PrimeResi.com - Editorial Highlights

A few selected highlights from last month on the journal of prime property, www.PrimeResi.com.

A few selected highlights from last month on the journal of prime property, www.PrimeResi.com.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

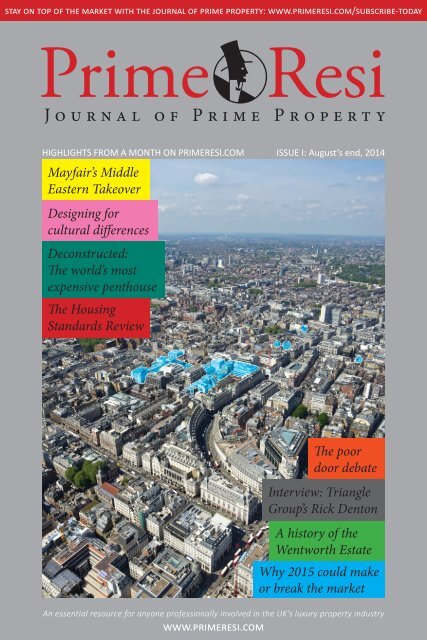

stay on top of the market with the journal of prime property: www.primeresi.<strong>com</strong>/subscribe-today<br />

PrimeQResi<br />

Journal of Prime Property<br />

HIGHLIGHTS FROM A MONTH ON PRIMERESI.COM<br />

Mayfair’s Middle<br />

Eastern Takeover<br />

Designing for<br />

cultural differences<br />

Deconstructed:<br />

The world’s most<br />

expensive penthouse<br />

The Housing<br />

Standards Review<br />

ISSUE I: August’s end, 2014<br />

The poor<br />

door debate<br />

Interview: Triangle<br />

Group’s Rick Denton<br />

A history of the<br />

Wentworth Estate<br />

Why 2015 could make<br />

or break the market<br />

An essential resource for anyone professionally involved in the UK’s luxury property industry<br />

www.primeresi.<strong>com</strong>

NEWS: PEOPLE & BUSINESS<br />

Bradman &<br />

Lipton back<br />

together for<br />

major resi<br />

play<br />

Uber-developers<br />

Godfrey Bradman<br />

and Sir Stuart Lipton<br />

are reportedly<br />

back in business<br />

and making a significant<br />

play on the<br />

UK’s private rented<br />

sector. Q<br />

Countrywide<br />

sells Sotheby’s<br />

franchise and<br />

two branches;<br />

others to be<br />

rebranded<br />

Countrywide has<br />

decided to sell its<br />

exclusive Sotheby’s<br />

International Realty<br />

licence, just four<br />

years into the 25<br />

year term. Q<br />

Oaktreebacked<br />

Anthology<br />

<strong>com</strong>pletes<br />

senior team<br />

New Oaktree Capital<br />

Management-backed<br />

property developer<br />

Anthology has <strong>com</strong>pleted<br />

its senior team<br />

by hiring former<br />

Mount Anvil man<br />

David Clark. Q<br />

Hamptons<br />

taps into<br />

short let<br />

boom<br />

Hamptons International<br />

has<br />

decided to launch<br />

a dedicated Short<br />

Lets Department<br />

in response to a<br />

‘significant rise in<br />

demand’. Q<br />

JLL research<br />

team hires<br />

high-profile<br />

property<br />

journalist<br />

JLL has made a<br />

strong signing<br />

to its Residential<br />

Research department,<br />

snapping up<br />

the former News<br />

Editor of Estates<br />

Gazette. Q<br />

Cluttons<br />

recruits digital<br />

guru<br />

Cluttons has hired a<br />

new digital marketing<br />

manager from<br />

Property Week<br />

magazine. Q<br />

Subscribe to <strong>PrimeResi</strong>.<strong>com</strong><br />

to get full access to daily<br />

prime property news & views<br />

New Exec Director for City<br />

& Westminster Property<br />

Associations<br />

The City and Westminster Property Associations<br />

– which look after the interests<br />

of over 400 of prime central London’s<br />

property owners, developers, investors<br />

and advisors – has appointed a new Executive<br />

Director. Q<br />

Read these stories<br />

and more in full at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/news<br />

Peace to chair TTA<br />

Liz Peace – the outgoing Chief Exec of<br />

the British Property Federation – is joining<br />

PR agency TTA Property. Q<br />

Bouygues appoints new<br />

Commercial Director<br />

Bouygues UK has promoted Colin<br />

Whitfield to the Group Commercial<br />

Director seat with immediate effect. Q<br />

Images, from top: Westminster Property Association, The British Property Federation, Cluttons<br />

