Washoe County, Nevada

Washoe County, Nevada

Washoe County, Nevada

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

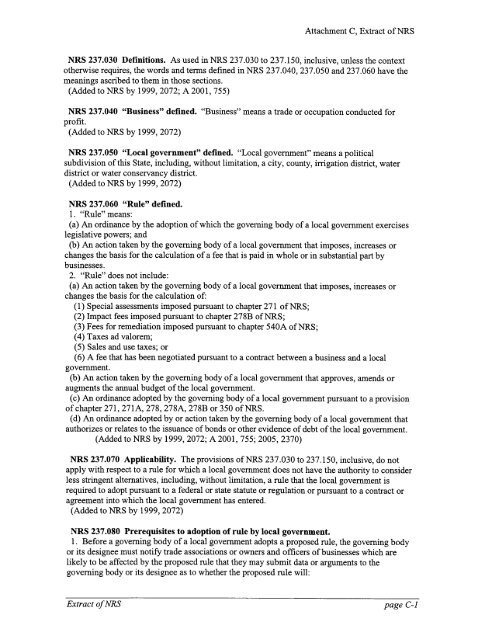

Attachment C, Extract of NRS<br />

NRS 237.030 Definitions. As used in NRS 237.030 to 237.150, inclusive, unless the context<br />

otherwise requires, the words and terms defined in NRS 237.040,237.050 and237.060 have the<br />

meanings ascribed to them in those sections.<br />

(Added to NRS by 7999,2072; A2001,755)<br />

NRS 237.040 "Business" defined. "Business" means a trade or occupation conducted for<br />

profit.<br />

(Added to NRS by 1999,2072)<br />

NRS 237.050 "Local government" defined. "Local government" means a political<br />

subdivision of this State, including, without limitation, a city, county, irrigation district, water<br />

district or water conservancy district.<br />

(Added to NRS by 1999,2072)<br />

NRS 237.060 o'Rule" defined.<br />

1. "Rule" means:<br />

(a) An ordinance by the adoption of which the goveming body of a local government exercises<br />

legislative powers; and<br />

(b) An action taken by the governing body of a local government that imposes, increases or<br />

changes the basis for the calculation of a fee that is paid in whole or in substantial part by<br />

businesses.<br />

2. "Rule" does not include:<br />

(a) An action taken by the governing body of a local governnent that imposes, increases or<br />

changes the basis for the calculation of:<br />

(1) Special assessments imposed pursuant to chapter 271 of NRS;<br />

(2) Impact fees imposed pursuant to chapter 2788 of NRS;<br />

(3) Fees for remediation imposed pursuant to chapter 540,{ of NRS;<br />

(4) Taxes ad valorem;<br />

(5) Sales and use taxes; or<br />

(6) A fee that has been negotiated pursuant to a contract between a business and a local<br />

government.<br />

(b) An action taken by the governing body of a local government that approves, amends or<br />

augments the arurual budget of the local government.<br />

(c) An ordinance adopted by the governing body of a local government pursuant to a provision<br />

of chapter 271,277A,278,278A,2788 or 350 of NRS.<br />

(d) An ordinance adopted by or action taken by the governing body of a local government that<br />

authorizes or relates to the issuance of bonds or other evidence of debt of the local government.<br />

(Added to NRS by 1999, 20'7 2; A 2001, 7 55; 2005, 237 0)<br />

NRS 237.070 Applicability. The provisions of NRS 237 .030 to 237.150, inclusive, do not<br />

apply with respect to a rule for which a local government does not have the authority to consider<br />

less stringent alternatives, including, without limitation, a rule that the local government is<br />

required to adopt pursuant to a federal or state statute or regulation or pursuant to a contract or<br />

agreement into which the local government has entered.<br />

(Addedto NRS by 1999, 2072)<br />

NRS 237.080 Prerequisites to adoption of rule by local government.<br />

1. Before a goveming body of a local government adopts a proposed rule, the governing body<br />

or its designee must notiff trade associations or owners and offrcers of businesses which are<br />

likely to be affected by the proposed rule that they may submit data or arguments to the<br />

governing body or its designee as to whether the proposed rule will:<br />

Extract ofNRS page C-I