion and Elan. New investments in the portfolio are United Therapeutics,<br />

Incyte, Epigenomics and Idenix.<br />

Net loss of CHF 104.2m<br />

2004: so far, marked<br />

outperformance against the<br />

benchmark<br />

Poor price performance above all<br />

from Ligand Pharmaceuticals<br />

Very successful investments in<br />

pre-IPO companies<br />

Portfolio changes<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 2

Biotechnology – <strong>BB</strong> Biotech<br />

Valuation<br />

In view of a still high spread between Biotech shares and their NAV, the stock still seems<br />

fundamentally undervalued at its present level. We believe that the spread will only start to<br />

narrow once <strong>BB</strong> Biotech’s management succeeds in generating a consistently better<br />

performance in relation to the benchmark. As the previous table illustrates, this has been<br />

the case in the current financial year, unlike in the period 2000-2003. Despite measures to<br />

close the gap between the NAP and share price, including the dividend payout and capital<br />

reduction, <strong>BB</strong> Biotech has so far failed to bring the spread lastingly below the 10% hurdle.<br />

It is currently around 17%. The following graph shows the spread trend in the last 12<br />

months:<br />

<strong>BB</strong> Biotech - Spread between NAV and share price<br />

Source: <strong>BB</strong> Biotech<br />

<strong>BB</strong> Biotech pays a dividend, which depends on the amount of the average yearly spread: if<br />

it is between<br />

5% and 10%, the dividend amounts to 1% of the NAV at year-end;<br />

>10% and 15%, it amounts to 2% of the NAV;<br />

>15 and 20%, 3% of NAV and<br />

>20%, 4% of NAV.<br />

The average spread in the period between 31.12.2003 and 30.09.2004 amounted to<br />

15.6%. This would mean a dividend payment of around CHF 2.50.<br />

<strong>BB</strong> Biotech’s share-price performance continues to be strongly influenced by the USD/CHF<br />

exchange rate, as over 90% of the portfolio is invested in US biotechnology shares.<br />

In our view, <strong>BB</strong> Biotech’s core investment, which together makes up around 73% of the<br />

portfolio, seem to be overvalued by around 10% in a peer-group comparison, as illustrated<br />

in the following table:<br />

Spread to NAV still over >15%<br />

Spread practically unchanged in<br />

the last 12 months<br />

Average spread in 2004: 15.6%<br />

Strong dependence on USD/CHF<br />

exchange rate<br />

Core holdings: overvalued by<br />

around 10%<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 3

Biotechnology – <strong>BB</strong> Biotech<br />

Selected valuation multiples for <strong>BB</strong> Biotech’s core holdings<br />

Company<br />

PER<br />

2005e<br />

EV/EBITDA<br />

2005e<br />

EBITDA Margin<br />

2005e (%)<br />

EPS CAGR<br />

(03-07)e (%)<br />

PEG Ratio<br />

2004e<br />

Gilead 32.1 17.6 52.5 21 1.8<br />

Celgene 51.0 n.a. n.a. 100.7 0.9<br />

Biogen IDEC 33.3 18.3 43.7 18 2.2<br />

Sepracor neg. n.a. n.a. n.a. n.a.<br />

Actelion 32.1 23.2 25.6 n.a. n.a.<br />

Genzyme 25.2 n.a. 24.3 21.7 1.4<br />

Eyetech 46.4 n.a. n.a. n.a. n.a.<br />

The Medicines Company 32.6 35.9 17.6 n.a. n.a.<br />

Mean 32.6 20.8 25.6 21.3 1.6<br />

BTK indices mean 30.1 17.6 28.9 18.3 1.8<br />

Global Pharma. mean 23.0 9.6 29.5 10.1 1.6<br />

Overall, therefore, we only see upside potential of around 7% for the stock and our<br />

recommendation is unchanged at a weak „buy“. For investors with an investment horizon<br />

of six months, the dividend yield of around 3% may be a further argument in favour of<br />