p.2<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/people

MARKETWATCH<br />

- New housebuilding starts: 0% change<br />

(Quarterly), u +22% (Annual) – HMRC<br />

NEWS: THE MARKET<br />

Middle Eastern buyers<br />

account for 50% of<br />

Mayfair’s super-prime deals<br />

Image courtesy of Wetherell<br />

uHouse price annual inflation: +19.3%<br />

in London, +10.7% in England, +3.5%<br />

in Wales, +6.0% in Scotland, +4.9% in<br />

Northern Ireland – ONS<br />

dAsking prices: England & Wales -2.9%;<br />

London -5.9% (Monthly) – Rightmove<br />

uPCL prices +11.3%; uPCL transactions<br />

+19.3%; uGreater London prices<br />

+12.1%; uGreater London transactions<br />

+20.1%; uEngland & Wales prices<br />

+5.9%; uEngland & Wales transactions<br />

+30.9% (Annual, Q2 on Q2) – Land<br />

Registry / LCP<br />

- London prices +0.3% (Monthly);<br />

dAnnual increase down from +8.1% to<br />

+7.9%; dnew prospective buyers -25%;<br />

dviewings -10%, uexchanges +3%<br />

(Annual); - London rents +0.5%; unew<br />

tenant registrations +17%; utenant<br />

viewings +25% (Annual) – Knight Frank<br />

uCapital values +15.9% (Annual);<br />

daverage gross yield down to 3.19% –<br />

Cluttons<br />

dTransaction levels -8% <strong>com</strong>pared to<br />

average (Quarterly) – Strutt & Parker<br />

uNew instructions +26%;<br />

dTransactions -9.9%; uPSF prices for<br />

NEWS: THE MARKET<br />

Appetite for<br />

Construction:<br />

New house<br />

building starts<br />

up by a fifth<br />

There’s been no<br />

change in the number<br />

of new house<br />

building starts over<br />

the last quarter,<br />

although the number’s<br />

up by nearly a<br />

fifth year-on-year,<br />

according to the<br />

latest Government<br />

stats. Q<br />

The Big<br />

Summer Sale:<br />

Record drop<br />

in August<br />

asking prices<br />

The average asking<br />

price of newly-marketed<br />

property<br />

across England and<br />

Wales is down by<br />

2.9% this month<br />

<strong>com</strong>pared to last,<br />

according to Rightmove.<br />

Q<br />

Resi yields<br />

drop but<br />

investor activity<br />

accelerates<br />

The pace of growth for<br />

residential investments<br />

slowed up in Q2, leaving<br />

capital values 15.9%<br />

up on the year, says<br />

Cluttons. Q<br />

‘The financial<br />

crisis no<br />

longer<br />

dominates<br />

the fortunes<br />

of the prime<br />

London<br />

residential<br />

market’<br />

A looming General<br />

Election and<br />

expectations of an<br />

interest rate rise<br />

have eclipsed the<br />

global economic<br />

meltdown as the<br />

primary factors affecting<br />

the top end<br />

of London’s property<br />

market, says<br />

Knight Frank.Q<br />

London<br />

house prices<br />

have risen<br />

by 19.3% in<br />

the last 12<br />

months -<br />

ONS<br />

While still strong,<br />

the pace of annual<br />

house price growth<br />

in the UK has<br />

dropped a smidge,<br />

from +10.4% in<br />

the year to May<br />

to +10.2% in the<br />

year to June 2014,<br />

according to the<br />

latest batch of stats<br />

from the ONS. Q<br />

Read these stories<br />

and more in full at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/news<br />

House price expectations<br />

‘substantially lower’ than<br />

May’s high point<br />

“The price exuberance seen in some corners<br />

of the market is easing,” says Knight<br />

Frank’s Gráinne Gilmore, as the agency’s<br />

monthly House Price Sentiment Index<br />

shows another drop. Q<br />

50% of new applicants made<br />

an offer in July – D&G<br />

There seem to be some pretty motivated<br />

househunters out there this Summer,<br />

with Douglas & Gordon reporting that<br />

nearly half of its new applicants actually<br />

made an offer on a property last month.Q<br />

Caution, Plateau: London’s<br />

new prime sales landscape<br />

There’s been “a distinct change in<br />

attitude on the part of both buyers and<br />

vendors” in prime London through<br />

this year’s second quarter, says Chestertons.Q<br />

London Uberground:<br />

Housing markets along the<br />

‘ginger line’ outperform<br />

One of London’s least-celebrated transport<br />

links – the ‘ginger line’ – has actually<br />

had a profound effect on the property<br />

markets it passes through, according to<br />

Hamptons International. Q<br />

Graph by Knight Frank<br />

p.4<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/the-market

Images, from top: The Crown Estate, Heron International, villaforsale-spain.<strong>com</strong>, Brimelow McSweeney<br />

Church sells chunk of<br />

Mayfair to Crowns for £381m<br />

The Church has offloaded its 64% stake in<br />

the Pollen Estate - that four acre square of<br />

Mayfair between Conduit Street, Regent<br />

Street, Burlington Gardens and Bond<br />

Street – for £381m. Q<br />

Heron Plaza site sells to<br />

Singapore’s UOL Group<br />

Singapore-based UOL Group has bought<br />

the Heron Plaza site on Bishopsgate from<br />

Gerald Ronson’s Heron International for<br />

£97m, with plans for luxury residential<br />

apartments, a hotel and retail units. It’s<br />

UOL’s first major London play. Q<br />

Subscribe to <strong>PrimeResi</strong>.<strong>com</strong><br />

to read these stories in full<br />

Nod for Brimelow<br />

McSweeney’s Soho scheme<br />

Brimelow McSweeney has bagged planning<br />

permission for its residential designs<br />

on 181-185 Wardour Street. Q<br />

NEWS: DEALS & DEVELOPMENTS<br />

‘Heroic’<br />

rescue of<br />

Brontë’s muse<br />

wins top<br />

restoration<br />

award<br />

A late medieval<br />

house in North<br />

Yorkshire that’s<br />

thought to have<br />

inspired the setting<br />

for Jane Eyre has<br />

walked away with<br />

this year’s coveted<br />

HHA & Sotheby’s<br />

Restoration<br />

Award.Q<br />

Hadley<br />

<strong>com</strong>pletes<br />

Chelsea<br />

Island<br />

acquisition<br />

with £48m<br />

bridge<br />

Luxury developer<br />

Hadley Property<br />

Group has <strong>com</strong>pleted<br />

the acquisition of<br />

a development site<br />

in Chelsea Harbour<br />

with a chunky<br />

bridging loan from<br />

Omni Capital. Q<br />

Lift off for<br />

government<br />

property<br />

search engine<br />

It’s just got a whole<br />

lot easier to find underused<br />

and empty<br />

government land and<br />

property. Q<br />

Construction<br />

firms battle it<br />

out over £600m<br />

Battersea<br />

Power Station<br />

contract<br />

It sounds like things<br />

are heating up in the<br />

battle for the £600m<br />

contract to redevelop<br />

the main Battersea<br />

Power Station building.<br />

Q<br />

Free<br />

Lamborghini<br />

Diablo: Spanish<br />

villa offered<br />

with supercar<br />

sweetener<br />

A villa on the Costa<br />

del Sol is being offered<br />

for sale with a free<br />

Lamborghini Diablo<br />

thrown in to sweeten<br />

the deal. Q<br />

Tough love for<br />

Candy’s Sugar<br />

Quay S106 plea<br />

Planners are “sticking<br />

to their guns” over<br />

a £15m affordable<br />

housing contribution<br />

requirement for Candy<br />

& Candy’s Sugar Quay<br />

development. Q<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/news<br />

p.5

NEWS<br />

Here’s what the first new-build for over a century on<br />

Britain’s most expensive street, Kensington Palace Gardens, will look like.<br />

Designed by Colwyn Foulkes & Partners and revealed on <strong>PrimeResi</strong> back in<br />

Millionaires’ Rows 2014:<br />

Britain’s most expensive streets, towns and areas<br />

The value of Britain’s most expensive streets is rising at nearly twice the national average,<br />

meaning that the number of “property millionaires” – with homes worth more than £1m<br />

