Tailored - EMA

Tailored - EMA

Tailored - EMA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>EMA</strong>Business<br />

n e w s , a d v i c e , l e a r n i n g a n d n e t w o r k i n g<br />

Issue 63 - October 2009<br />

In this issue:<br />

■ Drinking on the job?<br />

■ When do casual staff get leave?<br />

■ Determining what is casual employment<br />

■ RWC 2011 more than rugby<br />

<strong>Tailored</strong><br />

for quality<br />

How to escape from your<br />

corporate psychopath?<br />

Physios can save you money: how?<br />

How to make money from<br />

Aussie hand-outs<br />

E M A N o r t h e r n & C e n t r a l a r e t h e m a j o r s t a k e h o l d e r s i n :

<strong>EMA</strong>Business<br />

<strong>EMA</strong>Business is published for:<br />

<strong>EMA</strong> Northern<br />

159 Khyber Pass Rd, Grafton,<br />

Private Bag 92066 Auckland<br />

Ph: 09 367 0909 or 0800 800 362<br />

Email: ema@ema.co.nz Website: www.ema.co.nz<br />

Chief Executive: Alasdair Thompson<br />

Advocacy Manager: Bruce Goldsworthy<br />

Manager, Employment: David Lowe<br />

Manager <strong>EMA</strong> Learning: David Foley<br />

Manager <strong>EMA</strong> Events: Mauro Barsi<br />

Whangarei<br />

Myriam Heynen<br />

09 459 1501 mob 021 920 414<br />

Waikato<br />

Denis Quigan 07 839 2995 mob 027 203 0694<br />

Cor Speksnijder 07 853 0018 mob 027 203 0694<br />

Bay of Plenty<br />

Kim Stretton 07 577 9665<br />

Terry Arnold 07 575 8401 mob 021 662 656<br />

Rotorua<br />

Clive Thomson<br />

07 345 8122 mob 027 437 2808<br />

02<br />

03<br />

12<br />

04<br />

05<br />

07<br />

18<br />

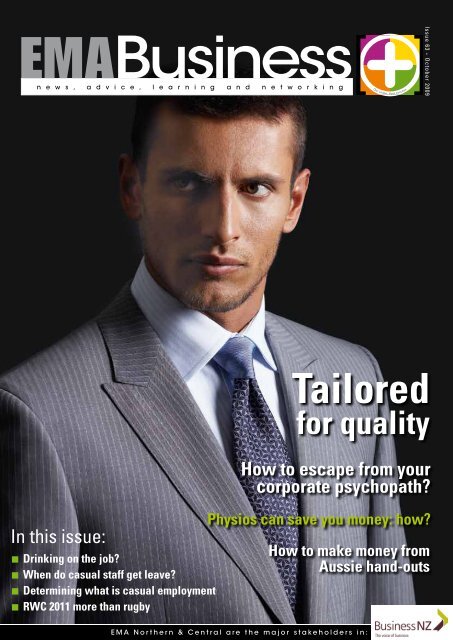

On the cover<br />

Joe Black the Tailor’s custom made (‘espoke’) suit by 120-year-old Auckland firm,<br />

Cambridge Clothing. The brand features a choice of fabric from over 100 premium Italian<br />

cloths, your initials sewn in the lining and your name engraved on the buttons. ‘espoke’<br />

two-piece suits start at $1195. For the full Cambridge Clothing story go to page 20<br />

Omission: Last month we omitted to credit Alan Wright of IRL for the great photo of IRL scientist Dr<br />

My Do on the cover, and also for the photo of the Brookhaven electro magnet on page 20.<br />

