EY Government Support Package_Portugal

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

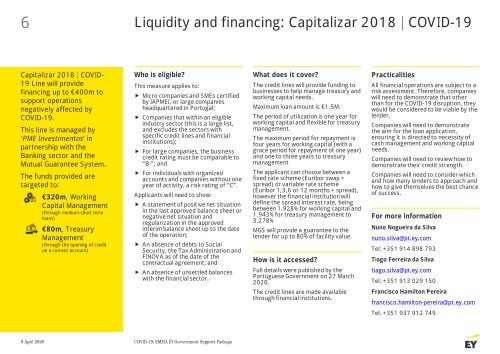

6<br />

Liquidity and financing: Capitalizar 2018 | COVID-19<br />

Capitalizar 2018 | COVID-<br />

19 Line will provide<br />

financing up to €400m to<br />

support operations<br />

negatively affected by<br />

COVID-19.<br />

This line is managed by<br />

‘PME Investimentos’ in<br />

partnership with the<br />

Banking sector and the<br />

Mutual Guarantee System.<br />

The funds provided are<br />

targeted to:<br />

€320m, Working<br />

Capital Management<br />

(through medium-short term<br />

loans)<br />

€80m, Treasury<br />

Management<br />

(through the opening of credit<br />

on a current account)<br />

Who is eligible?<br />

This measure applies to:<br />

Micro companies and SMEs certified<br />

by IAPMEI, or large companies<br />

headquartered in <strong>Portugal</strong>;<br />

Companies that within an eligible<br />

industry sector (this is a large list,<br />

and excludes the sectors with<br />

specific credit lines and financial<br />

institutions);<br />

For large companies, the business<br />

credit rating must be comparable to<br />

“B-”; and<br />

For individuals with organized<br />

accounts and companies without one<br />

year of activity, a risk rating of “C”.<br />

Applicants will need to show:<br />

A statement of positive net situation<br />

in the last approved balance sheet or<br />

negative net situation and<br />

regularization in the approved<br />

interim balance sheet up to the date<br />

of the operation;<br />

An absence of debts to Social<br />

Security, the Tax Administration and<br />

FINOVA as of the date of the<br />

contractual agreement; and<br />

An absence of unsettled balances<br />

with the financial sector.<br />

What does it cover?<br />

The credit lines will provide funding to<br />

businesses to help manage treasury and<br />

working capital needs.<br />

Maximum loan amount is €1.5M.<br />

The period of utilization is one year for<br />

working capital and flexible for treasury<br />

management.<br />

The maximum period for repayment is<br />

four years for working capital (with a<br />

grace period for repayment of one year)<br />

and one to three years to treasury<br />

management<br />

The applicant can choose between a<br />

fixed rate scheme (Euribor swap +<br />

spread) or variable rate scheme<br />

(Euribor 1,3,6 or 12 months + spread),<br />

however the financial institution will<br />

define the spread interest rate, being<br />

between 1.928% for working capital and<br />

1.943% for treasury management to<br />

3.278%<br />

MGS will provide a guarantee to the<br />

lender for up to 80% of facility value.<br />

How is it accessed?<br />

Full details were published by the<br />

Portuguese <strong>Government</strong> on 27 March<br />

2020.<br />

The credit lines are made available<br />

through financial institutions.<br />

Practicalities<br />

All financial operations are subject to a<br />

risk assessment. Therefore, companies<br />

will need to demonstrate that other<br />

than for the COVID-19 disruption, they<br />

would be considered to be viable by the<br />

lender.<br />

Companies will need to demonstrate<br />

the aim for the loan application,<br />

ensuring it is directed to necessity of<br />

cash management and working capital<br />

needs.<br />

Companies will need to review how to<br />

demonstrate their credit strength.<br />

Companies will need to consider which<br />

and how many lenders to approach and<br />

how to give themselves the best chance<br />

of success.<br />

For more information<br />

Nuno Nogueira da Silva<br />

nuno.silva@pt.ey.com<br />

Tel: +351 914 898 793<br />

Tiago Ferreira da Silva<br />

tiago.silva@pt.ey.com<br />

Tel: +351 913 029 150<br />

Francisco Hamilton Pereira<br />

francisco.hamilton-pereira@pt.ey.com<br />

Tel: +351 937 912 749<br />

6 April 2020 COVID-19: EMEIA <strong>EY</strong> <strong>Government</strong> <strong>Support</strong> <strong>Package</strong>