– is nearly 50% higher than it was last year.<br />

Property prices on the the UK’s ten most expensive streets have increased by 12.9% over<br />

the last 12 months, while Zoopla’s stats show a national average price rise of 6.6% over the<br />

same period.<br />

The portal’s annual Property Richlist shows that there are now 484,081 £1m+ homeowners<br />

in Britain – up 49% on last year – and that there are 10,613 streets in Britain with an<br />

average property value of £1m+, up 29% on 2013. 3,744 of those “Millionaires’ Rows” –<br />

just shy of a third of the total and all the top 20 – are in London.<br />

12 streets claim an average house prices over £10m. Kensington Palace Gardens again<br />

tops the table, with an average price of £42,730,760 (62 times the £263,705 value of the<br />

average British home, says Zoopla). The Boltons in SW10 takes second place with average<br />

house prices standing at £26,570,341, and Grosvenor Crescent in SW1 rounds out the top<br />

three with average property prices of £22,293,470.<br />

Outside of the capital, the most expensive street in Britain is Sunninghill Road in Surrey,<br />

where the average home is currently worth £5,605,067. The two most expensive towns<br />

outside London are both in Surrey, with average house prices in Virginia Water at<br />

£1,186,262 and Cobham at £1,003,400.<br />

W8 (Kensington) remains London’s most pricey postcode, with average property prices<br />

in the area of £2.78m. Neighbouring SW7 (Knightsbridge), the next most expensive area<br />

in the capital, has average values of £2.48m, while property values in third-placed SW3<br />

(Chelsea) stand at £2.37m. The rest of the top 10 is dominated by areas in South West,<br />

West and North West London. Q<br />

p.6<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/the-market

Britain’s Top 10<br />

Most Expensive Streets<br />

1. Kensington Palace Grdns, London W8<br />

2. The Boltons, London SW10<br />

3. Grosvenor Crescent, London SW1X<br />

4. Courtenay Avenue, London N6<br />

5. Ilchester Place, London W14<br />

6. Frognal Way, London NW3<br />

7. Carlyle Square, London SW3<br />

8. Montrose Place, London SW1X<br />

9. Cottesmore Gardens, London W8<br />

10. Manresa Road, London SW3<br />

Average<br />

Property Value<br />

£42,730,706<br />

£26,570,341<br />

£22,293,470<br />

£16,877,746<br />

£11,853,515<br />

£10,974,043<br />

£10,846,481<br />

£10,683,611<br />

£10,631,829<br />

£10,362,420<br />

Annual %<br />

Increase<br />

12.11%<br />

13.64%<br />

12.43%<br />

13.67%<br />

16.02%<br />

8.38%<br />

14.14%<br />

12.43%<br />

12.11%<br />

14.14%<br />

Britain’s Top 10<br />

Most Expensive Towns<br />

1. Virginia Water, Surrey<br />

2. Cobham, Surrey<br />

3. Keston, London<br />

4. Esher, Surrey<br />

5. Richmond, Surrey<br />

6. Beaconsfield, Buckinghamshire<br />

7. Chalfont St. Giles, Buckinghamshire<br />

8. Gerrards Cross, Buckinghamshire<br />

9. Radlett, Hertfordshire<br />

10. Weybridge, Surrey<br />

Average<br />

Property Value<br />

£1,186,262<br />

£1,003,400<br />

£947,955<br />

£931,669<br />

£906,770<br />

£897,872<br />

£836,434<br />

£815,222<br />

£794,569<br />

£785,400<br />

Annual %<br />

Increase<br />

5.91%<br />

6.94%<br />

10.81%<br />

10.08%<br />

12.47%<br />

4.79%<br />

0.47%<br />

9.38%<br />

14.21%<br />

6.96%<br />

Source: Zoopla.co.uk<br />

this is just a small selection of highlights from August’s news on <strong>PrimeResi</strong>.<strong>com</strong><br />

read the full stories here: www.primeresi.<strong>com</strong>/news<br />

p.7

VIEWS<br />

Why 2015 could make or break<br />

the UK’s property market<br />

For homeowners – especially those in the South East and London – it has never been<br />

more important who wins the next general election, says Trevor Abrahmsohn…<br />

In the past, whether it be New Labour or Conservative who won an election, it mattered<br />

little. Neither party were advocating any particular alarming legislation as it applies to<br />

property ownership and therefore there was no predictable downturn or upturn before or<br />

after the Election. It was a case of ‘same old’. I will admit, there has always been a hiatus a<br />

few weeks before and after an Election where the market has moved sideways for a short<br />

while but no real change has manifested itself.<br />

The spring Budget and the Autumn Statement have an effect particularly where Stamp<br />

Duty rises have been leaked beforehand and then there has been a real crescendo of activity<br />

in the weeks, days and hours before the Budget announcement where buyers accelerate<br />

and precipitate their activities in advance of rises in SDLT (Stamp Duty).<br />

The out<strong>com</strong>e of the May Election in 2015 will be different. With the Lib-Dems making<br />

Mansion Tax a main plank of their Manifesto and Ed Balls, of the Labour Party, aping<br />

their sentiments, the spectre of this draconian tax is having a very profound effect on the<br />

London property market particularly above £5-10million. Frankly, you can’t blame anyone<br />

since in London £2million will not buy you a mansion and it is a mischievous plot to<br />

describe what is otherwise a tax on London’s wealthy.<br />

By way of illustration, a person living in say a £5million house will be facing a gross tax<br />

of £60,000 per annum which is probably a third to a half of their gross in<strong>com</strong>e. A widow,<br />

for instance, who bought their family home many years ago and does not have a huge<br />

in<strong>com</strong>e will be distressed at this scurrilous and punitive tax. Even if they roll up the tax<br />

with interest, until such time as the widow dies or sells, the benefit that she would like to<br />

pass to her family (after death duties) will be soaked up by the Mansion Tax process.<br />

It is therefore no wonder that buyers and householders are so vexed about this and it is<br />

already having a profound effect on sentiments where people are delaying decisions until<br />

the out<strong>com</strong>e of the Election is better known. This negative sentiment has been getting<br />

gradually worse over the last 18 months from the obscene rises in SDLT since the Budget<br />

of 2012 where non-corporate tax has gone up by 40% and corporate by 300%.<br />

In addition the Chancellor (egged on by the Lib-Dems) has changed the taxation<br />

arrangements on Capital Gains and there is a “posse of the press” who consider ‘Jonny<br />

Foreigner’ buying property in the UK as being thoroughly ‘undesirable’ soaking up our<br />

limited supply of private housing.<br />

The net effect of all this is that the market outside the Central London area, particularly<br />

along the north west London corridor over £5-10million pounds has been conspicuously<br />

p.8<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

affected by fewer transactions. In fact the turnover of properties in<br />

this price range for estate agents is down by 60/70%. Even central<br />

London is now affected where prices are relatively stable (with no<br />

growth) and foreign buyers are markedly fewer.<br />

The Russians have local difficulties with a declining economy, a<br />

falling Rouble and a shrinking economy quite apart from the threat<br />

of sanctions on key individuals but other foreigners are being put<br />

off by this self-inflicted problem.<br />

Prices at the top end are generally down in the suburbs by 10-15%<br />

and I see no growth at all in Central London apart from the few hot<br />

spots where, at the best of times, there is no supply whatsoever.<br />

A telling sign of this malaise is that key roads in north west London have a number of<br />

un-sold properties whereas under usual circumstances there is just no supply.<br />