FINANCE How irrational exuberance hits markets<br />

Paul Winter discusses unintended consequences of govt interventions<br />

Tax review presents great chance<br />

NETWORKING Alasdair Thompson on business taxes for growth<br />

TECHNOLOGY Optimising the upturn<br />

MANUFACTURING<br />

RECRUITMENT<br />

Tax pooling changes: do they affect you?<br />

RWC 2011 more than rugby<br />

Employment FINANCE Pathway Expo features health<br />

Bidding for Aussie work<br />

07<br />

<strong>EMA</strong> central<br />

PO Box 1087 Wellington<br />

Ph: 04 473 7224 Fax: 04 473 4501<br />

Email: ema@emacentral.org.nz<br />

Website: www.emacentral.org.nz<br />

Chief Executive: Paul Winter<br />

Gisborne office: 06 863 2438<br />

Hawke’s Bay: 06 843 3419<br />

Taranaki: 06 759 4006<br />

19<br />

08<br />

09<br />

10<br />

15<br />

Go<br />

NETWORKING<br />

Global report<br />

TECHNOLOGY<br />

MANUFACTURING<br />

Court guidance helps defines casual employees<br />

RECRUITMENT<br />

FINANCE<br />

Is there a psychopath at your work?<br />

Employment chat<br />

Drinking on the job? Days off for casuals?<br />

NETWORKING<br />

Tax clarified on relocation costs, o'time meal allowances<br />

18<br />

Manawatu/Wanganui: 06 350 3395<br />

Nelson: 03 548 4528<br />

20<br />

TECHNOLOGY<br />

Cambridge Clothing - Quality underpins success<br />

FINANCE<br />

MANUFACTURING<br />

Member profile<br />

<strong>EMA</strong>Business<br />

Editor<br />

Gilbert Peterson 09 367 0916<br />

Writer<br />

Mary MacKinven<br />

Published by<br />

TPL Publishing Services<br />

Project Manager<br />

Anthony Stead 09 529 3921<br />

Advertising Sales<br />

Colin Gestro (09) 444 9158<br />

colin@affinityads.com<br />

ISSN No. 1176-4953<br />

14<br />

16<br />

17<br />

RECRUITMENT<br />

NETWORKING<br />

System software selection boosts productivity<br />

Physios TECHNOLOGYsave big money, and pain<br />

Virtualisation: Getting more from your IT<br />

MANUFACTURING<br />

RECRUITMENT<br />

FREE briefings for<br />

<strong>EMA</strong> members<br />

23<br />

24<br />

25<br />

16<br />

Our Vision. Your Success<br />

PAGE 1<br />

Find out about current and upcoming events<br />

KiwiSaver workshop<br />

20 August, 9.30am-12.30pm • <strong>EMA</strong> Learning, 159 Khyber Pass Road, Auckland<br />

18 August 2009<br />

Tuesday<br />

Managing Poor<br />

Performance<br />

NZ Institute of Chartered Accountan<br />

Auckland

<strong>EMA</strong>Business<br />

How irrational exuberance harms markets<br />

By Paul Winter, Chief Executive, <strong>EMA</strong> Central<br />

The contribution to economic growth<br />

from well functioning markets are often<br />

not well understood even though they<br />

multiply the rewards from innovation,<br />

and add comparative value and<br />

improvements in productivity. Hence,<br />

it seems, governments feel the need<br />

to continually alter the ‘rules of the<br />

economic game,’ often with unforeseen<br />

consequences.<br />

The functioning of markets is not<br />

always predictable and we need to<br />

remind ourselves people participating<br />

in them can be driven as much by<br />

emotion as by logic and<br />

information. The recent<br />

financial, liquidity and<br />

economic crises have well<br />

illustrated this.<br />

A result is that many people<br />

want Government to protect<br />

people from themselves.<br />

The impact on markets of<br />

decisions driven by emotion<br />

through excessive exuberance,<br />

or worry, is the harder challenge as<br />

it leads to the creation, and then the<br />

bursting of market bubbles, often with<br />

quite devastating effects.<br />

Irrational exuberance or worry tends<br />

to be contagious. At its worst it creates<br />

challenges via such things as huge<br />

government borrowings and deficits.<br />

Whether societies can stop these<br />

long cycle mood swings, or even<br />

dampen them, is currently the subject<br />

of a lot of debate. Like many things in<br />

life you often have to experience the<br />

loss from a bursting bubble to achieve<br />

a more balanced perspective on a<br />

personal level, and become less easily<br />

caught in future euphoria.<br />

I was living in Hong Kong when<br />

I experienced a period of irrational<br />

stock market exuberance. Wiser<br />

investors at the time understood what<br />

was happening. They described it as a<br />

“bell-hop market.” Normal assessments<br />

of risk and reward were cast aside,<br />

so even a bell-hop - the most junior<br />

worker in a hotel - came to believe<br />

investing in the stock market produced<br />

easy wealth. In principle this is similar to<br />

our irrational exuberance for investing<br />

in real estate.<br />

Education, and access to good<br />

and timely information can clearly<br />

make an important contribution to<br />

"A result is that many<br />

people want Government<br />

to protect people from<br />

themselves. "<br />

the quality of decisions. However, its<br />

impacts are usually not as immediate<br />

as the introduction of new laws and<br />

regulations can be. So it is not surprising<br />

the latter is the most typical response.<br />

History demonstrates that increasing<br />

the interventions of the state in the<br />

operation of markets can result in<br />

solutions worse than the problems they<br />

were trying to avoid.<br />

While the abject failure of<br />

communist states illustrates the point<br />

well, examples in New Zealand’s own<br />

history show we too have paid a high<br />

price because of poor solutions.<br />

More devastating long term is<br />

that government interventions don’t<br />

encourage the right cultural attitudes<br />

vital to achieving optimal behaviour.<br />

For example, its cultural attitudes that<br />

determine the strength of four of the<br />

five drivers of productivity that Treasury<br />

says is vital to accelerating our wealth<br />

creation – Innovation, Enterprise,<br />

Investment and Skills. (The fifth is<br />

natural resources, and our access, use<br />

and stewardship of them.)<br />

Every strength is a potential weakness<br />

and I would argue this is evident in our<br />

over dependence on the State to solve<br />

problems, on incentives that favour<br />

security of employment, or dependence<br />

on our welfare system including<br />

universal superannuation, or placing<br />

too high a value on owning our own<br />

homes.<br />

The challenge and rewards of<br />

investing in our own development<br />

and in entrepreneurial activity need<br />

far greater encouragement through<br />

better incentives and policy settings.<br />

Getting the balance right is the<br />

challenge.<br />

Peter Drucker, an original and<br />

influential thinker, argued in ‘The New<br />

Realities’ that we are in a new period<br />

when we avoid looking for panaceas to<br />

solve society’s problems.<br />

Instead he advocated for an enlightenment<br />

brought about by applying<br />

good information to each new<br />

challenge. He encouraged careful<br />

analysis and diagnosis of issues through<br />

sound information and transparent<br />

processes, and a search for the most<br />

effective remedies for each specific ill.<br />

Good information and transparent<br />

processes are also what we need<br />

implanted to gain the greatest benefits<br />

from well functioning markets.<br />

AGM 2009 & Issues Briefing<br />

All members are warmly invited to attend our last Issues Briefing for the year,<br />

commencing with the Annual General Meeting of the Employers and Manufacturers<br />

Association (Central) Inc. at 3.00 pm on Wednesday 25 November 2009.<br />

Refreshments will be provided at the conclusion.<br />

Venue: Duxton Hotel, 170 Wakefield St, Wellington<br />

PAGE 2<br />

<strong>EMA</strong> Business Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning and networking

By Alasdair Thompson, Chief Executive, <strong>EMA</strong> Northern <strong>EMA</strong>Business<br />

