Central and Eastern Europe à la carte - Raiffeisen Zentralbank ...

Central and Eastern Europe à la carte - Raiffeisen Zentralbank ...

Central and Eastern Europe à la carte - Raiffeisen Zentralbank ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

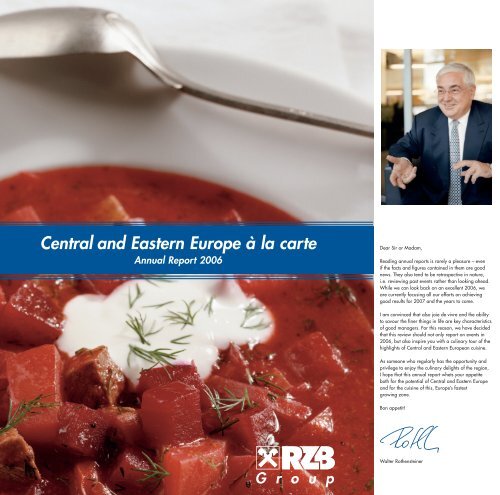

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong><br />

Annual Report 2006<br />

Dear Sir or Madam,<br />

Reading annual reports is rarely a pleasure – even<br />

if the facts <strong>and</strong> fi gures contained in them are good<br />

news. They also tend to be retrospective in nature,<br />

i.e. reviewing past events rather than looking ahead.<br />

While we can look back on an excellent 2006, we<br />

are currently focusing all our efforts on achieving<br />

good results for 2007 <strong>and</strong> the years to come.<br />

I am convinced that also joie de vivre <strong>and</strong> the ability<br />

to savour the fi ner things in life are key characteristics<br />

of good managers. For this reason, we have decided<br />

that this review should not only report on events in<br />

2006, but also inspire you with a culinary tour of the<br />

highlights of <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong>an cuisine.<br />

As someone who regu<strong>la</strong>rly has the opportunity <strong>and</strong><br />

privilege to enjoy the culinary delights of the region,<br />

I hope that this annual report whets your appetite<br />

both for the potential of <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong><br />

<strong>and</strong> for the cuisine of this, <strong>Europe</strong>’s fastest<br />

growing zone.<br />

Bon appetit!<br />

Walter Rothensteiner

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong><br />

Annual Report 2006

Summary of key data<br />

RZB Group 2006<br />

Monetary values are in Emn 2006 (minus OOEs) Change 2005 2004 2003<br />

Income Statement<br />

Net interest income after provisioning 1,840 1,840 31.5% 1,400 928 661<br />

Net commission income 1,177 1,177 43.7% 819 626 479<br />

Trading profit 257 257 48.8% 172 170 173<br />

General administrative expenses (2,113) (2,113) 34.2% (1,574) (1,196) (1,017)<br />

Profit before tax 1,882 1,286 38.3% 930 692 344<br />

Profit after tax 1,631 1,035 46.9% 705 566 278<br />

Consolidated profit 1,169 752 66.7% 451 446 216<br />

Earnings per share (E) 239.9 155.7 159.2% 92.6 102.3 48.8<br />

Ba<strong>la</strong>nce Sheet<br />

Loans <strong>and</strong> advances to banks 32,006 32,006 8.0% 29,647 22,229 19,152<br />

Loans <strong>and</strong> advances to customers 53,106 53,106 34.1% 39,613 27,957 22,180<br />

Deposits from banks 44,129 44,129 1.6% 43,416 32,270 27,423<br />

Deposits from customers 44,727 44,727 39.1% 32,158 23,386 16,990<br />

Equity (incl. minorities <strong>and</strong> profit) 6,637 6,637 34.1% 4,950 3,343 2,445<br />

Ba<strong>la</strong>nce sheet total 115,629 115,629 23.2% 93,863 67,864 56,053<br />

Regu<strong>la</strong>tory information<br />

Basis of assessment (incl. market risk) 70,656 70,656 26.7% 55,783 38,492 30,389<br />

Total own funds 7,614 7,614 46.4% 5,199 4,120 3,097<br />

Total own funds requirement 5,652 5,652 26.7% 4,463 3,079 2,431<br />

Excess cover 34.7% 34.7% 18.2 pp 16.5% 33.8% 27.4%<br />

Core capital ratio (banking book; Tier 1) 9.0% 9.0% 0.7 pp 8.3% 9.2% 7.5%<br />

Own funds ratio 10.8% 10.8% 1.5 pp 9.3% 10.7% 10.2%<br />

Performance<br />

Return on equity before tax 39.1% 26.7% 2.8 pp 23.9% 29.9% 15.5%<br />

Return on equity after tax 33.9% 21.5% 3.4 pp 18.1% 24.4% 12.5%<br />

Consolidated return on equity 34.0% 21.9% 6.4 pp 15.5% 22.8% 12.1%<br />

Cost/income ratio 56.7% 56.7% (2.2 pp) 58.9% 59.8% 64.1%<br />

Return on assets before tax 1.83% 1.25% 0.08 pp 1.17% 1.11% 0.67%<br />

Net provisioning ratio 0.63% 0.63% 0.11 pp 0.52% 0.64% 0.72%<br />

Risk-to-earnings ratio 15.8% 15.8% 3.0 pp 12.9% 17.4% 23.4%<br />

Resources<br />

Number of staff on ba<strong>la</strong>nce sheet date 55,434 55,434 19.9% 46,243 25,323 21,119<br />

of which in Austria 2,577 2,577 1.9% 2,529 2,373 2,513<br />

of which in the CEE region 52,528 52,528 20.9% 43,430 22,707 18,368<br />

Banking outlets 2,866 2,866 16.5% 2,461 932 740<br />

Ratings of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> Long-term Subordinated Short-term Fin. strength Outlook<br />

Moody‘s Investors Service A1 A2 P-1 C+ Stable<br />

St<strong>and</strong>ard & Poor‘s A+ A A-1 — Stable<br />

Retroactive reassignment (2002 – 2005) of a component of profit from Trading profit to Net commission income; see page 168.<br />

OOE: One-off effect; the sale of <strong>Raiffeisen</strong>bank Ukraine <strong>and</strong> the minority stake in Bank TuranAlem were deemed to be one-off effects.

Contents<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> 4<br />

Preface by the Managing Board 48<br />

The Managing Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> 50<br />

Supervisory Board’s Report 52<br />

Overview of RZB 53<br />

Vision <strong>and</strong> Mission 56<br />

Corporate Social Responsibility 62<br />

The <strong>Raiffeisen</strong> Banking Group in 2006 72<br />

Interview with CEO Walter Rothensteiner 77<br />

Group Management Report 80<br />

The course of business in 2006 86<br />

Summary of consolidated results 87<br />

Detailed review of items in the Income Statement 93<br />

The Ba<strong>la</strong>nce Sheet 99<br />

Equity 101<br />

Human Resources 103<br />

Risk management 107<br />

Outlook for 2007 111<br />

Segment reports 114<br />

Corporate Customers 114<br />

Financial Institutions <strong>and</strong> Public Sector 124<br />

Retail Customers 128<br />

Proprietary Trading 132<br />

Participations <strong>and</strong> Other 138<br />

Consolidated Financial Statements (financial statements applying IFRS) 144<br />

Income Statement 145<br />

Ba<strong>la</strong>nce Sheet 146<br />

Statement of Changes in Equity 147<br />

Cash Flow Statement 149<br />

Notes 151<br />

Notes to the Income Statement 170<br />

Notes to the Ba<strong>la</strong>nce Sheet 181<br />

Additional notes pursuant to IFRS 196<br />

Notes to financial instruments with Risk Report 204<br />

Disclosures required by Austrian <strong>la</strong>w 219<br />

Boards 222<br />

Organizational structure 224<br />

Unqualified Auditors’ Report 225<br />

Scope of consolidation <strong>and</strong> overview of equity participations 227<br />

Glossary 230<br />

Addresses <strong>and</strong> contacts 232<br />

Throughout this report, “RZB” is used to refer to the RZB Group; “<strong>Raiffeisen</strong> <strong>Zentralbank</strong>” is used whenever statements refer solely to <strong>Raiffeisen</strong> <strong>Zentralbank</strong><br />

Österreich AG. Tables may contain minor rounding errors. Statements of rates of change (percentages) are based on actual figures <strong>and</strong> not on the<br />

rounded figures provided in the tables.