Very recently, as sellers grasp the reality of this new circumstance, they are being more<br />

realistic with prices and this is triggering some sales – which is very wel<strong>com</strong>e.<br />

The market up to £2million (the threshold for Stamp Duty and coincidently Mansion<br />

Tax) has been very busy of late across London and the rest of the UK with growth of between<br />

8-10% but even this is slowing down and we will see what happens in September, a<br />

seasonally busy month, if sentiments have changed over the summer.<br />

In the lower price ranges I see 5% growth on an annualised basis since the shortage of<br />

private housing will always keep prices moving upwards. Buyers are concerned about<br />

rises in interest rates and its effect on mortgage rates which will happen at the end of this<br />

year and if not next year. Mortgagees are taking an inordinate amount of time to process<br />

mortgage applications and that is having an effect on the speed of the conveyancing<br />

process.<br />

Above £2million the cost of sales to trade upwards is 10% of the new purchase and this<br />

is having an effect on sentiments where householders are preferring to spend the money<br />

extending their properties either through loft conversions, ground floor extensions or<br />

basements since there could be a tangible tax free taxable gain when the enlarged property<br />

is sold rather than giving it to the taxman by way of SDLT.<br />

Prices between £1-2million, after the election, will probably remain similar i.e. 5% in<br />

growth but the real changes could be above this level where if a Mansion Tax is imposed<br />

by either a Labour Party or a coalition with the Lib-Dems I see prices dropping by 25%<br />

or more. There are some wel<strong>com</strong>e conciliatory sounds <strong>com</strong>ing from Danny Alexander<br />

(Chief Secretary to the Treasury) and even Ed Balls regarding the alternative proposals to<br />

Mansion Tax i.e. an extension to Council Tax Bands.<br />

If this is the case and the ‘devil is not in the detail’ then this will have a far less deleterious<br />

effect on the market. In fact if the council tax bands are extended in a sensible and<br />

progressive fashion, in line with the existing arrangements, there will be a sigh of relief<br />

all around and probably a spike in activity and prices once the first Budget of the new<br />

government is announced.<br />

Markets and sentiments hate uncertainty and frankly it has never<br />

been more important which party is elected in May 2015.<br />

If there is a Conservative government the markets will do very<br />

well indeed but a Labour Party with old Labour socialist instincts<br />

will not bode well for this sector. Q<br />

It is a<br />

mischievous<br />

plot to describe<br />

what is<br />

otherwise a tax<br />

on London’s<br />

wealthy<br />

Trevor Abrahmsohn is<br />

Managing Director of<br />

Glentree Estates<br />

glentree.co.uk<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views<br />

p.9

VIEWS<br />

Drivers, Divas & Dictators: A<br />

history of The Wentworth Estate<br />

Surrey’s Wentworth Estate is one of the most valuable residential<br />

enclaves in Britain. It has, as you might expect, had its fair share<br />

of savoury residents since Thomas Telford began developing it in<br />

the 1920s: lifetime local James Wyatt of Barton Wyatt shares his<br />

memories of the Estate’s evolution, from saluting Diana Dors and<br />

Barry Gibb to managing General Pinochet’s cess pit…<br />

Wentworth has been called many things over the years: ‘Exclusive’<br />

‘Estate of the stars’ ‘World renowned’ and so on, but the<br />

story of Wentworth has changed over the years, since it was first developed<br />

by Walter Tarrant in the early 1920’s. Wentworth continues<br />

to evolve today with nearly 50 new houses currently under development,<br />

it’s clear that Wentworth has lost none of its appeal.<br />

Tarrant has often been called a visionary, as the first developer to<br />

construct golf courses with houses dotted around them. His marketing<br />

was aimed at City gentlemen looking for weekend homes not<br />

too far from London with the added lure of a golf club close to your<br />

house. This recipe has since been repeated all over the World.<br />

St George’s Hill in Weybridge which he started developing in 1911<br />

was a resounding success and Tarrant set his eyes on an even larger<br />

prize by purchasing Wentworth in the early 1920’s. The Wentworth<br />

Estate covers 1,750 acres – almost twice as big as St George’s Hill<br />

and Tarrant set about instructing Harry Colt to design the first golf<br />

course – now the East Course and started building houses, albeit<br />

slightly smaller than some of the enormous piles he had built in<br />

Weybridge.<br />

Tarrant also designed and constructed the early parade of shops<br />

in Virginia Water where my office is now. The original plans which<br />

I have show the bank to be where Barclays Bank is, a furniture<br />

shop where Barton Wyatt is, an estate agent where the Wentworth<br />

Patisserie is now, a butcher where the Viceroy Indian restaurant is, a<br />

fishmonger where the Glasshouse is now and beyond that, a greengrocer<br />

which is now an estate agents. All of these modest sized<br />

shops came with residential ac<strong>com</strong>modation behind and above the<br />

