New horizons alternative Asian markets – From OPPortUNITY to CONNECtivitY

1sxNzy1

1sxNzy1

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

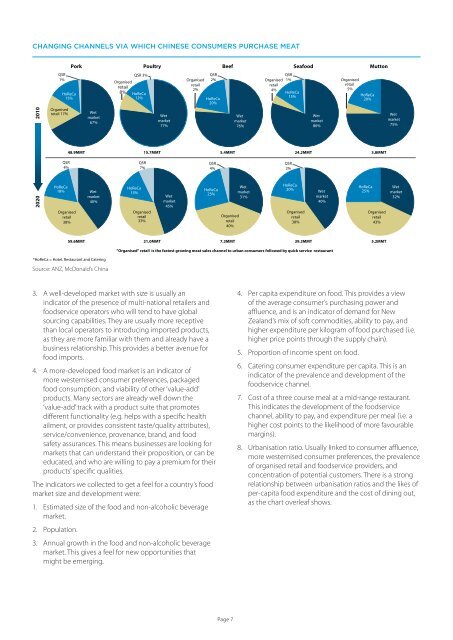

CHANGING CHANNELS VIA WHICH CHINESE CONSUMERS PURCHASE MEAT<br />

Pork<br />

Poultry<br />

Beef<br />

Seafood<br />

Mut<strong>to</strong>n<br />

2010<br />

QSR<br />

1%<br />

HoReCa<br />

15%<br />

Organised<br />

retail 17%<br />

Wet<br />

market<br />

67%<br />

QSR 3%<br />

Organised<br />

retail<br />

8% HoReCa<br />

12%<br />

Wet<br />

market<br />

77%<br />

Organised<br />

retail<br />

2%<br />

QSR<br />

2%<br />

HoReCa<br />

20%<br />

Wet<br />

market<br />

76%<br />

QSR<br />

Organised 1%<br />

retail<br />

4%<br />

HoReCa<br />

15%<br />

Wet<br />

market<br />

80%<br />

Organised<br />

retail<br />

5%<br />

HoReCa<br />

20%<br />

Wet<br />

market<br />

75%<br />

48.9MMT<br />

15.7MMT<br />

5.4MMT<br />

24.2MMT<br />

3.8MMT<br />

QSR<br />

4%<br />

QSR<br />

7%<br />

QSR<br />

4%<br />

QSR<br />

2%<br />

2020<br />

HoReCa<br />

18% Wet<br />

market<br />

40%<br />

Organised<br />

retail<br />

38%<br />

HoReCa<br />

15%<br />

Organised<br />

retail<br />

33%<br />

Wet<br />

market<br />

45%<br />

HoReCa<br />

25%<br />

Organised<br />

retail<br />

40%<br />

Wet<br />

market<br />

31%<br />

HoReCa<br />

20%<br />

Organised<br />

retail<br />

38%<br />

Wet<br />

market<br />

40%<br />

HoReCa<br />

25%<br />

Organised<br />

retail<br />

43%<br />

Wet<br />

market<br />

32%<br />

59.6MMT<br />

21.0MMT<br />

7.3MMT<br />

39.3MMT<br />

5.2MMT<br />

"Organised" retail is the fastest growing meat sales channel <strong>to</strong> urban consumers followed by quick service restaurant<br />

*HoReCa = Hotel, Restaurant and Catering<br />

Source: ANZ, McDonald’s China<br />

3. A well-developed market with size is usually an<br />

indica<strong>to</strong>r of the presence of multi-national retailers and<br />

foodservice opera<strong>to</strong>rs who will tend <strong>to</strong> have global<br />

sourcing capabilities. They are usually more receptive<br />

than local opera<strong>to</strong>rs <strong>to</strong> introducing imported products,<br />

as they are more familiar with them and already have a<br />

business relationship. This provides a better avenue for<br />

food imports.<br />

4. A more-developed food market is an indica<strong>to</strong>r of<br />

more westernised consumer preferences, packaged<br />

food consumption, and viability of other ‘value-add’<br />

products. Many sec<strong>to</strong>rs are already well down the<br />

‘value-add’ track with a product suite that promotes<br />

different functionality (e.g. helps with a specific health<br />

ailment, or provides consistent taste/quality attributes),<br />

service/convenience, provenance, brand, and food<br />

safety assurances. This means businesses are looking for<br />

<strong>markets</strong> that can understand their proposition, or can be<br />

educated, and who are willing <strong>to</strong> pay a premium for their<br />

products’ specific qualities.<br />

The indica<strong>to</strong>rs we collected <strong>to</strong> get a feel for a country’s food<br />

market size and development were:<br />

1. Estimated size of the food and non-alcoholic beverage<br />

market.<br />

2. Population.<br />

3. Annual growth in the food and non-alcoholic beverage<br />

market. This gives a feel for new opportunities that<br />

might be emerging.<br />

4. Per capita expenditure on food. This provides a view<br />

of the average consumer’s purchasing power and<br />

affluence, and is an indica<strong>to</strong>r of demand for <strong>New</strong><br />

Zealand’s mix of soft commodities, ability <strong>to</strong> pay, and<br />

higher expenditure per kilogram of food purchased (i.e.<br />

higher price points through the supply chain).<br />

5. Proportion of income spent on food.<br />

6. Catering consumer expenditure per capita. This is an<br />

indica<strong>to</strong>r of the prevalence and development of the<br />

foodservice channel.<br />

7. Cost of a three course meal at a mid-range restaurant.<br />

This indicates the development of the foodservice<br />

channel, ability <strong>to</strong> pay, and expenditure per meal (i.e. a<br />

higher cost points <strong>to</strong> the likelihood of more favourable<br />

margins).<br />

8. Urbanisation ratio. Usually linked <strong>to</strong> consumer affluence,<br />

more westernised consumer preferences, the prevalence<br />

of organised retail and foodservice providers, and<br />

concentration of potential cus<strong>to</strong>mers. There is a strong<br />

relationship between urbanisation ratios and the likes of<br />

per-capita food expenditure and the cost of dining out,<br />

as the chart overleaf shows.<br />

Page 7