Limmat Foundation, 8044 Zurich Project Center

Limmat Foundation, 8044 Zurich Project Center

Limmat Foundation, 8044 Zurich Project Center

- TAGS

- limmat

- zurich

- www.limmat.org

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Limmat</strong> <strong>Foundation</strong>, <strong>8044</strong> <strong>Zurich</strong> <strong>Project</strong> <strong>Center</strong><br />

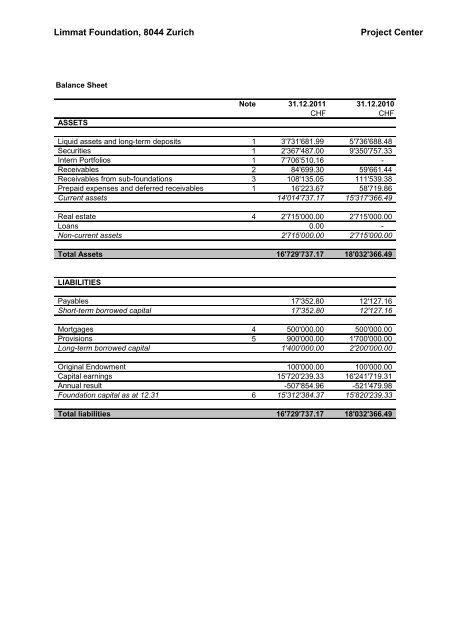

Balance Sheet<br />

ASSETS<br />

Note 31.12.2011 31.12.2010<br />

CHF CHF<br />

Liquid assets and long-term deposits 1 3'731'681.99<br />

Securities 1 2'367'487.00<br />

Intern Portfolios 1 7'706'510.16<br />

Receivables 2 84'699.30<br />

Receivables from sub-foundations 3 108'135.05<br />

Prepaid expenses and deferred receivables 1 16'223.67<br />

Current assets 14'014'737.17<br />

Real estate 4 2'715'000.00<br />

Loans 0.00<br />

Non-current assets 2'715'000.00<br />

Total Assets 16'729'737.17<br />

LIABILITIES<br />

Payables 17'352.80<br />

Short-term borrowed capital 17'352.80<br />

Mortgages 4 500'000.00<br />

Provisions 5 900'000.00<br />

Long-term borrowed capital 1'400'000.00<br />

Original Endowment 100'000.00<br />

Capital earnings 15'720'239.33<br />

Annual result -507'854.96<br />

<strong>Foundation</strong> capital as at 12.31 6 15'312'384.37<br />

Total liabilities 16'729'737.17<br />

5'736'688.48<br />

9'350'757.33<br />

-<br />

59'661.44<br />

111'539.38<br />

58'719.86<br />

15'317'366.49<br />

2'715'000.00<br />

-<br />

2'715'000.00<br />

18'032'366.49<br />

12'127.16<br />

12'127.16<br />

500'000.00<br />

1'700'000.00<br />

2'200'000.00<br />

100'000.00<br />

16'241'719.31<br />

-521'479.98<br />

15'820'239.33<br />

18'032'366.49

<strong>Limmat</strong> <strong>Foundation</strong>, <strong>8044</strong> <strong>Zurich</strong> <strong>Project</strong> <strong>Center</strong><br />

Annual Statement of Account<br />

Note 2011 2010<br />

CHF CHF<br />

General contributions 7 30'000.00 0.00<br />

<strong>Project</strong>-related contributions for administration 19'422.50 8'120.00<br />