shop.<br />

p.10<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

Image courtesy of Waterfords<br />

Indeed, when my grandfather bought the old estate agency<br />

practice of Gosling and Milner in 1965, the offices still had a two<br />

bedroom flat above it which my parents moved into. My bedroom<br />

as a small baby is my office today!<br />

Tarrant went on to construct the West Course, often known as<br />

the Burma Road, which is now used for the BMW PGA Championship<br />

in May.<br />

War time bought a huge change to Wentworth with the Clubhouse<br />

being requisitioned at the outbreak of the war. Soon after,<br />

the infamous but little known tunnels were constructed underground<br />

next to the Clubhouse, for the General Headquarters<br />

(GHQ) Signals. The tunnels were constructed in cast iron in the<br />

same style as the London Underground and were designed to be<br />

the Signals headquarters if there had been a devastating invasion<br />

of London. At the same time, the Clubhouse was occupied as the<br />

GHQ Home Forces who also lived in many of the houses around<br />

the estate. I do wonder whether golf matches carried on as normal?<br />

The tunnels are well guarded these days, although in the 1970’s<br />

my friends and I would often visit them as someone had thoughtfully<br />

chiselled out a hole in the back of the concrete entrance. It<br />

is rather fitting given Wentworth’s story during the war that our<br />

current local MP is the Rt. Hon. Phillip Hammond who was until<br />

recently Secretary of State for Defence.<br />

The estate has seen various changes in the type of homeowner<br />

over the years that I have lived here. In the 70’s glamour, pop stars<br />

and entertainers poured into the estate with Elton John, a couple<br />

of Bee Gee’s, Bruce Forsyth, Chris Squire of the rock band Yes and<br />

Diana Dors all living on the estate. A frequent sight was seeing the<br />

blonde bombshell of Diana Dors driving through the village in her<br />

open top azure blue Rolls Royce with the flowing locks of Barry<br />

Gibb next to her. Similarly, I would think nothing of bumping<br />

VIEWS<br />

A frequent<br />

sight was<br />

seeing the<br />

blonde<br />

bombshell<br />

of Diana<br />

Dors driving<br />

through the<br />

village in her<br />

open top azure<br />

blue Rolls<br />

Royce with the<br />

flowing locks<br />

of Barry Gibb<br />

next to her.<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views<br />

p.11

VIEWS<br />

into Elton John in film producer’s Brian Forbes’ book shop in the<br />

shopping parade. Yes, it was perhaps a strange place to grow up.<br />

During the 1980’s the estate filled with a large number of Scandinavian<br />

buyers – particularly Swedish families who had been<br />

hounded out of their country through high taxes. Another resident<br />

was pop star Gary Numan who was fond of shag pile carpet<br />

in his house, not only on the floor but up the walls too. He also<br />

had a private plane that he had crashed parked on his driveway.<br />

During the 1990’s Wentworth was taken over by a number of<br />

golfers, Nick Faldo – who had the slightly unnerving practice of<br />

standing at the far end of the Wentworth driving range with his<br />

instructor David Leadbetter, firing golf balls towards us less able<br />

golfers at the correct end.<br />

Other golfing residents included multiple major winner Sandy<br />

Lyle, Ernie Els, Thomas Bjorn, Wentworth Pro and Ryder Cup<br />

Captain Bernard Gallagher and Sam Torrance.<br />

In the late 1990’s, Chile’s ex-dictator General Pinochet found<br />

himself under house arrest on Wentworth in a house I managed.<br />

By that time, he was a doddery old chap, but could still manage a<br />

game of badminton. The modest four bedroom house was occupied<br />

by at least 12 people – mainly police on three shifts, 24 hours<br />

a day, so it isn’t surprising that our main management issue was<br />

the cess-pit which struggled a bit!<br />

After 2000, we saw the inexorable rise of the overseas buyer<br />

with Wentworth be<strong>com</strong>ing ever more highly sought after. The<br />

Clubhouse itself had been transformed by property tycoon Elliot<br />

Bernard with a new tennis, health, indoor swimming pool and spa<br />

<strong>com</strong>plex being built ensuring that Wentworth was fast be<strong>com</strong>ing<br />

the place to live. Larger houses were built and we saw the first<br />

inflow of the oligarchs from Eastern Europe particularly Russian,<br />

Ukrainian and Kazakhstanis. At the same time, a second international<br />

school opened locally which boosted the number of American’s<br />

living locally by 100%. We also saw a number of Far Eastern<br />

royal families buying locally, drawn not only by the golf but by the<br />

Guards Polo Club and the nearby Farnborough Private Airport.<br />

However, it is worth pointing out that of the less than 600 houses<br />

that line the private roads of Wentworth, the vast majority are UK<br />

owned and occupied.<br />

Today, Wentworth has a wide variety of property in varying sizes<br />

of gardens from well under half an acre to over 10 acres – the<br />

houses being worth anything from £500,000 to over £50,000,000.<br />

The area has a vibrant shopping parade with all the shops currently<br />

occupied – not a scenario that applies to many high streets around<br />

the country at the moment.<br />

This is all a far cry from the days in the early 1920’s when Walter<br />

Tarrant had his vision, and we have him to thank for that. Q<br />

Chile’s exdictator<br />

General<br />

Pinochet found<br />

himself under<br />

house arrest<br />

on Wentworth<br />

in a house I<br />

managed. By<br />

that time, he<br />

was a doddery<br />

old chap,<br />

but could<br />

still manage<br />

a game of<br />

badminton.<br />

James Wyatt is a Partner<br />

in Virginia Water estate<br />

agency Barton Wyatt.<br />

www.bartonwyatt.co.uk<br />

p.12<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

ONLY ON PRIMERESI.COM<br />

The Language<br />

of Luxury:<br />

Designing<br />

for cultural<br />

differences<br />

Understanding and anticipating cultural<br />

differences is a huge part of gaining<br />

a true insight into a client. Only when<br />

these are fully understood, can a home<br />

be created to exceed all their aspirations,<br />

explains Joe Burns… Q<br />

read the full stories on<br />

www.<strong>PrimeResi</strong>.<strong>com</strong><br />

p.13

VIEWS<br />

Letter From the Home Counties:<br />

Turning the wheel on a tanker<br />

There is no doubt that the Home Counties market remains buoyant, says Garry<br />

Collins. The appetite to buy is certainly out there and vendors which bring their<br />

properties to the market at a sensible price are achieving the desired out<strong>com</strong>e, but the<br />

message of ‘adjustment’ seems to be taking its time to filter to ground level…<br />

simple imbalance of supply and demand, as well as factors including vendor expectations,<br />

agents <strong>com</strong>peting for instructions in a challenging market and of course,<br />

A<br />

bullish media reports, all <strong>com</strong>bined to create a somewhat ‘superficial’ first quarter.<br />

This saw prices pushed beyond many vendor and agent expectations. Year on year,<br />

prices in London rose by as much as 18% in some parts, and this had a ripple effect on<br />

prices here in the Home Counties.<br />

However, it would appear that London buyers are starting to feel that enough is<br />

enough. Over the last month, we have started to see prices stabilise, echoed most recently<br />

by figures released from the Land Registry revealing average house prices held steady<br />

between May and June.<br />

This suggests recent moves to tighten mortgage lending rules, perhaps <strong>com</strong>bined with<br />

the anticipation of an interest rate hike at the end of the year, could have started to cool<br />

the market.<br />

Just like turning the wheel on a tanker, it takes a while for everything to catch up<br />

