North Atlantic Container Service - NORA

North Atlantic Container Service - NORA

North Atlantic Container Service - NORA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A PROJECT CO-FUNDED BY<br />

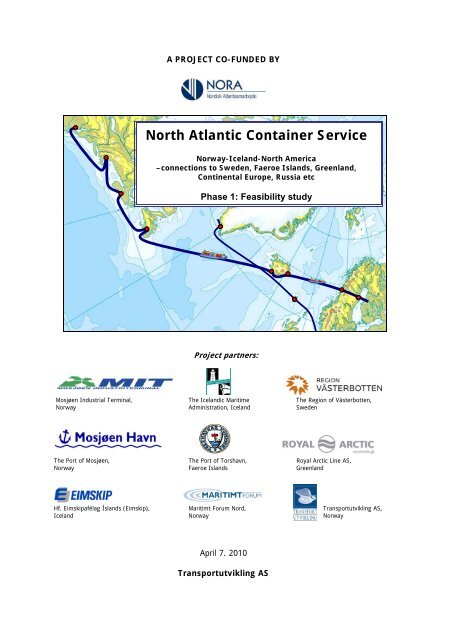

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Norway-Iceland-<strong>North</strong> America<br />

–connections to Sweden, Faeroe Islands, Greenland,<br />

Continental Europe, Russia etc<br />

Phase 1: Feasibility study<br />

Project partners:<br />

Mosjøen Industrial Terminal, The Icelandic Maritime The Region of Västerbotten,<br />

Norway Administration, Iceland Sweden<br />

The Port of Mosjøen, The Port of Torshavn, Royal Arctic Line AS,<br />

Norway Faeroe Islands Greenland<br />

Hf. Eimskipafélag Íslands (Eimskip), Maritimt Forum Nord, Transportutvikling AS,<br />

Iceland Norway Norway<br />

April 7. 2010<br />

Transportutvikling AS

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

“Drawing the line on the map is only one percent<br />

of the work connected to the development<br />

of international corridors”<br />

Victor P. Zhukov, Deputy Chairman of OSJD<br />

(UIC Expert Group meeting in Paris, March 14-2008)<br />

Transportutvikling AS Page 2 of 63

Content<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Content ________________________________________________________ 3<br />

List of figures ____________________________________________________ 5<br />

List of tables ____________________________________________________ 5<br />

Acronyms and abbreviations ________________________________________ 6<br />

1 Preface ______________________________________________________ 7<br />

2 Executive summary ____________________________________________ 8<br />

3 Background and objectives _____________________________________ 14<br />

3.1 Project background _______________________________________________ 14<br />

3.2 Duration _______________________________________________________ 15<br />

3.3 Project visions, goals and objectives _________________________________ 15<br />

3.4 Organization and participants _______________________________________ 15<br />

3.5 Methodological approach __________________________________________ 16<br />

3.6 Introduction to the feasibility study __________________________________ 17<br />

4 Logistical status and existing container services _____________________ 18<br />

4.1 The ports in the region ____________________________________________ 18<br />

4.1.1 Mosjøen (Norway) ______________________________________________________ 18<br />

4.1.2 Reykjavik (Iceland) _____________________________________________________ 20<br />

4.1.3 Reydarfjordur (Iceland) __________________________________________________ 21<br />

4.1.4 Torshavn (Faeroe Islands) _______________________________________________ 22<br />

4.1.5 Nuuk (Greenland) ______________________________________________________ 24<br />

4.1.6 Port at the <strong>North</strong> American East Coast ______________________________________ 24<br />

4.1.7 Other ports ___________________________________________________________ 25<br />

4.2 The shipping lines in the region _____________________________________ 26<br />

4.2.1 Eimskip (Iceland)_______________________________________________________ 26<br />

4.2.2 Eimskip-CTG (Iceland/Norway) ____________________________________________ 26<br />

4.2.3 Faroe Ship (Faeroe Islands) ______________________________________________ 27<br />

4.2.4 Samskip (Iceland) ______________________________________________________ 27<br />

4.2.5 Royal Arctic Line (Greenland) _____________________________________________ 27<br />

4.2.6 Various Lines (Norway) __________________________________________________ 28<br />

4.3 Existing container services _________________________________________ 28<br />

5 The transportation concept – logistical components __________________ 30<br />

5.1 Logistical idea and benefits ________________________________________ 30<br />

5.2 The ocean legs – main route ________________________________________ 31<br />

5.3 The transshipment operation on Iceland ______________________________ 32<br />

5.4 Ports __________________________________________________________ 34<br />

5.5 Sea routes connected to the main line ________________________________ 34<br />

5.5.1 Faeroe Islands _________________________________________________________ 34<br />

5.5.2 Greenland ____________________________________________________________ 35<br />

5.5.3 Norway/Mosjøen _______________________________________________________ 35<br />

5.5.4 Russia – synergy & connections ___________________________________________ 35<br />

5.6 Hinterland connections in Norway ___________________________________ 36<br />

Transportutvikling AS Page 3 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

5.7 Intermediaries/forwarders/organization/information etc _________________ 38<br />

6 A possible service – transportation product _________________________ 39<br />

6.1 Sea routes ______________________________________________________ 39<br />

6.2 The vessel size & operational consequences ____________________________ 39<br />

6.3 The Westbound route _____________________________________________ 41<br />

6.4 The Eastbound route ______________________________________________ 42<br />

6.5 A preliminary route indication ______________________________________ 43<br />

7 The market __________________________________________________ 45<br />

7.1 Population ______________________________________________________ 46<br />

7.2 Foreign trade – national figures _____________________________________ 48<br />

7.3 Foreign trade (volume) – weighted by population shares__________________ 50<br />

7.4 The regional industry structure and market potential ____________________ 51<br />

7.5 Market seminar __________________________________________________ 53<br />

7.6 Competition ____________________________________________________ 54<br />

7.6.1 Competing alternatives __________________________________________________ 54<br />

7.6.2 Transit times and frequency ______________________________________________ 54<br />

7.6.3 Transport subsidies _____________________________________________________ 56<br />

7.6.4 Rates ________________________________________________________________ 56<br />

7.7 The market – preliminary conclusions ________________________________ 58<br />

8 Financial & commercial viability __________________________________ 60<br />

9 Challenges – issues to be solved _________________________________ 61<br />

9.1 Changing the charter party and Alcoa logistics __________________________ 61<br />

9.2 <strong>Service</strong> description – development ___________________________________ 61<br />

9.3 Commercial conditions and competition _______________________________ 61<br />

9.4 The market _____________________________________________________ 61<br />

9.5 The vessel and operational consequences _____________________________ 62<br />

9.6 Organizational challenges __________________________________________ 62<br />

10 Recommendations & progress __________________________________ 63<br />

Transportutvikling AS Page 4 of 63

List of figures<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Figure 3-1: Deviation ______________________________________________________________ 14<br />

Figure 3-2: Organization ____________________________________________________________ 15<br />

Figure 3-3: The project - development process __________________________________________ 16<br />

Figure 3-4: The feasibility study - activities _____________________________________________ 17<br />

Figure 4-1: The Port of Mosjøen (2010) ________________________________________________ 18<br />

Figure 4-2: BBC Reydarfjordur calling the existing Alcoa quay in Mosjøen _____________________ 19<br />

Figure 4-3: Section of the new quay in Mosjøen (2009) ___________________________________ 19<br />

Figure 4-4: Eimskip's office in Sundaklettur, Reykjavik ____________________________________ 20<br />

Figure 4-5: The Port of Reykjavik - Sundahöfn (2009) ____________________________________ 20<br />

Figure 4-6: Alcoa Fjarðaál ___________________________________________________________ 21<br />

Figure 4-7: New container quay in Mjóeyri (planned) _____________________________________ 21<br />

Figure 4-8: The Port of Reydarfjordur/Mjóeyri (August 2009) _______________________________ 22<br />

Figure 4-9: Mobile crane for container handling (Mjóeyri, August 2009) ______________________ 22<br />

Figure 4-10: The Port of Torshavn - winter (2009) _______________________________________ 23<br />

Figure 4-11: The Port of Torshavn - summer (2009) ______________________________________ 23<br />

