ABM.499.09.12 - CC Visa Infinite Form - Alliance Bank Malaysia ...

ABM.499.09.12 - CC Visa Infinite Form - Alliance Bank Malaysia ...

ABM.499.09.12 - CC Visa Infinite Form - Alliance Bank Malaysia ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

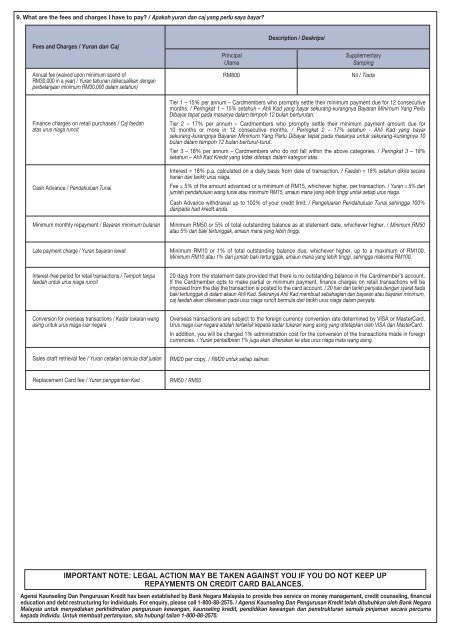

9. What are the fees and charges I have to pay? / Apakah yuran dan caj yang perlu saya bayar?<br />

Fees and Charges / Yuran dan Caj<br />

Annual fee (waived upon minimum spend of<br />

RM30,000 in a year) / Yuran tahunan (dikecualikan dengan<br />

perbelanjaan minimum RM30,000 dalam setahun)<br />

Principal<br />

Utama<br />

RM800<br />

Description / Deskripsi<br />

Supplementary<br />

Samping<br />

Nil / Tiada<br />

Finance charges on retail purchases / Caj faedah<br />

atas urus niaga runcit<br />

Cash Advance / Pendahuluan Tunai<br />

Minimum monthly repayment / Bayaran minimum bulanan<br />

Tier 1 – 15% per annum – Cardmembers who promptly settle their minimum payment due for 12 consecutive<br />

months. / Peringkat 1 – 15% setahun – Ahli Kad yang bayar sekurang-kurangnya Bayaran Minimum Yang Perlu<br />

Dibayar tepat pada masanya dalam tempoh 12 bulan berturutan.<br />

Tier 2 – 17% per annum – Cardmembers who promptly settle their minimum payment amount due for<br />

10 months or more in 12 consecutive months. / Peringkat 2 – 17% setahun - Ahli Kad yang bayar<br />

sekurang-kurangnya Bayaran Minimum Yang Perlu Dibayar tepat pada masanya untuk sekurang-kurangnya 10<br />

bulan dalam tempoh 12 bulan berturut-turut.<br />

Tier 3 – 18% per annum – Cardmembers who do not fall within the above categories. / Peringkat 3 – 18%<br />

setahun – Ahli Kad Kredit yang tidak ditetapi dalam kategori atas.<br />

Interest = 18% p.a. calculated on a daily basis from date of transaction. / Faedah = 18% setahun dikira secara<br />

harian dari tarikh urus niaga.<br />

Fee = 5% of the amount advanced or a minimum of RM15, whichever higher, per transaction. / Yuran = 5% dari<br />

jumlah pendahuluan wang tunai atau minimum RM15, amaun mana yang lebih tinggi untuk setiap urus niaga.<br />

Cash Advance withdrawal up to 100% of your credit limit. / Pengeluaran Pendahuluan Tunai sehingga 100%<br />

daripada had kredit anda.<br />

Minimum RM50 or 5% of total outstanding balance as at statement date, whichever higher. / Minimum RM50<br />

atau 5% dari baki tertunggak, amaun mana yang lebih tinggi.<br />

Late payment charge / Yuran bayaran lewat<br />

Minimum RM10 or 1% of total outstanding balance due, whichever higher, up to a maximum of RM100.<br />

Minimum RM10 atau 1% dari jumlah baki tertunggak, amaun mana yang lebih tinggi, sehingga maksima RM100.<br />

Interest-free period for retail transactions / Tempoh tanpa<br />

faedah untuk urus niaga runcit<br />

20 days from the statement date provided that there is no outstanding balance in the Cardmember’s account.<br />

If the Cardmember opts to make partial or minimum payment, finance charges on retail transactions will be<br />

imposed from the day the transaction is posted to the card account. / 20 hari dari tarikh penyata dengan syarat tiada<br />

baki tertunggak di dalam akaun Ahli Kad. Sekiranya Ahli Kad membuat sebahagian dari bayaran atau bayaran minimum,<br />

caj faedah akan dikenakan pada urus niaga runcit bermula dari tarikh urus niaga dalam penyata.<br />

Conversion for overseas transactions / Kadar tukaran wang<br />

asing untuk urus niaga luar negara<br />

Overseas transactions are subject to the foreign currency conversion rate determined by VISA or MasterCard.<br />

Urus niaga luar negara adalah tertakluk kepada kadar tukaran wang asing yang ditetapkan oleh VISA dan MasterCard.<br />

In addition, you will be charged 1% administration cost for the conversion of the transactions made in foreign<br />

currencies. / Yuran pentadbiran 1% juga akan dikenakan ke atas urus niaga mata wang asing.<br />

Sales draft retrieval fee / Yuran cetakan semula draf jualan<br />

RM20 per copy. / RM20 untuk setiap salinan.<br />

Replacement Card fee / Yuran penggantian Kad<br />

RM50 / RM50<br />

IMPORTANT NOTE: LEGAL ACTION MAY BE TAKEN AGAINST YOU IF YOU DO NOT KEEP UP<br />

REPAYMENTS ON CREDIT CARD BALANCES.<br />

Agensi Kaunseling Dan Pengurusan Kredit has been established by <strong>Bank</strong> Negara <strong>Malaysia</strong> to provide free service on money management, credit counseling, financial<br />

education and debt restructuring for individuals. For enquiry, please call 1-800-88-2575. / Agensi Kaunseling Dan Pengurusan Kredit telah ditubuhkan oleh <strong>Bank</strong> Negara<br />

<strong>Malaysia</strong> untuk menyediakan perkhidmatan pengurusan kewangan, kaunseling kredit, pendidikan kewangan dan penstrukturan semula pinjaman secara percuma<br />

kepada Individu. Untuk membuat pertanyaan, sila hubungi talian 1-800-88-2575.