buying the stock. We see the stock’s fair value at EUR 47.60.<br />

Fair value: EUR 47.60<br />

Recommendation still a weak<br />

„buy“<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 4

Biotechnology – <strong>BB</strong> Biotech<br />

Company<br />

No. of<br />

Securities<br />

30.09.2004<br />

Changes<br />

against<br />

30.06.2004 Currency<br />

Price in<br />

Original<br />

Currency<br />

Market Value<br />

on 30.09.<br />

(CHF m)<br />

As % of<br />

Portfolios<br />

As % of<br />

Company<br />

Market Value<br />

on 30.09.<br />

(EUR m)<br />

Gilead 6,000,000 0 USD 37.38 279.9 14.2 1.4 180.70<br />

Celgene 2,746,700 -143,900 USD 58.23 199.6 10.1 3.3 128.86<br />

Biogen Idec 2,600,000 0 USD 61.17 198.5 10.1 0.8 128.15<br />

Sepracor 3,000,000 0 USD 48.78 182.6 9.3 2.9 117.88<br />

Actelion 1,199,223 192,813 CHF 128.00 153.5 7.8 5.4 99.10<br />

Genzyme 2,229,000 0 USD 54.41 151.3 7.7 1.0 97.68<br />

EyeTech 3,476,362 0 USD 33.99 147.4 7.5 8.5 95.16<br />

Medicines Co. 4,074,075 0 USD 24.14 122.7 6.2 8.5 79.21<br />

AtheroGenics 2,050,000 0 USD 32.95 84.3 4.3 5.5 54.42<br />

Ligand Pharmac. 6,400,000 0 USD 10.02 80.0 4.1 8.7 51.65<br />

Amgen 1,000,000 0 USD 56.81 70.9 3.6 0.1 45.77<br />

ICOS 2,000,000 0 USD 24.14 60.2 3.1 3.2 38.86<br />

Elan 2,000,000 1,794,000 USD 23.40 58.4 3.0 0.5 37.70<br />

United Therapeutics 669,000 669,000 USD 34.93 29.2 1.5 3.1 18.85<br />

Pozen 2,217,000 0 USD 8.74 24.2 1.2 7.7 15.62<br />

Cell Therapeutics 2,378,062 -621,938 USD 6.86 20.4 1.0 3.9 13.17<br />

Incyte 1,403,244 1,403,244 USD 9.63 16.9 0.9 1.9 10.91<br />

Virologic 5,726,430 0 USD 2.00 14.3 0.7 10.7 9.23<br />

Epigenomics 1,000,000 1,000,000 EUR 7.85 12.2 0.6 6.3 7.88<br />

Auxilium Pharmac. 1,000,000 0 USD 8.53 10.6 0.5 4.9 6.84<br />

Idenix 500,000 500,000 USD 16.00 10.0 0.5 1.0 6.46<br />

Telik 208,400 0 USD 22.30 5.8 0.3 0.5 3.74<br />

Durect 1,306,527 -948,430 USD 1.40 2.3 0.1 2.5 1.48<br />

Theravance 2,007,168 0 USD 10.85 27.2 1.4 3.9 17.56<br />

Total 1,962.4 99.7 1,266.88<br />

Derivatives<br />

Medicines Company<br />

warrants (long)<br />

Virologic warrants<br />

(long)<br />

Auxilium Pharmac.<br />

(long)<br />

675,925 0 USD 18.22 15.4 0.8 1.4 9.94<br />

990,993 0 USD 1.19 1.5 0.1 1.8 0.97<br />

1,501,501 0 USD 4.10 1.5 0.1 1.5 0.97<br />

Total 18.4 1.0 11.88<br />

Liquidity (net) -13.2 -0.7 -8.52<br />

Total 1,967.4 100.0 1,270.11<br />

<strong>BB</strong> BIOTECH bearer<br />

shares<br />

1,478,294 -1,394,848 100.1<br />

Total 2,067.5 1,334.73<br />

Source: <strong>BB</strong> Biotech<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 5

Biotechnology – <strong>BB</strong> Biotech<br />

Imprint<br />

Published by: DZ BANK AG Deutsche Zentral-Genossenschaftsbank, Platz der Republik, 60265 Frankfurt am Main<br />

Board of Managing Directors: Dr. Ulrich Brixner (Chairman), Dr. Thomas Duhnkrack, Heinz Hilgert, Wolfgang Kirsch, Albrecht Merz,<br />

Dietrich Voigtländer<br />

Responsible: Klaus Holschuh, Head of Research and Volkswirtschaft, Tel.: 069 7447 1253<br />

Responsible: Dr. Lothar Weniger, Head of Equity Research, Tel.: 069 7447 1266, E-Mail: lothar.weniger@dzbank.de<br />

© DZ BANK AG Deutsche Zentral-Genossenschaftsbank, Frankfurt am Main 2004<br />

Reprinting and reproduction requires the approval of DZ BANK AG Deutsche Zentral-Genossenschaftsbank, Frankfurt am Main<br />

