Issuer Presentation - Nykredit

Issuer Presentation - Nykredit

Issuer Presentation - Nykredit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

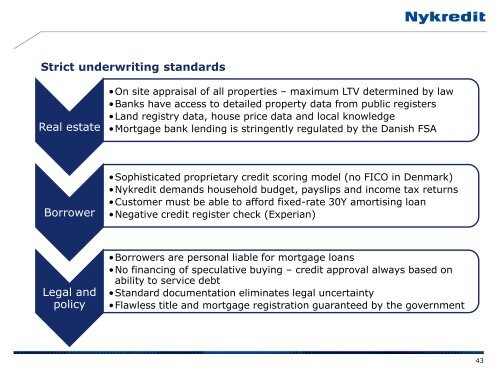

Strict underwriting standards<br />

Real estate<br />

Borrower<br />

Legal and<br />

policy<br />

•On site appraisal of all properties – maximum LTV determined by law<br />

•Banks have access to detailed property data from public registers<br />

•Land registry data, house price data and local knowledge<br />

•Mortgage bank lending is stringently regulated by the Danish FSA<br />

•Sophisticated proprietary credit scoring model (no FICO in Denmark)<br />

•<strong>Nykredit</strong> demands household budget, payslips and income tax returns<br />

•Customer must be able to afford fixed-rate 30Y amortising loan<br />

•Negative credit register check (Experian)<br />

•Borrowers are personal liable for mortgage loans<br />

•No financing of speculative buying – credit approval always based on<br />

ability to service debt<br />

•Standard documentation eliminates legal uncertainty<br />

•Flawless title and mortgage registration guaranteed by the government<br />

43