Tax review presents great chance<br />

The tax review underway offers a great<br />

chance to align New Zealand’s tax<br />

system with the imperative for New<br />

Zealand which is to rapidly improve the<br />

nation’s productivity.<br />

<strong>EMA</strong> has strong views on all matters<br />

related to tax. We say anything that<br />

discourages investment or harms our<br />

ability to earn higher incomes will<br />

ultimately hurt employment and wealth<br />

creation.<br />

And we certainly need more<br />

investment to increase productivity.<br />

We need 1.8% GDP growth each<br />

year in New Zealand over and above<br />

Australia to catch up with them by<br />

2025 and our company tax rate will<br />

need to be better than Australia’s. As<br />

well we need to be competitive with<br />

them in tax costs as headline tax rates<br />

are not everything- exemptions are<br />

important in the measuring of the<br />

effective tax rate.<br />

In addition, we need to address the<br />

Working for Families scheme which<br />

has perverse effects at present as earners<br />

move from welfare to higher incomes.<br />

It should only target the lowest income<br />

earners.<br />

The tax principles we are drafting<br />

for the tax review will include<br />

recommendations that the company<br />

tax rate be dropped to 18% or lower<br />

and for imputation credits to be<br />

removed. We will note, as we have done<br />

many times that companies are only a<br />

conduit for providing income for their<br />

employees and shareholders, and they<br />

should be where the tax is applied.<br />

In the past Treasury has used a static<br />

economic model to assess and rebut<br />

reductions to the company tax rate – it<br />

needs to apply a dynamic one.<br />

Alternatively, we support investigating<br />

different approaches for business tax<br />

such as ACE – ACE is Accreditation<br />

for Capital Equity – and means that<br />

tax should not be paid on normal rates<br />

of return or on equity invested. If<br />

Australia goes down this path it will<br />

be important to match or better the<br />

provisions they introduce.<br />

We will recommend negative tax<br />

gearing systems should only be aimed at<br />

the bottom strata of the tax base.<br />

While income tax rates in New<br />

Zealand are not too high, we do need<br />

for tax thresholds to return to indexed<br />

levels of the past 10 years to eliminate<br />

fiscal drag.<br />

We do not support a capital gains<br />

tax but other options targeted at rental<br />

property investment should discourage<br />

over-gearing and the ability to deduct<br />

depreciation. We would go along<br />

with an increase in GST to cover any<br />

revenue shortfall to retain a fiscally<br />

neutral tax system. SME’s should<br />

have the option of paying provisional<br />

tax aligned with their GST and paid<br />

bi-monthly with a wrap up annually,<br />

and with minimal or no penalties for<br />

shortfalls in that wrap up.<br />

We need to change the capture of<br />

Fringe Benefit Tax too, so it becomes<br />

part of the PAYE system. Fringe<br />

benefits should be treated as part<br />

personal income and taxed accordingly.<br />

Tax at the top level should apply<br />

equally to personal tax and trusts<br />

but not to companies due to the<br />

withholding nature of the income for<br />

companies.<br />

The overriding principle we<br />

promote is that the tax system should<br />

encourage investment and not overly<br />

penalise the earning of income, because<br />

we urgently need to raise productivity<br />

and to achieve this we need far greater<br />

investment and to reward higher labour<br />

productivity.<br />

Passage of super city law historic<br />

The passage of the super city bill<br />

into law made history for Auckland and<br />

New Zealand. <strong>EMA</strong> campaigned hard<br />

for this very outcome.<br />

Under the new law’s provisions the<br />

Auckland region is to become one city<br />

with one council with local boards to<br />

respond to, and manage local issues.<br />

We are confident the new<br />

governance structure will help expedite<br />

a rapid lift in productivity and for<br />

Auckland to move decisively to<br />

compete with other Pacific rim cities.<br />

We look forward to scrutinising the<br />

third Auckland bill for more detail.<br />

<strong>EMA</strong> NORTHERN AGM & COCKTAILS<br />

Members are invited to the Annual General Meeting of<br />

the EMPLOYERS & MANUFACTURERS ASSOCIATION<br />

(NORTHERN) INC to be held at:<br />

CT Club - NZ Institute of Chartered Accountants<br />

27-33 Ohinerau Street, Greenlane, Auckland<br />

Thursday, 5 November 2009, at 4.30 pm<br />

Members are reminded they are entitled to nominate a<br />

person(s) to stand for the Board of the Association. To do this<br />

you will need to complete the form (available by emailing to:<br />

raewyn.mckenzie@ema.co.nz) and returning it by 5.00 pm, 21<br />

October 2009. Nominations should be accompanied by a brief<br />

biography including the nominee’s employment history and<br />

outside interests.<br />

All members are entitled to attend the AGM, and vote or appoint<br />

a proxy. A proxy form for the purpose will be<br />

forwarded with the list of candidates for office seven days prior<br />

to the Annual General Meeting.<br />

Those wishing to attend should email to raewyn.mckenzie@<br />

ema.co.nz<br />

Our Vision. Your Success<br />

PAGE 3

<strong>EMA</strong>Business<br />

Tax pooling changes: do they affect you?<br />

Every business in New Zealand that<br />

pays provisional tax will be affected by<br />

the changes Inland Revenue has made to<br />

the Tax pooling rules.<br />

Tax pooling is provided by tax<br />

intermediaries to allow provisional<br />

taxpayers to manage their tax payments<br />

and allows businesses to:<br />

n Minimise use-of-money-interest<br />

(UOMI) with under and over<br />

payments of provisional tax,<br />

n Avoid late payment penalties; and<br />

n Finance tax<br />

In summary the rule changes are<br />

to extend tax pooling to apply to<br />

additional tax payable as a result of a<br />

reassessment which:<br />

n Includes Voluntary Disclosures and<br />

Resolution of a Dispute, and<br />

n Covers all tax types<br />

Funds will only be accessed with<br />

Take control<br />

of provisional tax<br />

payments and<br />

free up<br />

cash flow today<br />

www.tmnz.co.nz<br />

Our TaxFINANCE package allows us to<br />

pay your provisional tax for you. Why<br />

hand over money before you have to?<br />

• Authorised in one phone call<br />

• Rates from as low as 6% p.a.<br />

• Lending fee is deductible<br />

• No security or credit checks required<br />

For more information call 0800 729 829<br />

TMNZ - Financing SME Tax since 2003<br />

SMART TAX PAYMENTS<br />

an effective backdated date for the<br />

difference between the amount<br />

originally payable and amount payable<br />

as a result of a reassessment. Transfers<br />

of excess tax for all tax types will be<br />

allowed for deposit into a tax pooling<br />

account.<br />

Where a taxpayer transfers money<br />

to pay provisional tax with an effective<br />

date after terminal tax date, payment<br />

should be applied first to interest<br />

outstanding, then to the outstanding<br />

tax liability. The transfer of tax pooling<br />

funds between intermediaries will be<br />

allowed.<br />

This means?<br />

Essentially that IRD has more clearly<br />

identified the parameters with which<br />

businesses can use tax pooling.<br />

In addition, where IRD reassesses a<br />

taxpayer’s liability, the rules now allow<br />

for businesses to access tax payments<br />

for the additional tax they may need to<br />

pay for all tax types. Where reassessment<br />

occurs, tax pooling funds will only<br />

reduce exposure to UOMI, but not any<br />

penalties imposed.<br />

Prior to these rule changes, some<br />

taxpayers accessed tax pooling funds<br />

(with a back-dated effective provisional<br />

tax date) to pay outstanding GST<br />

liabilities in order to remove their<br />

exposure to penalties, as well as UOMI.<br />

Tax pooling was never intended to<br />

assist tax payments for businesses where<br />

payments are definitive.<br />

Tax Management New Zealand has been<br />

New Zealand’s leading tax intermediary<br />

since 2003, and is a partner with <strong>EMA</strong>. We<br />

can help you manage your provisional tax<br />

payments, maximise your cash flow, and<br />

minimise interest or penalty payments<br />

with our tax pooling facilities. Contact<br />

your accountant, or Tax Management<br />

NZ, for more detailed information.<br />

0800 829 888 www.tmnz.co.nz<br />

Icehouse kicks off Fast Pitch 2009<br />

Auckland University’s<br />

Icehouse has kicked<br />

off its Fast Pitch<br />

2009 competition for<br />

entrepreneurs.<br />

The real life<br />

Dragon’s Den scenario<br />

invites people to put<br />

their business ideas to<br />

a panel of judges, with<br />

prizes on the table.<br />

The Fast Pitch final on October 27 will have 10<br />

finalists competing for the main prize. Other categories<br />

are:<br />

n Best Intellectual Property Idea,<br />

n Best Funding Opportunity for Investors,<br />

n Best Presentation Skills and<br />

n People’s Choice award<br />

The overall winner will receive a prize package valued<br />

at over $15,000 including three months incubation in the<br />

ICE Accelerator.<br />

Last year’s Fast Pitch winner Todd Wackrow of mobile<br />

marketing company PocketVouchers said the event "was<br />

incredibly useful."<br />

The Icehouse has worked directly with 65 start-up<br />

companies and over 2,000 established companies.<br />

PAGE TMNZ 4 <strong>EMA</strong> Aug.indd <strong>EMA</strong> Business 1 Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning 24/7/09 and 10:40:53 networking AM