DZ BANK Research – all covered<br />

companies<br />

Companies where DZ BANK, DZ Financial Markets<br />

LCC and/or respective affiliates have provided<br />

investment banking services in the last 12 months<br />

Buy 74.2% Buy 80.8%<br />

Hold 9.8% Hold 15.4%<br />

Sell 16.0% Sell 3.8%<br />

Certification<br />

Each DZ BANK research analyst who is involved in the preparation of this research report certifies that:<br />

a) the views expressed in the research report accurately reflect such research analyst´s personal views about the subject securities and issuers; and<br />

b) that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in<br />

the research report.<br />

The numerical annotations in the text refer to the numbering of the notes below<br />

1) DZ BANK, DZ Financial Markets LLC and/or their respective affiliates beneficially own 1 % or more of any class of common equity<br />

securities of the subject company.<br />

2) DZ BANK, DZ Financial Markets LLC and/or their respective affiliates have managed or co-managed a public offering of securities of<br />

the subject company within the past five years.<br />

3) DZ BANK, DZ Financial Markets LLC and/or their respective affiliates beneficially make a market in, or undertakes the designated<br />

sponsor responsibilities of, the subject company. As such, the market maker may have an inventory position, either “long” or “short”,<br />

in the relevant security and may be on the opposite side of orders executed on the relevant exchange.<br />

4) DZ BANK, DZ Financial Markets LLC and/or their respective affiliates beneficially have received during the past 12 months<br />

compensation for investment banking services from the company, its parent, or its wholly owned or majority-owned subsidiary.<br />

5) DZ BANK, DZ Financial Markets LLC and/or their respective affiliates beneficially expect to receive or intend to seek compensation for<br />

investment banking services in the next 3 months from the company, its parent, or its wholly owned or majority-owned subsidiary.<br />

6) The author, or an individual who assisted in the preparation, of the report or a member of their respective household serves as an<br />

officer, director or advisory board member of the subject company.<br />

7) The author, or an individual who assisted in the preparation, of the report or a member of their respective household has a direct<br />

ownership position in securities issued by the subject company or derivatives thereof.<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 6

Biotechnology – <strong>BB</strong> Biotech<br />

Disclaimer<br />

1. This report has been prepared and/or issued by DZ BANK AG Deutsche Zentral-Genossenschaftsbank AG and/or one of its affiliates („DZ BANK“) and has been approved by DZ BANK<br />

AG Deutsche Zentral-Genossenschaftsbank AG, Frankfurt am Main, Germany in connection with its distribution in the European Economic Area and other such locations as noted below.<br />

The suitability of our recommendations for each investor depends to a great extent on the investment objectives, context and financial situation of the investor concerned. The<br />

recommendations and opinions contained in this report constitute the best judgement of DZ BANK at this date and time and are subject to change without notice as a result of future<br />

events or results. This report is for distribution in all countries only in accordance with the applicable law and rules and persons into whose possession this report comes should inform<br />

themselves about and observe such law and rules. This report constitutes an independent appraisal of the relevant issuer or security by DZ BANK; all evaluations, opinions or explanations<br />

contained herein are those of the author of the report and do not necessarily correspond with those of the issuer or third parties.<br />

This report is being furnished to you solely for your information and may not be reproduced, redistributed or published in whole or in part, to any other person.<br />

DZ BANK has obtained the information on which this report is based from sources believed to be reliable, but has not verified all of such information. Consequently, DZ BANK, DZ<br />

Financial Markets LLC and/or their respective affiliates do not make or provide any representations or warranties regarding the completeness or accuracy of the information or the<br />

opinions contained in this report. Further, DZ BANK assumes no liability for losses incurred as a result of distributing and/or using this report or for any losses which are in any way<br />

associated with the distribution and/or usage of this report. Any decision to effect an investment in securities should be founded on independent investment analysis and processes as<br />

well as other reports including, but not limited to, information memoranda, sales prospectuses or offering circulars rather than on the basis of this report. Whilst DZ BANK may provide<br />

hyperlinks to web sites of entities mentioned in this report, the inclusion of a link does not imply that DZ BANK endorses, recommends or approves any material on the linked page or<br />

accessible from it. DZ BANK accepts no responsibility whatsoever for any such material, nor for any consequences of its use.<br />

DZ BANK may have investment banking and other business relationships with the company or companies that are the subject of this report. DZ BANK’ s research analysts also provide<br />

important input into the investment banking and other business selection processes. Investors should assume that DZ BANK, DZ Financial Markets LLC and/or their respective affiliates<br />

are seeking or will seek investment banking or other business from the company or companies that are the subject of this report and that the research analysts who were involved in<br />

preparing this material may participate in the solicitation of such business.<br />

Research analysts are not compensated for specific investment banking transactions. The author(s) of this report receive(s) compensation that is based on (among other factors) the<br />

overall profitability of DZ BANK, which includes earnings from the firm’s investment banking and other businesses. DZ BANK generally prohibits its analysts, persons reporting to analysts,<br />

and members of their households from maintaining a financial interest in the securities or futures of any companies that the analysts cover.<br />