Figure 4-12: The Port of Nuuk (2009) _________________________________________________ 24<br />

Figure 4-13: The Port of Halifax ______________________________________________________ 25<br />

Figure 4-14: Eimskip-ocean services (2009) ____________________________________________ 26<br />

Figure 4-15: Eimskip-CTG’s ocean services (2009) _______________________________________ 26<br />

Figure 4-16: Faeroe Ships ocean services (2009) ________________________________________ 27<br />

Figure 4-17: Royal Arctic Lines ocean services (2009) _____________________________________ 28<br />

Figure 4-18: Present container services in the <strong>North</strong> <strong>Atlantic</strong> _______________________________ 29<br />

Figure 5-1: The new <strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong> and its connections _____________________ 30<br />

Figure 5-2: Godafoss _______________________________________________________________ 32<br />

Figure 5-3: BBC Reydarfjordur _______________________________________________________ 32<br />

Figure 5-4: Reykjafoss _____________________________________________________________ 32<br />

Figure 5-5: Transshipment alternatives Reydarfjordur - Reykjavik ___________________________ 33<br />

Figure 5-6: NCL’s “Clarissa” (323 TEU) _________________________________________________ 35<br />

Figure 5-7: Eimskip-CTG’s “Polfoss” (14 FEU/28 TEU) _____________________________________ 35<br />

Figure 5-8: Sea transports Murmansk - NAEC ___________________________________________ 36<br />

Figure 5-9: Mosjøen – hinterland connections ___________________________________________ 37<br />

Figure 5-10: Port of Mosjøen – road connections to Sweden/Finland _________________________ 37<br />

Figure 6-1: Increased volumes – impact on vessel size and handling times/storing capacity ______ 40<br />

Figure 6-2: Westbound route – logistical scheme ________________________________________ 41<br />

Figure 6-3: Eastbound route – logistical scheme _________________________________________ 42<br />

Figure 6-4: NACS – route concept and transit times (main line) _____________________________ 43<br />

Figure 7-1: Global security __________________________________________________________ 45<br />

Figure 7-2: Population – market area __________________________________________________ 46<br />

Figure 7-3: US East Coast ___________________________________________________________ 47<br />

Figure 7-4: Canadian East Coast ______________________________________________________ 47<br />

Figure 7-5: Norwegian merchandise trade – totals ex oil & oil products _______________________ 48<br />

Figure 7-6: Swedish merchandise trade - totals __________________________________________ 49<br />

Figure 7-7: NAEC merchandise trade - value ____________________________________________ 49<br />

Figure 7-8: NAEC merchandise trade and population _____________________________________ 50<br />

Figure 7-9: <strong>Container</strong> balance per trip/per ocean route____________________________________ 51<br />

Figure 7-10: Industry and trade flows – Nordkalotten _____________________________________ 52<br />

Figure 7-11: Information leaflet - market seminar in Umeå ________________________________ 53<br />

Figure 7-12: Rate composition - example _______________________________________________ 57<br />

List of tables<br />

Table 5-1: Distances and sailing time .......................................................................................... 31<br />

Table 6-1: Sailing times, existing and new route .......................................................................... 40<br />

Table 6-2: Example: westbound sailing ....................................................................................... 44<br />

Transportutvikling AS Page 5 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Table 7-1: Population – market area ........................................................................................... 46<br />

Table 7-2: Population shares – market area ................................................................................. 50<br />

Table 7-3: Maximum TEU potential based on population shares and Norwegian/Swedish trade ........ 50<br />

Table 7-4: <strong>Container</strong> balance per trip/per country ........................................................................ 51<br />

Table 7-5: Västerbottens and Norrbottens share of Sweden (%) ................................................... 52<br />

Table 7-6: ACL’s westbound <strong>North</strong> America schedule from Gothenburg (Departure times) ............... 55<br />

Table 7-7: ACL’s <strong>North</strong> America <strong>Service</strong> - transit times .................................................................. 55<br />

Table 7-8: Transit time <strong>North</strong>ern Sweden/Norway – Port of Halifax ................................................ 55<br />

Table 7-9: Transport subsidies in Sweden .................................................................................... 56<br />

Table 7-10: Through rates <strong>North</strong>ern Sweden/Norway – US (40 ft DC) ............................................ 57<br />

Acronyms and abbreviations<br />

AON Corporation providing Risk Management and other services<br />

CBP US Customs and Border Protection<br />

DC Dry container<br />

Dwell time Number of days where the container is stored at the ocean terminal<br />

EATL Europe Asia Transport Links<br />

EU The European Union<br />

EUR European Currency<br />

FCL Full <strong>Container</strong> Load<br />

FEU Forty Foot Equivalent Unit<br />

FIFO First in-first out<br />

GDP Gross Domestic Product (various definitions)<br />

IMF The International Monetary Fund<br />

ISPS The Internasjonal Ship and Port Security code<br />

LIFO Last in - first out<br />

MCS Murmansk Commercial Seaport<br />

MPMC Murmansk Port Mangement Company<br />

NACS <strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

NAEC The <strong>North</strong> American East Coast<br />

NVOCC Non Vessel Operation Common Carrier<br />

P.y. Per year<br />

RF Reefer container<br />

RZD The Railways of the Russian Federation<br />

STS crane Ship-to-shore crane<br />

TEU Twenty Foot Equivalent Unit<br />

USD United States Dollar<br />

USEC The East Coast of the United States<br />

Transportutvikling AS Page 6 of 63

1 Preface<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The development of new East-West transport solutions is of great importance for the industry and<br />

population in the <strong>North</strong>ern regions. The markets are often far away, and the distance to the customers<br />

and suppliers is consequently a challenge. At the same time relevant transport alternatives using the<br />

shortest distance are often lacking.<br />

The NACS project (<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong>) aims to develop a new intermodal east-west<br />

transport route between Norway-Iceland and <strong>North</strong> America. This route will be linked to existing<br />

hinterland connections in Sweden, Norway and Finland (east) and <strong>North</strong> America (west).<br />

This route will also create a new opportunity for Faeroe Islands and Greenland by linking existing<br />

routes to the NACS-corridor.<br />

Developing new transport routes takes time and requires persistence. We believe that the <strong>North</strong><br />

<strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong> is possible to realize as there at present is both existing volumes and<br />

existing routes in operation.<br />

The main challenge is to connect the two routes (Norway-Iceland and Iceland <strong>North</strong> America) into a<br />

seamless chain and bring in some new containers to defend the costs of a slightly larger vessel.<br />

We would like to thank <strong>NORA</strong> and the project partners for their contributions during the project period.<br />

April 7. 2010<br />

Einar M. Andersen /s/<br />

Mosjøen Industrial Terminal<br />

Managing Director/Project chairman<br />

Stig Nerdal /s/<br />

Transportutvikling AS<br />

Project manager<br />

Transportutvikling AS Page 7 of 63

2 Executive summary<br />

Background and objectives (3)<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The overall project background is a strong national and international focus on intermodality,<br />

container transports and lack of East-West services in the <strong>North</strong> <strong>Atlantic</strong>. There are existing routes<br />

but some of them do only cover the industrial market segment. These “industrial” ships can be<br />

utilized for a wider purpose (other customers), which can cover a larger market segment than only<br />

industrial transports. It is important to note that the potential market in the north not necessarily<br />

has to satisfy the full capacity of a container ship, since base-freight and operational container ships<br />

are already in operation between Mosjøen and Reydarfjordur, Reykjavik and <strong>North</strong> America and<br />

there are existing connections to/from Greenland and Faeroe Islands. However, they should be<br />

further developed and integrated. This is a unique position. By linking existing services together, a<br />

new concept/service can succeed.<br />

Iceland, as an island, has a strategic position in the <strong>Atlantic</strong> Ocean. Iceland depends on various<br />

seaborne transport solutions, as well as serving an important transshipment function for a wider<br />

market. The geographic location of Mosjøen (eastern part of the <strong>NORA</strong> region) and existing<br />

transport infrastructure do also indicate that a larger regional market in Norway and Sweden can be<br />

served, -and probably also some regions of Finland.<br />

The duration of this feasibility study was approximately 8-10 months and it was completed by<br />