<strong>EMA</strong>Business<br />

2011 Cup event more than rugby<br />

Business benefits from Rugby World<br />

Cup 2011 will be much greater than<br />

just hosting key contacts at world<br />

class rugby games.<br />

The legacy from improving our<br />

sports and other infrastructure,<br />

accelerated road and other projects<br />

such as development of the Auckland<br />

waterfront, investor<br />

interest and boosted<br />

sectors such as tourism<br />

and marine, will result<br />

in big benefits for all<br />

New Zealanders.<br />

As a consequence<br />

New Zealand will<br />

earn the ability to<br />

promote itself as a<br />

destination for world<br />

events.<br />

These were key<br />

messages delivered to<br />

an audience of <strong>EMA</strong><br />

Northern members<br />

last month by Martin<br />

Snedden, chief<br />

executive of tournament<br />

organiser Rugby New<br />

Zealand 2011 Ltd, and Clyde Rogers,<br />

group manager of AucklandPlus.<br />

Workshops and toolkits will be<br />

made available by mid next year<br />

for all business (the Business Ready<br />

programme) along with a Visitor<br />

Ready programme to help target<br />

on estimated 60,000 international<br />

tourists, 2000 international media<br />

and 2500 international VIPs expected<br />

here for the six-week tournament<br />

(September 9, 2011 to Labour<br />

Weekend, October 24).<br />

World television broadcasts could<br />

reach four billion.<br />

RWC games will be hosted at<br />

Martin Snedden, chief executive of Rugby New Zealand 2011 Ltd<br />

13 locations around New Zealand<br />

with festivals aimed at all and sundry,<br />

to attract and entertain domestic<br />

and international tourists between<br />

matches.<br />

For email updates of business<br />

opportunities right now you can<br />

register on www.auckland2011.<br />

com/business.<br />

You are invited to draw<br />

up a business plan to identify<br />

opportunities talk about previous<br />

major events such as the America’s<br />

Cup and Lions’ rugby tours, and<br />

consider how you can cluster<br />

with others (if necessary) to gain<br />

tournament-related contracts.<br />

You can:<br />

n Supply goods and services,<br />

n Supply teams, sponsors, etc,<br />

n Offer sponsorship,<br />

n Tap in to the visitor market,<br />

n Contribute to infrastructure<br />

development,<br />

n Apply for subcontracts and<br />

form clusters,<br />

n Find opportunities specific<br />

to Maori/Pacific Island<br />

businesses.<br />

Your Guide to Business<br />

Opportunities around Rugby<br />

World Cup 2011 is at www.<br />

auckland2011.com/business.<br />

Register for free on the nationwide<br />

tender site www.tenderlink.com/<br />

businessopportunities2011 as well as for<br />

central and local government tenders,<br />

licence holder and sub-contractor<br />

requirements. Tickets go on sale early<br />

next year.<br />

E MArket<br />

B2B trading online for sales innovation, and<br />

to streamline your procurement process<br />

Supply your business clients from the comfort of your swivel chair<br />

BUYERS:<br />

n Your own e-commerce system set up ready to<br />

manager<br />

n Simple-to-use. No charge to buyers<br />

n Collaborate with other buyers to get bigger<br />

volume discounts<br />

SELLERS:<br />

n Sell business to business for small fee - no charge<br />

until your first sale<br />

n Load and update your own catalogue<br />

n Full control of your own online store<br />

n Full audit trail for procurement<br />

Not an <strong>EMA</strong> member?<br />

Call 0800 800 362<br />

Go to www.ema.co.nz to sign up to<br />

E MArket and for more details<br />

Our Vision. Your Success<br />

PAGE 5

Relax...<br />

(There’s only 300<br />

job applicants<br />

to sort out and<br />

respond to)<br />

With QJumpers’ free Applicant<br />

Tracking System, it’s dead easy.<br />

Are you looking to recruit staff? Are you<br />

looking forward to sorting, checking, sifting,<br />

ranking and analysing hundreds of applicants<br />

into a coherent order? You’ll want to contact<br />

the short listed and manage them through the<br />

interview process. Then of course because you<br />

value your brand reputation, you’ll need to<br />

respond quickly and professionally to the alsorans.<br />

Paperwork, paperwork!<br />

There is an easier way. It’s QJumpers’<br />

Applicant Tracking System and it’s free with any<br />

QJumpers recruitment product.<br />

Our Applicant Tracking System is an online<br />

godsend to HR and business managers as it<br />

automatically receives online applications and<br />

allows you to manage them all from the same<br />

window. Many New Zealand businesses have<br />

already saved significant time and money with<br />

our Applicant Tracking System, let alone our<br />

other fantastic recruitment tools and solutions.<br />

Visit our website www.QJumpers.co.nz<br />

or call 0800 QJUMPERS (0800 758 673)<br />

See our DEMO<br />

online today.<br />

www.QJumpers.co.nz

By Mike Burgess, Pathways Trustee secretary <strong>EMA</strong>Business<br />

Pathways Expo promotes health careers<br />

Pathways to Employment Trust<br />

held its first Health Sciences Expo<br />

at Massey University last month.<br />

The alignment to health-science<br />

based careers reflects skill sets still<br />

in demand from employers. A South<br />

Auckland based event will also be<br />

held.<br />

Associate Minister of Health<br />

Jonathan Coleman opened it, and<br />

he was impressed.<br />

The event targeted interested<br />

students from 15 schools on the<br />

North Shore and Auckland City<br />

region. A total of 255 students<br />

attended. Exhibitors received<br />

631 registrations from interested<br />

students.<br />

The feedback showed<br />

students were very happy with<br />

the structure of the day, and<br />

exhibitors noted the benefits of<br />

having a pre-selected audience.<br />

“A very well organised and<br />

very worthwhile event . . . . .<br />

. a great range of<br />

speakers with good<br />

messages . . . . the<br />

stands provided<br />

valuable information<br />

with people<br />

being available to<br />

individually answer<br />

questions. . .”<br />

Teacher<br />

“Interesting stuff.<br />

The information<br />

A Navy diving compression chamber attracted strong interest<br />

provided tells you what a<br />

career offers beyond the pay<br />

and study. I also received a lot<br />

of useful information about<br />

health careers outside the<br />

coverage of the medical school.<br />

Much more useful than seeing<br />

the careers advisor . . .”<br />

Teacher<br />

“A great day – interest level<br />

was extremely high with all<br />

students showing qualified<br />

interest in the stand”<br />

University teacher<br />

“Interest levels have been very high<br />

. . . . The targeted nature of this<br />

event has made this a very useful<br />

opportunity . . . .”<br />

Health Board spokesperson<br />

“A very good selection of students<br />

who seemed to be positively<br />

encouraged and enlightened by all the<br />

exhibitors”<br />

Armed Forces spokesperson<br />

QJumpers comes recommended<br />

“I used QJumpers because of the <strong>EMA</strong><br />

connection and discount offered, plus<br />

the ability to move the job forward in<br />

stages as we required. We started<br />

off with the basic product, Applicant<br />

Sourcing, and then moved up to the<br />

filtered service. Had we had more<br />

applicants I would have considered<br />

using the short list service.<br />

“I was very happy the ad was on the<br />

web the same day we contacted them.<br />

There was a slight delay of one day<br />

before the results were filtered for me<br />

due to demand.<br />

“I checked the filtering process against<br />

the applicants that were filtered out<br />

and I must say they were filtered very<br />

accurately. We got our staff member<br />

from the filtered applicants and have<br />

been very happy with her.<br />

“I would use QJumpers again - it was<br />

efficient and value for money!”<br />

Jean Berry<br />

Vision Consulting Group Limited<br />

Our Vision. Your Success<br />

PAGE 7

<strong>EMA</strong>Business<br />

Darren Mitchell, <strong>EMA</strong> Legal<br />

Court guidance helps defines casuals<br />

Hiring staff on a casual basis is a<br />

common practice but determining<br />

when an employee is actually<br />

‘casual’ or not is not always easy.<br />

The employment relationship may<br />

develop over time into something<br />

that can no longer be considered to be<br />

casual. This is where the employer’s<br />

obligations towards the employee can<br />

increase significantly. Ending such a<br />

relationship can become more difficult<br />

and costly for an employer who gets it<br />

wrong.<br />

There is no specific legislative<br />

definition in New Zealand for casual<br />

employment. But a recent case from<br />

the Employment Court does provides<br />

further guidance on what can be<br />

defined as casual employment.<br />

First, under s.6 of the Employment<br />

Relations Act 2000, in defining casual<br />

employment the “real nature of the<br />

relationship” will be considered in the<br />

event of a dispute. The Employment<br />

Court recently recognised this<br />

requirement in the case of Jinkinson<br />

v Oceana Gold (NZ) Limited CHCH<br />

CC 9/09.<br />

In this case, Ms Jinkinson was<br />

employed for 19 months by Oceana<br />

Gold in the mining operations<br />

as a Grade Controller until her<br />

employment was terminated on<br />

the grounds of redundancy. She<br />

challenged her termination in the<br />

Employment Relations Authority<br />

via a personal grievance for<br />

unjustified dismissal. The Authority<br />

determined that Ms Jinkinson was<br />

a casual employee at the time her<br />

employment was terminated. This was<br />

a crucial factor in its finding that the<br />

redundancy was justified.<br />

On appeal to the Employment<br />

Court, Ms Jinkinson challenged the<br />

Authority’s determination regarding<br />

her status as a casual employee. This<br />

was a preliminary issue for the Court<br />

to decide, before considering her<br />

claim for unjustified dismissal. The<br />

detailed judgment considered the<br />

issue over Ms Jinkinson’s employment<br />

status in depth, relying on its<br />

obligation to ascertain the “real nature<br />

of the relationship.”<br />

Couch, J noted that Ms Jinkinson<br />

was employed on a written<br />

employment agreement that stated<br />

she was a casual employee. While<br />

this was a relevant factor, the Court<br />

needed to look further into the<br />

nature of the relationship, as “the<br />

description of the relationship is not<br />

to be treated as determinative.”<br />

Reviewing legal authority<br />

from New Zealand and overseas<br />

jurisdictions, the Court found that<br />

a common indicator of permanent,<br />

as opposed to casual employment,<br />

was the obligation on the employer<br />

to provide ongoing work to the<br />

employee. In turn, the employee will<br />

have an obligation to carry out the<br />

work.<br />

The Court considered that there<br />

were a number of factors that led<br />

to its finding that Ms Jinkinson’s<br />

employment was actually permanent<br />

rather than casual. These included:<br />

n The employment agreement, while<br />

labelled ‘casual’, had no express<br />

term whereby the employee could<br />

decline work offered to her by the<br />

company.<br />

n The agreement required two<br />

weeks notice of an intention<br />

to take leave and required the<br />

employee to work overtime and<br />

shift leave.<br />

n The agreement had detailed<br />

provisions for termination for<br />

medical incapacity and redundancy.<br />

n The employee was required to<br />

seek permission to undertake<br />

secondary employment.<br />

n The employee worked “extensively<br />

and consistently” throughout<br />

her 19 months of employment,<br />

working on average 45 hours per<br />

week.<br />

n The employee was consistently<br />

employed on a rostered basis many<br />

weeks in advance.<br />

n The employee was paid wages<br />

in lieu of notice and redundancy<br />

compensation upon termination.<br />

The Court found that while the<br />

parties may have originally intended<br />

the employment relationship to be<br />

casual, this had been varied over<br />

time by the parties conduct. The<br />

original agreement had been replaced<br />

with an agreement for permanent<br />

employment. Many of the actual<br />

contractual provisions that existed<br />

between the parties were more<br />

consistent with permanent rather<br />

than casual employment.<br />

As Ms Jinkinson was found by the<br />

Court to be a permanent employee,<br />

she now had the ability to challenge<br />

her termination on the grounds of<br />

redundancy.<br />

Jinkinson v Oceana Gold provides a<br />

number of guidelines for employers<br />

who are dealing with casual<br />

employment. Even where the parties<br />

to an employment relationship<br />

may specifically agree in writing<br />

that employment is on a casual<br />

basis only, the real nature of the<br />

employment relationship is what<br />

will be determinative if the matter<br />

ends in dispute. Where employment<br />

is ongoing and consistent, and<br />

perhaps where a number of further<br />

obligations agreed over time,<br />

employment will more than likely be<br />

considered to be permanent, rather<br />

than casual.<br />

Employers who incorrectly employ<br />

casual staff may risk a potentially<br />

costly dispute and personal grievance<br />

action, as well as further liability<br />

for incorrectly paid, or unpaid<br />

holiday pay. Getting the relevant<br />

employment documentation correct,<br />

and ensuring that this is updated over<br />

time to accurately reflect the actual<br />

arrangement between the parties is<br />

crucial. <strong>EMA</strong> is available to advise<br />

employers on these particular issues.<br />

Contact Darren Mitchell at <strong>EMA</strong> Legal<br />

in Wellington on 04 470 9927 email:<br />

darrenm@emalegal.org.nz<br />

PAGE 8<br />

<strong>EMA</strong> Business Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning and networking