2.The securities/ADRs discussed in this report are either listed on a US exchange, traded in the US over-the-counter, or traded only on a foreign exchange. Those securities that are not<br />

registered in the US, subject to certain exceptions, may not be offered or sold, directly or indirectly, within the US or to US persons (within the meaning of Regulation S and under the<br />

Securities Act). This report does not constitute an offer or solicitation with respect to the purchase or sale of any security within the meaning of Section 5 of US Securities Act and neither<br />

this report nor anything contained herein shall form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. DZ Financial Markets LLC (a wholly<br />

owned subsidiary of DZ BANK) is a registered broker dealer in the United States and has accepted responsibility for the distribution of this report in the United States and, subject to the<br />

limitations of any local registrations, in Canada under applicable requirements. This report is intended for distribution in the United States to qualified institutional buyers (within the<br />

meaning of Rule 144A under the Securities Act) and to institutional accredited investors (within the meaning of Regulation D under the Securities Act) and to US Persons (within the<br />

meaning of Regulation S under the Securities Act) outside the United States that are qualified institutional buyers or institutional accredited investors. In Canada it may only be distributed<br />

to persons who are resident in Canada to whom trades of the securities described herein may be made exempt from the prospectus requirements of applicable provincial or territorial<br />

securities laws.<br />

3.This report is for distribution in the United Kingdom only to persons who are of a kind described in the Financial Services and Markets Act 2000 (Financial Promotion Order 2001,<br />

Articles 19 and 49). It is directed exclusively to market counterparties and intermediate customers. It is not directed at private customers and any investments or services to which the<br />

report may relate are not available to private customers. No persons other than a market counterparty or an intermediate customer should read or rely on any information in this report.<br />

DZ BANK does not deal for, or advise or otherwise offer any investment services to private customers in the United Kingdom.<br />

4.DZ BANK Research – Recommendation Definitions<br />

(Except as otherwise noted, expected performance within the 6 month period from the date of the rating):<br />

Buy: greater than 5% increase in share price<br />

Hold: price changes between +5% and -5%<br />

Sell: more than 5% decrease in share price<br />

Any price targets shown for companies discussed in this report may not be achieved due to multiple risk factors, including, without limitation, market volatility, sector volatility, corporate<br />

actions, the state of the economy, the failure to achieve earnings and/or revenue projections, the unavailability of complete and accurate information and/or a subsequent occurrence that<br />

affects the underlying assumptions made by DZ BANK or by other sources relied upon in the report.<br />

DZ BANK may also have published other research about the company during the period covered that did not contain a price target but that discussed valuation matters. The price targets<br />

shown should be considered in the context of all prior published research as well as developments relating to the company, its industry and financial markets.<br />

By accepting this report, you agree to be bound by the foregoing limitations. Additional information on the contents of this report is available on request.<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

OND J FMAMJ J A S OND J FMAMJ J A S O<br />

<strong>BB</strong> BIOTECH (FRA)<br />

90-Tage-Durchschnitt<br />

Source: DATASTREAM<br />

Rating History<br />

Recommendation Date Price<br />

buy 05.11.02 41.30<br />

accumulate 07.06.02 47.02<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 7

C500e<br />

Biotechnology – <strong>BB</strong> Biotech<br />

Research Team Life Science<br />

Dr. Christa Bähr, CFA Healthcare +49 – (0)69 – 74 47 – 72 42 christa.baehr@dzbank.de<br />

Dr. Patrick Fuchs, CEFA Biotechnology/Healthcare +49 – (0)69 – 74 47 – 22 48 patrick.fuchs@dzbank.de<br />

Dr. Thomas Höger, CEFA Biotechnology +49 – (0)69 – 74 47 – 30 67 thomas.hoeger@dzbank.de<br />

Oliver Schlüter Pharmaceuticals/Pharma-Wholesale +49 – (0)69 – 74 47 – 16 04 oliver.schlueter@dzbank.de<br />

Peter Spengler, CIIA Pharmaceuticals +49 – (0)69 – 74 47 – 36 94 peter.spengler@dzbank.de<br />

Sales Institutional Investors<br />

Frankfurt, Domestic +49 – (0)69 – 74 47 – 49 90 alexander.von.gilsa@dzbank.de<br />

Frankfurt, International +49 – (0)69 – 74 47 – 12 18 barbara.schulz@dzbank.de<br />

1)-7) Important: Please read the references to possible conflicts of interest and disclaimers/disclosures at the end of this report. 8