March 2010.<br />

The long term goal is to develop a new, balanced, and commercial viable transport service based<br />

on an East-West structure through the port of Mosjøen and Iceland. As a consequence of this main<br />

structure it is an ambition to connect feeder systems (existing or new) to Greenland and the Faeroe<br />

Islands.<br />

The objectives (shorter term) are to evaluate the opportunity (this feasibility study). .<br />

The project is partly funded by <strong>NORA</strong> and the organization consists of a Management Committee,<br />

Competence/reference group and a Project Manager. The Management Committee is chaired by Mr.<br />

Einar M. Andersen, the Managing Director of Mosjøen Industrial Terminal. In addition, the following<br />

organizations have been involved: The Icelandic Maritime Administration, Region Västerbotten, The<br />

Port of Mosjøen, Eimskip, Royal Arctic Line, the Port of Torshavn and others.<br />

The project manager has been Mr. Stig Nerdal (Transportutvikling AS). He has been assisted by<br />

staff from Transportutvikling AS.<br />

Logistical status and existing container services (4)<br />

This chapter includes a short description of ports and the existing ocean services. The following<br />

ports where introduced: Mosjøen, Reykjavik, Reydarfjordur, Torshavn and Nuuk. In addition, ports<br />

like Argentia, Halifax, Everett, Richmond and a few Norwegian ports are briefly mentioned.<br />

It is also made an introduction to the shipping lines in the region, mainly Eimskip and Eimskip-<br />

related companies (Eimskip-CTG and Faeroe Ships). Comments are also made on Royal Arctic Lines,<br />

Samskip and various Norwegian Shipping Lines. The present services are illustrated in a separate<br />

map.<br />

The transportation concept – logistical components (5)<br />

The basic idea is to establish an alternative, east-west, intermodal transport solution in the <strong>North</strong><br />

<strong>Atlantic</strong> based on an ocean service between the Port of Mosjøen in Norway, ports on Iceland for<br />

transshipment operations and ports at the <strong>North</strong> American East Coast (NAEC). This main route may<br />

Transportutvikling AS Page 8 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

be connected to other regions in the <strong>North</strong> <strong>Atlantic</strong> region (Greenland and Faeroe Islands) through<br />

feeder services. It is furthermore possible to connect services to/from Europe and <strong>North</strong> West<br />

Russia to the route.<br />

The main opportunities connected to the new transport concept are:<br />

• The market will be introduced to a new transport alternative<br />

• There is a potential for lower costs, particularly for some market segments. Well developed<br />

and managed, it is believed that the new transport concept could be an economically feasible<br />

alternative.<br />

• Current routes between Sweden/Norway and NAEC represent a deviation and the new<br />

transport concept could be developed into a faster transport service due to shorter distance for<br />

most market segments. There is a potential for time savings.<br />

• Greenland and Faeroe Islands could be linked to the main route. A new alternative to <strong>North</strong>ern<br />

Norway/Sweden will show up (eastbound) and by increasing the volumes on the westbound<br />

trade, better frequencies may occur.<br />

• There are potential synergies with other routes and ports, for instance new ocean routes from<br />

Murmansk (Russia), <strong>North</strong>-South routes along the Norwegian Coast etc<br />

• It is important to note that there is base-freight between Mosjøen and Reydarfjordur and<br />

between Reykjavik and NAEC. NACS is not starting on scratch since the additional income from<br />

the new service does not have to cover 100% of the costs, only the marginal costs, to be<br />

profitable. The ambition is to put the separate elements (ocean routes, ports etc) of the<br />

logistical chain together and show the customers one product and a seamless chain.<br />

• The route will have positive impact on business development in the <strong>North</strong>ern region,<br />

particularly connected to ports like Reydarfjordur and Mosjøen.<br />

Several sea routes (Faeroe Island, Continent, Norwegian Coast, Greenland etc) are connected to<br />

the main route Mosjøen-Iceland-<strong>North</strong> American East Coast.<br />

The existing route to <strong>North</strong> America from Iceland originates in Reykjavik. A transportation chain<br />

from Norway to <strong>North</strong> America by using this route requires that the container is moved between<br />

Reydarfjordur to Reykjavik (transshipment).<br />

In principle this can be done by several alternatives, but probably the best alternative is a deviation<br />

of the Mosjøen-Iceland ship from Reydarfjordur to Reykjavik. This requires only on transshipment<br />

operation in Reykjavik.<br />

The hinterland connections to Mosjøen are well developed. Mosjøen has rail connections northsouth<br />

and excellent road connections in all relevant directions. Mosjøen is located along the E6<br />

(north-South road connection between northern Norway and Rome) and 2-3 different road<br />

connections to Sweden, and further to Finland (and Russia) by a ferry connection (Umeå-Vaasa).<br />

The majority of cities in Västerbotten in Sweden can be connected to Mosjøen by truck within less<br />

than 8 hours.<br />

A broad set of intermediaries/forwarders can be used to support the new transport solution.<br />

A possible service – transportation product (6)<br />

The present rotation between Iceland (Reykjavik) and four ports at the NAEC is 28 days (Reykjavik-<br />

Reykjavik), while the present rotation between Mosjøen and Iceland (Reydarfjordur) is 7 days. The<br />

ambition is to change the rotation to Mosjøen-Reydarfjordur-Reykjavik (westbound) for connections<br />

to the above mentioned NAEC- route from Reykjavik. The roundtrip (Mosjøen-Mosjøen) will be<br />

approximately 9 days and the sailing time between Reydarfjordur and Reykjavik approximately one<br />

day. The Eastbound trip from Reykjavik runs directly to Mosjøen without calling at Reydarfjordur.<br />

Transportutvikling AS Page 9 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

It may be possible to make the detour Reydarfjordur-Reykjavik once a month as an alternative to<br />

the regular 9-day connection.<br />

The route concept depends on a slightly larger vessel between Mosjøen and Iceland, because the<br />

rotation will change and additional capacity for new containers is required. The present vessel has a<br />

capacity of approximately 170 TEU’s while the new system requires a ship carrying approximately<br />

250 TEU’s. This calculation is based on the assumption of 30 TEU’s (from new customers) per trip.<br />

Based on the assumptions made, Argentia can be connected to Mosjøen, every 3-4 week, within 10<br />

days and Richmond within 17 days. Iceland can be connected to Mosjøen every 9 day. When the<br />

frequency between Iceland and <strong>North</strong> America improves, NACS, as a logistical chain, will improve.<br />

The through time between Mosjøen and Richmond (US) is 15-16 days and 9-10 days to Canada.<br />

The market (7)<br />

Macro conditions (politics, economy, legislation etc) influence any transportation concept and the<br />

viability of the transport corridor. These conditions are important as they have impact on the<br />

corridor’s business climate and market conditions. It is important to note that the new transport<br />

concept will run through countries where the risk is considered as low (green/grey areas).<br />

The preliminary market conclusions indicate a market potential to/from Sweden/Norway of 4-500<br />

TEU’s per 9 day rotation. The majority of the containers is westbound and goes between<br />

Norway/Sweden and <strong>North</strong> America/Iceland. Faeroe Islands will contribute with some containers<br />

while Greenland has a limited potential. On a shorter term perspective the volumes will be lower<br />

and a share of the potential will use other transport alternatives.<br />

The competing transit time to <strong>North</strong> America (Halifax) is 15-20 days. This transit time is possible<br />

to match, but not on a weekly frequency. The through time is limited by the existing rotation<br />

between Reykjavik and NAEC. At present NACS can match the competing alternatives every 28 day.<br />

When the frequency between Iceland and NAEC improves, the NACS’ competitive position will<br />

improve.<br />

The transit time to and from Iceland, compared to the alternatives, will be substantially improved<br />

and the frequency will be competitive. For many alternatives the transit time will be reduced by<br />

more than 50%. The transit time to/from the Faeroe Islands will also be reduced, due to quite good<br />

connection between Iceland and the Faeroes. Greenland is more complicated due to lack of<br />

frequencies between Iceland and Greenland.<br />

The through rates between <strong>North</strong>ern Sweden/Norway to/from NAEC are strongly influenced by the<br />

cost of pre-/on carriage. A transport distance of 1000-1500 km is required to connect a<br />