Lisbon<br />

PORTUGAL<br />

Rabat<br />

MOROCCO<br />

SPAIN<br />

Madrid<br />

IRELAND<br />

Dublin<br />

ALGERIA<br />

UNITED KINGDOM<br />

London<br />

Algier<br />

Paris<br />

FRANCE<br />

Amsterdam<br />

NETHERLANDS<br />

Brussels<br />

BELGIUM<br />

LUXEMBURG<br />

Bern<br />

SWITZERLAND<br />

Mi<strong>la</strong>n<br />

Tunis<br />

TUNESIA<br />

Frankfurt

TURKEY<br />

Warsaw<br />

ALBANIA<br />

BULGARIA<br />

ROMANIA<br />

UKRAINE<br />

BELARUS<br />

LITHUANIA<br />

RUSSIA<br />

Bucharest<br />

Chisinau<br />

Kiev<br />

Minsk<br />

Vilnius<br />

Sofia<br />

Pristina<br />

Moscow<br />

SERBIA<br />

KOSOVO<br />

MACEDONIA<br />

SLOVAKIA<br />

HUNGARY<br />

Tirana<br />

ESTONIA<br />

LATVIA<br />

Belgrade<br />

Rome<br />

DENMARK<br />

Berlin<br />

BOSNIA AND<br />

HERZEGOVINA<br />

Prague<br />

CZECH REPUBLIC<br />

AUSTRIA<br />

SLOVENIA<br />

Vienna Bratis<strong>la</strong>va<br />

Ljubljana<br />

Budapest<br />

Zagreb<br />

CROATIA<br />

Sarajevo<br />

POLAND<br />

MOLDOVA<br />

GREECE<br />

GERMANY<br />

Stockholm<br />

MALTA<br />

SWEDEN<br />

ITALY<br />

MONTENEGRO<br />

Copenhagen<br />

Skopje<br />

Istanbul<br />

Athens<br />

Riga

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Introduction<br />

The typical foods of any country always reflect its history, traditions<br />

<strong>and</strong> social development. As the saying goes:<br />

”If you want to<br />

a country well,<br />

have to become<br />

with its cuisine.

get to know<br />

you first<br />

acquainted<br />

“<br />

Throughout the world, the tastes <strong>and</strong> consistencies of the local foods convey an idea<br />

of the way the people approach life. That is why we have created this presentation of<br />

selected culinary delicacies from the markets we serve.<br />

You are certain to be astonished by the wealth of ideas <strong>and</strong> the culinary diversity.<br />

Join us in exploring the fascinating world of pierogi, sarma, borsch <strong>and</strong> tarator as you<br />

broaden your culinary horizons. <strong>Raiffeisen</strong> was a pioneer in many of the financial<br />

markets of <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong>.<br />

With us, you can also be a pioneer in the exploration of these culinary worlds.<br />

The recipes of the dishes can be accessed at http://ar2006.rzb.at<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Introduction

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Vienna

Vienna: The Emperor of Beef<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Vienna<br />

What would you like to know about Viennese cuisine? The famous wiener schnitzel (escalope),<br />

in any case, is an import, as are gou<strong>la</strong>sh <strong>and</strong> pa<strong>la</strong>tschinken. But the Viennese have every right to<br />

be proud of their tafelspitz, succulent boiled beef served with its c<strong>la</strong>ssic sauces <strong>and</strong> vegetables.<br />

This is how it all began: In 1873 the city council of Vienna issued new quality st<strong>and</strong>ards for beef,<br />

which specified that it could be sold in a total of 22 different cuts. At that time, imperial Vienna<br />

saw absolutely nothing out of the ordinary about this. Each cut was endowed with a special name,<br />

<strong>and</strong> soon there were restaurants specializing in boiled <strong>and</strong> sometimes fried beef delicacies. The<br />

most famous of these establishments was Meissl und Schaden. This is where the local dignitaries<br />

dined along with everyone else with an appropriate rank, name <strong>and</strong> table reservation. The<br />

Viennese turned the task of distinguishing between tafelspitz, kruspelspitz <strong>and</strong> weisses hieferl<br />

into a pleasurable science. And even today, the crowning creation of bourgeois cuisine is still<br />

considered to be a well-hung <strong>and</strong> properly prepared cut of beef, even though the days when<br />

the emperor (of beef) reigned supreme are long over <strong>and</strong> gone.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Croatia<br />

Croatia:<br />

Hardly a Hot Tip Anymore<br />

Croatia is often described as the new Côte d’Azur. Those in the know rave about the<br />

historical architecture of the coastal cities, the barren, rocky l<strong>and</strong>scapes, the vineyards<br />

<strong>and</strong> the great diversity of the coastal regions. But Croatian-Mediterranean cuisine<br />

is equally impressive.<br />

Chefs in coastal areas can draw on an extremely wide range of ingredients. They can<br />

choose, for example, from sardines, sea wolf, sea bream <strong>and</strong> spiny lobster, all of which<br />

were still in the water only hours earlier. Other sea-dwellers, such as c<strong>la</strong>ms, head straight<br />

for the soup kettle. Brudet is the name of the local version of the fish soup prepared<br />

along the Mediterranean coast of France as bouil<strong>la</strong>baisse. The addition of vinegar,<br />

however, lends brudet a sour note unknown in its southern French re<strong>la</strong>tive. Once again,<br />

the preparation varies greatly by region. If you’ve first tasted brudet in Split, you<br />

won’t recognize it in Zadar or Šibenik, where the vegetables, spices <strong>and</strong> fish varieties<br />

are different.<br />

The best fish come from the Gulf of Kvarner, where they have an optimal habitat, <strong>and</strong><br />

this good life leaves a wonderful taste behind, even after they’ve l<strong>and</strong>ed on your p<strong>la</strong>te.<br />

Gourmets generally agree: the scampi <strong>and</strong> sole from the Gulf of Kvarner are so delicious<br />

that it would be worth traveling much farther than Croatia to enjoy the taste.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Croatia

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Slovenia<br />

0<br />

Slovenia:<br />

Multicultural <strong>Central</strong> <strong>Europe</strong><br />

Pasta, strudel, gou<strong>la</strong>sh – where are we? Most likely in a Slovenian restaurant or home,<br />

where the culinary spirit <strong>and</strong> taste of <strong>Central</strong> <strong>Europe</strong> are more evident than almost anywhere<br />

else. There’s a bit of Austrian Baroque, the clear air of the mountains <strong>and</strong> the azure of the<br />

sea, all spiced with the lightness of Italy. And, of course, a dash of Hungary is thrown in<br />

for good measure.<br />

The recipes found at this crossroads of <strong>Europe</strong>an culture are well-suited to the international<br />

pa<strong>la</strong>te. Here, for example, is a strudel recipe from the year 1860: “Take a sunny day on<br />

which the wind is silent, a quiet hour in which the children are silent, a contented housewife<br />

whose husb<strong>and</strong> is silent, two sensitive h<strong>and</strong>s, lots of love, a bucket of patience <strong>and</strong> a dash<br />

of happiness.”<br />

This is the very strudel that Slovenes love to eat, boiled or baked, filled with salty or sweet<br />

ingredients. Slovenian strudel culture reaches its apogee with the gibanica, a creation with<br />

four different <strong>la</strong>yers: poppy seeds, apples, curd cheese <strong>and</strong> nuts. Traditionalists, by the way,<br />

insist on struklji. It is made of buckwheat flour, the way gr<strong>and</strong>ma used to.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Slovenia

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Hungary<br />

Hungary:<br />

The Sine Qua Non is Paprika<br />

Gou<strong>la</strong>sh is a c<strong>la</strong>ssic example of a dish that serves as a satisfying main course or a snack between<br />

meals. But it is also responsible for an almost Babylonian confusion of tongues: Austrians who travel<br />

to Hungary for the first time <strong>and</strong> order gou<strong>la</strong>sh are surprised to be served soup instead of the<br />

dish they would expect at home: cubed meat in a thick sauce with lots of stewed onion.<br />

What most non-Hungarians mean when they say gou<strong>la</strong>sh has a different name in Hungary itself:<br />

pörkölt or paprikás. But the <strong>la</strong>tter does, at least, lead us to one of the most important ingredients in<br />