This is no bad thing; the property market is very adept at coping with periods of<br />

adjustment but, just like turning the wheel on a tanker, it takes a<br />

while for everything to catch up. At present, vendors are still being<br />

influenced by reports of rising property prices and so naturally<br />

want to achieve the best possible price for their home. However,<br />

even in the current market where demand is high, over-ambitious<br />

pricing will only achieve viewings; these won’t necessarily convert<br />

into sales, particularly at the top end of the market where price<br />

rises haven’t been as steep as the middle-market.<br />

There has, however, been a slight rise in sale of properties over<br />

£1million which can be partly attributed to rising prices over the<br />

last six months, pushing more properties over this price bracket. It<br />

could also be linked to more people moving out of the capital after<br />

achieving a top price for their city home. Those buyers looking in<br />

the £1m and above bracket are less likely to rely on financing, and<br />

those that do tend to, have substantial equity, say 50%, therefore<br />

are less affected by the recent Mortgage Market Review. Q<br />

Just like<br />

turning the<br />

wheel on a<br />

tanker, it takes<br />

a while for<br />

everything to<br />

catch up<br />

Garry Collins is Manager<br />

of Waterfords Sunningdale<br />

and Chobham<br />

www.waterfords.co.uk<br />

p.14<br />

this is just a small selection of highlights from August’s views on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/views

SUBSCRIBE NOW<br />

PrimeQResi<br />

Journal of Prime Property<br />

WWW.PRIMERESI.COM/SUBSCRIBE-TODAY<br />

The only news & views resource dedicated to the<br />

top-end of the UK’s residential property sector<br />

Breaking News updated<br />

throughout the working day.<br />

IMAGE CREDITS: Inside Cambridge House, Wetherell; Old Queen St, Galliard Homes; RICS; Hamilton Bradshaw Real Estate<br />

Deals, developments<br />

& instructions<br />

Intelligence<br />

Q Daily Sales & Rental Stats<br />

from Lonres: the latest market<br />

intel from London’s leading realtime<br />

data provider.<br />

Q <strong>PrimeResi</strong> Intelligence<br />

Library: a searchable archive of<br />

residential research reports, data<br />

and reference briefings.<br />

Views & Opinions from some of<br />

the most opinionated, informed &<br />

and authoritative characters in the<br />

prime property industry.<br />

Market trends &<br />

analysis<br />

Briefings<br />

www.<strong>PrimeResi</strong>.<strong>com</strong><br />

People moves &<br />

career opportunities<br />

Q Daily Breakfast Briefing<br />

Emails: all the latest stories<br />

straight to your inbox in time for<br />

coffee and porridge.<br />

Q Weekly Bulletin Emails: a<br />

handy digest of the week’s biggest<br />

and most read stories, delivered<br />

every Monday.<br />

p.15

REQUIRED READING<br />

The Housing Standards Review:<br />

What can developers expect?<br />

In a drive to simplify the myriad of standards, guidance and<br />

codes that apply to the construction of new homes in the UK, the<br />

government announced in March that current housing standards<br />

are to be reduced by 90% from 100 to around 10 by early next<br />

year. Shelia McCusker explains what the changes could potentially<br />

mean for prime resi developers…<br />

This move – the result of the 2013 Housing Standards Review<br />

consultation – <strong>com</strong>es as wel<strong>com</strong>e news for the sector, which<br />

hasn’t seen a shift of this scale in decades.<br />

Details won’t be available until the draft regulations and technical<br />

standards are published at some point this summer, but in the<br />

meantime we can chew on the promise that technical standards are<br />

to be consolidated into the Building Regulations and ac<strong>com</strong>panying<br />

Approved Documents. Assessing the technical requirements<br />

will fall to building control – effectively meaning that planning<br />

permission will be granted conditional to <strong>com</strong>pliance.<br />

With the burden of <strong>com</strong>pliance checking migrating to Local<br />

Diagram via DCLG © Crown copyright, 2014. Copyright in the typographical arrangement rests with the Crown<br />

p.16<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/required-reading

Authority Building Control (LABC) and Approved Inspectors,<br />

the corresponding increase in workload once the new system is in<br />

place will be considerable.<br />

Voluntary assessments like the Code for Sustainable Homes and<br />

Secured by Design will be dismantled and assimilated into Building<br />

Regulations. In an effort to recognise that one size doesn’t fit<br />

all, the government has suggested that the new system will include<br />

flexibility, with local authorities having limited powers to enable<br />

different levels of performance when local circumstances require<br />

it. Optional standards will also be included in relation to minimum<br />

space requirements, targets for renewables (The Merton Rule),<br />

levels of accessibility and requirements of wheelchair-adaptable<br />

housing.<br />

While there is clearly a need for more rational and intelligible system<br />

of standards, what we don’t know is whether or not the consolidation<br />

of standards will really result in the best new housing. The<br />

review covers access, security, water, energy and space, but doesn’t<br />

include standards for daylight and sunlight, or building materials.<br />

With all this in mind, can we identify potential risks or issues for<br />

residential developers or is it too early to tell?<br />

There is already concern that the revised system will improve<br />

the standard of poorer performing developments, but in so doing<br />

set lower targets for the majority of developments. Considering<br />

the changes from a prime or super-prime residential perspective,<br />

certain major elements such as minimum space standards do not<br />

seem particularly relevant, except where developments are of sufficient<br />

scale to attract an affordable housing provision.<br />

But how will the new system play out once implemented? Will<br />

any alternative assessment processes emerge? Will the shift of<br />

responsibility between planning departments and building control<br />

lead to issues further down the line, beyond planning approval?<br />

We can only speculate at this stage, although one likely out<strong>com</strong>e<br />

is that approved inspectors and building control officers will need<br />

to be<strong>com</strong>e involved at an earlier stage of design development. This<br />

is already the case with many prime residential developments<br />

where independent approved inspectors are concerned, but it<br />

is less typical where building regulations <strong>com</strong>pliance is handled<br />

directly by the local authority building inspectors.<br />

As the implementation of the new system unfolds over the forth<strong>com</strong>ing<br />

months we can expect significant changes in our processes.<br />

From a designer’s perspective we are pleased to see these changes<br />

and believe that, on balance, they will make life more manageable<br />

for the design team. That said, only time will tell whether the<br />

government’s stated objective of consolidating standards without<br />

<strong>com</strong>promising quality, and in particular sustainability targets, has<br />

been achieved. Q<br />

One likely<br />

out<strong>com</strong>e is<br />

that approved<br />

inspectors<br />

and building<br />

control officers<br />

will need<br />

to be<strong>com</strong>e<br />

involved at<br />

an earlier<br />

stage of design<br />

development<br />

Sheila McCusker is a<br />

Founding Director of<br />

MSMR Architects<br />

msmrarchitects.co.uk<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there’s more at www.<strong>PrimeResi</strong>.<strong>com</strong>/required-reading<br />