Scandinavian base port. At present, a 40ft DC container can be transported from the north to NAEC<br />

for approximately USD 4 000 and from NAEC at a through rate is probably 15% lower. The land<br />

transport portion of the rate is 30-40%.<br />

Rates are volatile and influenced by market conditions, customer volumes and various other<br />

conditions. Larger companies may have a better rate and smaller companies can pay more for the<br />

transports. By using the right vessel and securing some additional cargo/customers, NACS should be<br />

competitive when it comes to rates, for market players in northern Sweden/Norway.<br />

The main reasons are:<br />

• There is base freight (Alcoa) on the Norway-Iceland route. Only incremental costs (larger vessel,<br />

some extra nautical miles, sales etc) have to be covered.<br />

Transportutvikling AS Page 10 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

• The pre-/on carriage cost will be substantially reduced by using the port of Mosjøen, compared<br />

with the existing cost of connecting a Scandinavian base port. Even if NACS cannot match the<br />

ocean freight, the total rate can be matched due to drayage/delivery cost portion of the rate.<br />

If NACS can match the <strong>North</strong>ern Norway/Sweden – NAEC rates, it should also be able to match the<br />

rates to/from Iceland and Faeroe Islands.<br />

Rates are influenced by Swedish transport subsidies. Subsidies can be obtained if the transport<br />

distance between the origin/destination in Sweden and Mosjøen is above 401 km. But, the distance<br />

to Mosjøen is shorter than the distance to for instance Gothenburg, which should have positive<br />

impact on the land transport rate. The Swedish transport subsidies favors domestic transport<br />

alternatives inside Sweden.<br />

Competitive rates, for NACS and for the NAEC trade, are more important than transit times. This is<br />

due to the fact that there seems to be only minor differences in best-case transport time and that<br />

the existing alternatives have a better frequency.<br />

Financial & commercial viability (8)<br />

The route’s financial and commercial viability has to be evaluated in detail throughout the next<br />

phase of the project work. Such evaluation should also include a risk analysis.<br />

In principle, the cost side of the new route is (probably) connected to the introduction of a larger<br />

ship between Mosjøen and Iceland and the change in rotation (hours and calls).<br />

Vessel capacity Mosjøen-Reydarfjordur<br />

The new vessel requires some larger TEU-capacity than the existing ship, due to fewer rotations<br />

and additional cargo (new containers). There are some costs connected to increased capacity.<br />

Based on the assumptions used, the new vessel capacity is at least 250 TEU (+ 80 TEU’s).<br />

Distance and time consumption<br />

The present roundtrip (Mosjøen-Reydarfjordur-Mosjøen) is 1 380 n.m. while the new roundtrip<br />

(Mosjøen-Reydarfjordur-Reykjavik-Mosjøen) is 2.000 n.m. (+ 45%). Due to the reduction in the<br />

number of rotations, the annual production (n.m.) will increase by 13%. The sailing distance will<br />

also have an impact on the time consumption (main engine on) and increased volumes from new<br />

customers will also influence the handling time at the ports where new containers are<br />

loaded/unloaded.<br />

Vessel operating costs<br />

In the present (2009/2010) market, the TC rate for a 170 TEU ship and a 250 TEU ship are<br />

approximately the same. This is not the usual picture and based on a longer term evaluation of the<br />

market, the increase in TC- rate may be +USD 500-1000 per day. By assuming that the travel<br />

dependent costs are 50% of the TC-rate, the cost increase (TC rate surplus + travel dependent<br />

costs) per year is approximately USD 270.000 – 540.000 per year.<br />

A potential viable business<br />

30 new TEU’s per round trip is 60 single trip containers, which is 2.460 average 1 single trip<br />

containers per year.<br />

If the new service is able to capture 2.460 new FCL containers and the increased cost is max. USD<br />

540.000, the average cost is USD 160 per container between Norway and Iceland.<br />

1 Average means the average of all containers independent on commodity, destination etc<br />

Transportutvikling AS Page 11 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Even though these simplified calculations do not take into consideration the risk of running the<br />

business, overhead costs, profits, that there will be empties, container costs, sometime 10 TEU<br />

instead of 30 etc, - it shows a potential.<br />

USD 160 per container/TEU represents low operational vessel costs (marginal costs). It is<br />

comparable with the full capacity vessel costs of operating among the largest deep-sea container<br />

vessels of today. The reason is that the service is in operation, there is base freight and that we<br />

only have to cover the incremental costs.<br />

Furthermore, when the idea is that the Norway-Iceland service shall add volume to other existing<br />

routes (like Iceland –<strong>North</strong> America, routes to the Faeroe Islands, along Norwegian Coast etc),<br />

these routes may increase their revenue at a low variable cost basis (handling etc), - if there is<br />

available capacity. There are obvious synergies connected to the concept.<br />

Challenges – issues to be solved (9)<br />

There are several tasks which have to be solved prior to the commercial operation. The report has<br />

discussed the following issues:<br />

The charter party on the route Mosjøen-Reykjavik is operated by commercial players. It is of<br />

crucial interest that the new concept is beneficiary for, and accepted by, Alcoa and Eimskip. Alcoa<br />

and Eimskip have to accept a change in the Charter party’s conditions (vessel size and rotation).<br />

The service description in this document is an idea and not a product ready for sale. The service<br />

has to be further developed and detailed.<br />

As a part of the service description the commercial conditions have to be shown. Such conditions<br />

are rates (various trades, commodities and container sizes), transit times, frequencies etc.<br />

Frequency and through transit times are challenges. Rates may therefore be more important at the<br />

initial stages of the development of the service, as low rates, to some extent, may compensate for<br />

low frequency.<br />

A more detailed market evaluation has to be conducted prior to commercial operation. This<br />

market study has to be based on the developed product and commercial conditions (rate, time etc).<br />

Specific/targeted customers should be approached.<br />

The increased number of containers influences handling time at the terminals, storage, logistical<br />

procedures and consequently the vessel rotation. The change of vessel requires another vessel<br />

than the present. Availability of a relevant vessel has to be checked.<br />

There will be various organizational issues to handle; like the role of forwarding, sales<br />

organization etc. Committed partners have to be involved throughout the development.<br />

Recommendations & progress (10)<br />

We believe that NACS is an opportunity. In reality, a rather unique opportunity in the north, since<br />

this transport concept has base freight and existing vessels in operation.<br />

Logistically, a main challenge is to connect the two rotations into a system where there are<br />

acceptable frequencies and a competitive rate. If the frequency/transit time is not acceptable to the<br />

market, the customer has to be compensated with lower rates. Low frequency and high rates is<br />

not a combination which can be offered to the customers.<br />

Transportutvikling AS Page 12 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Furthermore, NACS cannot be successful if Alcoa’s own logistical priorities suffer, and the Mosjøen-<br />

Reydarfjordur route continues to operate as a plain industrial service. It is very important to work<br />

with Alcoa and develop a concept where Alcoa is comfortable.<br />

Based on Alcoa’s acceptance and commitment from partners, the project will be ready to<br />

continue into phase 2.<br />

The basic elements in phase 2 are:<br />

1. A meeting between the project initiators (Port of Mosjøen, Mosjøen Industrial Terminal,<br />

Icelandic Maritime Administration), Alcoa and Eimskip, where the ambitions are to discuss the<br />

challenges/opportunities and further progress.<br />

2. Based on a positive outcome from the meeting, a “business plan” should be developed. The<br />

important elements are:<br />

• A detailed service description (the product) has to be developed.<br />

• All other business plan issues like finance, organization, risk etc<br />

• Various consequence and risk evaluations<br />

3. A market approach, based on the developed service description<br />

4. Assuming positive market feedback, the practical operation/service could commence<br />

The meeting should be held prior to summer 2010 and the “business plan” should be completed<br />

within a period of 6-8 months subsequent to acceptance and funding of the work.<br />