Hungarian cuisine: paprika. The spiciness <strong>and</strong> color of this red powder made from ripe red peppers<br />

by drying <strong>and</strong> grinding them provide the taste <strong>and</strong> hue of a c<strong>la</strong>ssic gou<strong>la</strong>sh sauce.<br />

Hungarians assess the quality of paprika with the meticulousness of a book-keeper, carefully<br />

checking the origin, variety, hotness, quality grade <strong>and</strong> lots more. Any Hungarian deserving of the<br />

name can tell the difference in his sleep between one of the milder powders, sweet paprika, the<br />

rather rare semisweet form <strong>and</strong> the somewhat hotter “rose” paprika.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Hungary

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The Pickled Cucumber Meridian<br />

The<br />

Pickled Cucumber<br />

Meridian<br />

<strong>Europe</strong> is home to a number of important culinary dividing lines.<br />

Just as Switzerl<strong>and</strong> is separated into the two sides of the Rösti<br />

Line (of thinly sliced fried potatoes) <strong>and</strong> the Bavarians have their<br />

Weisswurst Equator (of veal sausages), <strong>Central</strong> <strong>Europe</strong>ans have a<br />

Salzgurken Meridian (of pickled cucumbers) running across<br />

the Continent from Berlin to Vienna.<br />

Pickles are not an invention of modern times; they were already prized by the ancient<br />

Romans. But ancient history witnessed not only mass migrations of peoples but migrations<br />

of pickles as well, <strong>and</strong> a variety of cucumbers eventually settled east of the Salzgurken<br />

Meridian, only to be pickled in turn by their new fans. This can take p<strong>la</strong>ce in a wide<br />

variety of ways, depending on the climate, soil <strong>and</strong> techniques of the region in which the<br />

cucumbers happen to be growing.<br />

The Polish, Hungarians, (eastern) Austrians <strong>and</strong> their neighbors agree that there can be<br />

no agreement on the proper production manner or subsequent taste of a pickled<br />

cucumber. Some may describe them as having a fruity vegetable taste, but there are<br />

decisive differences in the final product, depending on which cucumber varieties were<br />

chosen, when they were picked, the type of water <strong>and</strong> spices used, the length of pickling<br />

<strong>and</strong> the quantity of the salt. The secrets of making pickled cucumbers are often h<strong>and</strong>ed<br />

down in a strictly oral tradition as though one were dealing with the ultimate in state<br />

secrets. Some people allow their cucumbers to pickle in the sun, while others insist that<br />

they remain in the cel<strong>la</strong>r. There is also an old tradition of adding a slice of bread to the<br />

barrel to get things started.<br />

Spices such as garlic, pepper, bay-leaf <strong>and</strong> sugar are popu<strong>la</strong>r. Pickles take on a special<br />

f<strong>la</strong>ir if certain leaves are added, with cherry leaves allegedly having an especially<br />

beneficial effect. The Poles are considered the true specialists. There the aroma of<br />

pickled cucumbers wafts from many rural homes, where they are prepared according to<br />

very special recipes. And every producer is convinced that his or hers results in the finest<br />

pickles the world has ever known.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The Pickled Cucumber Meridian

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Bosnia <strong>and</strong> Herzegovina<br />

Bosnia <strong>and</strong> Herzegovina:<br />

A Wide Variety of Good P<strong>la</strong>in Cooking<br />

Stuffed cabbage has lots of fans both inside Austria <strong>and</strong> outside as well. In Bosnia <strong>and</strong> Herzegovina<br />

this delicacy is known as sarma <strong>and</strong> provides an authentic example of the kind of food prepared on<br />

special days. Probably the gourmets of Bosnia <strong>and</strong> Herzegovina would enjoy their stuffed cabbage even<br />

more often if it did not take so much time <strong>and</strong> effort to prepare.<br />

For those less familiar with stuffed cabbage, here is a quick rundown of the steps required for its preparation.<br />

First, entire heads of white cabbage are marinated in the same manner as sauerkraut. The stem is cut<br />

crossways with a knife to allow the marinade to penetrate it. The subsequent fermentation produces <strong>la</strong>ctic<br />

acid. The cabbage is then separated into individual leaves, stuffed with ground meat, <strong>and</strong> cooked until<br />

tender with more cabbage, bacon <strong>and</strong> spices. As with all the hearty dishes of good p<strong>la</strong>in cooking, there’s<br />

an important rule that should be observed: the bigger the pot, the better the taste.<br />

It is self-evident that there are as many ways of preparing stuffed cabbage as there are different regional,<br />

ethnic <strong>and</strong> religious backgrounds among the popu<strong>la</strong>tion. Because the country’s cuisine has been subject<br />

to the influence of both Turkish <strong>and</strong> Greek traditions, sarma is not the only dish to offer a wide range of<br />

variations. Other popu<strong>la</strong>r dishes are one-pot meals of meat <strong>and</strong> vegetables as well as Turkish honey <strong>and</strong><br />

halva, ground nuts in honey.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Bosnia <strong>and</strong> Herzegovina

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Albania

Albania:<br />

Where ”Organic“ Is Simply That<br />

In Western <strong>Europe</strong>, expensive advertising campaigns have been designed around<br />

the concept, but here it is simply a fact of life: the foodstuffs produced by Albanian<br />

farmers in this barren-looking, mountainous l<strong>and</strong>scape are completely organic.<br />

If you w<strong>and</strong>er through the olive groves or try the tasty fruit of the orange trees,<br />

you may have the feeling you’ve been transported to sunny Greece or southern Italy.<br />

There’s no question about it: Albanian cuisine is heavily influenced by the<br />

Mediterranean. Aromatic <strong>la</strong>mb p<strong>la</strong>ys just as important a role as fresh fish direct<br />

from the sea, which within a few short hours makes the journey from its saltwater<br />

home to the grill or oven before l<strong>and</strong>ing on your p<strong>la</strong>te. Does that make Albania<br />

an undiscovered paradise for gourmets? For the most part you can expect a tasty<br />

cuisine that produces often astonishing results from only a few ingredients <strong>and</strong><br />

fresh vegetables.<br />

An attentive traveler will discover a wealth of aromas <strong>and</strong> recipes that reflect the<br />

region’s Ottoman past. There are the intensely sweet desserts, for example:<br />

a cake soaked in honey or the famous oshaf, a sheep’s cheese pudding with figs<br />

that might be equally at home in the Peloponnesus or a café in the Istanbul bazaar.<br />

And after a meal in which you have savored the intense f<strong>la</strong>vors of natural<br />

ingredients, you will once again feel the breeze of the Greek isl<strong>and</strong>s when your<br />

host brings out a bottle of raki, which is what the Albanians call br<strong>and</strong>y.<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Albania

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Kosovo<br />

0

Kosovo: It All Revolves<br />

Around F<strong>la</strong>t Bread<br />

From the Balkan countries to the Middle East, many of the national cuisines<br />

revolve around f<strong>la</strong>t, unleavened bread. What the Turks call pide <strong>and</strong> the<br />

Greeks pita, is pite in Kosovo. But the really conspicuous thing about the<br />

Kosovar version of bread made from salt, flour, yeast <strong>and</strong> water is that it is<br />

inconspicuous.<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Kosovo<br />

While bread may simply remain bread in other countries, in Kosovo it often<br />

remains unseen, hidden beneath <strong>la</strong>yers of all kinds of imaginative delicacies.<br />

Cheese, meat, leeks, paprika <strong>and</strong> many other ingredients may p<strong>la</strong>y the leading<br />

role. The difference between a good <strong>and</strong> an excellent pite is decided by<br />

whether or not the coating is added immediately before the bread is returned<br />

to the hot oven to reheat it. An especially popu<strong>la</strong>r form of pite is rolled up<br />

in a snail-like form.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – <strong>Europe</strong>’s Sour Pots<br />

<strong>Europe</strong>’s<br />

Sour Pots<br />

We have to remember that at a time when the refrigerator<br />

had not yet been invented, it was preserved vegetables with a<br />

decidedly acidic taste that helped the people of <strong>Central</strong> <strong>and</strong><br />

<strong>Eastern</strong> <strong>Europe</strong> to get through the long, cold winters.<br />

