marzo 2009 - Mirada Magazine Inc

marzo 2009 - Mirada Magazine Inc

marzo 2009 - Mirada Magazine Inc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

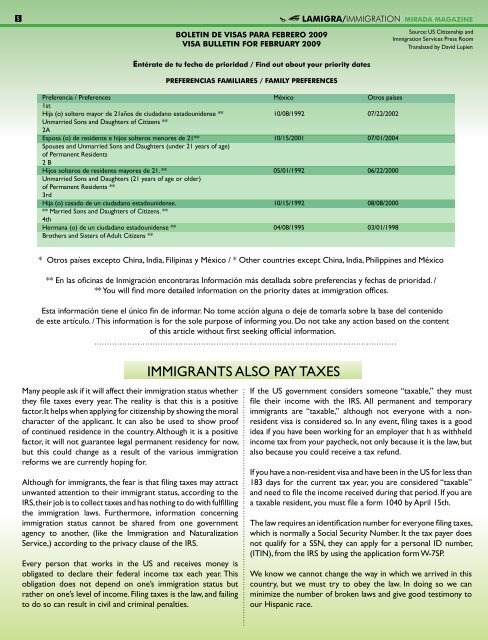

BOLETIN DE VISAS PARA FEBRERO <strong>2009</strong><br />

VISA BULLETIN FOR FEBRUARY <strong>2009</strong><br />

Entérate de tu fecha de prioridad / Find out about your priority dates<br />

PREFERENCIAS FAMILIARES / FAMILY PREFERENCES<br />

LAMIGRA/IMMIGRATION MIRADA MAGAZINE<br />

Preferencia / Preferences México Otros países<br />

1st<br />

Hija (o) soltero mayor de 21años de ciudadano estadounidense ** 10/08/1992 07/22/2002<br />

Unmarried Sons and Daughters of Citizens **<br />

2A<br />

Esposa (o) de residente e hijos solteros menores de 21** 10/15/2001 07/01/2004<br />

Spouses and Unmarried Sons and Daughters (under 21 years of age)<br />

of Permanent Residents<br />

2 B<br />

Hijos solteros de residente mayores de 21. ** 05/01/1992 06/22/2000<br />

Unmarried Sons and Daughters (21 years of age or older)<br />

of Permanent Residents **<br />

3rd<br />

Hija (o) casado de un ciudadano estadounidense. 10/15/1992 08/08/2000<br />

** Married Sons and Daughters of Citizens. **<br />

4th<br />

Hermana (o) de un ciudadano estadounidense ** 04/08/1995 03/01/1998<br />

Brothers and Sisters of Adult Citizens **<br />

Source: US Citizenship and<br />

Immigration Services Press Room<br />

Translated by David Lupien<br />

* Otros países excepto China, India, Filipinas y México / * Other countries except China, India, Philippines and México<br />

** En las oficinas de Inmigración encontraras Información más detallada sobre preferencias y fechas de prioridad. /<br />

** You will find more detailed information on the priority dates at immigration offices.<br />

Esta información tiene el único fin de informar. No tome acción alguna o deje de tomarla sobre la base del contenido<br />

de este artículo. / This information is for the sole purpose of informing you. Do not take any action based on the content<br />

of this article without first seeking official information.<br />

Many people ask if it will affect their immigration status whether<br />

they file taxes every year. The reality is that this is a positive<br />

factor. It helps when applying for citizenship by showing the moral<br />

character of the applicant. It can also be used to show proof<br />

of continued residence in the country. Although it is a positive<br />

factor, it will not guarantee legal permanent residency for now,<br />

but this could change as a result of the various immigration<br />

reforms we are currently hoping for.<br />

Although for immigrants, the fear is that filing taxes may attract<br />

unwanted attention to their immigrant status, according to the<br />

IRS, their job is to collect taxes and has nothing to do with fulfilling<br />

the immigration laws. Furthermore, information concerning<br />

immigration status cannot be shared from one government<br />

agency to another, (like the Immigration and Naturalization<br />

Service,) according to the privacy clause of the IRS.<br />

Every person that works in the US and receives money is<br />

obligated to declare their federal income tax each year. This<br />

obligation does not depend on one’s immigration status but<br />

rather on one’s level of income. Filing taxes is the law, and failing<br />

to do so can result in civil and criminal penalties.<br />

IMMIGRANTS ALSO PAY TAXES<br />

If the US government considers someone “taxable,” they must<br />

file their income with the IRS. All permanent and temporary<br />

immigrants are “taxable,” although not everyone with a nonresident<br />

visa is considered so. In any event, filing taxes is a good<br />

idea if you have been working for an employer that h as withheld<br />

income tax from your paycheck, not only because it is the law, but<br />

also because you could receive a tax refund.<br />

If you have a non-resident visa and have been in the US for less than<br />

183 days for the current tax year, you are considered “taxable”<br />

and need to file the income received during that period. If you are<br />

a taxable resident, you must file a form 1040 by April 15th.<br />

The law requires an identification number for everyone filing taxes,<br />

which is normally a Social Security Number. It the tax payer does<br />

not qualify for a SSN, they can apply for a personal ID number,<br />

(ITIN), from the IRS by using the application form W-7SP.<br />

We know we cannot change the way in which we arrived in this<br />

country, but we must try to obey the law. In doing so we can<br />

minimize the number of broken laws and give good testimony to<br />

our Hispanic race.