We do also recommend that the port of Mosjøen continues with their port development<br />

projects connected to container handling. The work should at least include STS-operation, access<br />

to sufficient space/storage areas on shorter/longer term and logistical/stevedoring procedures. A<br />

project where the port of Mosjøen and the port of Reydarfjordur are cooperating is probably a<br />

benefit.<br />

<strong>Container</strong> transport is a derivate. It is a consequence of business development and cooperation<br />

among people and the industry. A transport conference for the <strong>NORA</strong> region (and connected<br />

markets), where NACS has an important role, may be of great value for the further development of<br />

NACS.<br />

We believe that both the business plan for NACS and a transport conference could be co-funded by<br />

<strong>NORA</strong>, as work progresses from the initial project (this feasibility study).<br />

Concept and ideas “die” if they are not kept alive. Based on a positive acceptance from Alcoa, we<br />

believe that it is important to move fast into the next phases on the NACS development.<br />

Transportutvikling AS Page 13 of 63

3 Background and objectives<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Below is a short presentation of the project background, time schedule, goals & objectives,<br />

organization and methodological approach.<br />

3.1 Project background<br />

The overall project background is, among other issues, a strong national and international focus on<br />

intermodality, particularly east-west ocean services and containers as the loading unit.<br />

Furthermore, an ambition is to focus on the <strong>North</strong> <strong>Atlantic</strong> region and the development of sustainable<br />

ocean transports connected to the hinterland (like environmental friendly rail connections at some<br />

ports) and between the various “islands” in the region. There are existing routes but some of them do<br />

only cover the industrial market segment. These “industrial” ships can be utilized for a wider purpose<br />

(other customers), which can cover a larger market segment than only industrial transports.<br />

ACL’s<br />

<strong>North</strong> America route<br />

NACS<br />

©Transportutvikling AS, 2010<br />

DEVIATION<br />

A similar commercial interest for<br />

an ocean going east-west<br />

transport, as in Norway, is found<br />

in <strong>North</strong>ern Sweden. The present<br />

transport solutions (for instance<br />

to <strong>North</strong> America) have to be<br />

routed through<br />

southern/continental European<br />

ports for transshipment prior to<br />

any arrival at the <strong>North</strong> American<br />

East Coast. Consequently, the<br />

feeder costs to southern base<br />

ports are often higher than the<br />

Trans-<strong>Atlantic</strong> rate. The same<br />

deviation usually occurs if the<br />

destination is Iceland and other<br />

<strong>North</strong> <strong>Atlantic</strong> locations.<br />

Figure 3-1: Deviation<br />

Iceland, as an island, has a strategic position in the <strong>Atlantic</strong> Ocean. Iceland depends on various<br />

seaborne transport solutions, as well as serving as an important transshipment function for a wider<br />

market.<br />

Faeroe Islands and Greenland represent smaller cargo volumes and these countries do also depend on<br />

integration with other routes, hubs and regions to create a satisfactory volume-base for more frequent<br />

and commercial viable services.<br />

It is known that there are potential customers who are in a position to utilize a new service and<br />

connections. The market (size, commodities, balance, rates etc) is not fully known and cannot be<br />

verified without market studies. It is important to notify that this potential market not necessarily has<br />

to satisfy the full capacity of a container ship, since base-freight and operational container ships are<br />

already in operation between Mosjøen and Reydarfjordur, Reykjavik and <strong>North</strong> America and there are<br />

existing connections to/from Greenland and Faeroe Islands. However, they should be further<br />

developed and integrated. This is a unique position. By linking existing services together, a new<br />

concept/service can succeed.<br />

Transportutvikling AS Page 14 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The geographic location of for instance Mosjøen (eastern part of the <strong>NORA</strong> region) and existing<br />

transport infrastructure do also indicate that a larger regional market in Norway and Sweden can be<br />

served, -and probably also some regions of Finland.<br />

3.2 Duration<br />

The duration of this feasibility study was approximately 8-10 months and it was completed by March<br />

2010.<br />

3.3 Project visions, goals and objectives<br />

The long term goal is to develop a new, balanced, and commercial viable transport service based on<br />

an East-West structure through the port of Mosjøen and Iceland. As a consequence of this main<br />

structure it is an ambition to connect feeder systems (existing or new) to Greenland and the Faeroe<br />

Islands.<br />

The objectives (shorter term) are to evaluate the opportunity and to prepare the conditions for a small<br />

scale service based on existing infrastructure and suitable vessels, as well as improving the logistical<br />

network in the <strong>North</strong> <strong>Atlantic</strong> region.<br />

The expected outcome of the project work is to produce an evaluation of the opportunity, the market,<br />

the logistical concept and various issues which are critical to the success of the service.<br />

It is important that a future concept not only is beneficial for one or a few organizations, but to several<br />

players in the logistical chain, -including the “owners” of the existing transport concept between<br />

Mosjøen and Reydarfjordur. The benefits of Eimskip and Alcoa should be clearly identified and<br />

focused on.<br />

The tasks to be performed during the feasibility study, which shall contribute to the above mentioned<br />

goals/objectives, are presented in chapter 3.6.<br />

3.4 Organization and participants<br />

A successful project development depends on active contributions from the project partners.<br />

The organization consists of a Management Committee (Prosjektfølgegruppe), a<br />

Competence/reference group and a Project Manager. The Management Committee is chaired by Mr.<br />

Einar M. Andersen, the<br />

Managing Director of<br />

Project committee (Prosjektfølgegruppe)<br />

Mr. Einar M. Andersen, Managing Director, Mosjøen Industry terminal, Norway<br />

Mr. Gísli Viggósson, Director of Research and Development, The Icelandic Maritime Admin., Iceland<br />

Ms. Sigríður Þorgrímsdóttir, Byggdastofnun, Iceland<br />

Mr. Mårten Edberg, Chief Transport POlanner, Region Västerbotten, Sweden<br />

Mr. Kurt Jessen Johansson, Managing Director, The Port of Mosjøen, Norway<br />

PROJECT OFFICE & SECRETARIATE<br />

Project Manager: Mr. Stig Nerdal<br />

Staff from Transportutvikling AS and<br />

Transportutvikling Bodø AS<br />

REFERENCE GROUP<br />

Mr. Steingrímur Sigurðsson,<br />

Hf. Eimskipafélag Íslands (Eimskip), Iceland<br />

Mr. Niels Clemensen,<br />

Royal Arctic Line AS, Greenland<br />

Mr. Jónsvein Lamhauge<br />

The port of Torshavn, Faeroes Islands<br />

Mr. Tor Husjord<br />

Maritimt Forum Nord/Redriforbundet, Norway<br />

Mosjøen Industrial<br />

Terminal. The project<br />

manager has been Mr. Stig<br />

Nerdal (Transportutvikling<br />

AS). He has been assisted<br />

by staff from<br />

Transportutvikling AS. The<br />

Competence group<br />

consists of highly<br />

professional people from<br />

the ports and shipping<br />

industry.<br />

The organization is shown<br />

in figure 3-2.<br />

Figure 3-2: Organization<br />

Transportutvikling AS Page 15 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

During the project period, 3 Project Committee meetings have been held (Iceland, Sweden and<br />

Norway). A market seminar was held in Umeå on January 26. 2010 (see chapter 7.5).<br />

3.5 Methodological approach<br />

The method, in general, is based on an analytical approach where desk studies and theory are<br />

combined with the commercial partners’ practical experiences and competence. The entire project<br />

development intends to be conducted throughout 3 main phases, where phase 3 is commercial<br />

operation.<br />

Phase 1 is this feasibility study, where the purpose is to describe and evaluate the concept. This<br />

feasibility study is a start-up document and further evaluations/studies will usually be required before<br />

entering into phase 2. More than one feasibility study may be required. Based on the feasibility<br />

studies, the decisions to enter into phase 2 will be taken.<br />

Phase 2 concerns the development of a business plan and any required preparations for the<br />

commercial operations. The business plan is the decision making platform for entering into the<br />

commercial service or an intermediate demonstration period (demonstration run).<br />