They turned a necessity into a virtue, adopting the culture of fermentation <strong>and</strong> of<br />

marination. Many one-pot meals, soups <strong>and</strong> some traditional dishes for festive occasions<br />

as well have mild, well-rounded aromas that are the result of <strong>la</strong>ctic acid-fermentation.<br />

No one gets sour about that, because not only does this food taste great, it is also<br />

easier to digest. And that brings us to sauerkraut, the hero of everyday cuisine in many<br />

countries but still an unknown for many people who live westwards of Alsace, where it<br />

is called choucroute. Sauerkraut offers an amazing range of possibilities. An aromatic<br />

elixir of health straight from the barrel, it also mixes well with noodles, for example in<br />

the dish known as krautfleckerln, where it is baked with f<strong>la</strong>t noodles <strong>and</strong> onions, or as<br />

an accompaniment to roast pork, fish or offal, such as tripe.<br />

Sauerkraut originally comes from northern China, where people discovered ages ago<br />

that finely sliced white cabbage becomes a wonderful dish when it is allowed to ferment<br />

in a vat with a bit of salt. Full of vitamin C <strong>and</strong> <strong>la</strong>ctic-acid bacteria, it is not only the<br />

pride of peasants who make it at home but also extremely popu<strong>la</strong>r with chefs <strong>and</strong> with<br />

doctors, who praise its healthy properties to the skies. There is an old (<strong>and</strong> true) saying<br />

about the best cabbage-eater living the longest.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – <strong>Europe</strong>’s Sour Pots

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Serbia

Serbia: A Paradise For Carnivores<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Serbia<br />

First let’s clear the air on a question that is frequently heard in Vienna: yes, the dish called “Serbian<br />

beef with rice” that is typically found on the menus of that increasingly rare species of simple Viennese<br />

restaurant, the beisl, does indeed come from Serbia. That takes us straight to the leading ingredient in<br />

Serbian cuisine, which is not rice but meat.<br />

Ćevapčići are found on many Belgrade street corners. The little sausage-shaped meat-rolls are made<br />

of <strong>la</strong>mb, beef <strong>and</strong> sometimes pork, are five to eight centimeters long on average, seasoned with garlic,<br />

salt, pepper <strong>and</strong> paprika as well as herbs depending on their avai<strong>la</strong>bility, topped with red onion rings<br />

<strong>and</strong> served with somun bread. Some diners like to add a dollop of the sour cream called kajmak or<br />

some ajvar, a mixture of paprika <strong>and</strong> puréed eggp<strong>la</strong>nt.<br />

And if a Serbian carnivore does not feel like eating ćevapčići, he or she can always order šiš ćevap<br />

(ćevapčići on a skewer), pljeskavica (the same meat patted into thin “burgers” <strong>and</strong> fried), or ražnjići,<br />

the c<strong>la</strong>ssic Serbian skewered meat.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Bulgaria

Bulgaria:<br />

The Secret of the Centenarians<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Bulgaria<br />

Is there a word in Bulgarian for anti-aging? Perhaps it’s simply “yoghurt.” In any case there are<br />

a conspicuously <strong>la</strong>rge number of people more than 100 years old in the Rhodope Mountains<br />

of southern Bulgaria.<br />

What’s their secret? Some say that it’s Bulgaria’s famous yoghurt. Certainly, yoghurt is found on<br />

every menu of the week <strong>and</strong> p<strong>la</strong>ys a leading, or at least supporting, role in a wealth of recipes.<br />

It is eaten alone or with fresh vegetables or a modest portion of meat. Tarator, for example,<br />

is a cold yoghurt-cucumber soup that is just as much a part of summer in Bulgaria as<br />

comp<strong>la</strong>ining about it is in Austria. The former, however, is a lot more pleasant than the <strong>la</strong>tter.<br />

When Bulgarian tourists walk down our supermarket aisles with their incredible variety of<br />

yoghurt – milk from Austria, milk from Savoy, high-fat, low-fat, no-fat <strong>and</strong> everything in between<br />

– all they can say is: “We invented it!” And they do so with a smile.<br />

The researchers at multinational food corporations may spend a lot of time worrying about<br />

further developing their high-tech product, but the Methuse<strong>la</strong>hs of Bulgaria couldn’t care less.<br />

The fact of the matter is: real yoghurt is made in Bulgaria, where people have been making it<br />

since the time of the ancient Thracians. As the story goes, shepherds wore a sack of <strong>la</strong>mbskin<br />

on their belts <strong>and</strong> filled it with milk. Their body temperature <strong>and</strong> the microflora of the <strong>la</strong>mbskin<br />

did the rest, fermenting the milk. Unfortunately, no food chemist was there to watch.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Romania

Romania: Cuisine with a History<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Romania<br />

Lift the lids of Romanian pots <strong>and</strong> pans <strong>and</strong> one thing becomes clear: the country’s cuisine –<br />

like that of others – is a reflection of its geography <strong>and</strong> history. The Danube <strong>and</strong> its delta with<br />

their unbelievable abundance of fish provide two of the Romanians’ favorite species: carp <strong>and</strong><br />

pike-perch, both of which are prepared with a healthy dose of garlic. Romanian menus owe<br />

a debt of gratitude to many national cuisines <strong>and</strong> cultures, <strong>and</strong> they read like a pot-pourri<br />

of recipes from old Austrian, Italian, Jewish, Hungarian, Greek <strong>and</strong> Turkish kitchens.<br />

Wherever you are in Romania, simply lift the lid of a soup pot in which ciorba is simmering<br />

away, <strong>and</strong> you will discovery the diversity of the country’s regional cuisines.<br />

Depending on where you are, you will find sauerkraut, tripe, ravioli, poultry or fish swimming<br />

in the soup.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The ”Little Water“<br />

0<br />

The ”Little Water“<br />

Any time fine food is served in Russia, the sine qua non<br />

to go with it is traditionally “little water” (vodka is the<br />

diminutive of the Russian word for water, voda).<br />

The traditional way of serving it is 100 grams at a time, <strong>and</strong> drinking it properly requires<br />

some practice. First: hold your breath. Next: down all 100 grams in a single go. Then:<br />

exhale in relief. Another tradition is to follow a shot of vodka with a pickled cucumber.<br />

Vodka consumption is falling at the moment, a trend that some see as a sign of<br />

economic stability. Vodka has always been a child of its time. With the col<strong>la</strong>pse of the<br />

ruble in 1998, the cheap vodka br<strong>and</strong> “Crisis” was the thing to drink, but in recent<br />

months “Putinka” has become especially popu<strong>la</strong>r. Vodka has always p<strong>la</strong>yed an<br />

important role in politics as well. Lenin saw it as the drug of capitalism, dem<strong>and</strong>ed a<br />

dictatorship of sobriety, <strong>and</strong> deported members of the most famous vodka dynasty.<br />

But the results, even when viewed soberly, were no more successful than simi<strong>la</strong>r projects<br />

undertaken by his successors. Apart from the wines made by the Rothschilds, there is<br />

hardly another beverage that has so many legends connected with it as does vodka.<br />

They begin with the story of how it was first made back in the 15 th century, but both<br />

Pol<strong>and</strong> <strong>and</strong> Russia c<strong>la</strong>im this honor for themselves.<br />

The raw material used in the making of vodka is generally not the potato, as is often<br />

assumed, but rather grain, usually a mixture of rye <strong>and</strong> wheat. They are fermented to<br />

create a mash <strong>and</strong> then distilled several times. Afterwards the distil<strong>la</strong>te is filtered through<br />

tons of activated charcoal to remove any foreign substances left over from fermentation.<br />

The choice of water <strong>and</strong> the grains used in fermentation have a decisive influence on the<br />

quality of the final product. But the secret of success for a truly fine vodka lies not only<br />

in its taste: if the distil<strong>la</strong>te has been properly processed, the consumer can hardly tell the<br />

next morning that vodka (even in <strong>la</strong>rge quantities) was drunk the night before.<br />

