Issuer Presentation - Nykredit

Issuer Presentation - Nykredit

Issuer Presentation - Nykredit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

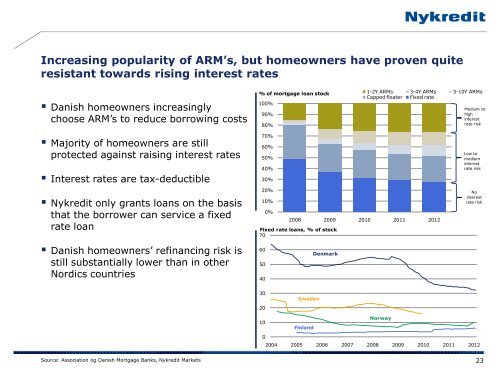

Increasing popularity of ARM’s, but homeowners have proven quite<br />

resistant towards rising interest rates<br />

� Danish homeowners increasingly<br />

choose ARM’s to reduce borrowing costs<br />

� Majority of homeowners are still<br />

protected against raising interest rates<br />

� Interest rates are tax-deductible<br />

� <strong>Nykredit</strong> only grants loans on the basis<br />

that the borrower can service a fixed<br />

rate loan<br />

� Danish homeowners’ refinancing risk is<br />

still substantially lower than in other<br />

Nordics countries<br />

Source: Association og Danish Mortgage Banks, <strong>Nykredit</strong> Markets<br />

% of mortgage loan stock<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

Fixed rate loans, % of stock<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

0%<br />

Sweden<br />

Finland<br />

Denmark<br />

1-2Y ARMs 3-4Y ARMs 5-10Y ARMs<br />

Capped floater Fixed rate<br />

2008 2009 2010 2011 2012<br />

Norway<br />

Medium to<br />

high<br />

interest<br />

rate risk<br />

Low to<br />

medium<br />

interest<br />

rate risk<br />

No<br />

interest<br />

rate risk<br />

2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

23