Phase 3 is implementation of the concept/commercial operation.<br />

The illustration shows the various phases.<br />

www.transportutvikling.no<br />

Feasibility study<br />

•Draft service/idea<br />

•Feasibility and evaluation<br />

•<strong>Service</strong> description<br />

•Market studies<br />

•Evaluation<br />

•Progress proposals<br />

•Decisions<br />

•Etc<br />

Development process<br />

New <strong>Container</strong>-service <strong>Container</strong> service in the <strong>North</strong> <strong>Atlantic</strong><br />

Development phase<br />

•”Business planning”<br />

•Organization<br />

•Details logistics, market etc<br />

•Commercial agreements<br />

•Risk evaluations<br />

•Funding issues<br />

•Decisions<br />

•Etc<br />

Time<br />

Implementation<br />

•Starting up the service<br />

Phase 1 Phase 2<br />

Phase 3<br />

Figure 3-3: The project - development process<br />

OK OK<br />

This report is related to phase 1, - the feasibility study<br />

Transportutvikling AS Page 16 of 63

3.6 Introduction to the feasibility study<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

A feasibility study is the first step to be taken in the development process. It aims to lead into the<br />

preparation of a business plan for the transport service. The feasibility study is based on methods<br />

developed by Transportutvikling AS. The issues shown in figure 3-4 are discussed during the project<br />

period.<br />

www.transportutvikling.no<br />

©Transportutvikling AS<br />

Development process intermodale corridors<br />

Step 1: THE FEASIBILITY STUDY<br />

Market feasibility &<br />

competition<br />

Operational feasibility and<br />

interoperability<br />

Macro environment, political &<br />

administrative conditions<br />

Initial activities (planning,<br />

partnerships etc)<br />

Description of the project and<br />

logistical idea<br />

Evaluations and study conclusions<br />

Next steps, business model and<br />

basics for the business plan<br />

Technical feasibility &<br />

infrastructure requirements<br />

Organizational and managerial<br />

feasibility<br />

Financial & commercial feasibility<br />

Risk issues Environment and external costs<br />

Other specific issues Other specific issues<br />

These activities<br />

represent the main<br />

project steps, -starting<br />

with the market, then<br />

logistics, commercial<br />

conditions etc.<br />

Network building and<br />

partnerships are also<br />

important elements<br />

supporting the future<br />

project work.<br />

Figure 3-4: The feasibility<br />

study - activities<br />

Transportutvikling AS Page 17 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

4 Logistical status and existing container services<br />

This chapter includes a short description of ports and the existing ocean services.<br />

4.1 The ports in the region<br />

The description focuses on those ports which are directly connected to the transportation service. A<br />

few other ports are mentioned throughout the description.<br />

4.1.1 Mosjøen (Norway)<br />

The port of Mosjøen is the largest (by tons) container port in <strong>North</strong>ern Norway, the fourth largest drybulk<br />

port and number 3 when it comes to general cargo. In 2008 the port handled a total of ca. 1,2<br />

mill. tons. There are only 1,5 employees at the Port Authority because stevedoring and port logistics<br />

are handled by commercial players like the Mosjøen Industrial Terminal.<br />

The port of Mosjøen is located in the middle of Norway, in Nordland County.<br />

Figure 4-1 shows the port of Mosjøen and Alcoa’s production facility. The container port is located in<br />

connection to the alumina plant.<br />

Figure 4-1: The Port of Mosjøen (2010)<br />

Existing<br />

and new berth<br />

Alcoa production<br />

facilities<br />

Berth specifications and maritime conditions<br />

The length of the container berth (existing berth) is 270 meter and the maximum ship draft is 10,5<br />

meter (based on 0,5 m. under keel clearance).<br />

Transportutvikling AS Page 18 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Figure 4-2: BBC Reydarfjordur calling the existing Alcoa quay in Mosjøen<br />

It is possible to utilize a new quay (which is recently completed) on the opposite side of the existing<br />

berth. The new quay is 90 m long and the maximum ship draft is 8 m.<br />

The port is sheltered and the maritime conditions are good.<br />

Terminal area<br />

Figure 4-3: Section of the new quay in Mosjøen (2009)<br />

The on berth storage area is limited, but<br />

satisfactory for a small scale container<br />

transport. There are adjacent storage<br />

areas which can be utilized. Adjacent areas<br />

are, to some extent, challenged by a ferry<br />

berth and its road connections. The ferry<br />

will be re-located and additional space will<br />

be available.<br />

The picture shows a section of the new<br />

container quay. The existing quay is<br />

located to the left and the new quay front<br />

(not visible on the picture) to the right.<br />

Equipment<br />

The port is equipped with a rail-mounted “Molde kran” (1989). At present the crane handles 15 lifts<br />

per hour. The crane can handle 35 tons on 11 m. outreach and 20 tons on 30 m. outreach.<br />

The moving equipment at the port consists of two 32 tons SMW forklifts able to stack two-high. The<br />

port is also equipped with a Kalmar terminal Tractor for the purpose of longer distance moves.<br />

Operators<br />

The berths are partly owned by Alcoa and partly by the municipality of Vefsn. Mosjøen Industrial<br />

Terminal (MIT) organizes stevedoring and the terminal operation.<br />

Transportutvikling AS Page 19 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Connections<br />

The port has good road and railway connections, as well as regular north-south short sea services.<br />

See chapter 5.6 for “hinterland connections” in Mosjøen.<br />

4.1.2 Reykjavik (Iceland)<br />

Reykjavík is Iceland’s principal seaport, with facilities for handling all types of cargo and a<br />

comprehensive range of maritime support services. In addition, Reykjavík is Iceland’s number one<br />

cruise port. The port area is owned by<br />

Faxaflóahafnir sf, Associated Icelandic Ports (AIP).<br />

AIP has developed the Sundahöfn to utilize its<br />

potential. Reclamation work has been carried out to<br />

develop additional land for container handling. A<br />

new 450 meter multipurpose quay, the Skarfabakki,<br />

was opened in 2007 and a new 25 hectare<br />

container storage area, linking the terminals of<br />

Eimskip and Samskip, is due to enter into service in<br />

2011.<br />

Figure 4-4: Eimskip's office in Sundaklettur, Reykjavik<br />

From 1968 Iceland’s most important import-export operations have been carried out at the Sundahöfn<br />

Port facilities. Cargo handling takes place on the Sundahöfn harbor complex, east of the city centre.<br />

Here, Iceland’s two largest shipping companies, Eimskip and Samskip, operate major container<br />

terminals and offer warehousing and logistics support. The port handles some 230,000 TEU.<br />

The port/operators have all suitable berths, equipment, storage areas, warehousing and service<br />

systems to handle the container service. Eimskip handles all operations at their section of the<br />

Sundahöfn port.<br />

The Eimskip area is<br />

approximately 29 hectare and<br />

the ship draft is 9,5 m at the<br />

Eimskip berth. Crane moves<br />

per hour are indicated to 28.<br />

Figure 4-5 shows the<br />

Sundahöfn section of the port<br />

of Reykjavik. Eimskip’s<br />

terminal area is marked by a<br />

red circle.<br />

There are excellent road<br />

connections to/from the<br />

terminal area.<br />

Figure 4-5: The Port of Reykjavik -<br />

Sundahöfn (2009)<br />

Transportutvikling AS Page 20 of 63

4.1.3 Reydarfjordur (Iceland)<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Reydarfjordur is located on Eastern Iceland, approximately 700 km by road from Reykjavik. The Alcoa<br />

Fjardaal aluminum smelter is located to Mjóeyri a few km east of Reydarfjordur. The plant was<br />

officially opened in June 2007. This project is Alcoa's first new primary aluminum facility in 20 years.<br />

The capacity is close to 350.000 tons per year.<br />

The municipality owns the quay infrastructure and storing areas. The total terminal area is 4-6<br />

hectares and there are satisfactory expansion opportunities, mainly to the west.<br />

The ship draft is more than<br />

14 m. and the quay length is<br />

380 m. 2/3 (approximately)<br />

of the quay length is blocked<br />

by a dry bulk conveyer belt,<br />

handling inbound raw<br />

materials for Alcoa. This may<br />

represent a potential conflict<br />

for other vessels, due to<br />

Alcoa’s first refusal rights<br />

when calling at the berth.<br />

Figure 4-6: Alcoa Fjarðaál<br />

The port is equipped with one mobile container crane handling approximately 28 lifts per hour. There<br />

are sufficient lifting and moving equipment at the port, including 2-3 reach stackers.<br />