In Russia, vodka is mostly drunk with friends <strong>and</strong> acquaintances over a meal. Whether<br />

it is served ice-cold or warm is not just a matter of taste, but sometimes the result of<br />

simple coincidence. Tasting sessions for vodka are simi<strong>la</strong>r to those for wine. The tasters<br />

check the aroma <strong>and</strong> the powerful, sometimes even sweet taste. They also watch to see<br />

whether the distil<strong>la</strong>te runs down the side of the g<strong>la</strong>ss like oil or water. Tasting is done<br />

with the tongue, pa<strong>la</strong>te <strong>and</strong> cheeks. High-quality vodka leaves a mild taste in the mouth,<br />

while cheap vodka creates a burning sensation. The aroma can be creamy, spicy or<br />

neutral. In addition to expensive vintage vodkas, others that are en vogue have<br />

extravagant f<strong>la</strong>vors: Polish Zubrówka, for example, to which buffalo grass is added,<br />

giving it a yellow color <strong>and</strong> mild aroma, <strong>and</strong> Starka, which is aged in oak casks.<br />

To arrange to meet someone in Russia to drink vodka, you need do no more than<br />

gesture towards your throat, a ritual that has been traditional since the time of Peter the<br />

Great. A round of vodka drinking also requires a toast: over the course of the evening<br />

everyone at the table is expected to come up with a more or less profound saying.<br />

By the way, drinking vodka alone, without family or friends, is frowned upon in Russia,<br />

where it is considered a sign of alcoholism.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The ”Little Water“

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Pol<strong>and</strong><br />

Pol<strong>and</strong>: The L<strong>and</strong> of Pierogi<br />

It is remarkably varied: the cuisine of the Polish people, who love their fine food <strong>and</strong> drink. Given the<br />

great variety of possible fillings, pierogi are an unrivalled Polish favorite, but they are only one<br />

example among many fine dishes in the national cuisine.<br />

In case you have never tried them: imagine <strong>la</strong>rge ravioli filled with mushrooms, potatoes, cabbage,<br />

fish or liver – even a sweet filling – <strong>and</strong> then doused with hot butter. Downed with a shot of vodka,<br />

they’re even better. Polish chefs show the same level of inventiveness when it comes to preparing bigos,<br />

a hunter’s stew of steamed sauerkraut with various kinds of meat. Bigos improves with every reheating<br />

<strong>and</strong> used to be particu<strong>la</strong>rly popu<strong>la</strong>r with the Polish gentry, the sz<strong>la</strong>chta. The real fans today, however,<br />

are the skiers you can see fortifying themselves with bigos in the ski-lodges of Zakopane at the foot<br />

of the Tatra Mountains. Gourmets dining at Warsaw’s top restaurants are equally reluctant to renounce<br />

the country’s culinary symbol.<br />

If it’s a quick snack they want, however, they choose zurek, a hearty soup of sliced sausage, avai<strong>la</strong>ble<br />

at almost any restaurant or snack-bar. Zurek gets its slightly sour taste from the addition of<br />

fermented cracked rye.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Pol<strong>and</strong>

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The Czech Republic

The Czech Republic:<br />

A Dumpling for All Seasons<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – The Czech Republic<br />

There’s an old fairy-tale about a l<strong>and</strong> of milk <strong>and</strong> honey that can be reached only by<br />

first eating one’s way through a thick <strong>la</strong>yer of semolina pudding. The Czech version<br />

more likely features a clump of dumpling dough.<br />

There’s really no telling how the Czechs, despite the richness of their cuisine, keep<br />

from resembling their dumplings, which are variously made of potatoes, diced white<br />

bread, semolina, wheat flour or curd cheese. With their delicious fillings of bacon,<br />

meat or various types of fruit, these dumplings are an object of special devotion<br />

on the part of Czech chefs. Any leftover devotion is used in the preparation of roast<br />

pork – the national dish is called vepro-knedlo-zélo, “pork-dumpling-cabbage” –<br />

or svickova, beef fillet in a creamy vegetable sauce, which is accompanied,<br />

of course, by the popu<strong>la</strong>r knedliky (German: knödel – a dumpling, what else?).<br />

Did you know that if you make dumpling dough of diced bread you should first<br />

fry the dice in butter? That gives the dish an especially smooth taste. And there is,<br />

indeed, truth to the story about the major contribution that 19 th -century Bohemian<br />

cooks made to Viennese cuisine: Bohemia, today in the Czech Republic, is a real<br />

paradise for mehlspeisen (desserts with flour as the main ingredient), which now<br />

have such Czech-derived Viennese names as pa<strong>la</strong>tschinken (crêpes), ko<strong>la</strong>tschen<br />

(yeast pastry with a cheese or sweet filling), buchteln (baked yeast dumplings) <strong>and</strong><br />

liwanzen (gâteaux bohémiens). The original recipes fill entire volumes of cookbooks<br />

in Czech libraries.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Slovakia<br />

Slovakia: All Cheese<br />

Liptauer is a spicy s<strong>and</strong>wich spread that the owners of Vienna’s distinctive wine taverns,<br />

the heurige, proc<strong>la</strong>im to be a typically Viennese specialty. The name, however, is derived<br />

from the Slovakian region of Liptov (German: Liptau). Thus it is a c<strong>la</strong>ssic Slovakian recipe,<br />

<strong>and</strong> the original version features bryndza, ewe’s milk cheese of a type found only<br />

in Slovakia.<br />

It is kept in brine in small wooden barrels, where its shelf life is of quite limited duration.<br />

In any case, bryndza tastes best when it’s absolutely fresh. It can be used as a spread<br />

on b<strong>la</strong>ck bread, as an ingredient in liptauer, or in bryndza dumplings. People who love<br />

sheep’s milk cheese but find conventional bryndza a bit overwhelming can try the milder<br />

version, which tastes a lot like Greek feta without the saltiness.<br />

Oshtjepka, a semi-hard cheese made from cow’s <strong>and</strong> sheep’s milk <strong>and</strong> traditionally dried<br />

beneath the ceiling of mountain huts, is another type of cheese found only in Slovakia.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Slovakia

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Caviar: Only the Best is Good Enough<br />

Caviar:<br />

Only the Best<br />

is Good Enough<br />

Sturgeon roe is an uncompromising luxury.<br />

Not only does it taste incomparably good, it is<br />

prestige in an edible form.<br />

Caviar has a purist touch with a whiff of extravagance. It likes to be spooned into the<br />

mouth with utensils made of mother-of-pearl or horn, because the sensitive aroma is<br />

irritated by any contact with metal. Caviar prefers to be burst open between tongue<br />

<strong>and</strong> pa<strong>la</strong>te without further additions, although it does tolerate blini, potatoes with butter<br />

or sour cream. Champagne <strong>and</strong> vodka are also more than welcome as liquid<br />

accompaniments.<br />

A genuine problem associated with sturgeon fishing has sometimes spoiled the<br />

cosmopolitan caviar community’s taste for these delicate fish eggs. At times, the sturgeon<br />

popu<strong>la</strong>tion, in particu<strong>la</strong>r that of the beluga, has been threatened with extinction<br />

because of over-fishing <strong>and</strong> pollution. Even the UN has become involved. Now the<br />

a<strong>la</strong>rm bells are now falling silent. Fishing quotas are being <strong>la</strong>rgely respected <strong>and</strong> many<br />

sturgeon fishermen have switched to more sustainable methods.<br />

However, anyone who wants to enjoy caviar <strong>and</strong> a clear conscience at the same time<br />

should ask whether the caviar has been produced in a sustainable manner taking into<br />

account the needs of the species. If in doubt, it is better not to buy. This also adds to<br />

the awareness of restaurateurs <strong>and</strong> gourmet shop-owners, <strong>and</strong> will, eventually, have an<br />

impact on producers as well. That will help the sturgeon to survive <strong>and</strong> thus continue<br />

contributing to the pleasure of caviar fans in years to come.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Caviar: Only the Best is Good Enough

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Russia<br />

0<br />

Russia:<br />

Babushka’s Favorite Recipes<br />

It is said that the foundations for the multi-course meals now typical of French gr<strong>and</strong>e cuisine<br />

were <strong>la</strong>id by the feasts consumed by the Russian tsars <strong>and</strong> their entourages during frequent<br />

visits to Paris. But that was a long time ago: with the arrival of the October Revolution,<br />

such gourmet extravaganzas disappeared for quite some time.<br />

What remained, however, were the blinis. These thin pancakes of buckwheat flour can be<br />

found today as a convenience product of the “caviar society” in any gourmet shop worthy of<br />

the name. Aficionados, however, insist on the necessity of freshly preparing them in a heavy<br />

cast-iron blini pan. Sour cream is an obligatory addition, whether the blinis are served<br />

with caviar or salmon. What many people don’t realize, however, is that blinis can also<br />

be served with a mushroom, vegetable or meat filling, or simply brushed with melted butter.<br />