Contributions and fundraising 49'422.50 8'120.00<br />

Human resource costs 8 -130'967.00 -126'254.00<br />

Travel and representation costs -13'913.45 -19'681.00<br />

Indirect project costs -144'880.45 -145'935.00<br />

Statement of <strong>Foundation</strong> Activity -95'457.95 -137'815.00<br />

Human resource costs 8 -623'351.45 -606'021.50<br />

Travel and representation costs -14'027.95 -17'340.20<br />

Informational material and conferences 7 -54'564.45 -23'370.99<br />

Information technology and office machines -9'855.90 -30'954.70<br />

Financial audit -24'127.40 -24'325.35<br />

General office and administration costs -16'332.47 -21'873.05<br />

Administrative costs -742'259.62 -723'885.79<br />

Rental income 9 21'000.00 21'000.00<br />

Real estate expenses -39'325.14 -48'965.05<br />

Net real estate expenses -18'325.14 -27'965.05<br />

Statement of Administration -760'584.76 -751'850.84<br />

Earned income on liquid assets and long-term deposits 9'920.59 7'018.19<br />

Securities earnings 174'831.89 228'247.10<br />

Financial Earnings 184'752.48 235'265.29<br />

Bank fees, commissions, deposit fees -30'289.00 -31'777.10<br />

Market-value adjustment for securities 10 -859'473.33 449'493.38<br />

Market-value adjustment for currency 10 -126'179.57 -797'384.47<br />

Net market-value adjustment -985'652.90 -347'891.09<br />

Results Assets Management -831'189.42 -144'402.90<br />

Ausgleich Ergebnis interne Portfolios<br />

Real Estate adjustment 4 -17'438.89 -17'438.90<br />

Financial Result -848'628.31 -161'841.80<br />

Earnings from services to third parties 11 15'000.00 15'300.00<br />

Other Results 15'000.00 15'300.00<br />

Annual Result before Allocation of Funds -1'689'671.02 -1'036'207.64<br />

Variations in provisions 5 800'000.00 100'000.00<br />

Sub-foundation contributions to the project center:<br />

-according to project expenditure 12 251'654.60 290'804.50<br />

-according to capital or financial result 12 130'161.46 123'923.16<br />

Total Allocation of Funds 1'181'816.06 514'727.66<br />

Annual Result -507'854.96 -521'479.98

<strong>Limmat</strong> <strong>Foundation</strong>, <strong>8044</strong> <strong>Zurich</strong> <strong>Project</strong> <strong>Center</strong><br />

<strong>Project</strong> <strong>Center</strong><br />

Annex to the annual report 2011<br />

I. Goal of the <strong>Project</strong> <strong>Center</strong><br />

The <strong>Project</strong>-<strong>Center</strong> is corresponding to the organizational capital by FER 21.<br />

II. Statement of principles for financial reporting<br />

The statement of principles for the financial reporting can be found at www.limmat.org/RLG<br />

III. Line item explanation of the balance sheet<br />

1. Liquid assets and securities<br />

Securities are values according to current market value. Therefore, on the liabilities page, a provision for<br />

market price fluctuation will be shown (cf. note 5). The securities are part of the fixed assets, and therefore<br />

appear in the Financial Report under that heading.<br />

Portfolio structure:<br />

31.12.2011<br />

Type of investment Switzerland Abroad Total<br />

in CHF in % in CHF in % in CHF in %<br />

Liquid assets and long-term deposits 1,929,863.79 14% 1,801,818.20 13% 3,731,681.99 27%<br />

Bonds and simmilars 2,447,800.23 18% 1,557,281.47 11% 4,005,081.70 29%<br />

Stocks ans simmilars 3,437,347.40 25% 2,549,739.21 18% 5,987,086.61 43%<br />

Alternative investments 0.00 0% 81,828.85 1% 81,828.85 1%<br />

Sub-total of securities 5,885,147.63 43% 4,188,849.53 30% 10,073,997.16 73%<br />

Total 7,815,011.42 57% 5,990,667.73 43% 13,805,679.15 100%<br />

31.12.2010<br />

Switzerland Abroad Total<br />

in CHF in % in CHF in % in CHF in %<br />

Liquid assets and long-term deposits 3,443,146.56 23% 2,293,541.92 15% 5,736,688.48 38%<br />

Bonds and simmilars 1,137,985.00 8% 825,686.08 5% 1,963,671.08 13%<br />

Stocks ans simmilars 4,667,832.00 31% 2,616,407.05 17% 7,284,239.05 48%<br />

Alternative investments 0.00 0% 102,847.20 1% 102,847.20 1%<br />

Sub-total of securities 5,805,817.00 38% 3,544,940.33 23% 9,350,757.33 62%<br />

Total 9,248,963.56 61% 5,838,482.25 39% 15,087,445.81 100%<br />

The accrued interest of CHF 2,129.17 as of 31.12.2011 are included in the prepaid expenses and deferred<br />

receivables.<br />

This division includes the shares held by the project center's internal portfolios:<br />

<strong>Project</strong> <strong>Center</strong> Stock 31.12. Change in value 2011<br />

Portfolio 1 (Bonds) 3,911,061.70<br />

9,565.70<br />

Portfolio 2 (Swiss Stocks) 2,821,890.15<br />

28,997.15<br />

Portfolio 3 (Foreign Stocks) 973,558.31<br />

-12,615.82<br />

Total 7,706,510.16<br />

25,947.03<br />

2. Receivable: withholding tax.<br />

3. Internal accounts: Current account with the 14 sub-foundations

<strong>Limmat</strong> <strong>Foundation</strong>, <strong>8044</strong> <strong>Zurich</strong> <strong>Project</strong> <strong>Center</strong><br />

4. Real Estate<br />

Rosenbühlstrasse 32, <strong>8044</strong> Zürich (<strong>Foundation</strong> domicile)<br />

(in CHF)<br />

Date of latest<br />

appraisal<br />

Building, (<strong>Foundation</strong><br />

domicile)<br />

Content,<br />

Furniture&Fixtures Total<br />

Book (carrying) value 1/1/11 2,615,000.00 100,000.00 2,715,000.00<br />

Additions 0.00 0.00<br />

Book (carrying) value 12/31/11 2,615,000.00 100,000.00 2,715,000.00<br />

Cumulated Depreciation *) 0.00 0.00 0.00<br />

Net Value 12/31/11 2,615,000.00 100,000.00 2,715,000.00<br />

Mortgages 500,000.00 500,000.00<br />

Insurance/Replacement (Current) value 06.03.2009 3,269,800.00 250,000.00 3,519,800.00<br />

Estimated curent market value 03.02.2006 5,980,000.00<br />

*) Because of the low book value applied of the property, it does not need any adjustment for depreciation.<br />

