Barn boss a referee and coach - The Western Producer

Barn boss a referee and coach - The Western Producer

Barn boss a referee and coach - The Western Producer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6<br />

BY ED WHITE<br />

WINNIPEG BUREAU<br />

NOVEMBER 22, 2012 | WWW.PRODUCER.COM | THE WESTERN PRODUCER<br />

MARKETS<br />

MARKETS EDITOR: D’ARCE MCMILLAN | Ph: 306-665-3519 F: 306-934-2401 | E-MAIL: DARCE.MCMILLAN@PRODUCER.COM | TWITTER: @DARCEMCMILLAN<br />

SHIPPING | CAR UNLOADS<br />

WINNIPEG — Grain is rushing<br />

through the Canadian transportation<br />

network in the first months<br />

after the death of the CWB’s export<br />

monopoly.<br />

“Overall, things are looking pretty<br />

good,” said Mark Hemmes, manager<br />

of the federally appointed<br />

grain system monitor Quorum<br />

Corp., in a speech during the Fields<br />

on Wheels conference Nov. 6.<br />

That perception dominated the<br />

conference, which is the grain<br />

industry’s annual logistics forum.<br />

Not only has the system not broken<br />

down as a new set of logistical signals<br />

were switched on, but remarkable<br />

efficiency gains have been<br />

seen since Aug. 1.<br />

“For the first 13 weeks of this year,<br />

we have started to bust unloading<br />

paradigms, between both railroads<br />

in co-operation with grain companies,<br />

about capacity in Vancouver,”<br />

said Canadian Pacific Railway grain<br />

shipping manager Murray Hamilton.<br />

“Is this the new norm? Is that<br />

what’s going to be sustainable<br />

going forward?”<br />

Car unloading totals in Vancouver<br />

are at levels almost unimaginable<br />

10 years ago, while shipping<br />

through Thunder Bay has hit nearrecord<br />

levels in recent weeks <strong>and</strong><br />

the port of Churchill has seen good<br />

grain flow.<br />

<strong>The</strong> lack of significant problems in<br />

the grain transportation business is<br />

a pleasant surprise to many in the<br />

Canadian grain industry, considering<br />

that the CWB played a dominant<br />

role in many aspects of the<br />

grain logistics system, from organizing<br />

sales to ordering <strong>and</strong> organizing<br />

rail car allocation to directing<br />

grain to port terminals.<br />

Many players, such as grain companies,<br />

some farm groups <strong>and</strong> grain<br />

merchants, argued for years that<br />

the system could be more efficient<br />

without the CWB’s involvement<br />

because it added an extra layer of<br />

complexity to the system.<br />

However, many of the same players<br />

feared the switchover could<br />

reveal unforeseen gaps in the system<br />

or faulty structures as the new<br />

system evolved.<br />

Those problems have not materialized.<br />

“Is this all about the CWB? I’m not<br />

ready to say that yet,” said Hemmes.<br />

“But I can tell you that things are<br />

looking really good.”<br />

<strong>The</strong> industry had more than a<br />

year to prepare for the end of the<br />

monopoly, with federal agriculture<br />

minister Gerry Ritz making it<br />

clear as soon as the Conservative<br />

government won a majority that<br />

he intended to kill the board’s<br />

monopoly powers.<br />

Hemmes said he believes the railway<br />

companies didn’t want to be<br />

the cause of system problems so<br />

they knuckled down to ensure that<br />

didn’t happen.<br />

“<strong>The</strong> railways went into this crop<br />

year with a mindset that said<br />

nobody’s going to (be able to)<br />

blame us for this, so it’s working,”<br />

said Hemmes.<br />

Hamilton said the months before<br />

Aug. 1 were a harried time, with a<br />

feeling of “organized mayhem”<br />

within his company as it prepared<br />

for the new logistics signals.<br />

Weekly Vancouver grain car<br />

unloads of more than 4,500, well<br />

above the 4,000 per week average of<br />

the past five years, revealed extra<br />

capacity that has been hiding within<br />

the system.<br />

Hamilton said CPR’s new chief<br />

executive officer, Hunter Harrison,<br />

is pushing his grain people to find<br />

more.<br />

“He is absolutely convinced that<br />

there is more capacity out there,”<br />

said Hamilton.<br />

“Between railroads <strong>and</strong> grain<br />

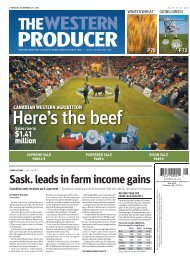

SMOOTH SHIPPING<br />

<strong>The</strong> end of the CWB monopoly <strong>and</strong> replacement of its logistical influence have<br />

not led to significant transportation problems in the first 15 weeks of 2012-13<br />

compared to the same period of other recent years. Grain is flowing well.<br />

All grain <strong>and</strong> wheat shipments to port (thous<strong>and</strong> tonnes)<br />

