pensions - aafi-afics - UNOG

pensions - aafi-afics - UNOG

pensions - aafi-afics - UNOG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

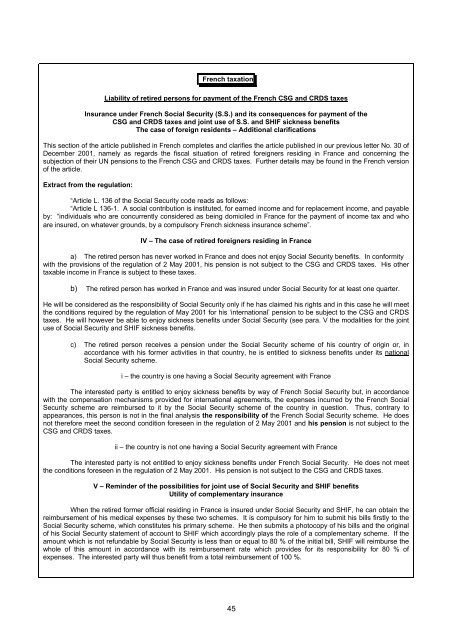

French taxation<br />

Liability of retired persons for payment of the French CSG and CRDS taxes<br />

Insurance under French Social Security (S.S.) and its consequences for payment of the<br />

CSG and CRDS taxes and joint use of S.S. and SHIF sickness benefits<br />

The case of foreign residents – Additional clarifications<br />

This section of the article published in French completes and clarifies the article published in our previous letter No. 30 of<br />

December 2001, namely as regards the fiscal situation of retired foreigners residing in France and concerning the<br />

subjection of their UN <strong>pensions</strong> to the French CSG and CRDS taxes. Further details may be found in the French version<br />

of the article.<br />

Extract from the regulation:<br />

“Article L. 136 of the Social Security code reads as follows:<br />

“Article L 136-1. A social contribution is instituted, for earned income and for replacement income, and payable<br />

by: “individuals who are concurrently considered as being domiciled in France for the payment of income tax and who<br />

are insured, on whatever grounds, by a compulsory French sickness insurance scheme”.<br />

IV – The case of retired foreigners residing in France<br />

a) The retired person has never worked in France and does not enjoy Social Security benefits. In conformity<br />

with the provisions of the regulation of 2 May 2001, his pension is not subject to the CSG and CRDS taxes. His other<br />

taxable income in France is subject to these taxes.<br />

b) The retired person has worked in France and was insured under Social Security for at least one quarter.<br />

He will be considered as the responsibility of Social Security only if he has claimed his rights and in this case he will meet<br />

the conditions required by the regulation of May 2001 for his ‘international’ pension to be subject to the CSG and CRDS<br />

taxes. He will however be able to enjoy sickness benefits under Social Security (see para. V the modalities for the joint<br />

use of Social Security and SHIF sickness benefits.<br />

c) The retired person receives a pension under the Social Security scheme of his country of origin or, in<br />

accordance with his former activities in that country, he is entitled to sickness benefits under its national<br />

Social Security scheme.<br />

i – the country is one having a Social Security agreement with France<br />

The interested party is entitled to enjoy sickness benefits by way of French Social Security but, in accordance<br />

with the compensation mechanisms provided for international agreements, the expenses incurred by the French Social<br />

Security scheme are reimbursed to it by the Social Security scheme of the country in question. Thus, contrary to<br />

appearances, this person is not in the final analysis the responsibility of the French Social Security scheme. He does<br />

not therefore meet the second condition foreseen in the regulation of 2 May 2001 and his pension is not subject to the<br />

CSG and CRDS taxes.<br />

ii – the country is not one having a Social Security agreement with France<br />

The interested party is not entitled to enjoy sickness benefits under French Social Security. He does not meet<br />

the conditions foreseen in the regulation of 2 May 2001. His pension is not subject to the CSG and CRDS taxes.<br />

V – Reminder of the possibilities for joint use of Social Security and SHIF benefits<br />

Utility of complementary insurance<br />

When the retired former official residing in France is insured under Social Security and SHIF, he can obtain the<br />

reimbursement of his medical expenses by these two schemes. It is compulsory for him to submit his bills firstly to the<br />

Social Security scheme, which constitutes his primary scheme. He then submits a photocopy of his bills and the original<br />

of his Social Security statement of account to SHIF which accordingly plays the role of a complementary scheme. If the<br />

amount which is not refundable by Social Security is less than or equal to 80 % of the initial bill, SHIF will reimburse the<br />

whole of this amount in accordance with its reimbursement rate which provides for its responsibility for 80 % of<br />

expenses. The interested party will thus benefit from a total reimbursement of 100 %.<br />

45