instrucciones tabla retencion 2011 - Departamento de Hacienda ...

instrucciones tabla retencion 2011 - Departamento de Hacienda ...

instrucciones tabla retencion 2011 - Departamento de Hacienda ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

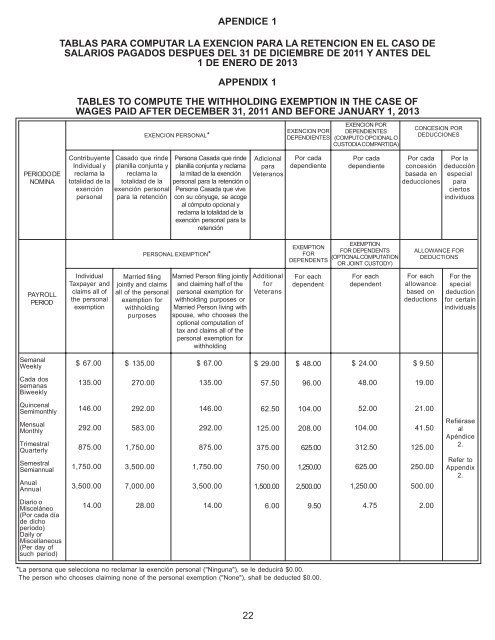

APENDICE 1TABLAS PARA COMPUTAR LA EXENCION PARA LA RETENCION EN EL CASO DESALARIOS PAGADOS DESPUES DEL 31 DE DICIEMBRE DE <strong>2011</strong> Y ANTES DEL1 DE ENERO DE 2013APPENDIX 1TABLES TO COMPUTE THE WITHHOLDING EXEMPTION IN THE CASE OFWAGES PAID AFTER DECEMBER 31, <strong>2011</strong> AND BEFORE JANUARY 1, 2013EXENCION PERSONAL*EXENCION PORDEPENDIENTESEXENCION PORDEPENDIENTES(COMPUTO OPCIONAL OCUSTODIA COMPARTIDA)CONCESION PORDEDUCCIONESPERIODO DENOMINAContribuyenteIndividual yreclama latotalidad <strong>de</strong> laexenciónpersonalCasado que rin<strong>de</strong>planilla conjunta yreclama latotalidad <strong>de</strong> laexención personalpara la retenciónPersona Casada que rin<strong>de</strong>planilla conjunta y reclamala mitad <strong>de</strong> la exenciónpersonal para la retención oPersona Casada que vivecon su cónyuge, se acogeal cómputo opcional yreclama la totalidad <strong>de</strong> laexención personal para laretenciónAdicionalparaVeteranosPor cada<strong>de</strong>pendientePor cada<strong>de</strong>pendientePor cadaconcesiónbasada en<strong>de</strong>duccionesPor la<strong>de</strong>ducciónespecialparaciertosindividuosPERSONAL EXEMPTION*EXEMPTIONFORDEPENDENTSEXEMPTIONFOR DEPENDENTS(OPTIONAL COMPUTATIONOR JOINT CUSTODY)ALLOWANCE FORDEDUCTIONSPAYROLLPERIODIndividualTaxpayer andclaims all ofthe personalexemptionMarried filingjointly and claimsall of the personalexemption forwithholdingpurposesMarried Person filing jointlyand claiming half of thepersonal exemption forwithholding purposes orMarried Person living withspouse, who chooses theoptional computation oftax and claims all of thepersonal exemption forwithholdingAdditionalforVeteransFor each<strong>de</strong>pen<strong>de</strong>ntFor each<strong>de</strong>pen<strong>de</strong>ntFor eachallowancebased on<strong>de</strong>ductionsFor thespecial<strong>de</strong>ductionfor certainindividualsSemanalWeekly$ 67.00$ 135.00$ 67.00$ 29.00$ 48.00$ 24.00$ 9.50Cada dossemanasBiweekly135.00270.00135.0057.5096.0048.0019.00QuincenalSemimonthlyMensualMonthlyTrimestralQuarterlySemestralSemiannualAnualAnnual146.00292.00875.001,750.003,500.00292.00583.001,750.003,500.007,000.00146.00292.00875.001,750.003,500.0062.50125.00375.00750.001,500.00104.00208.00625.001,250.002,500.0052.00104.00312.50625.001,250.0021.0041.50125.00250.00500.00RefiérasealApéndice2.Refer toAppendix2.Diario oMisceláneo(Por cada día<strong>de</strong> dichoperíodo)Daily orMiscellaneous(Per day ofsuch period)14.0028.0014.006.009.504.752.00*La persona que selecciona no reclamar la exención personal ("Ninguna"), se le <strong>de</strong>ducirá $0.00.The person who chooses claiming none of the personal exemption ("None"), shall be <strong>de</strong>ducted $0.00.22