Buletin Geospatial Sektor Awam - Bil 1/2008 - Malaysia Geoportal

Buletin Geospatial Sektor Awam - Bil 1/2008 - Malaysia Geoportal

Buletin Geospatial Sektor Awam - Bil 1/2008 - Malaysia Geoportal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

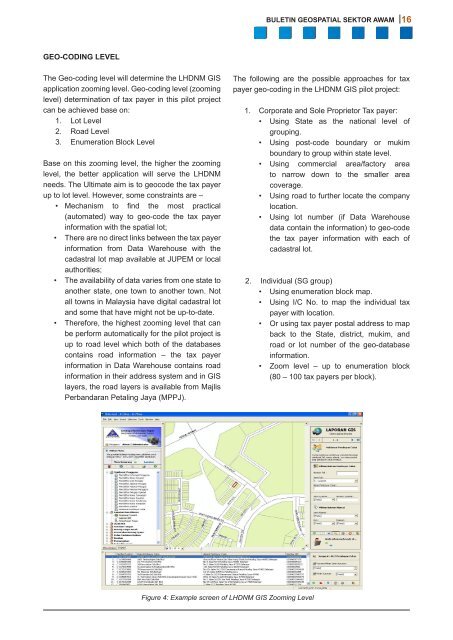

BULETIN GEOSPATIAL SEKTOR AWAM 16GEO-CODING LEVELThe Geo-coding level will determine the LHDNM GISapplication zooming level. Geo-coding level (zoominglevel) determination of tax payer in this pilot projectcan be achieved base on:1. Lot Level2. Road Level3. Enumeration Block LevelBase on this zooming level, the higher the zoominglevel, the better application will serve the LHDNMneeds. The Ultimate aim is to geocode the tax payerup to lot level. However, some constraints are –• Mechanism to find the most practical(automated) way to geo-code the tax payerinformation with the spatial lot;• There are no direct links between the tax payerinformation from Data Warehouse with thecadastral lot map available at JUPEM or localauthorities;• The availability of data varies from one state toanother state, one town to another town. Notall towns in <strong>Malaysia</strong> have digital cadastral lotand some that have might not be up-to-date.• Therefore, the highest zooming level that canbe perform automatically for the pilot project isup to road level which both of the databasescontains road information – the tax payerinformation in Data Warehouse contains roadinformation in their address system and in GISlayers, the road layers is available from MajlisPerbandaran Petaling Jaya (MPPJ).The following are the possible approaches for taxpayer geo-coding in the LHDNM GIS pilot project:1. Corporate and Sole Proprietor Tax payer:• Using State as the national level ofgrouping.• Using post-code boundary or mukimboundary to group within state level.• Using commercial area/factory areato narrow down to the smaller areacoverage.• Using road to further locate the companylocation.• Using lot number (if Data Warehousedata contain the information) to geo-codethe tax payer information with each ofcadastral lot.2. Individual (SG group)• Using enumeration block map.• Using I/C No. to map the individual taxpayer with location.• Or using tax payer postal address to mapback to the State, district, mukim, androad or lot number of the geo-databaseinformation.• Zoom level – up to enumeration block(80 – 100 tax payers per block).Figure 4: Example screen of LHDNM GIS Zooming Level