Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DIFFERENCES BETWEEN CORPORATE LENDING<br />

AND PROJECT FINANCE<br />

In the context of money and capital markets, the term project<br />

finance refers to a specific discipline of financing. Project<br />

finance is the financing of an asset with the lender primarily<br />

relying on the cash flow from this asset as the source for<br />

the repayment of the financing. The asset itself is the main<br />

collateral. The lender has no or only limited recourse to the<br />

sponsors of the project.<br />

Thus, project finance is also described as “cash-flow based,<br />

limited-recourse (or non-recourse) financing”.<br />

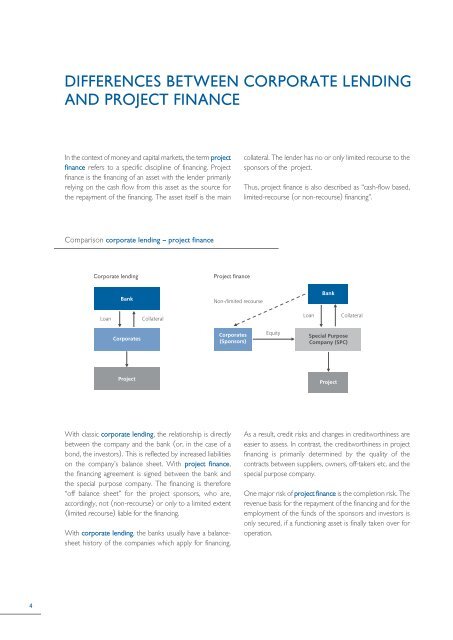

Comparison corporate lending – project finance<br />

Corporate lending<br />

Project finance<br />

Bank<br />

Non-/limited recourse<br />

Bank<br />

Loan<br />

Collateral<br />

Loan<br />

Collateral<br />

Corporates<br />

Corporates<br />

(Sponsors)<br />

Equity<br />

Special Purpose<br />

Company (SPC)<br />

Project<br />

Project<br />

With classic corporate lending, the relationship is directly<br />

between the company and the bank (or, in the case of a<br />

bond, the investors). This is reflected by increased liabilities<br />

on the company’s balance sheet. With project finance,<br />

the financing agreement is signed between the bank and<br />

the special purpose company. The financing is therefore<br />

“off balance sheet” for the project sponsors, who are,<br />

accordingly, not (non-recourse) or only to a limited extent<br />

(limited recourse) liable for the financing.<br />

With corporate lending, the banks usually have a balancesheet<br />

history of the companies which apply for financing.<br />

As a result, credit risks and changes in creditworthiness are<br />

easier to assess. In contrast, the creditworthiness in project<br />

financing is primarily determined by the quality of the<br />

contracts between suppliers, owners, off-takers etc. and the<br />

special purpose company.<br />

One major risk of project finance is the completion risk. The<br />

revenue basis for the repayment of the financing and for the<br />

employment of the funds of the sponsors and investors is<br />

only secured, if a functioning asset is finally taken over for<br />

operation.<br />

4