There are plans to extend the quay structure by building an adjacent quay. Drawings/calculations are<br />

made by IMA. Further development depends on acceptable market conditions.<br />

Figure 4-7: New container quay in Mjóeyri (planned)<br />

Existing multipupose quay<br />

(container and dry-bulk)<br />

New 140 m. container quay<br />

(planned)<br />

Transportutvikling AS Page 21 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Figure 4-8: The Port of Reydarfjordur/Mjóeyri (August 2009)<br />

Eimskip runs the stevedoring activity for Alcoa at the port, - like:<br />

• Unloading of alumina vessels<br />

• Loading/unloading of container vessels<br />

o Alcoa (container/bulk), Eimskip and Samskip<br />

o 3-4 vessel calls per week<br />

o Total operation 1.000-1.200 lifts/week<br />

• <strong>Container</strong> yard operation (all container moves within the<br />

Alcoa area)<br />

• Stuffing and stripping of containers<br />

Figure 4-9: Mobile crane for container handling (Mjóeyri, August 2009)<br />

4.1.4 Torshavn (Faeroe Islands)<br />

The port of Torshavn (Tórshavnar havn) is Faeroe Islands’ major port. The port is owned by the<br />

Municipality of Torshavn. In year 2000 the neighboring port of Kollafjord was formally included in the<br />

port district of Torshavn.<br />

The port of Torshavn and the port of Kollafjord 2 are the only ports at the Faeroes which have regular<br />

container services.<br />

There are 14 employees at the port and stevedoring is organized by private operators. In 2008 the<br />

port handled a total of 636.000 tons and 2,600 vessels called the port.<br />

2 The distance between Torshavn and Kollafjord is 20 minutes by car. At present, 5.000 m 2 can be utilized for<br />

container storing. The depth is 11,8 m along a 26 m. quay front. A new container quay/area is developed; where<br />

the storage area is 20.000 m 2 and the quay length is 150 m. Samskip has regular sailings to Kollafjord.<br />

Transportutvikling AS Page 22 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The port of Torshavn is equipped with a 1,5 year old mobile container crane (owned by Faroe<br />

ship/Eimskip), 2 container stackers (handling loaded 40 ft containers) and 3 tug masters handling Ro-<br />

Ro vessels 3 .<br />

The quay is 215 m. long and the depth is between 8 and 9,5 m. The storage area for containers is<br />

25.000 m 2 .<br />

Figure 4-10 shows the port of Torshavn and one of Eimskip’s container vessels alongside the quay.<br />

Figure 4-11 shows the same quay during summer time, when a cruise ship is calling the port.<br />

Figure 4-10: The Port of Torshavn - winter (2009)<br />

Figure 4-11: The Port of Torshavn - summer (2009)<br />

3<br />

The ferry quay is 198 meter and the depth is 8,3 m. The ferry quay is equipped with a 25 m. wide mobile Ro-Ro<br />

facility.<br />

Transportutvikling AS Page 23 of 63

4.1.5 Nuuk (Greenland)<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The Port of Nuuk is the dominating port on Greenland and the main port for Royal Arctic Lines’<br />

container traffic. The majority of the cargo to/from Greenland is handled through Nuuk.<br />

The container quay (existing container terminal on figure 4-12), “Ny atlantkaj”, is 100 m. long and 9,8<br />

meter deep. The largest ship which has called the berth was 230 m. long. The container quay is<br />

equipped with 4 reach stackers of 40-50 tons lifting capacity and a stacking capacity of 5. The port<br />

does also have one 25 t fork lift and a few forklifts with lower capacity.<br />

The port has in-house storing facilities for FCL and cold stores for fish products. Figure 4-12 shows the<br />

existing container terminal as well the planned terminal east of the existing facility.<br />

Figure 4-12: The Port of Nuuk (2009)<br />

Existing<br />

container<br />

terminal<br />

New container<br />

terminal<br />

(planned)<br />

4.1.6 Port at the <strong>North</strong> American East Coast<br />

Eimskip’s “America-route” calls at the following ports at the <strong>North</strong> American East Coast:<br />

Transportutvikling AS Page 24 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Argentia (Canada, New Foundland)<br />

Argentia Harbor is a small harbor located on the east side of Placentia Bay. Argentia has three wharf<br />

complexes that can be utilized by shippers: the Navy Dock, the marine <strong>Atlantic</strong> with its roll on/off<br />

ramp facility and the refurbished Fleet Dock.<br />

The Fleet Dock, where Eimskip calls, is 430 m. in length. Berth 1 and 2 is 300 m. and the depth is 12<br />

m. The port is ice-free and connected to the hinterland by truck.<br />

Halifax (Canada, Nova Scotia)<br />

Halifax is strategically located near major shipping lanes operating<br />

on the <strong>North</strong> <strong>Atlantic</strong>. Halifax has one of the largest natural harbors<br />

in the world. The Port of Halifax has two modern container<br />

terminals with twelve gantry cranes. Five cranes can accommodate<br />

post-Panamax vessels. It’s a naturally deep harbor, with container<br />

berths in the range of 13,7-16.7 m. The port is ice-free. There are<br />

excellent intermodal rail, truck, water and air connections.<br />

Figure 4-13: The Port of Halifax<br />

Boston/Everett (USA, Massachusetts)<br />

Everett is located 6.6 km north of Boston. Eimskip is calling at the Preferred Freezer <strong>Service</strong>s terminal.<br />

The working pier is 112 m and the draft is 6,7 m. The port has a 22,000-pallet-position facility, with<br />

an extensive freezer capacity.<br />

It accommodates imported containers and trailer loads of freight, and up to 15 refrigerated boxcars<br />

per week. The three-railcar siding is serviced directly by CSX Monday to Friday. In addition, a biweekly<br />

container line calls directly at the facility.<br />

Richmond (USA, Virginia)<br />

The port of Richmond is centrally located on the East Coast in Central Virginia, halfway between<br />

Maine and Florida. The dock has 483 m. wharf length and 7,6 m. depth alongside. There are excellent<br />

rail, truck and water connections. The port of Richmond has selected a new terminal operator from<br />

October 1, 2009; Port Contractors, Incorporated (PCI).<br />

4.1.7 Other ports<br />

There are also other ports that may be of interest when further developing the container service.<br />

Several ports have exhaustive plans for their development and new/other services may be connected<br />

to “The <strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong>”.<br />

Without going into the details, we mention the following ports:<br />

• Murmansk<br />

o Large Russian dry bulk port with railway connection and ambitions to develop new<br />

East-West container shipping services<br />

• Kirkenes (Norway)<br />

o Norwegian port closely located to the Russian border. Potential when it comes to<br />

transshipping Russian cargo<br />

• Sortland<br />

o Medium sized, multipurpose port in <strong>North</strong>ern Norway<br />

• Tromsø (Norway)<br />

o Fishery/multipurpose port in <strong>North</strong>ern Norway. Located along the coast line<br />

Due to the focus of the study (East-West in the <strong>North</strong>ern <strong>North</strong> <strong>Atlantic</strong>) European and Continental<br />

ports are not mentioned. They are of course important for a dominant share of all services in the<br />

region.<br />

Transportutvikling AS Page 25 of 63

4.2 The shipping lines in the region<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The main shipping lines in the northern region, carrying containers, are:<br />

4.2.1 Eimskip (Iceland)<br />

Eimskip, based in Reykjavík, has evolved from a shipping company into a<br />

leading provider of transport, logistics and cold storage services (Norway.<br />

New Foundland, Faeroes Islands and China). Through its worldwide<br />

shipping network, Eimskip offers total transport solutions including all cargo handling (particularly<br />

temperature controlled cargo), administration and information exchange regarding its services.<br />