Adding lots of butter to the yeast batter as well makes the blinis especially light.<br />

But Russians do not live by blinis alone; they also love soups. Shtshi, for example, a nutritious<br />

peasant dish of cabbage, diced vegetables, meat, spices <strong>and</strong> sour cream. It might be said<br />

to be the “babushka” of all Russian soups. Shtshi can also include beets <strong>and</strong> kvas,<br />

a sour mixture of rye flour fermented with yeast.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Russia

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Be<strong>la</strong>rus

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Be<strong>la</strong>rus<br />

Be<strong>la</strong>rus:<br />

Rare Foods from Forest <strong>and</strong> Field<br />

Everyone has heard about borsch. But who knows what draschenji is, for example?<br />

And who has heard of motshanka? Have you?<br />

The fields <strong>and</strong> forests of Be<strong>la</strong>rus supply the ingredients for a bold cuisine, in which<br />

potatoes, mushrooms <strong>and</strong> berries are prepared according to centuries-old recipes, many<br />

of which have been h<strong>and</strong>ed down by word of mouth. “Processed” rather than prepared<br />

might be the appropriate word in some cases. Decadent Western diners may turn up<br />

their noses at some of the wild mushrooms that feature in Be<strong>la</strong>rusian cuisine, considering<br />

them “inedible.” It’s true that some of the wilder ones have to be “tamed” by hours of<br />

slow cooking before being brought to the table.<br />

But this is the way that Be<strong>la</strong>rusian chefs take these rare products, whose avai<strong>la</strong>bility<br />

varies depending on the soil <strong>and</strong> weather, <strong>and</strong> transform them into tasty main courses<br />

or side dishes. They pay no attention to the clock, <strong>and</strong> there’s no real reason to, either.<br />

Diners in the know g<strong>la</strong>dly wait for the aroma of draniki – little pancakes made of<br />

freshly grated potato, <strong>and</strong> fried in <strong>la</strong>rd – to waft from the kitchen: it’s a sure sign that<br />

a fantastic meal is about to be served.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Ukraine<br />

Ukraine: Who Would Ever<br />

Have Thought<br />

Who should rightfully take credit for borsch, that hearty beet soup<br />

that warms the body <strong>and</strong> soul on cold winter evenings?<br />

The Russians have long since adopted it as part of their culinary<br />

heritage, <strong>and</strong> the Lithuanians <strong>and</strong> Poles are equally fond of it.<br />

But now all the evidence is in, <strong>and</strong> researchers agree: borsch was first<br />

served in Ukraine. This event took p<strong>la</strong>ce on the northern B<strong>la</strong>ck Sea<br />

coast, where an inventive housewife conceived the idea of making<br />

a soup of meat, bacon, garlic <strong>and</strong> much more. And, of course, she<br />

also added beets to give the concoction its bright-red color <strong>and</strong><br />

inimitable sweet-sour aroma.<br />

What few people realize, however, is that this c<strong>la</strong>ssic winter dish is<br />

also served in the summer months in a chilled version: “borsch light.”<br />

But no matter how many different possibilities there may be for<br />

preparing borsch, fans of the red soup all agree: a spoonful of sour<br />

cream, added just before serving, is a must.

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Ukraine

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Austria<br />

Austria:<br />

The Height of Sweet Desserts<br />

Mehlspeisen, the Austrian word for desserts with flour as the main ingredient, are considered<br />

to be the absolute apogee of Alpine cuisine. And towering over most of the rest is<br />

kaiserschmarren, the unmistakable culinary l<strong>and</strong>mark of a country where people love to eat<br />

big <strong>and</strong> love to eat, period.<br />

Schmarren is an Austrian word for nonsense, <strong>and</strong> some of the stories about how kaiserschmarren<br />

first came to be prepared may be just that. In any case, they’re as numerous as the raisins the<br />

dish contains. Emperor Francis Joseph <strong>and</strong> his wife, Sisi, usually p<strong>la</strong>y the leading roles. One<br />

version concerns the emperor’s personal chef in Bad Ischl, who used to make a concoction of<br />

flour, milk <strong>and</strong> eggs <strong>and</strong> serve it to mountain hikers <strong>and</strong> shepherds. On one occasion he added<br />

a few raisins because he was trying to please the empress. The emperor, otherwise a modest<br />

husb<strong>and</strong>, assumed the chef had named it after him, kaiser meaning “emperor.” Another<br />

anecdote is based on Sisi’s love of minimalist food. One of her chefs had the idea of serving<br />

small pieces of fried pancake batter with a bit of plum jam. This was still too much for the<br />

empress, <strong>and</strong> the emperor is reported to have said: “Then give me the schmarren (nonsense)<br />

that the chef has made.”

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> <strong>à</strong> <strong>la</strong> <strong>carte</strong> – Austria

Preface<br />

48 www.rzb.at<br />

Preface by the Managing Board<br />

Dear Sir or Madam,<br />

RZB 2006<br />

As we present our seventh record result in a row in the pages of this report, we do so in the awareness<br />

of having had a really exceptional year. Our results were shaped – among other things – by one-off<br />

effects that caused an unexpectedly <strong>la</strong>rge rise in profit. However, our profit without these one-off<br />

effects provided even more impressive evidence that RZB is exactly on course, because it too broke<br />

all records.<br />

We remained true to our growth strategy during the year under review <strong>and</strong> continued to exp<strong>and</strong><br />

faster than the market as a whole. As a result, RZB recorded gains in market share both in Austria<br />

<strong>and</strong> in <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> (the CEE-region). The Group’s expansion in the CEE-region was<br />

accelerated further by the acquisition of Impexbank in Russia <strong>and</strong> eBanka in the Czech Republic. In<br />

Austria, RZB again reinforced its position as the country’s third-<strong>la</strong>rgest bank, <strong>and</strong> <strong>Raiffeisen</strong> has now<br />

become by far the <strong>la</strong>rgest banking group in Austria.<br />

2006 was also a noteworthy year in that we sold a Network Bank for the first time. After the<br />

acquisition of Bank Aval in the Ukraine – a major bank with over 1,300 branches – we were<br />

repeatedly asked whether we wouldn’t like to save ourselves the effort of merging it with the mediumsized<br />

<strong>Raiffeisen</strong>bank Ukraine. In the end, the offers we received for <strong>Raiffeisen</strong>bank were for amounts<br />

that prompted us to sell, albeit without the associated <strong>Raiffeisen</strong> br<strong>and</strong> rights. The book gain from<br />

this sale came to E 486 million. In addition, we recorded a gain from the sale of our minority stake<br />

in Kazakhstan’s Bank TuranAlem, which we sold – in line with our strategy – on the grounds that we<br />

could not acquire the majority interest we were striving for on acceptable terms. The one-off effects of<br />

these two transactions amounted to E 596 million, increasing profit by about a third.<br />

Profit before tax <strong>and</strong> Consolidated profit after tax <strong>and</strong> minorities came to E 1,882 million <strong>and</strong><br />

E 1,169 million, respectively. However, the true extent of our success in the year under review<br />

was demonstrated by our results without the one-off effects we have described: Profit before tax of<br />

E 1,286 million trans<strong>la</strong>tes into impressive growth of 38.3 per cent – <strong>and</strong> that coming on top of growth<br />

of more than a third in 2005.<br />

We expect the positive development of our Profit from operating activities to continue in 2007, <strong>and</strong> we<br />

expect close on two-digit growth in our Profit before tax. However, this figure is based on our 2006<br />

profit net of the one-off effects. Our Cost/income ratio should be stable at close to its present healthy<br />

level. Because we will have a substantially broader capital base, our Return on equity will probably be<br />

below its current level without one-off effects.<br />

In the words of our long-term Vision Statement, “RZB is the leading Banking Group in Austria <strong>and</strong><br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong>.” This vision is ambitious but already palpable, because we have moved<br />

another big step closer to fulfilling it. RZB is building on solid foundations <strong>and</strong> its strategic orientation<br />

is sound.<br />

In Austria, these foundations are a strong market position in RZB’s core business segments – corporate<br />

customer business <strong>and</strong> investment banking – <strong>and</strong> the <strong>Raiffeisen</strong> Banking Group’s status as the country’s<br />

leader in retail banking <strong>and</strong> business with small <strong>and</strong> medium-sized enterprises.<br />