4,500<br />

4,000<br />

all grain<br />

3,500<br />

wheat only<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

* 5-yr. avg. is 2007-08 to 2011-12<br />

0<br />

Vancouver Prince Rupert ThunderBay Churchill<br />

5-yr. avg.*<br />

2011-12<br />

2012-13<br />

5-yr. avg.*<br />

2011-12<br />

2012-13<br />

Source: Canadian Grain Commission | WP GRAPHIC<br />

companies, I suspect we’re going to<br />

get to a br<strong>and</strong> new paradigm of efficiency<br />

in Vancouver.”<br />

Hemmes said many aspects of the<br />

new system are still new, <strong>and</strong> it’s too<br />

soon to tell how well they will do in<br />

the long run.<br />

However, the system has made<br />

5-yr. avg.*<br />

www.secan.com<br />

Grain flow good in open market<br />

Vancouver has excellent fall | No major complications seen in early months following end of CWB monopoly<br />

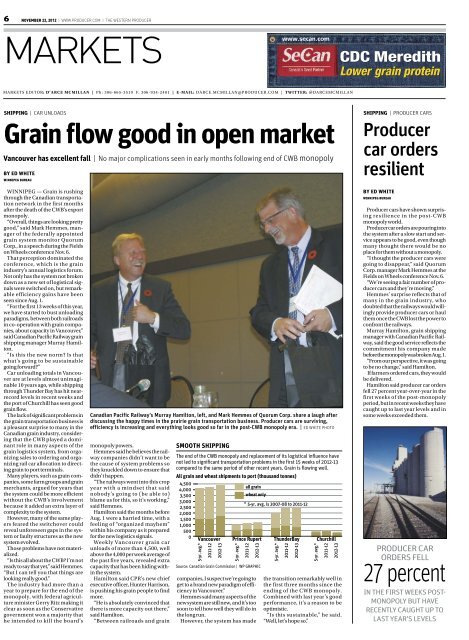

Canadian Pacific Railway’s Murray Hamilton, left, <strong>and</strong> Mark Hemmes of Quorum Corp. share a laugh after<br />

discussing the happy times in the prairie grain transportation business. <strong>Producer</strong> cars are surviving,<br />

efficiency is increasing <strong>and</strong> everything looks good so far in the post-CWB monopoly era. | ED WHITE PHOTO<br />

2011-12<br />

2012-13<br />

5-yr. avg.*<br />

2011-12<br />

2012-13<br />

the transition remarkably well in<br />

the first three months since the<br />

ending of the CWB monopoly.<br />

Combined with last year’s good<br />

performance, it’s a reason to be<br />

optimistic.<br />

“Is this sustainable,” he said.<br />

“Well, let’s hope so.”<br />

CDC Meredith<br />

Lower Lower grain grain protein<br />

protein<br />

SHIPPING | PRODUCER CARS<br />

<strong>Producer</strong><br />

car orders<br />

resilient<br />

BY ED WHITE<br />

WINNIPEG BUREAU<br />

<strong>Producer</strong> cars have shown surprising<br />

resilience in the post-CWB<br />

monopoly world.<br />

<strong>Producer</strong> car orders are pouring into<br />

the system after a slow start <strong>and</strong> service<br />

appears to be good, even though<br />

many thought there would be no<br />

place for them without a monopoly.<br />

“I thought the producer cars were<br />

going to disappear,” said Quorum<br />

Corp. manager Mark Hemmes at the<br />

Fields on Wheels conference Nov. 6.<br />

“We’re seeing a fair number of producer<br />

cars <strong>and</strong> they’re moving.”<br />

Hemmes’ surprise reflects that of<br />

many in the grain industry, who<br />

doubted that the railways would willingly<br />

provide producer cars or haul<br />

them once the CWB lost the power to<br />

confront the railways.<br />

Murray Hamilton, grain shipping<br />

manager with Canadian Pacific Railway,<br />

said the good service reflects the<br />

commitment his company made<br />

before the monopoly was broken Aug. 1.<br />

“From our perspective, it was going<br />

to be no change,” said Hamilton.<br />

If farmers ordered cars, they would<br />

be delivered.<br />

Hamilton said producer car orders<br />

fell 27 percent year-over-year in the<br />

first weeks of the post-monopoly<br />

period, but in recent weeks they have<br />

caught up to last year levels <strong>and</strong> in<br />

some weeks exceeded them.<br />

PRODUCER CAR<br />

ORDERS FELL<br />

27 percent<br />

IN THE FIRST WEEKS POST-<br />

MONOPOLY BUT HAVE<br />

RECENTLY CAUGHT UP TO<br />

LAST YEAR’S LEVELS