By David Lowe<br />

<strong>EMA</strong>Business<br />

Is there a psychopath at your workplace?<br />

One in 10 businesses have a<br />

corporate psychopath destroying their<br />

workplace or have someone capable<br />

of going ‘postal’, according to<br />

research by the Auckland University<br />

Business School’s research.<br />

Corporate psychopaths are described<br />

as “highly destructive and manipulative<br />

individuals with dark sides<br />

who have no remorse for their<br />

actions, which can result in serious<br />

issues for organisations and the<br />

people within them.” So says senior<br />

lecturer Dr Giles Burch.<br />

“They function within normal<br />

society, often with apparent success<br />

and the respect of their bosses,” Dr<br />

Burch adds. Dr Burch released his<br />

research on the topic late September.<br />

Most people will have worked<br />

with someone they think fits<br />

the description of a corporate<br />

psychopath. The condition is<br />

far more than someone they<br />

just didn’t get along with.<br />

There was probably<br />

widespread dislike for the<br />

person, but when the manager<br />

made initial inquiries, the<br />

person concerned has a fair<br />

explanation of what he did.<br />

“Doing what’s best for the<br />

business - doesn’t require a<br />

popularity contest.”<br />

Corporate psychopaths<br />

are very difficult to deal<br />

with. Even their manager can be<br />

intimidated by them. Most bosses<br />

will have a fair idea when all is not<br />

well, but it is difficult to substantiate<br />

a gut feeling in determining if<br />

a person is just unpopular, or is<br />

manipulatively destroying your<br />

team!<br />

The research showed female<br />

psychopaths are more dangerous<br />

and skilled in their manipulations.<br />

With management still dominated<br />

by males, even the most determined<br />

male manager may let the behaviour<br />

go should such a person turn on<br />

them by suggesting allegations of a<br />

sexual nature were in the wind.<br />

You can avoid the corporate<br />

psychopath<br />

The best insurance against<br />

becoming one of the 10% of<br />

businesses that hire a corporate<br />

psychopath is to thoroughly check<br />

out the people you hire beforehand.<br />

I’m not talking about complicated<br />

psychology assessments. But do<br />

use the simple tool of reference<br />

checking effectively.<br />

Some tips to ensure your<br />

reference checking is effective are:<br />

n Ask the candidate for referees for<br />

whom they have worked for a<br />

long period of time. At least 12<br />

months is a good guide.<br />

n Ask the candidate to give<br />

permission to check with their<br />

most recent employer, even if it<br />

is their current boss.<br />

"Doing what’s best for<br />

the business doesn’t<br />

require a popularity<br />

contest"<br />

n Make sure the referee is a<br />

relatively senior person, not<br />

a supervisor who might be<br />

doing the candidate a favour,<br />

or someone who might say<br />

anything to get rid of the person.<br />

n Ask the key question “Would<br />

you employ this person again?”<br />

Listen carefully to how they<br />

answer that question.<br />

n Ask follow-up questions. You<br />

really need to know if they<br />

would have this person back<br />

again.<br />

Case study<br />

A candidate supplied referees that<br />

she had worked for only briefly, so was<br />

asked to supply other references for<br />

whom she had worked with for at least<br />

a year. When she declined she was<br />

told her application would be taken<br />

no further. The candidate then sent<br />

the potential employer a torrent of<br />

abusive e-mails. Lesson: the employer<br />

considered themself to have had a<br />

lucky escape!<br />

Escape routes<br />

If you are unlucky enough to end<br />

up with a corporate psychopath in<br />

your team, the sooner you deal with it<br />

the better.<br />

Incompatibility is a valid reason<br />

to end an employment relationship,<br />

but no quick fix, and you should get<br />

advice from <strong>EMA</strong>.<br />

Using incompatibility can be helpful<br />

in that you do not have to attribute<br />

fault, and can take a mediation type<br />

role, but still retain the right to<br />

end employment if, after having<br />

gone through all the steps, the<br />

problem remains.<br />

An employer could wait<br />

for the corporate psychopath<br />

to overstep the mark and do<br />

something you can categorise<br />

as misconduct, or serious<br />

misconduct. Given the capacity<br />

for clever manipulation you<br />

could be waiting a long time for<br />

such circumstances. But most<br />

employers who start out on the<br />

long path of incompatibility get a<br />

good result and wish they had started<br />

sooner.<br />

An employer dealing with people<br />

like this needs to be clear about the<br />

problem they are trying to solve. You<br />

must not blame people for things you<br />

cannot substantiate. But if you can<br />

represent an issue so that it clearly<br />

sets out that the business has the<br />

problem, not the employee, and if it is<br />

a legitimate problem of the team not<br />

getting along, you may be able to work<br />

through to a satisfactory outcome.<br />

Our Vision. Your Success<br />

PAGE 9

Employment chat<br />

What employers are asking AdviceLine this month<br />

Drinking on the job? Days off for casuals?<br />

Q. A risk in the hospitality industry is, of course, staff<br />

access to alcohol. I’ m thinking of writing a policy or<br />

clause in our employment contracts that specifies no<br />

drinking in the restaurant, before a problem occurs.<br />

What can I say, and how can I enforce it? – Mark, Our<br />

Favourite Restaurant<br />

Dear Mark<br />

First of all there might be times when it’s appropriate<br />

for staff to drink in your restaurant, e.g. at work<br />

functions such as farewells for colleagues, or when they<br />

are off duty. So any policy must be specific to the nature<br />

of employment and the extent of drinking, not the<br />

restaurant per se (I suppose that’s obvious).<br />

When a person’s judgement or behaviour is<br />

unacceptable, or the employee breaches health or safety<br />

regulations, a contributing cause could be their abuse of<br />

drugs/alcohol. But without their admission of this, or a<br />

positive breath test result, you can’t point the finger at<br />

the cause. You must tread with caution.<br />

Nonetheless health and safety are serious<br />

considerations around food businesses and in kitchens.<br />

The other aspect I suppose you are referring to is the<br />

unauthorised use of the employer’s property (i.e. your<br />

alcohol) which could also amount to theft. So a clause<br />

in the employment agreement could say something to<br />

the effect:<br />

“I [the employee] understand I am not permitted to<br />

drink Our Favourite Restaurant’s alcohol or consume any<br />

other alcohol or non prescribed drugs during my hours of<br />

employment here except when offered by the employer on<br />

special occasions, failure to comply with this requirement could<br />

cause health and safety risks, or deter customers and affect the<br />

business’ reputation.”<br />

“My employer’s reasonable cause to suspect drug/alcohol<br />

use could result in my being required to be tested for my level<br />

of consumption; and a finding that I have not complied will<br />

result in a performance review and possibly termination if<br />

judged to be serious misconduct.”<br />

Meeting employee needs<br />

in challenging times<br />

We would caution against introducing drug testing<br />

without thorough planning and reason to suspect that<br />

use has caused problems or is connected to criminal<br />

activity as it is invasive and a legal minefield – talk to<br />

<strong>EMA</strong> first.<br />

A policy given to all staff, or an additional clause in<br />

your Policies and Procedures or House Rules, could<br />

save each contract being re-worked, and could say<br />

the same as above – preferably after discussion and<br />

agreement with staff. Each person needs to sign a copy<br />

of the policy by a given date.<br />

Talk to us for help with more specific wording<br />

and to ensure legality; and check out our A-Z<br />

Employers Guide on Drug Testing.<br />

Employee Assistance Programmes<br />

Trauma Support<br />

Change and Outplacement<br />

Telephone: 0508 664 981<br />

Email: theteam@seed.co.nz<br />

Web: www.seed.co.nz<br />

Career Coaching<br />

Conflict Resolution<br />

Wellness Programmes<br />

Q. Casual workers – what a nightmare working out their<br />

pay! When is a casual employee entitled to a paid day<br />

off? Surely if they are only working three days a week on<br />

average, they can take breaks the other two days? And<br />

what if they work on public holidays? – Dane<br />

Dear Dane<br />

All employees are entitled to the same minimum<br />

amount of paid leave for sickness (five work days a year<br />

cumulative for 20 days) and bereavement (maximum of<br />

three days per person its not restricted to the number<br />

of times a year). These incidences can fall on a work day<br />

FBSEE007<br />

><br />

PAGE 10<br />

<strong>EMA</strong> Business Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning and networking