p.17

INTERVIEW<br />

Triangle<br />

Group’s<br />

Rick Denton<br />

on buying<br />

Holborn Links<br />

and building<br />

investments<br />

Triangle’s acquisition of the Holborn<br />

Links portfolio – a prized four-acre<br />

swathe of London’s Midtown – has been<br />

one of the biggest deals of 2014 so far.<br />

The development and investment group’s<br />

new CEO Rick Denton talks exclusively<br />

to <strong>PrimeResi</strong> about how it all came about<br />

and why the capital continues to provide<br />

such great investment opportunities…<br />

p.18<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews

INTERVIEW<br />

Let’s start with the Holborn Links<br />

acquisition in June. Why was this<br />

such an important deal?<br />

At £212.5 million, Holborn Links is the<br />

largest London acquisition we have made<br />

on behalf of our clients to date.<br />

However, more importantly, the site represents<br />

a fantastic investment opportunity<br />

in a part of London that continues to be<br />

underdeveloped and has huge potential.<br />

We were instrumental in scoping the opportunity<br />

and for the strategy to enhance<br />

the quality of the overall site.<br />

The portfolio was acquired on<br />

behalf of Perez International; what<br />

was Triangle’s role and how long<br />

did the process take?<br />

Triangle was responsible for the sourcing<br />

of the investment concept, the scoping<br />

of the development opportunity, the liaison<br />

with investors and for negotiating the<br />

<strong>com</strong>pletion particulars. The process took<br />

in excess of nine months, which included<br />

around a six month time period from<br />

exchange to <strong>com</strong>pletion.<br />

We hear the portfolio’s future<br />

development will be managed by Triangle<br />

Group. Are there any plans to<br />

develop or increase the residential<br />

element?<br />

The portfolio will indeed be managed<br />

and further developed by Triangle Group<br />

on behalf of its investors. The development<br />

plans are currently under review so<br />

at this stage we are quantifying the extent<br />

to which it may include a more substantial<br />

residential element.<br />

At the time, you mentioned; “this<br />

strategic acquisition is a consequence<br />

of our international clients<br />

seeking to grow their presence in<br />

London.” How would you describe<br />

the current international appetite<br />

for London property?<br />

The appetite from international investors<br />

for both residential and <strong>com</strong>mercial<br />

property in London continues to<br />

be strong. London still represents great<br />

investment opportunities that will deliver<br />

excellent long-term value, in a secure<br />

environment.<br />

Will the Group be looking to acquire<br />

any other similarly high-profile<br />

portfolios or resi sites in the<br />

near future?<br />

Yes. We are always on the look-out for<br />

good investment opportunities that meet<br />

our clients’ investment criteria. There<br />

continue to be a lot of exciting opportunities<br />

in the London market, and beyond.<br />

What type of joint ventures can we<br />

expect to see from the Group over<br />

the next few years? What kind of<br />

partners might you be looking for?<br />

They might not always be joint ventures,<br />

but it’s important for Triangle to continue<br />

to build strong partnerships that allow<br />

us to operate at the highest level. We will<br />

continue to seek partners to support us on<br />

future deals particularly in the property,<br />

legal and financial services sectors. The<br />

evolution of profitable long term investment<br />

partnerships is core to the ethics of<br />

Triangle Group.<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews<br />

p.19

You also moved your HQ to Guernsey;<br />

why did you decide on this<br />

particular spot?<br />

We opened the office in Guernsey to<br />

give our rapidly expanding international<br />

client base greater access to important<br />

foreign markets, and significantly greater<br />

flexibility in structuring their investment<br />

portfolios. Guernsey is a widely-respected<br />

financial centre with a highly sophisticated<br />

legal and regulatory framework. In our<br />

research we also identified that Guernsey<br />

is one of the leading international centres<br />

for the formation of specialist investment<br />

<strong>com</strong>panies and funds.<br />

You’ve headed up some pretty major<br />

operations in the past (Denton’s<br />

former roles have included Head of<br />

International Wealth Advisory for<br />

Barclays Group, Offshore Commercial<br />

Director of Fortis Intertrust<br />

and Executive Vice President for<br />

Bank of Bermuda); where are you<br />

planning to take Triangle Group<br />

over the next five years?<br />

Our strategy is to continue to secure<br />

Triangle’s position as a leading international<br />

investment, development and asset<br />

management group focused on property,<br />

hotels and resorts, and private equity. We<br />

pride ourselves in delivering a unique<br />

partnership with clients to deliver superior<br />

returns from investment projects.<br />

We will always be entrepreneurial in<br />

our approach, and maintain our focus on<br />

client service. In five years’ time Triangle<br />

will still be identifying and converting<br />

the best investment opportunities for its<br />

clients in London; but also we will be operating<br />

in other major international hubs.<br />

Triangle also offers a property<br />

search and acquisition service. Are<br />

you seeing growth in this side of the<br />

business? Where are you seeing most<br />

of the demand originating from?<br />

We’re still seeing strong demand for<br />

property in the residential market,<br />

although not necessarily for pure investment<br />

purposes. This demand is <strong>com</strong>ing<br />

from high net worth individuals from<br />

around the world, and is driven largely<br />

by the <strong>com</strong>mon desire to have a foothold<br />

in London. Our aim is to search for and<br />

create innovative product opportunities<br />

including <strong>com</strong>mercial property, developments<br />

and property funds associated with<br />

our knowledge of the London property<br />

market.<br />

How do you foresee London’s residential<br />

property market changing<br />

over the short and long term?<br />

Over the past 10 years there has been an<br />

influx of investment into residential property<br />

market in Central London which has<br />

had well documented consequences on<br />

house prices across London. We believe<br />

that there may be some small amounts of<br />

volatility in the short term but the longer<br />

term outlook will see continued growth.<br />

This is driven by the continuing demand<br />

for London stock amongst the international<br />

wealthy <strong>com</strong>munity. Q<br />

this is just a small selection of highlights from August’s features on <strong>PrimeResi</strong>.<strong>com</strong><br />

there are more interviews & profiles at www.<strong>PrimeResi</strong>.<strong>com</strong>/features/interviews

ONLY ON PRIMERESI.COM<br />

Crime &<br />

Refurbishment:<br />

How to buy and<br />

develop a former<br />

police site<br />

First image by Leonard Bentley (CC-BY-SA-2.0); second image by Newtown Grafitti (CC-BY-2.0)<br />

