Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

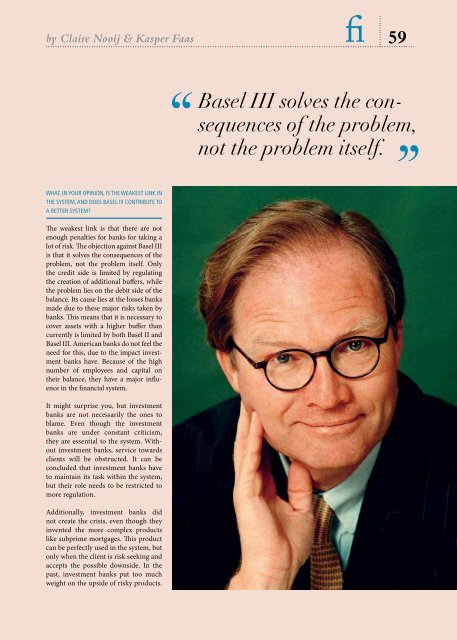

y Claire Nooij & Kasper Faas<br />

WHaT, iN yoUR opiNioN, iS THE WEakEST liNk iN<br />

THE SySTEM, aND DoES BaSEl iii coNTRiBUTE To<br />

a BETTER SySTEM?<br />

The weakest link is that there are not<br />

enough penalties for banks for taking a<br />

lot of risk. The objection against Basel III<br />

is that it solves the consequences of the<br />

problem, not the problem itself. Only<br />

the credit side is limited by regulating<br />

the creation of additional buffers, while<br />

the problem lies on the debit side of the<br />

balance. Its cause lies at the losses banks<br />

made due to these major risks taken by<br />

banks. This means that it is necessary to<br />

cover assets with a higher buffer than<br />

currently is limited by both Basel II and<br />

Basel III. American banks do not feel the<br />

need for this, due to the impact investment<br />

banks have. Because of the high<br />

number of employees and capital on<br />

their balance, they have a major influence<br />

in the financial system.<br />

It might surprise you, but investment<br />

banks are not necessarily the ones to<br />

blame. Even though the investment<br />

banks are under constant criticism,<br />

they are essential to the system. Without<br />

investment banks, service towards<br />

clients will be obstructed. It can be<br />

concluded that investment banks have<br />

to maintain its task within the system,<br />

but their role needs to be restricted to<br />

more regulation.<br />

Additionally, investment banks did<br />

not create the crisis, even though they<br />

invented the more complex products<br />

like subprime mortgages. This product<br />

can be perfectly used in the system, but<br />

only when the client is risk seeking and<br />

accepts the possible downside. In the<br />

past, investment banks put too much<br />

weight on the upside of risky products.<br />

“<br />

59<br />

Basel III solves the consequences<br />

of the problem,<br />

not the problem itself.<br />

”