sport club corinthians paulista

sport club corinthians paulista

sport club corinthians paulista

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52<br />

2011 was marked by sowing. it was a year of reformulations<br />

in youth football, of heavy investments in infrastructure<br />

for and of renovation of the social facilities. the seeds<br />

were planted to ensure a good harvest in the near future<br />

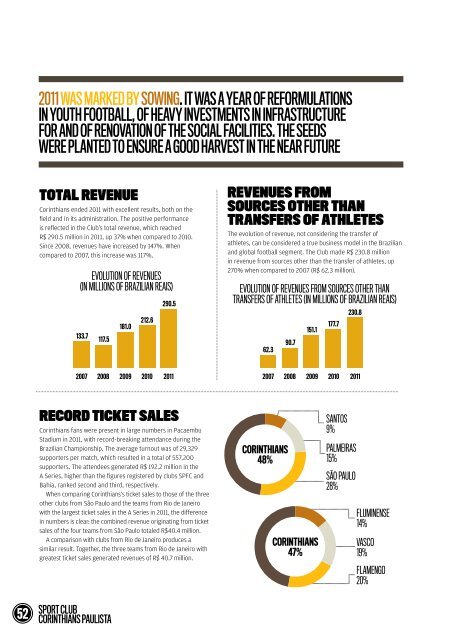

total revenue<br />

Corinthians ended 2011 with excellent results, both on the<br />

field and in its administration. The positive performance<br />

is reflected in the Club’s total revenue, which reached<br />

R$ 290.5 million in 2011, up 37% when compared to 2010.<br />

Since 2008, revenues have increased by 147%. When<br />

compared to 2007, this increase was 117%.<br />

<strong>sport</strong> <strong>club</strong><br />

<strong>corinthians</strong> <strong>paulista</strong><br />

evolution of revenues<br />

(in Millions of brazilian reais)<br />

133.7<br />

2007<br />

117.5<br />

181.0<br />

212.6<br />

290.5<br />

2008 2009 2010 2011<br />

record ticket sales<br />

Corinthians fans were present in large numbers in Pacaembu<br />

Stadium in 2011, with record-breaking attendance during the<br />

Brazilian Championship. The average turnout was of 29,329<br />

supporters per match, which resulted in a total of 557,200<br />

supporters. The attendees generated R$ 192.2 million in the<br />

A Series, higher than the figures registered by <strong>club</strong>s SPFC and<br />

Bahia, ranked second and third, respectively.<br />

When comparing Corinthians's ticket sales to those of the three<br />

other <strong>club</strong>s from São Paulo and the teams from Rio de Janeiro<br />