Property developers have been paying up<br />

to £10m apiece for ‘under-used’ Met Police<br />

sites like Barnes Green and Connaught<br />

Gardens over the last year, and plenty<br />

more of these are set to hit the market over<br />

the <strong>com</strong>ing months. But how do you turn<br />

such unusual – and often iconic – buildings<br />

into viable apartment schemes? Paul<br />

Reed gives us the lowdown… Q<br />

The ‘Poor Door’ Debate:<br />

Do separate entrances<br />

make practical sense?<br />

There are clearly issues<br />

surrounding how affordable<br />

housing is delivered<br />

in the capital, but the tone<br />

of this ‘poor door’ debate<br />

risks throwing the baby<br />

out with the bathwater,<br />

says Edward Burton… Q<br />

read the full stories on www.<strong>PrimeResi</strong>.<strong>com</strong><br />

p.21

PROPERTIES<br />

Chelsea on Sea<br />

Landmark<br />

Recently confirmed as the UK’s priciest<br />

seaside town, one in three homes in<br />

Sal<strong>com</strong>be is apparently now worth over<br />

£1m. Tiny plots of land on the waterfront<br />

can go for upwards of £2m, so when an<br />

Edwardian number like this <strong>com</strong>es up in<br />

one of the best spots on the Estuary, you<br />

can expect a bunfight.<br />

• Sunny Cliff Hotel, Cliff Road,<br />

Sal<strong>com</strong>be<br />

• Offers Over £4.5m<br />

• Marchand Petit / Primelocation<br />

Images courtesy of agents listed<br />

p.22<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

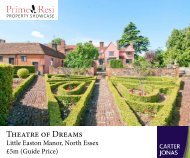

Theatre of Dreams<br />

With a previous owner like legendary actor, film and theatre<br />

director and producer Basil Dean of Ealing Studios and ‘Pearl &<br />

Dean’ fame, there was always going to be more to Little Easton<br />

Manor than meets the eye.<br />

PROPERTIES<br />

• Little Easton Manor<br />

• £5m (Guide Price)<br />

• Carter Jonas<br />

Chelsea Power Show<br />

One of the largest homes in all of Chelsea, this<br />

eighteen-bedroomed beauty stands on the<br />

grounds of the former Coleherne House, the<br />

famed residence owned by the Tattersall family<br />

and later the Victorian actor-playwright-manager<br />

Dion Boucicault.<br />

• 6 The Boltons<br />

• £39.5m<br />

• Russell Simpson<br />

Prime Online<br />

Claiming to be the first country estate to<br />

be marketed through an online agent, this<br />

19th century manor house is causing quite<br />

the stir.<br />

• Coolham Manor<br />

• £5.5m<br />

• Sellmyhome.co.uk<br />

p.23

PROPERTIES<br />

Inside the world’s<br />

most expensive<br />

penthouse<br />

The world’s most expensive penthouse<br />

– £240m – has been unveiled in<br />

Monaco. It has a waterslide to link the<br />

dancefloor to the pool.<br />

Taking over the top five storeys of the<br />

Tour Odeon tower on Av. de l’Annonciade,<br />

the five bed 35,000 sq ft apartment<br />

is one of 73 private residential<br />

units in the first high rise to be built in<br />

the principality since the Eighties.<br />

Prince Albert of Monaco has had more<br />

than a hand in the project, personally<br />

giving the go-ahead to the the 557<br />

foot, 49 and 44-storey towers in 2009,<br />

overturning his papa Prince Rainier’s<br />

embargo on high rises.<br />

Knight Frank is handling the penthouse<br />

sale, and expects to bring in<br />

€300m, which the agency says would<br />

make it the most pricey top floor on<br />

Earth. The Tour Odeon’s developer,<br />

Daniele Marzocco’s Groupe Marzocco<br />

SAM, is confident that”we can get a<br />

little bit more.”<br />

James Price, Knight Frank: “These<br />

duplexes and the penthouse are set to<br />

catch the eye of those looking for the<br />

very best properties across the world’s<br />

leading markets.” Q<br />

All images courtesy of Tour Odeon /<br />

Groupo Marzocco<br />

p.24<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

:DECONSTRUCTED:<br />

Tour Odeon, Monaco<br />

• Developer: Groupe Marzocco<br />

PROPERTIES<br />

• Sales Agent: Knight Frank<br />

• Architect: Alexandre Girald<br />

• Interiors: Alberto Pinto Agency<br />

• Construction (general): Vinci<br />

• Finance: SCI Odéon, Claudio<br />

Marzocco<br />

• www.odeon.mc<br />

p.25

PROPERTIES<br />

Amazon builds<br />

Soho portfolio<br />

with office block<br />

acquisition<br />

Luxury residential developer Amazon<br />

Property has bought a 20,500 sq ft office<br />

block in the middle of Soho.<br />

Swan House, 52 Poland Street is currently home to seven floors of offices with Yo!<br />

Sushi and Lucky Voice karaoke bar taking up the ground and basement levels. The<br />

building is just 300 metres from the new Tottenham Court Road Crossrail station.<br />

The developer has some rather good form in office-to-resi conversions, including<br />

turning the old Paramount Studios HQ, round the corner from Poland St on<br />

Wardour St in Soho, into 15 high spec apartments.<br />

Amazon Property in a JV will acquire the freehold of the building at 51% ahead of<br />

the March 2014 book value, at a Net Initial Yield of 2.5%.<br />

CGIs courtesy of Amazon Property;<br />

photograoh courtesy of British Land<br />

p.26<br />

get all the latest on luxury properties & developments at<br />

www.<strong>PrimeResi</strong>.<strong>com</strong>/properties

PROPERTIES<br />

Tim Roberts, Head of Offices, British<br />

Land: “The expiry profile at 52 Poland<br />

Street means there is potential for<br />

vacant possession of upper parts in June<br />

2015. The site attracted very strong interest,<br />

reflecting the strength and depth<br />

of the WE investment market. It is an<br />

opportune time to sell and focus on<br />

projects elsewhere in our portfolio.”<br />

Chris Lanitis, Partner, Amazon Property:<br />

“The acquisition of 52 Poland<br />

Street is an exciting addition to Amazon<br />

Property’s rapidly expanding portfolio<br />

and signifies our wider drive to obtain<br />

well-located London sites. The building’s<br />

trophy address and expansive<br />

internal space presented the perfect<br />

opportunity to deliver more of our<br />

signature, luxury apartments and penthouses<br />

to the market. Amazon Property<br />

has firmly established itself as an office-to-resi<br />

specialist, with a number of<br />

successful schemes across Zones 1 and<br />

2. 52 Poland Street promises to continue<br />

this achievement and we look forward<br />

to securing vacant possession of the first<br />

to seventh floors and starting work in<br />

June next year.”<br />

CBRE and Irwin Mitchell advised<br />

British Land. Amazon Property was<br />

unrepresented. Q<br />

p.27

Q<br />

An essential resource for anyone professionally involved in the UK’s luxury property industry<br />

www.primeresi.<strong>com</strong><br />

stay on top of the market with the journal of prime property: www.primeresi.<strong>com</strong>/subscribe-today