Check out our special offer<br />

exclusive to <strong>EMA</strong> members.<br />

Go to www.ema.co.nz/memberbenefi ts or call 09 966 7478<br />

TEMP/CONTRACT<br />

ACCOUNTING<br />

EXECUTIVE<br />

TECH/OPS<br />

SALES/MKTING<br />

OFFICE SUPPORT<br />

<<br />

out of the employee’s control.<br />

The entitlement applies to casual,<br />

fixed term and permanent part time<br />

or full time employees.<br />

You need to assume your<br />

employee's honesty in good faith<br />

when they ask for leave. In the<br />

case of casual or part timers the<br />

employee is eligible after s/he has<br />

worked for the employer at least<br />

an average of 10 hours a week for<br />

a period of six months and not less<br />

than one hour in every week or no<br />

less than 40 hours in every month<br />

during that period.<br />

Full timers have to have worked<br />

six months continuously. Sick leave<br />

can be taken in advance with the<br />

agreement of both parties.<br />

The same qualifying criteria<br />

applies to bereavement leave but this<br />

leave cannot be taken in advance of<br />

working for you for six months.<br />

There are two categories of<br />

bereavement leave entitlement:<br />

n three days on the death of<br />

immediate family members -<br />

defined as spouse, parent, child,<br />

brother or sister, grandparent,<br />

grandchild and parents-in-law -<br />

and<br />

n one day on the death of<br />

any other person for whom<br />

the employer considers that<br />

the employee has suffered a<br />

bereavement. Factors to take into<br />

account include the closeness<br />

of the relationship with the<br />

deceased person, the employee's<br />

responsibility for any or all of<br />

the related ceremonies and other<br />

cultural responsibilities.<br />

It is also plausible for an<br />

employee to take two days to<br />

attend a tangi and a third day for<br />

the unveiling of the deceased’s<br />

headstone, or to attend a local<br />

memorial service or to attend to<br />

the affairs relating to the will of the<br />

deceased person.<br />

Bereavement and sick leave are<br />

paid at relevant daily pay for every<br />

day taken as sick or bereavement<br />

leave that would otherwise be a<br />

working day for the employee.<br />

Relevant daily pay is defined as the<br />

amount of pay that an employee<br />

would have received had he/she<br />

worked on the day concerned,<br />

and includes productivity and<br />

incentive payments, overtime and<br />

cash payment for board and lodging<br />

had they been received on the day<br />

concerned.<br />

When any employee works on a<br />

public holiday, s/he is entitled to be<br />

paid a time and a half for the hours<br />

worked and also to an alternative<br />

holiday. The Holiday Act 2003<br />

requires that the alternative holiday<br />

must be a whole day irrespective of<br />

the hours worked.<br />

See our A-Z Employers Guides on Casual<br />

Work, Sick Leave, Bereavement, Annual<br />

Leave and Public Holidays. Or just call<br />

AdviceLine for a chat to sort it all out.<br />

Our website has a sample employment<br />

agreement for casual workers too.<br />

By the <strong>EMA</strong> Advocacy team in<br />

consultation with <strong>EMA</strong> Advice, and<br />

based on real calls to <strong>EMA</strong>’s AdviceLine.<br />

The information in this article is a guide<br />

only and not to be used as business<br />

advice without further consultation.<br />

Start with our AdviceLine team at phone<br />

0800 800 362 (within New Zealand), 1800<br />

300 362 (from Australia) or 09-367 0909<br />

(for <strong>EMA</strong> Northern) or 04-473 7224 (for<br />

<strong>EMA</strong> Central), 8am-8pm weekdays.<br />

Alternatively, email adviceline@ema.<br />

co.nz, and read or download information<br />

such as the A-Z of Employing – a<br />

manager’s guide on more than 100<br />

specific topics, at www.ema.co.nz/<br />

advice.<br />

PAYROLL<br />

More New Zealand businesses use Ace<br />

Payroll than any other computerised<br />

wages program.<br />

Visit our constantly updated website at www.acepay.co.nz<br />

for employment law, legislative links, tax planning etc<br />

or call toll free on 0800 223 729 for a free demonstration kit.<br />

PAYROLL<br />

Our Vision. Your Success<br />

PAGE 11

By Business NZ’s CEO Phil O’Reilly<br />

Optimising the upturn<br />

When it comes to leveraging off the<br />

economic upturn, being prepared<br />

with the right skills and training is<br />

paramount.<br />

Some are saying the upturn has<br />

already started. Others are erring on<br />

the side of caution with the bumpy<br />

recovery theory. Personally, I think it’s<br />

going to be a very patchy recovery.<br />

While the July BNZ Capital –<br />

Business New Zealand Performance<br />

of Manufacturing Index<br />

suggested expansion, especially<br />

after steady improvements<br />

throughout most of 2009, the<br />

August slip to 48.9 gave us a<br />

timely reality check of caution.<br />

Whether the recovery<br />

fully kicks in during the next<br />

few months or next year, we<br />

cannot begin to prepare our<br />

workforce too soon.<br />

It’s been great to see so<br />

many businesses do all they<br />

can to keep staff on through these<br />

tough times, knowing that when the<br />

upturn comes, they will need them<br />

more than ever.<br />

Likewise, staff have been very<br />

flexible and understanding of the<br />

predicament their employers are<br />

in. Many have taken accrued leave,<br />

unpaid leave or even dropped hours<br />

down from full time to part time.<br />

What we need now to really<br />

come out of the downturn stronger<br />

than ever, able to capitalise on every<br />

opportunity is:<br />

1. A highly skilled workforce, and<br />

2. Export-driven growth.<br />

New Zealand is nowhere near<br />

fulfilling its capacity as a worldleading<br />

innovative exporting nation.<br />

But, with a domestic market of just<br />

four million, exporting is vital to our<br />

growth.<br />

"Research has consistently<br />

suggested 20% of New<br />

Zealand's workforce doesn't<br />

have the literacy and numeracy<br />

skills needed to perform at their<br />

best in their jobs."<br />

Capturing the untapped talent<br />

within our workforce is key. It’s about<br />

more than traditional education<br />

and technical knowledge. It’s about<br />

knowing how to take that knowledge<br />

and turn it into marketable IP,<br />

products and services.<br />

It’s about knowing how to<br />

commercialise our cleverness and sell<br />

it to the rest of the world.<br />

This is what we aimed to convey at<br />

the international business forum Go<br />

Global on 30 September. We heard<br />

some great New Zealand exporting<br />

success stories – from Fletcher<br />

Building, Glidepath, Animation<br />

Research and New Zealand Merino.<br />

Let’s learn from these.<br />

Of course to really get our ideas off<br />

the ground and out into the world,<br />

we need a workforce supportive of<br />

‘NZ Inc’ at every level. For this, we<br />

need a workforce of ‘good citizens’.<br />

Good citizenship plays out in the<br />

workplace through things such as:<br />

n Good teamwork<br />

n Contributing to the overall<br />

aims and objectives of the<br />

business<br />

n Emotional intelligence<br />

n A willingness to learn<br />

n Turning up on time<br />

n Resilience.<br />

All of these are often underappreciated<br />

attributes.<br />

Skills are the lever for a step<br />

change, but it’s important we<br />

get the basics right first, in order to<br />

build a strong foundation for their<br />

development.<br />

Currently, more than a million<br />

New Zealanders are not literate<br />

enough to actively participate at work.<br />

This affects the country’s productivity.<br />

Immigrants’ language skills would<br />

benefit from increased training.<br />

While the children go to school<br />

Specialist Employment Lawyers<br />

Our high success rate reflects our expertise. Our 13 lawyers specialise in employment law and only act for<br />

members. As part of a member-owned organisation, <strong>EMA</strong> Legal offers services that are excellent value.<br />

Strategic advice Practical solutions Skilled representation<br />

Key contacts<br />

Susan-Jane Davies (04) 470 9923 sjdavies@emalegal.org.nz<br />

Parvez Akbar (09) 367 0931 parvez.akbar@ema.co.nz<br />

Maree Kirk (03) 548 4513 mkirk@emacentral.org.nz<br />