with the largest ticket sales in the A Series in 2011, the difference<br />

in numbers is clear: the combined revenue originating from ticket<br />

sales of the four teams from São Paulo totaled R$40.4 million.<br />

A comparison with <strong>club</strong>s from Rio de Janeiro produces a<br />

similar result. Together, the three teams from Rio de Janeiro with<br />

greatest ticket sales generated revenues of R$ 40.7 million.<br />

revenues from<br />

sources other than<br />

transfers of athletes<br />

The evolution of revenue, not considering the transfer of<br />

athletes, can be considered a true business model in the Brazilian<br />

and global football segment. The Club made R$ 230.8 million<br />

in revenue from sources other than the transfer of athletes, up<br />

270% when compared to 2007 (R$ 62.3 million).<br />

evolution of revenues froM sources other than<br />

transfers of athletes (in Millions of brazilian reais)<br />

62.3<br />

2007<br />

CORiNThiANS<br />

48%<br />

90.7<br />

151.1<br />

177.7<br />

230.8<br />

2008 2009 2010 2011<br />

CORiNThiANS<br />

47%<br />

santos<br />

9%<br />

palMeiras<br />

15%<br />

são paulo<br />

28%<br />

fluMinense<br />

14%<br />

vasco<br />

19%<br />

flaMenGo<br />

20%<br />

The Club’s financial management in the past five years has been<br />

marked by balance, along with ample generation of revenues. This<br />

more responsible attitude allowed a permanent investment in the<br />

football department, without the irresponsibility seen in the past<br />

or negative effects on the Club’s finances. An example of this is the<br />

evolution of investment related to the total revenue generated. In 2007,<br />

investments in the football department accounted for 85.1% of the<br />

total revenues; this figure dropped to 67.1% in 2011.<br />

The Club has been posting positive and increasing cash flow<br />

generation. This indicator, usually used in the corporate sector, is<br />

known as EBITDA, and refers to earnings before financial expenses,<br />

taxes, depreciation and amortization. In 2010, Corinthians’s EBITDA<br />

was R$ 41.1 million, reaching R$ 73.7 million in 2011, up 79%. When<br />

compared to the total revenue produced, known as the EBITDA<br />

margin, the indicator has shown positive results for four consecutive<br />

years. In 2011 alone, it reached 25%.<br />

econoMic<br />

perforMance//<br />

<strong>club</strong> management time to invest<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

-<br />

85.1%<br />

114.6<br />

133.7<br />

2007<br />

81.2<br />

69.1%<br />

117.5<br />

costs of the football department<br />

73.8%<br />

133.6<br />

181.0<br />

153.4<br />

72.1%<br />

212.6<br />

2008 2009 2010 2011<br />

cash flow generation<br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

-<br />

(50,000)<br />

evolution of investMents in the football<br />

departMent as a proportion of total revenue<br />

(in Millions of brazilian reais, except line)<br />

194.9<br />

ebitda evolution x total revenue<br />

(in Millions of brazilian reais, except line)<br />

-5.1<br />

134.3<br />

-3.8%<br />

ebitda<br />

total revenue<br />

ebitda margin<br />

26.8<br />

117.5<br />

181.0<br />

38.7 41.1<br />

212.6<br />

67.1%<br />

290.5<br />

290.5<br />

22.8% 21.4% 73.6<br />

19.3% 25.4%<br />

2007 2008 2009 2010 2011<br />

In 2007, the Club’s net debt was R$ 101.6 million, but there was a<br />

low level of investment, both in players and in fixed assets. The<br />

current administration reversed this situation, keeping the Club’s<br />

indebtednesses at a balanced level and considerably increasing the<br />

level of investment. Between 2007 and 2011, investments grew by<br />

651%, while indebtedness increased by 76% in the same period.<br />

Investments made in 2011 increased by 107% when compared<br />

to 2010, while indebtedness increased by 47%, thus proving<br />

that the current administration’s finances remain balanced. The<br />

Club also presented a significant improvement in its fixed assets,<br />

due to heavy investments in the Joaquim Grava Training Center,<br />

in addition to investments in high-level players, wich will allow<br />

Corinthians to form very competitive teams.<br />

200<br />

150<br />

100<br />

50<br />

The investment plan was very positive for the Club.<br />

Overall, in 2011, the Club’s indebtedness increased by<br />

R$ 56.8 million, while the investment in fixed and intangible<br />

assets grew by R$ 62.1 million.<br />

Analyzing data from December 2007 to December 2011,<br />

it can be seen that indebtedness increased by R$ 77.3 million,<br />

while the increase in fixed/intangible assets was of R$ 103<br />

million. Therefore, in this period, Corinthians’s assets grew<br />

by a significant R$ 25.7 million.<br />

evolution of indebtedness x investMents in fixed or<br />

intanGible assets (in Millions of brazilian reais)<br />

indebtedness<br />

fixed/intangible<br />

101.6<br />

evolution of indebtedness x investMents Made<br />

(in Millions of brazilian reais)<br />

101.6<br />

12.7<br />

2007<br />

143.2<br />

indebtedness<br />

investments made<br />

97.2<br />

25.1<br />

97.2<br />

149.7<br />

99.8<br />

99.8<br />

158.1<br />

122.1<br />

184.1<br />

178.9<br />

2007 2008 2009 2010 2011<br />

38.9<br />

122.1<br />

46.0<br />

178.9<br />

2008 2009 2010 2011<br />

95.4<br />

246.2<br />

sustainability<br />

report 2011 53