To finance tthe renovation works, a 7-year fix-loan of CHF 500'000 (until Dec. 2012, at 3.44%) was taken. It is<br />

shown as mortgage, although the lending bank uses the portfolio as collateral, instead of the property.<br />

5. Provisions<br />

There is a targeted provision for market fluctuations of approx. 12% of the invested assets (net current assets<br />

+ securities). Due to the negative result of the portfolio management, the provision was reduced of CHF<br />

800,000 to CHF 900’000 as per December 31, 2011.<br />

6. Capital<br />

Original endowment: CHF 100,000 on 3/13/1972. Capital earnings do arise from donations, but for the most<br />

part are a result of the financial gains (less administration costs) of the <strong>Foundation</strong> (project center) since 1972.<br />

Organizational capital (project center) is not intended for projects, but for the infrastructure of the foundation.<br />

IV. Line item explanation of the profit and loss account<br />

7. Video 40 years<br />

For the 40 years celebration of the foundation in 2012, it was shot a film. The costs of CHF 31,073.25 has<br />

been carried by a donation of CHF 30’000.<br />

8. Human Resource costs<br />

The total costs of human resources amounts to - CHF 754,318.45, including CHF 74,476.50 social insurance.<br />

It comprises the real working hours for project management (CHF 130,967) and for general administration<br />

costs (CHF 623,351.45).<br />

All employees (5.1 full-time positions) are employed with full benefits. The members of the Board do not<br />

receive compensation.<br />

9. Properties<br />

Property Rosenbühlstrasse 32: Garage rented to Honegger Patronage (CHF 5,000); premises rented to third<br />

parties (CHF 16,000)<br />

10. Gross value adjustments<br />

2011, in CHF Securities Currencies Total<br />

Gains 656,766.35 526,571.24 1,183,337.59<br />

Losses -1,516,239.68 -652,750.81 -2,168,990.49<br />

Net -859,473.33 -126,179.57 -985,652.90<br />

11. Services: Consulting to non profit organisations.<br />

12. Administration fees paid by the sub-foundations to the <strong>Project</strong> <strong>Center</strong><br />

Vor each sub-foundation there is a different agreement for the administration fees charged by the <strong>Project</strong><br />

<strong>Center</strong>. (See the respective annex to the financial report of each sub-foundation).

<strong>Limmat</strong> <strong>Foundation</strong>, <strong>8044</strong> <strong>Zurich</strong> <strong>Project</strong> <strong>Center</strong><br />

V. Further disclosures<br />

Founder: The <strong>Limmat</strong> <strong>Foundation</strong> was founded in 1972 by Dr. Arthur Wiederkehr (Zürich, † 2001).<br />

Compensation: Members of the Board of Directors receive no compensation from the foundation. They are<br />

reimbursed only for travel costs and other foundation-related expenses (2011: CHF 3,691.40).<br />

Volunteer work: Friends of the <strong>Foundation</strong> also provide non-compensated services such as project visitation<br />

and collaboration. This volunteer labor amounted to approximately 470 work hours in 2011.<br />

Related organizations: The <strong>Limmat</strong> <strong>Foundation</strong> is independent. Close contacts are maintained with partner<br />

organizations, but this independence is nonetheless safeguarded. The <strong>Limmat</strong> <strong>Foundation</strong> is also a member<br />

of proFonds, the umbrella organization for philanthropic organizations in Switzerland.<br />

Leasing equipment:<br />

Total duration: 60 months (CHF 13,695)<br />

Until 21.12.2011: 31 months<br />

Remaining period: 29 months x 228.25 = CHF 6,619.25<br />

Patronage Committee<br />

The following personalities are members of the Committee of Patronage of the <strong>Limmat</strong> <strong>Foundation</strong>,<br />

showing their support for its activities.<br />

- H.I.&R.H Archduke Rudolf of Austria<br />

- Jeroo Billimoria, President of Child Helpline International <strong>Foundation</strong>, Amesterdam<br />

- Prof. Luis Fernando Cruz, former President of the Fundación Carvajal, Cali, Colombia<br />

- Prof. J. Gregory Dees, The Fuqua School of Business, Duke University, USA<br />

- Jean-Pierre Hocké, former UN commissioner for Refugees<br />

- Dr. Mark R.Hoenig, Partner and Member of the Board, Egon Zehnder International<br />

- Dr. Gabi Huber, member of Parliament (FDP)<br />

- Nicolas Imboden, former delegate of the Swiss Government for Trade Agreements<br />

- Dr. Arthur Loepfe, former member of Parliament (CVP)<br />

- Prof. Edouard Owczarczak , CEO of Management Joint Trust<br />

- Prof. Robert Purtschert, former Director of the Verbandsmanagement-Institut (VMI) Fribourg<br />

- Otmar Sorgenfrei, former Executive Director, Fondation Nestlé Pro Gastronomia<br />

- Susanna Tamaro, author<br />

- Dr. Alfred Wiederkehr, lawer<br />

- Pirmin Zurbriggen, gold medalist Olympic Games<br />

VI. Efficiency Report<br />

See the annexes to the financial report of each sub-foundation