Preface Managing Board Supervisory Board’s Report Overview of RZB <strong>Raiffeisen</strong> Banking Group

RZB 2006<br />

In <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong>, we operate the banking network with the broadest coverage of<br />

the region <strong>and</strong> boast award-winning product <strong>and</strong> service quality. Our innovative power <strong>and</strong><br />

technological edge underscore our c<strong>la</strong>im to leadership. At the same time, RZB’s business operations<br />

go h<strong>and</strong>-in-h<strong>and</strong> with uncompromising monitoring of risks <strong>and</strong> its traditionally conservative evaluation<br />

of those risks.<br />

Since we operate in dynamic markets <strong>and</strong> need to act accordingly if we are to achieve our goals,<br />

we will continue to pursue our growth strategy. As in the past, the challenge in the future will be to<br />

steer our growth. We are well known for our early identification of opportunities <strong>and</strong> trends, for their<br />

exploitation <strong>and</strong> for extracting a good return over risk from them.<br />

This having been said, we can fund a <strong>la</strong>rge part of our growth out of earned capital. As in 2006, our<br />

owners will be carrying out regu<strong>la</strong>r capital increases to promote our growth path. In the long term, the<br />

capital needed for our dynamic growth in a market that is home to over 350 million people cannot be<br />

raised in Austria, with its popu<strong>la</strong>tion of only 8 million. Consequently, RZB will also continue to resort<br />

to the international financial markets in order to raise capital, <strong>and</strong> we will conduct active asset <strong>and</strong><br />

liability management to optimize our employment of capital.<br />

RZB will not veer from its consistent commitment to quality. We believe that it p<strong>la</strong>ys an important part<br />

in our success, alongside our striving for sustained <strong>and</strong> partnership-based customer re<strong>la</strong>tionships. We<br />

are pleased with the positive feedback that we receive from our customers, including in particu<strong>la</strong>r the<br />

praise we were given within the scope of a study ordered jointly by Austria’s corporate banks. The<br />

study confirmed RZB’s quality, competence, value for money <strong>and</strong> commitment to partnership, especially<br />

compared with our competitors’ offerings.<br />

Our consistent commitment to quality was also acknowledged by major international business<br />

magazines. For instance, RZB won over 70 awards for its achievements in Austria <strong>and</strong> <strong>Central</strong> <strong>and</strong><br />

<strong>Eastern</strong> <strong>Europe</strong> during 2006, including awards from The Banker, Euromoney, Global Finance, TMI,<br />

Finance New <strong>Europe</strong>, Trade Finance <strong>and</strong> Trade <strong>and</strong> Forfaiting Review.<br />

We thank our customers for the trust they have p<strong>la</strong>ced in RZB <strong>and</strong> for our successful work together.<br />

We extend the same thanks to our shareholders, to their representatives within <strong>Raiffeisen</strong> <strong>Zentralbank</strong>’s<br />

boards <strong>and</strong> to those who do business with us. Our special thanks naturally also go out to our<br />

employees, who now number over 55,000 <strong>and</strong> whose excellent work made our outst<strong>and</strong>ing result<br />

possible in the first p<strong>la</strong>ce. We look forward to continuing together on our successful path in 2007.<br />

Walter Rothensteiner Herbert Stepic<br />

Patrick Butler Karl Sevelda Manfred Url<br />

Interview Management Report Segment Reports Consolidated Financial Statements Glossary Contacts<br />

www.rzb.at<br />

Preface<br />

49

Managing Board<br />

50 www.rzb.at<br />

The Managing Board<br />

The members of <strong>Raiffeisen</strong> <strong>Zentralbank</strong>’s Managing Board (from left to right):<br />

Karl Sevelda, Herbert Stepic, Walter Rothensteiner, Patrick Butler, Manfred Url.<br />

RZB 2006<br />

Preface Managing Board Supervisory Board’s Report Overview of RZB <strong>Raiffeisen</strong> Banking Group

RZB 2006<br />

Walter Rothensteiner<br />

Remits: Management Services; Strategic Controlling; Participations; Public Re<strong>la</strong>tions; Human Resources; Legal <strong>and</strong> Compliance;<br />

Audit; Tax; Group Head Office/Executive Secretariat (jointly with Manfred Url).<br />

Born in 1953; read Commercial Science at the Vienna University of Economics <strong>and</strong> Business Administration; senior positions<br />

at <strong>Raiffeisen</strong>l<strong>and</strong>esbank Niederösterreich-Wien (most recently in management), member of the Managing Board of Leipnik-<br />

Lundenburger Industrie AG <strong>and</strong> sugar industry group Agrana. Joined <strong>Raiffeisen</strong> <strong>Zentralbank</strong> in 1995 as Vice-Chairman of the<br />

Managing Board; Chairman of the Managing Board <strong>and</strong> CEO since June 1995.<br />

Selected supervisory board posts <strong>and</strong> other positions: Kathrein & Co. Privatgeschäftsbank AG (C), Casinos Austria AG (C),<br />

Österreichische Lotterien Ges.m.b.H. (C), <strong>Raiffeisen</strong> Bausparkasse Ges.m.b.H. (C), <strong>Raiffeisen</strong> Centrobank AG (C), <strong>Raiffeisen</strong><br />

International Bank-Holding AG (C), Leipnik Lundenburger Invest Beteiligungs AG, Oesterreichische Kontrollbank AG,<br />

Oesterreichische Nationalbank AG (Generalrat), Österreichische Galerie Belvedere, Österreichische Volksbanken AG,<br />

UNIQA Versicherungen AG, Wiener Staatsoper GmbH.<br />

Herbert Stepic<br />

Remits: Branches <strong>and</strong> Representative Offices; Country <strong>and</strong> Bank Risk Management; Chairman of the Managing Board of<br />

<strong>Raiffeisen</strong> International Bank-Holding AG.<br />

Born in 1946; read Commercial Science at the Vienna University of Economics <strong>and</strong> Business Administration; joined RZB in 1973,<br />

where he developed the <strong>Raiffeisen</strong> Foreign Trade Service; was also Managing Director of trading house F.J. Elsner & Co; a<br />

member of the Managing Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> since 1987 <strong>and</strong> Deputy to the CEO since 1995.<br />

Selected supervisory board posts <strong>and</strong> other positions: Chairman of the supervisory boards of numerous RZB Network Banks;<br />

member of the supervisory boards of OMV AG, Oesterreichische Kontrollbank AG, <strong>Raiffeisen</strong> Centrobank AG.<br />

Patrick Butler<br />

Remits: Global Treasury; Global Markets; Economics <strong>and</strong> Financial Market Research.<br />

Born in 1957; read Modern History at Oxford; began his banking career in 1979 with Chemical Bank <strong>and</strong> County Bank (NatWest<br />

Group) working in London <strong>and</strong> New York; <strong>la</strong>ter joined Creditanstalt-Bankverein (subsequently BACA Group), most recently<br />

as Group Treasurer; <strong>la</strong>ter Global Treasurer of Arab Bank; a member of the Managing Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> since<br />

October 2004.<br />

Selected supervisory board posts: Kathrein & Co. Privatgeschäftsbank AG, <strong>Raiffeisen</strong> Centrobank AG, <strong>Raiffeisen</strong> International<br />

Bank-Holding AG, <strong>Raiffeisen</strong> Wohnbaubank AG, RZB Private Equity Holding AG, Wiener Börse AG.<br />

Karl Sevelda<br />

Remits: Austrian Corporate Customers; Multinational Corporate Customers; Corporate, Trade <strong>and</strong> Export Finance; Customer<br />

Services.<br />

Born in 1950; read Social Science <strong>and</strong> Economics at the Vienna University of Economics <strong>and</strong> Business Administration <strong>and</strong> then<br />

became free<strong>la</strong>nce researcher <strong>and</strong> staff-member at the Wirtschaftspolitisches Institut, (economic policy institute); subsequently<br />

worked <strong>and</strong> held senior positions at Creditanstalt-Bankverein; a member of the Managing Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong><br />

since 1998.<br />

Selected supervisory board posts <strong>and</strong> other positions: Bene AG, ÖBB Infrastruktur Bau AG, Österreichische Bundesbahnen-Holding<br />