PAGE 12<br />

<strong>EMA</strong> Business Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning and networking

and get taught English, the adults can slip through the<br />

cracks, affecting workplace literacy and numeracy. This is<br />

not simply whether people can read or write. It’s about<br />

a whole range of skills - how well people can do these<br />

things, their communication skills, how well people work<br />

in teams, and whether firms can introduce new technology<br />

and approaches.<br />

Research in many industries has consistently suggested<br />

that about 20% of New Zealand's workforce don't have<br />

the literacy and numeracy skills needed to perform at their<br />

best in their jobs.<br />

We are now poorer on a per capita GDP basis than<br />

most of the developed world. But, we can leapfrog the rest<br />

of the world in:<br />

n Innovation and IP, and<br />

n Skills formation – which is the most important thing in<br />

the productivity sector.<br />

More than ever, the saying "we had no money, so we had<br />

to be smart" applies to our situation in New Zealand.<br />

In order to propel New Zealand forward, the key for<br />

training providers is to know what businesses need and<br />

expect from the education system. This applies to both<br />

private and public sector educators.<br />

Employers often prefer private sector providers first,<br />

followed by polytechnics, and then universities. This is<br />

because they see private sector providers as:<br />

n Being more practical in focus and thus relevant to the<br />

workplace<br />

n Being more aware of the changing demands of the<br />

marketplace<br />

n Demonstrating more value through applied knowledge<br />

n Maintaining better employer engagement – which<br />

universities can often lack.<br />

Many graduates of traditional training establishments are<br />

not as qualified for the real world. There is a particular gap<br />

here when it comes to training for export success.<br />

This is why Export New Zealand (a division of Business<br />

New Zealand) is offering practical, comprehensive training<br />

packages to prepare exporters for maximising their<br />

business in international markets and driving New Zealand<br />

towards an export-led recovery.<br />

We’re running these through the export divisions of<br />

Business NZ’s four regional business associations: <strong>EMA</strong><br />

Northern, <strong>EMA</strong> Central, the Canterbury Employers’<br />

Chamber of Commerce and the Otago Southland<br />

Employers’ Association.<br />

We recognise the need over time to offer courses<br />

from the fundamentals for those new to exporting, to<br />

training for those who have either studied in the export<br />

field previously, or already have international business<br />

experience.<br />

The next Export New Zealand entry-level, ‘Export<br />

Fundamental’ courses in the region are in Tauranga on<br />

October 15 (Exporting<br />

Processes -Think<br />

Like an Exporter)<br />

and Hamilton on<br />

November 4 (Making<br />

the Most of Trade<br />

Shows).<br />

If you’re a business in<br />

any part of the export<br />

spectrum, I suggest you<br />

get in touch with your<br />

regional Export New<br />

Zealand representative<br />

Phil O’Reilly<br />

and find the training<br />

that’s right for you. You<br />

can find out more from<br />

the regional training sections on www.exportnewzealand.<br />

org.nz.<br />

It’s time to take New Zealand business beyond the<br />

limitations of geography and skills. By putting in place<br />

the right skills now, we can propel ourselves beyond<br />

the recession and into growth to conquer the world of<br />

innovative products and services. Let’s give the world<br />

something to buy!<br />

Certificate in<br />

Quality Assurance 2010<br />

Limited number of places available<br />

For people wanting quality information and training in<br />

quality<br />

n Gain the skills that will help you and your business<br />

“Work Smarter Not Harder”<br />

n Learn how to identify “Opportunities for Improvement”<br />

and improve your profile.<br />

n A recognised Level 5 certificate course providing a<br />

broad understanding of quality management<br />

This course develops a wide range of practical skills<br />

that can be applied to manage quality in all types of<br />

organisations and industries.<br />

By correspondence nationally with classroom options<br />

available in Auckland, Christchurch and other locations if<br />

numbers permit.<br />

Enrolments – open now, an early enrolment means<br />

you only pay the 2009 Fee<br />

Intakes start - 17 Feb 2010 Mid Year - 21 July 2010<br />

New Zealand Organisation for Quality<br />

Contact Tess Stewart at National Office Palmerston North.<br />

Ph: 06 351 4407, Fax: 06 351 4408<br />

Email: quality@nzoq.org.nz<br />

Web: www.nzoq.org.nz<br />

Our Vision. Your Success<br />

PAGE 13

Advertorial<br />

System software selection boosts productivity<br />

Electrex, formed in 1982 by director Rex Alder,<br />

specialises in the sourcing and supply of a diverse<br />

selection of local and international electrical<br />

hardware to customers throughout the country. The<br />

company’s range includes environmentally-friendly cable<br />

covers and electrical ducting manufactured from recycled<br />

waste plastics suited to underground use.<br />

To keep track of its 4000 different components and 400<br />

customers Electrex turned to MYOB EXO Business to keep<br />

track of everything, said Rex Alder.<br />

The company stocks Scame products from Italy which<br />

include industrial plugs, connectors, outlets, switches, and<br />

distribution and consumer boards, all manufactured to<br />

stringent European CEE Standards.<br />

Other suppliers include the Electroflex group of flexible<br />

conduit connections, Entrelec Terminals from France, and the<br />

Grantline range of New Zealand-made foot switches, batten<br />

holders, spiral ties, terminal boxes, meter boxes, and locking<br />

nuts.<br />

Electrex employs 10 staff at its Glenfield premises on the<br />

North Shore, along with sales agents in the lower North Island<br />

and the South Island.<br />

Electrex utilizes MYOB solutions, including modules from<br />

the MYOB EXO Business suite and MYOB EXO Payroll, since<br />

they first became available, and its been happy with the<br />

products and service on offer.<br />

“EXO Business is a proven system that’s easy to use and<br />

saves time,” Alder said.<br />

“All staff from accountants to dispatchers are trained to<br />

operate the software and use it regularly.<br />

“EXO Business gives our staff the ability to quickly drill<br />

down through materials, stock levels, billing, and packing slips<br />

to identify the correct component, as well as manage rolling<br />

stock tables on any identified range of components.”<br />

“The software is also configured to ensure orders are<br />

prepared and dispatched in a timely manner.<br />

“Purchase orders come through from some customers via<br />

Electronic Data Interchange (EDI) which generates a sales<br />

order in our system that we turn into a packing slip for use<br />

when we ship the required items.<br />

“Our matching invoice is then returned to the customer via<br />

EDI and matched for auto payment. The order is filled using<br />

available stock, with EXO Business automatically adding the<br />

weight and cubic size to the courier print out or truck docket.<br />

“It can be a complex process, and each part of the job is<br />

handled by a separate department,” Alder said.<br />

“But EXO Business ensures it runs smoothly, and with no<br />

time wasted.”<br />

As well as assisting in the distribution of orders, EXO<br />

Business has provided additional functionality when generating<br />

the monthly invoices.<br />

“EXO Business enables us to automatically match individual<br />

payments against invoices which have been sent out, and that<br />

gives staff a detailed review of each debtor’s payment history,”<br />

Alder said.<br />

“Not only can we keep track of client payments, we can also<br />

prepare statements and invoices easily for our head office and<br />

branches to ensure other staff are kept updated as well.”<br />

For more information on MYOB EXO Business go to myob.co.nz/exo/ema<br />

or talk to the EXO team today on 0800 MYOB EXO<br />

PAGE 14<br />

<strong>EMA</strong> Business Plus Magazine - Exclusive <strong>EMA</strong> news, advice, learning and networking

