Crédito Hipotecario - Banco Falabella

Crédito Hipotecario - Banco Falabella

Crédito Hipotecario - Banco Falabella

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

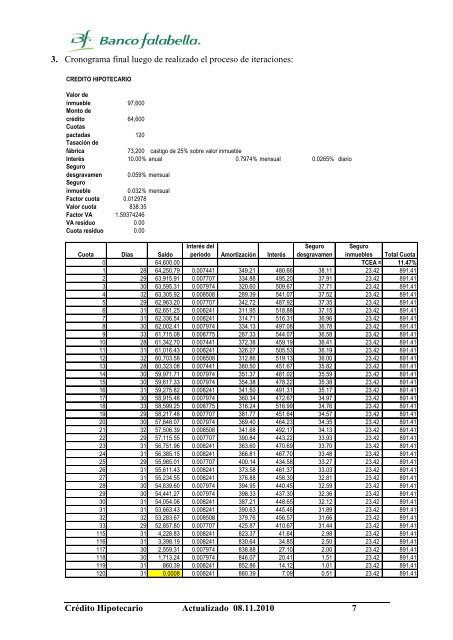

3. Cronograma final luego de realizado el proceso de iteraciones:CREDITO HIPOTECARIOValor deinmueble 97,600Monto decrédito 64,600Cuotaspactadas 120Tasación defábrica 73,200 castigo de 25% sobre valor inmuebleInterés 10.00% anual 0.7974% mensual 0.0265% diarioSegurodesgravamen 0.059% mensualSeguroinmueble 0.032% mensualFactor cuota 0.012978Valor cuota 838.35Factor VA 1.59374246VA residuo 0.00Cuota residuo 0.00Cuota Días SaldoInterés delperiodo Amortización InterésSegurodesgravamenSeguroinmuebles Total Cuota0 64,600.00 TCEA = 11.47%1 28 64,250.79 0.007441 349.21 480.66 38.11 23.42 891.412 29 63,915.91 0.007707 334.88 495.20 37.91 23.42 891.413 30 63,595.31 0.007974 320.60 509.67 37.71 23.42 891.414 32 63,305.92 0.008508 289.39 541.07 37.52 23.42 891.415 29 62,963.20 0.007707 342.72 487.92 37.35 23.42 891.416 31 62,651.25 0.008241 311.95 518.88 37.15 23.42 891.417 31 62,336.54 0.008241 314.71 516.31 36.96 23.42 891.418 30 62,002.41 0.007974 334.13 497.08 36.78 23.42 891.419 33 61,715.08 0.008775 287.33 544.07 36.58 23.42 891.4110 28 61,342.70 0.007441 372.38 459.19 36.41 23.42 891.4111 31 61,016.43 0.008241 326.27 505.53 36.19 23.42 891.4112 32 60,703.58 0.008508 312.86 519.13 36.00 23.42 891.4113 28 60,323.08 0.007441 380.50 451.67 35.82 23.42 891.4114 30 59,971.71 0.007974 351.37 481.02 35.59 23.42 891.4115 30 59,617.33 0.007974 354.38 478.22 35.38 23.42 891.4116 31 59,275.82 0.008241 341.50 491.31 35.17 23.42 891.4117 30 58,915.48 0.007974 360.34 472.67 34.97 23.42 891.4118 33 58,599.25 0.008775 316.24 516.99 34.76 23.42 891.4119 29 58,217.48 0.007707 381.77 451.64 34.57 23.42 891.4120 30 57,848.07 0.007974 369.40 464.23 34.35 23.42 891.4121 32 57,506.39 0.008508 341.68 492.17 34.13 23.42 891.4122 29 57,115.55 0.007707 390.84 443.22 33.93 23.42 891.4123 31 56,751.96 0.008241 363.60 470.69 33.70 23.42 891.4124 31 56,385.15 0.008241 366.81 467.70 33.48 23.42 891.4125 29 55,985.01 0.007707 400.14 434.58 33.27 23.42 891.4126 31 55,611.43 0.008241 373.58 461.37 33.03 23.42 891.4127 31 55,234.55 0.008241 376.88 458.30 32.81 23.42 891.4128 30 54,839.60 0.007974 394.95 440.45 32.59 23.42 891.4129 30 54,441.27 0.007974 398.33 437.30 32.36 23.42 891.4130 31 54,054.06 0.008241 387.21 448.65 32.12 23.42 891.4131 31 53,663.43 0.008241 390.63 445.46 31.89 23.42 891.4132 32 53,283.67 0.008508 379.76 456.57 31.66 23.42 891.4133 29 52,857.80 0.007707 425.87 410.67 31.44 23.42 891.41115 31 4,228.83 0.008241 823.37 41.64 2.98 23.42 891.41116 31 3,398.19 0.008241 830.64 34.85 2.50 23.42 891.41117 30 2,559.31 0.007974 838.88 27.10 2.00 23.42 891.41118 30 1,713.24 0.007974 846.07 20.41 1.51 23.42 891.41119 31 860.39 0.008241 852.86 14.12 1.01 23.42 891.41120 31 0.0008 0.008241 860.39 7.09 0.51 23.42 891.41Crédito <strong>Hipotecario</strong> Actualizado 08.11.2010 7