Eimskip employs 1.544 people<br />

and operates in 16 countries.<br />

Through its subsidiaries, Eimskip<br />

also operates several vessels,<br />

trucks and trailers.<br />

Eimskip operates regular ocean<br />

services between Iceland, the<br />

Continent, UK, Scandinavia and<br />

America.<br />

Figure 4-14: Eimskip-ocean services<br />

(2009)<br />

The main interest when it comes to this project is Eimskip’s America route and the industrial service<br />

between Mosjøen and Reydarfjordur.<br />

4.2.2 Eimskip-CTG (Iceland/Norway)<br />

Eimskip-CTG is 100% owned by Eimskip. CTG (Cold store and<br />

Transport Group) is a former Norwegian Shipping Line<br />

specialized in temperature controlled cargo. Eimskip-CTG AS is specialized as a total supplier to fish<br />

brokers, fishing vessels and as a<br />

ship owner’s agents<br />

Eimskip-CTG has 5 Norwegian<br />

offices and operates ocean<br />

services, with 8 self sustained<br />

vessels, along the Norwegian<br />

coast, Iceland, Baltic and Europe.<br />

Figure 4-15: Eimskip-CTG’s ocean<br />

services (2009)<br />

Transportutvikling AS Page 26 of 63

4.2.3 Faroe Ship (Faeroe Islands)<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

The transport company Skipafelagið Føroyar (Faroe<br />

Ship) established in 1919, merged in 2004 with<br />

Eimskip.<br />

Faeroe Ships ocean services are more or less<br />

integrated with Eimskip’s routes.<br />

The map shows the routes which are promoted as<br />

Faeroe Ships own routes, mainly connecting the<br />

Faeroe Islands and southern Scandinavia, UK and the<br />

Continent.<br />

Figure 4-16: Faeroe Ships ocean services (2009)<br />

4.2.4 Samskip (Iceland)<br />

Samskip employs about 1,400 people working in more than 20<br />

countries worldwide. Samskip is offering multimodal container logistics,<br />

extensive container services to and from Iceland and the Faroe Islands<br />

along with refrigerated cargo logistics and international forwarding.<br />

While operating routes between Iceland (both Reykjavik and Reydarfjordur)/Faeroes (Kollafjord) and<br />

Europe, their main market focus is south of the <strong>North</strong>ern region.<br />

Samskip's partner in <strong>North</strong>ern Norway is the Norwegian shipping line Nor Lines.<br />

4.2.5 Royal Arctic Line (Greenland)<br />

Royal Arctic Line (RAL) was formed in 1992 with the transition of<br />

Greenland's sea transport from being a traditional and<br />

conventional cargo operation into becoming a fully modernized<br />

container operation. The operation to/from Greenland is based on a sole and exclusive right from the<br />

Greenland Home Rule to operate regular services. Therefore, RAL is the only container line calling<br />

ports on Greenland. RAL operates services between:<br />

• ports in Greenland<br />

• Greenlandic ports, Aalborg and Reykjavík<br />

• Greenlandic ports and certain overseas ports via Aalborg or Reykjavík.<br />

Royal Arctic Line has entered into ongoing agreements with other shipping companies (like Eimskip),<br />

and through these agreements Royal Arctic Line is able to offer the customers a variety of overseas<br />

destinations for their cargo.<br />

Transportutvikling AS Page 27 of 63

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Royal Arctic Line established routes<br />

Figure 4-17: Royal Arctic Lines ocean services (2009)<br />

Figure 4-17 shows RAL’s services. The direct route between USA/Canada and South Greenland is not<br />

in operation and cargo is transshipped in Reykjavik.<br />

4.2.6 Various Lines (Norway)<br />

There are a few shipping lines offering container services operating along the Norwegian Coast.<br />

Chriship (privately owned) operates the only 100% container vessel in <strong>North</strong>ern Norway between<br />

Bodø and Tromsø/Alta in a charter party with Tollpost Globe. NorLines (owned by Hurtigruten ASA<br />

(50%) and Det Stavangerske Dampskibsselskap AS (50%) operates a fleet of multipurpose vessels<br />

along the entire Norwegian Coast, and with various connections to the Continent. <strong>North</strong> Sea <strong>Container</strong><br />

line (NCL) (partly owned by Elkem) operates container vessels along the Norwegian Coast (up to<br />

Nordland County) and south to the Continent.<br />

See also chapter 5.5.3 for shipping lines calling at the port of Mosjøen.<br />

4.3 Existing container services<br />

Figure 4-18 shows the most important regular container services in the northern part of the <strong>North</strong><br />

<strong>Atlantic</strong>.<br />

Transportutvikling AS Page 28 of 63

<strong>North</strong> <strong>Atlantic</strong> container services 2010<br />

Including the new <strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong> - NACS<br />

NOR LINES<br />

Network of MPP-vessels (TEU capacity 26-127) sailing<br />

along the Norwegian Coast (Kirkenes-Oslo). 28 ports are<br />

called in <strong>North</strong>ern Norway and 24 in the south. The<br />

services are connected to non-Norwegian ports like<br />

Lysekil, Hirtshals, Århus, Halmstad, Copenhagen,<br />

Rostock, Swinoujscie, Cuxhaven and Eemshaven.<br />

©Transportutvikling AS, 2010<br />

EIMSKIP-CTG<br />

Regular services along the<br />

Norwegian Coast (including<br />

Murmansk), Iceland, Baltic’s and<br />

Europe (Grimsby and Velsen).<br />

CHRISHIP<br />

Operates a small container line (ca. 80 TEU) between<br />

Bodø and Tromsø/Alta in Norway. The route is linked to<br />

the railway in Bodø and offers services thrice a week.<br />

Chartered by Tollpost Globe.<br />

ROYAL ARCTIC LINE (RAL)<br />

Main route (Atlant) operated by container vessels<br />

(TEU capacity 250-700) between Ålborg and<br />

Greenland. A feeder system for other ports on<br />

Greenland is connected to the main route.<br />

NCL (<strong>North</strong> Sea <strong>Container</strong> Line)<br />

Operates regular container ships along the Norwegian<br />

Coast and to/from Rotterdam. The most northerly port is<br />

Sørfold (north of Bodø). NCL has a weekly call in<br />

Mosjøen (to/from Rotterdam)<br />

SMYRIL LINE<br />

Operates a combined ferry/Ro-Ro vessel,<br />

where a weekly connection between<br />

Torshavn and Seydisfjordur (<strong>North</strong>–<br />

East Iceland) is a part of the route.<br />

<strong>North</strong> <strong>Atlantic</strong> <strong>Container</strong> <strong>Service</strong><br />

Kirkenes<br />

Murmansk<br />

Figure 4-18: Present container services in the <strong>North</strong> <strong>Atlantic</strong><br />

Alta<br />

RAL does also offer a service to US/Canada by<br />

connecting their main route to Reykjavik and Eimskip’s<br />

<strong>North</strong> America route.<br />

Tromsø<br />

Sortland<br />

Bodø<br />

EIMSKIP<br />

Industrial container<br />

service between Mosjøen<br />

and Reydarfjordur<br />

(Chartered by Alcoa)<br />

Neskaupstadur<br />

Seydisfjordur<br />

Aasiaat<br />

Isafjordur<br />

Sisimiut<br />

MOSJØEN<br />

REYDAR-<br />

FJORDUR<br />

REYKJAVIK<br />

Umeå<br />

Nuuk<br />

Vaasa<br />

Ålesund<br />

Narsaq<br />

OSLO<br />

Fredrikstad<br />

Gothenburg<br />

EIMSKIP (<strong>North</strong> America Route)<br />

Eimskips service to <strong>North</strong> America<br />

has only departures every 3rd week<br />

(28 days) from Reykjavik. The<br />

sailing schedule is as follows<br />

FAEROE SHIP<br />

The company is owned by<br />

Eimskip and operates routes<br />

between Iceland and<br />

Europe/UK and south Norway<br />

•Reykjavik (DEP)<br />

•Argentia (south)<br />

•Everett/Boston (south)<br />

•Richmond (turning point)<br />

•Halifax (north)<br />

•Argentia (north)<br />

•Reykjavik (ARR)<br />

SAMSKIP<br />

Samskips regular container activity is dominated by<br />

services south of the northernmost regions. Samskip<br />

has regular services from Reykjavik and Reydarfjordur<br />