<strong>EMA</strong>'s TAX TIPS <strong>EMA</strong>Business<br />

On relocation and overtime meal allowance<br />

Recent changes enacted into legislation<br />

this month include clarification around<br />

the tax treatment of relocation payments<br />

and overtime meal allowances. These<br />

are intended to resolve a degree of<br />

uncertainty in the current law relating to<br />

their tax treatment.<br />

The amendments specify that in order<br />

for relocation payments to be exempt<br />

from tax, the payment must reflect<br />

actual expenditure incurred, and the<br />

expenditure must be incurred within<br />

certain time limits, generally by the end<br />

of the next income year following the<br />

income year in which the employee<br />

relocates. In addition, the expense must<br />

be on the list of eligible relocation<br />

expenses issued by the Commissioner.<br />

The proposed list is relatively<br />

expansive including such things as<br />

the cost of removal, transportation<br />

and storage (including the relocation<br />

and boarding of pets), certain costs<br />

associated with selling an existing home<br />

and acquiring a new dwelling, as well as<br />

the cost of health checks, immigration<br />

and tax advice associated with the<br />

relocation.<br />

In an attempt to restrict the<br />

tax exemption to cases of genuine<br />

relocations, there are also requirements<br />

in terms of the distance of the new<br />

location and what will constitute<br />

relocation.<br />

For an overtime meal allowance to<br />

be exempt from tax under the new<br />

legislation, the allowance will need<br />

to reflect either actual expenditure<br />

incurred by the employee or a<br />

reasonable estimate of expected costs.<br />

Documentation will be required for<br />

amounts over $20 per meal.<br />

In addition, it either needs to be<br />

stated in the employee’s employment<br />

contract that they are eligible for a<br />

payment in relation to overtime, or the<br />

employer must have a policy or practice<br />

of paying an overtime meal allowance.<br />

Student loan repayments sped up<br />

A Bill designed to encourage<br />

voluntary student loan repayments also<br />

passed its final stages this month.<br />

Individuals who make voluntary<br />

repayments on their student loans of<br />

$500 or more in a tax year, either by<br />

way of lump sum or smaller increments,<br />

are eligible for a 10% bonus. For<br />

example, a student who makes $1,000<br />

in voluntary repayments during a tax<br />

year will receive a $100 reduction in<br />

their student loan balance.<br />

The bonus will be credited to the<br />

individual’s student loan account on<br />

April 1 following the tax year in which<br />

the voluntary payment was made. For<br />

those repaying their student loan in full,<br />

the bonus will be provided at the time<br />

of final payment.<br />

The scheme is wide-ranging in<br />

Manukau Events Centre Special Offer<br />

its application, to overseas and New<br />

Zealand-based borrowers, graduates and<br />

those still studying. One point to note<br />

is that repayments must be made to<br />

Inland Revenue and not StudyLink in<br />

order to qualify for the bonus.<br />

Since the introduction in 2006 of<br />

interest-free student loans, the number<br />

of people repaying them in full each<br />

year has decreased. This legislation,<br />

which will apply to all payments made<br />

from April 1, 2009, is expected to<br />

reduce repayment times and reduce<br />

overall costs to Government.<br />

Further changes expected to<br />

apply from April 1, 2011 - will be<br />

incorporated in a Bill to be introduced<br />

later this year. They aim to simplify the<br />

current student loan system by moving<br />

toward its electronic management. The<br />

Bill will also introduce changes for<br />

borrowers employed in New Zealand,<br />

removing annual assessments and<br />

moving to a pay period repayment<br />

system. This should remove the need<br />

for end-of-year assessments and squareups.<br />

The proposal to deduct repayments<br />

from students’ holiday jobs while<br />

studying if they earn over $367 a week<br />

has been scrapped.<br />

Rohini Ram is an Executive Director at Ernst<br />

& Young. If you require any assistance<br />

with any of the issues discussed above,<br />

please contact Rohini on 09 377 4790 or<br />

email rohini.ram@nz.ey.com.<br />

$45 per person*<br />

including:<br />

Venue hire<br />

Car parking<br />

Morning tea<br />

Working lunch<br />

Afternoon tea<br />

*excludes GST<br />

Excellent Value<br />

Daily Delegate Package<br />

Small meetings for<br />

10 - 50 people<br />

09 976 7777<br />

www.pacific.org.nz<br />

Our Vision. Your Success<br />

PAGE 15

<strong>EMA</strong>Business<br />

Physios can save big money, keep staff pain free<br />

By 2006 Mt Cook Airline became<br />

concerned that Queenstown Airport<br />

had the highest lost time injury rate<br />

for any Air New Zealand site in the<br />

world – 2.5 injuries per month in May<br />

2006. Each injury was costing an<br />

average of $26,000. It transpired that<br />

customer service advisors and ramp crew<br />

were manually processing increasing<br />

volumes of baggage without the loading<br />

equipment or staff available at larger<br />

airports.<br />

They enlisted the assistance of<br />

Remarkable Physios to fine tune a<br />

Worksafe initiative. The lost time<br />

injury rate since went from 2.5 per<br />

month in 2006 to 300 days without<br />

any lost time injuries in 2007. The cost<br />

of new injuries per month in 2006<br />

was $65,000; the savings estimated at<br />

$650,000.<br />

A 23-year old fencer five<br />

months after an injury complained<br />

of non-specific low back pain.<br />

An eight-week work hardening<br />

programme was initiated to increase his:<br />

n Confidence to move<br />

n Strength of the trunk and<br />

associated leg muscles<br />

n Fitness to normalise normal<br />

function<br />

n Endurance to be able to<br />

confidently work for a full<br />

day performing all tasks for<br />

full normal duties<br />

After six months he reported nil<br />

further episodes of low back pain.<br />

A large engineering company had<br />

increasing reported incidences of<br />

shoulder pain in one specific area of<br />

the factory. The physio team brought<br />

in identified the area used power<br />

tools for a significant portion of their<br />

day. The report outlined:<br />

n Ergonomic suggestions on<br />

modification of equipment<br />

n Proposed adaption of worker<br />

technique<br />

n Workplace intervention to<br />

educate, train and successfully<br />

manage the worker<br />

discomfort.<br />

“Physiotherapists as movement<br />

specialists are ideally suited to<br />

treating and working with work<br />

place injury and problems,” said Ann<br />

Bennett, a physiotherapist in Kumeu,<br />

Auckland.<br />

One of her clients, an office<br />

worker, presented with neck and<br />

arm pain and a lot of dysfunction<br />

(stiffness) in her spine and the<br />

muscles in her arm. It was found her<br />

work station was causing significant<br />

postural stress. A work site<br />

assessment was organized. Many little<br />

things not quite right were put right,<br />

and they were inexpensive! With a<br />

proactive employer the issues were<br />

sorted in a week.<br />

In another case, senior<br />

physiotherapist Gillian McDowell<br />

found a large Invercargill bank had<br />

undergone a “make over” installing<br />

new Italian desks. They were split<br />