AG, <strong>Raiffeisen</strong> Centrobank AG, <strong>Raiffeisen</strong> International Bank-Holding AG, RZB Private Equity Holding AG, Unternehmens Invest AG,<br />

Bene Privatstiftung (Managing Board), Fepia Privatstiftung (Managing Board), Herbert Depisch Privatstiftung (Managing Board).<br />

Manfred Url<br />

Remits: Transaction Services; Credit Management; Marketing; Organization/IT; Verbund (<strong>Raiffeisen</strong> Banking Group); Group Head<br />

Office/Executive Secretariat (jointly with Walter Rothensteiner).<br />

Born in 1956; read Commercial Science at the Vienna University of Economics <strong>and</strong> Business Administration, followed by a period<br />

abroad in France (ESSCA business school in Angers <strong>and</strong> Banque Indosuez in Paris); held several senior positions – most recently<br />

in management – at <strong>Raiffeisen</strong>-L<strong>and</strong>esbank Steiermark; a member of the Managing Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> since 1998.<br />

Selected supervisory board posts: <strong>Raiffeisen</strong> Datennetz Ges.m.b.H. (C), <strong>Raiffeisen</strong> Vermögensverwaltungsbank AG (C), Europay<br />

Austria Zahlungsverkehrssysteme GmbH, <strong>Raiffeisen</strong> Informatik GmbH, <strong>Raiffeisen</strong> International Bank-Holding AG, VISA Service<br />

Kreditkarten AG.<br />

(C) = Chairman.<br />

See page 224 for an Organization Chart of <strong>Raiffeisen</strong> <strong>Zentralbank</strong>.<br />

Interview Management Report Segment Reports Consolidated Financial Statements Glossary Contacts<br />

Managing Board<br />

www.rzb.at<br />

51

Supervisory Board’s Report<br />

52 www.rzb.at<br />

Supervisory Board’s Report<br />

RZB 2006<br />

The Supervisory Board of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG was, in its meetings, kept<br />

abreast by the Managing Board of business transactions of note <strong>and</strong> the development<br />

of the bank <strong>and</strong> its group during the 2006 financial year. The Supervisory Board<br />

performed all the tasks that are incumbent upon it by <strong>la</strong>w <strong>and</strong> pursuant to the Articles of<br />

Association.<br />

The Supervisory Board met four times during the 2006 financial year. In a further 26<br />

cases, it made decisions by way of written ballots. The Supervisory Board’s Working<br />

Committee met five times during the period under review <strong>and</strong> also made two decisions<br />

by written ballot. The committee for examining <strong>and</strong> preparing adoption of the Annual<br />

Financial Statements, the proposal regarding the appropriation of profit <strong>and</strong> the<br />

Management Report met once. The Personnel Committee met twice.<br />

KPMG Austria GmbH Wirtschaftsprüfungs- und Steuerberatungsgesellschaft, Vienna,<br />

examined the Consolidated Financial Statements (Ba<strong>la</strong>nce Sheet, Income Statement,<br />

Notes), the Group Management Report <strong>and</strong> the Annual Financial Statements <strong>and</strong><br />

Management Report on <strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG. That examination<br />

revealed no grounds for objection <strong>and</strong> the legis<strong>la</strong>tive requirements were met in full, so<br />

an unqualified Auditors’ Report could be issued. The Supervisory Board concurs with<br />

the Managing Board’s report on the results of the audit for the 2006 financial year <strong>and</strong><br />

with the Managing Board’s proposal regarding the appropriation of profit. The Annual<br />

Financial Statements of <strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG for 2006 are thus final for the purposes<br />

of § 125 Abs. 2 AktG (Austrian stock corporations act).<br />

There was a change in the membership of the Company’s boards during the 2006 financial year.<br />

Georg Doppelhofer, Generaldirektor of <strong>Raiffeisen</strong>-L<strong>and</strong>esbank Steiermark AG, retired on 31 December<br />

2005. His successor, Generaldirektor Markus Mair, was co-opted to the Supervisory Board of<br />

<strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG as of 1 January 2006 <strong>and</strong> was elected to the Supervisory Board<br />

during the General Meeting of Shareholders held on 20 June 2006.<br />

For the seventh time in succession, the RZB Group posted a record profit. Its ba<strong>la</strong>nce sheet total<br />

grew to almost E 116 billion <strong>and</strong> consolidated profit for the year amounted to close to E 1.17 billion,<br />

providing the figures to bear out the superb effectiveness of its strategic orientation. As a<br />

consequence, the RZB Group is now one of the world's 100 <strong>la</strong>rgest banks. In addition, <strong>Raiffeisen</strong><br />

<strong>Zentralbank</strong> Österreich AG acts as the central institution of the Austrian <strong>Raiffeisen</strong> Banking Group,<br />

which is organized as a cooperative.<br />

To mark our sustained outst<strong>and</strong>ing business performance, the Supervisory Board extends its special<br />

thanks <strong>and</strong> appreciation to the Managing Board as well as the senior management <strong>and</strong> other staff of<br />

<strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG <strong>and</strong> the entire Group for their work <strong>and</strong> unremitting dedication<br />

during the year ended.<br />

The Supervisory Board<br />

Christian Konrad<br />

Chairman<br />

Preface Managing Board Supervisory Board’s Report Overview of RZB <strong>Raiffeisen</strong> Banking Group

RZB 2006<br />

Overview of RZB<br />

RZB’s Ba<strong>la</strong>nce Sheet Total<br />

ebn<br />

105<br />

90<br />

75<br />

60<br />

45<br />

30<br />

15<br />

44.6<br />

<strong>Raiffeisen</strong> <strong>Zentralbank</strong> Österreich AG (<strong>Raiffeisen</strong> <strong>Zentralbank</strong>) was founded in 1927. It is the<br />

central institution of the Austrian <strong>Raiffeisen</strong> Banking Group (RBG). <strong>Raiffeisen</strong> <strong>Zentralbank</strong> is one<br />

of the foremost corporate <strong>and</strong> investment banks in Austria, where it services the country’s <strong>la</strong>rgest<br />

corporations <strong>and</strong> institutions. In addition to its role as the Group’s central institution, <strong>Raiffeisen</strong><br />

<strong>Zentralbank</strong> functions as the core enterprise within the RZB Group (RZB). RZB is a banking group with<br />

Austrian origins that also sees <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> (the CEE-region) as its home market. The<br />

Group’s exceptional popu<strong>la</strong>rity with its customers, its resultant growth <strong>and</strong> its strong commitment to<br />

<strong>Central</strong> <strong>and</strong> <strong>Eastern</strong> <strong>Europe</strong> have made it a top p<strong>la</strong>yer in the region. Besides <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong><br />

<strong>Europe</strong>, RZB also has a presence in a number of international financial centres <strong>and</strong> in the emerging<br />

markets of Asia. RZB is Austria’s third-<strong>la</strong>rgest banking group.<br />

46.4<br />

56.1<br />

0<br />

2001 2002 2003 2004 2005 2006<br />

IFRS-compliant data at 31 December of each year.<br />

67.9<br />

93.9<br />

Growth based on solid foundations<br />

Ba<strong>la</strong>nce Sheet Total of € 115.6 billion<br />

As a result of its expansion in <strong>Central</strong> <strong>and</strong> <strong>Eastern</strong><br />

<strong>Europe</strong> <strong>and</strong> with the help of gains in market share<br />

within Austria, RZB’s ba<strong>la</strong>nce sheet total has grown<br />

rapidly <strong>and</strong> sustainably in recent years. In 2006, it<br />

reached � 115.6 billion, which trans<strong>la</strong>tes into a<br />

strong advance of 23.2 per cent versus year-end<br />

2005.<br />

This means that RZB’s ba<strong>la</strong>nce sheet total has more<br />

than doubled in just three financial years, <strong>and</strong> most<br />

of that growth has been organic. The proportion<br />

of RZB’s ba<strong>la</strong>nce sheet total accounted for by<br />