Global Trends in Sustainable Real Estate - Jones Lang LaSalle

Global Trends in Sustainable Real Estate - Jones Lang LaSalle

Global Trends in Sustainable Real Estate - Jones Lang LaSalle

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Global</strong> <strong>Trends</strong> <strong>in</strong> Susta<strong>in</strong>able <strong>Real</strong> <strong>Estate</strong>: An Occupier’s Perspective – February 2008<br />

Introduction<br />

Look<strong>in</strong>g back, one theme resonates <strong>in</strong> the demand side of the<br />

property <strong>in</strong>dustry dur<strong>in</strong>g 2007: susta<strong>in</strong>ability. The year saw a<br />

steady growth of <strong>in</strong>terest <strong>in</strong> and attention to the contribution of<br />

corporate real estate to susta<strong>in</strong>ability and corporate social<br />

responsibility (CSR) commitments. As we enter 2008, most<br />

major corporates now have public susta<strong>in</strong>ability statements.<br />

Aga<strong>in</strong>st this back-drop they are also beg<strong>in</strong>n<strong>in</strong>g to pursue<br />

susta<strong>in</strong>able solutions <strong>in</strong> both new and exist<strong>in</strong>g real estate<br />

portfolios.<br />

Susta<strong>in</strong>ability is thus firmly on the corporate agenda. But the<br />

views of corporate occupiers towards susta<strong>in</strong>able real estate<br />

are not widely known. This brief<strong>in</strong>g paper addresses this by<br />

draw<strong>in</strong>g upon the results obta<strong>in</strong>ed from a global survey of over<br />

400 corporate occupiers, conducted jo<strong>in</strong>tly by <strong>Jones</strong> <strong>Lang</strong><br />

<strong>LaSalle</strong> and CoreNet <strong>Global</strong> at CoreNet Summits <strong>in</strong> S<strong>in</strong>gapore,<br />

Denver, Melbourne and London dur<strong>in</strong>g 2007. The aim of the<br />

survey was to gauge corporate awareness, to understand the<br />

key issues driv<strong>in</strong>g susta<strong>in</strong>ability <strong>in</strong> real estate, and to <strong>in</strong>vestigate<br />

some of the perceptions that may be shap<strong>in</strong>g corporate action<br />

and therefore real estate demand.<br />

The views expressed by occupiers and their advisers through<br />

this survey confirm that susta<strong>in</strong>ability reached a tipp<strong>in</strong>g po<strong>in</strong>t <strong>in</strong><br />

2007. The corporate momentum beh<strong>in</strong>d susta<strong>in</strong>ability and CSR<br />

will further <strong>in</strong>tensify over the next twelve months and will<br />

generate real and consistent occupier demand for susta<strong>in</strong>able<br />

real estate across all markets. The ability of the supply side <strong>in</strong><br />

these markets to address such demands is, as occupiers have<br />

identified, presently sporadic at best and needs to be urgently<br />

addressed.<br />

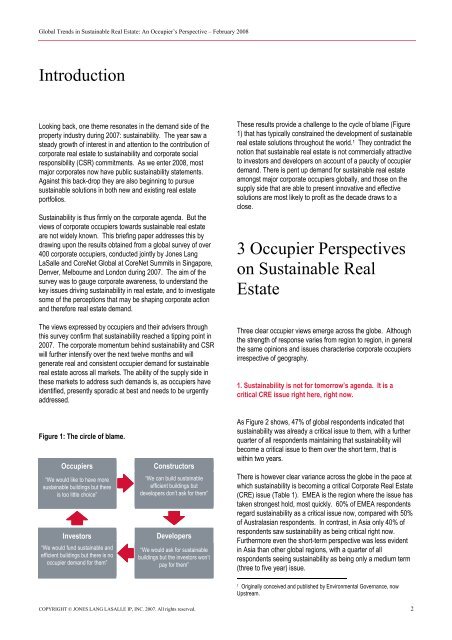

Figure 1: The circle of blame.<br />

Occupiers<br />

“We would like to have more<br />

susta<strong>in</strong>able build<strong>in</strong>gs but there<br />

is too little choice”<br />

Investors<br />

“We would fund susta<strong>in</strong>able and<br />

efficient build<strong>in</strong>gs but there is no<br />

occupier demand for them”<br />

Constructors<br />

“We can build susta<strong>in</strong>able<br />

efficient build<strong>in</strong>gs but<br />

developers don’t ask for them”<br />

Developers<br />

“We would ask for susta<strong>in</strong>able<br />

build<strong>in</strong>gs but the <strong>in</strong>vestors won’t<br />

pay for them”<br />

These results provide a challenge to the cycle of blame (Figure<br />

1) that has typically constra<strong>in</strong>ed the development of susta<strong>in</strong>able<br />

real estate solutions throughout the world. 1 They contradict the<br />

notion that susta<strong>in</strong>able real estate is not commercially attractive<br />

to <strong>in</strong>vestors and developers on account of a paucity of occupier<br />

demand. There is pent up demand for susta<strong>in</strong>able real estate<br />

amongst major corporate occupiers globally, and those on the<br />

supply side that are able to present <strong>in</strong>novative and effective<br />

solutions are most likely to profit as the decade draws to a<br />

close.<br />

3 Occupier Perspectives<br />

on Susta<strong>in</strong>able <strong>Real</strong><br />

<strong>Estate</strong><br />

Three clear occupier views emerge across the globe. Although<br />

the strength of response varies from region to region, <strong>in</strong> general<br />

the same op<strong>in</strong>ions and issues characterise corporate occupiers<br />

irrespective of geography.<br />

1. Susta<strong>in</strong>ability is not for tomorrow’s agenda. It is a<br />

critical CRE issue right here, right now.<br />

As Figure 2 shows, 47% of global respondents <strong>in</strong>dicated that<br />

susta<strong>in</strong>ability was already a critical issue to them, with a further<br />

quarter of all respondents ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g that susta<strong>in</strong>ability will<br />

become a critical issue to them over the short term, that is<br />

with<strong>in</strong> two years.<br />

There is however clear variance across the globe <strong>in</strong> the pace at<br />

which susta<strong>in</strong>ability is becom<strong>in</strong>g a critical Corporate <strong>Real</strong> <strong>Estate</strong><br />

(CRE) issue (Table 1). EMEA is the region where the issue has<br />

taken strongest hold, most quickly. 60% of EMEA respondents<br />

regard susta<strong>in</strong>ability as a critical issue now, compared with 50%<br />

of Australasian respondents. In contrast, <strong>in</strong> Asia only 40% of<br />

respondents saw susta<strong>in</strong>ability as be<strong>in</strong>g critical right now.<br />

Furthermore even the short-term perspective was less evident<br />

<strong>in</strong> Asia than other global regions, with a quarter of all<br />

respondents see<strong>in</strong>g susta<strong>in</strong>ability as be<strong>in</strong>g only a medium term<br />

(three to five year) issue.<br />

1 Orig<strong>in</strong>ally conceived and published by Environmental Governance, now<br />

Upstream.<br />

COPYRIGHT © JONES LANG LASALLE IP, INC. 2007. All rights reserved. 2