EY Government Support Package_Portugal

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

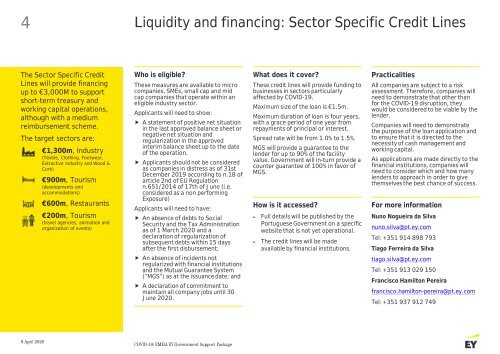

4<br />

Liquidity and financing: Sector Specific Credit Lines<br />

The Sector Specific Credit<br />

Lines will provide financing<br />

up to €3,000M to support<br />

short-term treasury and<br />

working capital operations,<br />

although with a medium<br />

reimbursement scheme.<br />

The target sectors are:<br />

€1,300m, Industry<br />

(Textile, Clothing, Footwear,<br />

Extractive Industry and Wood &<br />

Cork)<br />

€900m, Tourism<br />

(developments and<br />

accommodations)<br />

€600m, Restaurants<br />

€200m, Tourism<br />

(travel agencies, animation and<br />

organization of events)<br />

Who is eligible?<br />

These measures are available to micro<br />

companies, SMEs, small cap and mid<br />

cap companies that operate within an<br />

eligible industry sector.<br />

Applicants will need to show:<br />

A statement of positive net situation<br />

in the last approved balance sheet or<br />

negative net situation and<br />

regularization in the approved<br />

interim balance sheet up to the date<br />

of the operation.<br />

Applicants should not be considered<br />

as companies in distress as of 31st<br />

December 2019 according to n.18 of<br />

article 2nd of EU Regulation<br />

n.651/2014 of 17th of June (i.e.<br />

considered as a non performing<br />

Exposure)<br />

Applicants will need to have:<br />

An absence of debts to Social<br />

Security and the Tax Administration<br />

as of 1 March 2020 and a<br />

declaration of regularization of<br />

subsequent debts within 15 days<br />

after the first disbursement;<br />

An absence of incidents not<br />

regularized with financial institutions<br />

and the Mutual Guarantee System<br />

(“MGS”) as at the issuance date; and<br />

A declaration of commitment to<br />

maintain all company jobs until 30<br />

June 2020.<br />

What does it cover?<br />

These credit lines will provide funding to<br />

businesses in sectors particularly<br />

affected by COVID-19.<br />

Maximum size of the loan is €1.5m.<br />

Maximum duration of loan is four years,<br />

with a grace period of one year from<br />

repayments of principal or interest.<br />

Spread rate will be from 1.0% to 1.5%.<br />

MGS will provide a guarantee to the<br />

lender for up to 90% of the facility<br />

value. <strong>Government</strong> will in-turn provide a<br />

counter guarantee of 100% in favor of<br />

MGS.<br />

How is it accessed?<br />

►<br />

►<br />

Full details will be published by the<br />

Portuguese <strong>Government</strong> on a specific<br />

website that is not yet operational.<br />

The credit lines will be made<br />

available by financial institutions.<br />

Practicalities<br />

All companies are subject to a risk<br />

assessment. Therefore, companies will<br />

need to demonstrate that other than<br />

for the COVID-19 disruption, they<br />

would be considered to be viable by the<br />

lender.<br />

Companies will need to demonstrate<br />

the purpose of the loan application and<br />

to ensure that it is directed to the<br />

necessity of cash management and<br />

working capital.<br />

As applications are made directly to the<br />

financial institutions, companies will<br />

need to consider which and how many<br />

lenders to approach in order to give<br />

themselves the best chance of success.<br />

For more information<br />

Nuno Nogueira da Silva<br />

nuno.silva@pt.ey.com<br />

Tel: +351 914 898 793<br />

Tiago Ferreira da Silva<br />

tiago.silva@pt.ey.com<br />

Tel: +351 913 029 150<br />

Francisco Hamilton Pereira<br />

francisco.hamilton-pereira@pt.ey.com<br />

Tel: +351 937 912 749<br />

6 April 2020<br />

COVID-19: EMEIA <strong>EY</strong> <strong>Government</strong> <strong>Support</strong> <strong>Package</strong>